PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1068663

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1068663

The Kitchen Furniture Market in China

This report provides a comprehensive picture of the kitchen furniture industry in China , enhanced by historical trends on production, consumption and international trade, analysis of the production and distribution systems and information on major players. The study also includes forecasts of the real growth of the market for the years 2020 and 2025 . The research was carried out via direct interviews with Chinese and international kitchen furniture manufacturers operating in China.

Kitchen furniture exports and imports are broken down by country and by geographical region of origin/destination. Historical data are provided for the time frame 2016-2021. A similar analysis was conducted for the international trade of a list of selected appliances (refrigerator and freezers, cooking appliances, clothes washers and driers, dishwashing machines, hoods) relevant for the kitchen industry for the period 2016-2021.

Chinese kitchen production is analysed by including historical series of kitchen production in value and volume for the years 2016-2021. Kitchen production in China is broken down according to:

- style (classic, country, modern basic, modern, design, high tech);

- cabinet door material (solid wood, veneer, laminated, decorative paper, thermoplastics, lacquered, melamine, aluminium, glass);

- cabinet door colour (white, bright, neutral) and lacquering (bright, opaque);

- worktop material (solid surface materials, natural and engineered stone, laminated, tiles, steel and aluminium, wood, glass).

The chapter on the distribution system offers an analysis of the major sales channels (contract/building trade, kitchen specialists, furniture shops, furniture chains, and DIY) for kitchen and their 2014-2019 trends, including a list of the main kitchen furniture retailers in the major Chinese provinces and short profiles of the leading furniture chains. Reference prices for kitchen furniture and the weight of built-in appliances on the value of the kitchen market are also considered. The analysis also includes the profiles of 22 Chinese cities , which include economic and demographic statistics, kitchen demands, an indicator that ranks the cities according to their business attractiveness, and the analysis of the commercial areas of each city through the geolocation of over 65 brands.

An in-depth analysis of the competitive system identifies the leading Chinese manufacturers by kitchen production, sales, price range and exports. Updated company profiles of the top manufacturers provide data on the company's total turnover, number of employees, export share, location of manufacturing plants and distribution channels. The competitive system analysis also identifies a selection of leading international kitchen manufacturers operating on the Chinese market, providing descriptions of their distribution strategies and short company profiles.

The final chapter tries to identify the major domestic demand determinants , which includes macro-economic indicators (country indicators, real growth of GDP and inflation up to 2025, population indicators, data on disposable income and wealth, data on construction sector and real estate); population dynamics (population, urbanization, analysis of the top cities); consumers' trends and preferences; real estate and construction sector development (investments in residential building, data on the construction sector).

A list of more than 60 major players in the kitchen furniture industry in China is also included.

Highlights:

In 2021, kitchen production in China reached a value of US$ 8,757 million (RMB 56,489 million), registering an annual growth of +24.5% in US$ (+16.3% in RMB). Approximately 4.1 million kitchen sets were produced by Chinese kitchen furniture firms, of which around 280 thousand were addressed to exports and almost 3.9 million to the domestic market. Most of the production of kitchen furniture is managed by the top 50 players, which accounts for almost 75% of its total value. In fact, over the last few years, the industry has undergone a process of consolidation, including several IPO and M&A. Oppein confirmed as the largest player.

Kitchen specialists hold the major share as distribution channel, but Contract and Building Trade hold the second position.

European players hold 30% of the upper-end market, and a huge 80% of the luxury market.

Selected companies mentioned:

Aisen, Akani, Amblem, Aodu , Arrow, Baineng, Beigeer, Bigtime, Borcci (Fotile), Borlonclan, Cacar, Canbo, Daeshin, Debao, Deson, Dicano, Doton, Elabor, Eueasa, Euromax Neuvelle, Haier, Hanex, Haozhaotou, Homtor, Ikea, Jiaci, Joydar, Kangjie, Kenner, Macess, Macro, Mekea, Mkxy, Nbmin, Olo Home, Oppein, Oulin, Oupu, Ouyi, Pianor, Rebon, Schmidt, Siples, Nobilia, Vidas, Vifa Kitchen, Wanjia, Welon, Yalig, Häcker Küchen, ZBOM Cabinets.

