PUBLISHER: Digital TV Research | PRODUCT CODE: 949756

PUBLISHER: Digital TV Research | PRODUCT CODE: 949756

Digital TV Research Subscription

Digital TV Research publishes 25+ reports each year with 400 clients since 2011. More and more of our clients take annual subscriptions that include all of our reports - with attractive discounts offered.

Why choose us?

- We cover 138 countries across seven regions

- Detailed bottom-up updates and forecasts by country for pay TV and OTT

- 30+ years of experience and connections: key for the validation of our data

- Flexible, customised research: choose from a single country profile to an annual subscription package.

- Competitive and reasonable prices

- Fast-turnaround on analyst feedback

Each country report comes in three parts:

- Insight: Thorough scrutiny in a PDF document, giving market analysis of the key players.

- Outlook: Subscriber forecasts via charts and graphs in a PPT document that can be exported for your presentations.

- Detailed excel workbook covering each year from 2010 to 2027 to allow easy comparisons and market growth forecasts.

Forecasts for 138 countries:

| Albania | Algeria | Angola | Argentina |

| Armenia | Australia | Austria | Azerbaijan |

| Bahrain | Bangladesh | Belarus | Belgium |

| Benin | Bolivia | Bosnia | Botswana |

| Brazil | Bulgaria | Burkina Faso | Burundi |

| Cambodia | Cameroon | Canada | CAR |

| Chad | Chile | China | Colombia |

| DR Congo | Rep Congo | Costa Rica | Cote d'Ivoire |

| Croatia | Cyprus | Czech Rep. | Denmark |

| Dominican Rep. | Ecuador | Egypt | El Salvador |

| Eq Guinea | Estonia | Ethiopia | Finland |

| France | Gabon | Gambia | Georgia |

| Germany | Ghana | Greece | Guatemala |

| Guinea | Honduras | Hong Kong | Hungary |

| Iceland | India | Indonesia | Ireland |

| Israel | Italy | Japan | Jordan |

| Kazakhstan | Kenya | Kuwait | Laos |

| Latvia | Lebanon | Liberia | Lithuania |

| Luxembourg | Macedonia | Madagascar | Malawi |

| Mali | Malaysia | Malta | Mexico |

| Moldova | Mongolia | Montenegro | Morocco |

| Mozambique | Myanmar | Namibia | Nepal |

| Netherlands | New Zealand | Nicaragua | Niger |

| Nigeria | Norway | Oman | Pakistan |

| Panama | Paraguay | Peru | Philippines |

| Poland | Portugal | Puerto Rico | Qatar |

| Romania | Russia | Rwanda | Saudi Arabia |

| Senegal | Serbia | Sierra Leone | Singapore |

| Slovakia | Slovenia | South Africa | South Korea |

| Spain | Sri Lanka | Sweden | Switzerland |

| Syria | Taiwan | Tanzania | Thailand |

| Togo | Tunisia | Turkey | Uganda |

| Ukraine | UAE | UK | USA |

| Uruguay | Uzbekistan | Venezuela | Vietnam |

| Zambia | Zimbabwe |

SAMPLE: Qatar OTT TV & video insight

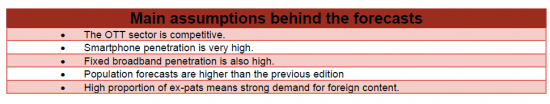

OTT TV & video revenues are forecast to reach $92 million by 2027, double from $45 million in 2021. SVOD will contribute $75 million in 2027, up from $38 million in 2021. There will be 605,000 SVOD subscriptions by 2027 compared with 362,000 at end-2021. About 54% of the TV households will pay for at least one SVOD subscription by 2027.

Netflix ($7.99-14.99/month) launched in January 2016. We forecast 213,000 subscribers by 2027; up from 143,000 in 2021. Netflix is carried by Ooredoo.

Amazon Prime Video started operations in November 2016 as part of its global rollout. Subscriptions cost $5.99/month, with little original or local content. We forecast 62,000 Amazon subscribers by 2027.

Apple TV+ started in Qatar with its global rollout in November 2019, with 34,000 subscribers expected by 2027.

HBO Max, Paramount+ and Disney+ are not expected to start in the Arabic-speaking countries due to deals with OSN.

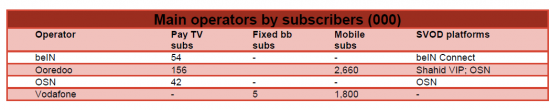

OSN (briefly called Wavo. QAR35-79.50/month) launched in August 2017. As well as 27 linear channels, OSN exclusively carries Disney+ originals, Paramount+ and HBO content. We forecast 91,000 subscribers by 2027.

After a cost cutting drive, OSN now places more emphasis on its SVOD platform. OSN has exclusive deals with seven Hollywood studios. It will increase Arabic content to a quarter of the total.

Transmitting in English, Arabic and French, StarzPlay has 6,000 hours of Hollywood content as well as 2,000 hours of Arabic content. Discovery+ is on offer. We forecast 120,000 subscribers by 2027.

MBC's Shahid VIP provides linear channels as well as on-demand content. Ooredoo carries Shahid VIP. We forecast 62,000 subscribers by 2027.

beIN Connect provides access to 34 linear channels available on the satellite TV package as well as 2,000 on-demand TV episodes and 300 on-demand movies - free to satellite TV subs or $18/month to others.

Hong Kong's Viu started operations in Bahrain, Egypt, Jordan, Kuwait, Oman, Qatar, Saudi Arabia and UAE in February 2017. With 40,000 hours on offer, local content is included as well as international fare to appeal to ex-pats.

Viu recorded 49.4 million monthly active users across 16 markets by June 2021. Viu had 7.0 million paying subscribers by June 2021, up from 5.3 million paying subscribers by end-2020, 3.6 million in 2019 and 1.4 million in 2018. Most of these subscribers are in South East Asia.

The Ooredoo TV IPTV platform (up to 190 channels, including bundles from beIN, MBC and OSN) is part of a triple-play package (up to 1Gbps). We estimated 156,000 subscribers at end-2021. In October 2015, Ooredoo has distribution deals with SVOD platforms OSN and Shahid VIP.

Ooredoo is investing QAR1 billion on an extensive fiber network. Ooredoo is constructing the government-owned National Broadband Network (QNBN). Ooredoo had 2.66 million mobile subscribers by September 2021.

Vodafone won the license for the second fixed line service in April 2010. Vodafone sold its stake to a local consortium in late 2018. Vodafone started its Giga TV OTT platform in late 2019. Vodafone had 5,000 fixed broadband and 1.80 million mobile subscribers by September 2021.