Research field and methodology

Basic Data

- Overview: Production, International trade, Consumption

- Furniture consumption by segment

- World market of kitchen furniture: production and consumption. Focus on selected countries

The activity trend

- Production, International trade, Consumption, 2016-2021. US$ Million, RMB Million, Thousand units , Prices US$ per unit

- Consumption, forecasts 2022-2025. Thousand units

- The openness of the kitchen furniture market, 2016-2021

International trade

- China and Hong Kong. Exports and Imports of kitchen furniture by country and by geographical area, 2016-2021

- World market of kitchen furniture. Main origin of imports for selected countries

- Trade of major appliances (focus on selected products). Exports and Imports by country and by geographical area, 2016-2021

- Hoods

- Refrigerators and Freezers

- Dishwashers

- Cooking Appliances

- Washing machines

Kitchen furniture supply structure

- Productive clusters and Employment

- Location of a sample of 100 kitchen furniture and appliance manufacturers, by Province

- Year of establishment, number of employees and covered plant surface in sqm in a sample of companies

- Number of employees and average turnover per employee in a sample of companies

- Breakdown of kitchen furniture by style

- Breakdown of supply by style. Data 2017-2019-2021

- Breakdown of supply by style in a sample of companies

- Breakdown of supply by cabinet door material and colour

- Breakdown of supply by cabinet door material, colour, lacquering. Data 2017-2019-2021

- Breakdown of supply by cabinet door material and colour in a sample of companies

- Most used colours for cabinet doors in a sample of companies

- Most used types of wood for cabinet doors in a sample of companies

- Breakdown of supply by worktop material

- Breakdown of supply by worktop material. Data 2017-2019-2021

- Breakdown of supply by worktop material in a sample of companies

- Manufacturers of cabinet doors and other components

Distribution

- Distribution pattern in a sample of companies

- Breakdown of domestic kitchen sales by distribution channel. Data 2017-2019-2021

- Breakdown of domestic kitchen sales by distribution channel in a sample of companies

- Number of outlets and average turnover per outlet in a sample of companies

- Main Kitchen furniture retailers in: Guangzhou; Chengdu; Xian; Donguan; Beijing; Qingdao; Hangzhou; Shanghai; Shengyang; Shenzen; Fuzhou

- Main furniture chains

- Main DIY and Department Stores

- Kitchen demand in a selected sample of Chinese cities

- Reference prices for kitchen furniture and appliances

- Jointed sales of kitchen furniture and built-in appliances

- Incidence of built-in appliances on the total value of kitchen consumption. Data 2017-2019-2021

- Incidence of built-in appliances on total kitchen sold in a sample of companies.

- Leading Electronics-Appliances Stores: Short Profiles.

The Competitive System

- Top 50 players

- Top 50 Chinese kitchen furniture manufacturers: sales, market shares and short profiles

- Main exporters

- Export sales in a sample of Chinese kitchen furniture manufacturers

- Export sales in a sample of Chinese kitchen furniture manufacturers by Country/Area

- Sales in China

- Top 50 players in the Chinese kitchen furniture market: Sales and market shares

- Sales by average factory price

- Kitchen furniture market. Top players in the low price range

- Kitchen furniture market. Top players in the middle-low price range

- Kitchen furniture market. Top players in the middle price range

- Kitchen furniture market. Top players in the upper-middle price range

- Kitchen furniture market. Top players in the upper price range

- Kitchen furniture market. Top players in the luxory

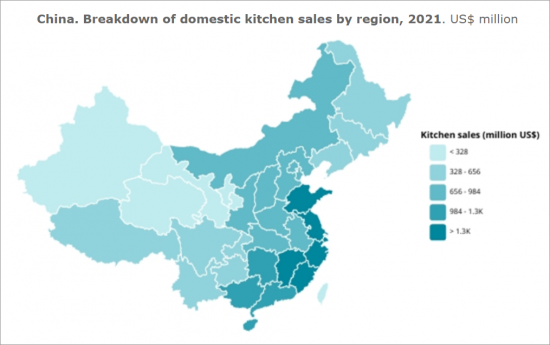

- Sales by region

- Breakdown of domestic kitchen sales by region in a sample of companies

- Foreign kitchen furniture players in China

- Kitchen furniture sales in China from foreign brands

Economic trend and demand determinants

- Macroeconomic data

- Population and urbanization process

- Construction sector and real estate

Annex I: Architects and Interior Designers

Annex II: List of Chinese companies mentioned and/or interviewed