PUBLISHER: 360iResearch | PRODUCT CODE: 1434944

PUBLISHER: 360iResearch | PRODUCT CODE: 1434944

Battery Anode Materials Market by Material (Active Anode Materials, Anode Binders, Anode Foils), Battery Product (Battery Pack, Cell), End-Use - Global Forecast 2024-2030

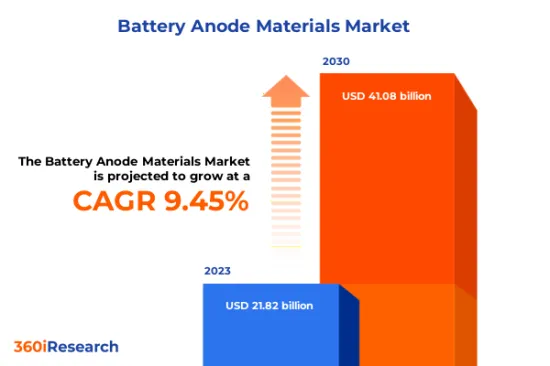

[183 Pages Report] The Battery Anode Materials Market size was estimated at USD 21.82 billion in 2023 and expected to reach USD 23.86 billion in 2024, at a CAGR 9.45% to reach USD 41.08 billion by 2030.

Global Battery Anode Materials Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 21.82 billion |

| Estimated Year [2024] | USD 23.86 billion |

| Forecast Year [2030] | USD 41.08 billion |

| CAGR (%) | 9.45% |

Battery anode materials encompass a range of materials used in negative electrodes or anode of various batteries. Anodes are crucial for battery operation as they host the lithium ions during discharging and recharging cycles, and the use of appropriate battery anode materials is crucial for the performance, safety, and efficiency of the batteries. The proliferation of electric vehicles, propelled by environmental concerns regarding vehicular emissions and supportive government policies for the production of EVs, has driven the need for advanced battery anode materials. Furthermore, the increasing adoption of portable electronics such as tablets, smartphones, and laptops commands the need for high-performance batteries, fostering growth in battery anode materials. However, constraints related to the usage and production of battery anode materials involve issues related to the environmental impact of mining or processing operations. Additionally, the performance degradation of battery anode materials over time poses a significant challenge. Researchers and key players are investing in R&D initiatives to develop or discover novel battery anode materials associated with enhanced performance characteristics. Furthermore, optimizing existing manufacturing methods to reduce costs and improve scalability and exploring sustainable methods of manufacturing battery anode materials can provide new avenues of growth for the battery anode materials market.

Regional Insights

The Americas region, particularly the U.S. and Canada, is associated with the presence of several key EV manufacturers and producers of electronic devices, propelling the demand for battery anode materials. Additionally, the Americas region has experienced the expansion of battery anode material production facilities and the incorporation of advanced recycling technologies for graphite and silicon battery anode materials. Europe exhibits a strong commitment to environmental sustainability and has been a frontier in the adoption of clean energy technologies, including advanced battery systems and battery anode materials. Europe's strategic initiatives, such as the European Battery Alliance, aim to secure the supply chain for battery components and foster innovation in battery technologies, influencing the use and development of novel battery anode materials. The APAC region acts as a manufacturing base for EV and battery components, thereby fuelling the production of battery anode materials. APAC nations such as South Korea, China, and India are involved in research initiatives to develop innovative battery anode materials suited for energy storage systems. Furthermore, the demand for cost-effective, compact, and miniaturized electronic device components stimulates the need for battery anode materials.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Battery Anode Materials Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Battery Anode Materials Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Battery Anode Materials Market, highlighting leading vendors and their innovative profiles. These include Amprius Technologies, Inc., Anovion Technologies, BASF SE, BTR New Material Group Co., Ltd., Daejoo Electronic Materials Co., Ltd., E-magy, Enevate Corporation, Epsilon Advanced Materials Pvt. Ltd., Gotion High-tech Co., Ltd., Himadri Speciality Chemicals Ltd., Hunan Kingi Technology Co., Ltd., JFE Chemical Corporation, Kanthal AB, Kuraray Co., Ltd., Kureha Corporation, Mitsubishi Chemical Corporation, NEI Corporation, NEO Battery Materials Ltd., Nexeon Ltd., Ningbo Shanshan Co., Ltd., Nippon Carbon Co., Ltd., POSCO Chemical Co., Ltd., Resonac Holdings Corporation, SGL Carbon SE, Shin-Etsu Chemical Co., Ltd., Sila Nanotechnologies Inc., Sumitomo Chemical Co., Ltd., Talga Group, Targray Technology International Inc., Tokai Carbon Co., Ltd. by Cabot Corporation, and Vianode.

Market Segmentation & Coverage

This research report categorizes the Battery Anode Materials Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Material

- Active Anode Materials

- Li-Compounds & Metal

- Natural Graphite

- Silicon

- Synthetic Graphite

- Anode Binders

- Polyvinylidene Fluoride

- Styrene Butadiene Copolymer

- Anode Foils

- Aluminium Foils

- Copper Foil

- Active Anode Materials

- Battery Product

- Battery Pack

- Cell

- End-Use

- Automotive

- Non-Automotive

- Aerospace

- Energy Storage

- Marine

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Battery Anode Materials Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Battery Anode Materials Market?

3. What are the technology trends and regulatory frameworks in the Battery Anode Materials Market?

4. What is the market share of the leading vendors in the Battery Anode Materials Market?

5. Which modes and strategic moves are suitable for entering the Battery Anode Materials Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Battery Anode Materials Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Significant growth in the adoption of electric vehicles worldwide

- 5.1.1.2. Increasing utilization of battery anode materials in portable devices

- 5.1.1.3. Governmental initiatives and investments for green energy projects

- 5.1.2. Restraints

- 5.1.2.1. Environmental impact battery anode materials

- 5.1.3. Opportunities

- 5.1.3.1. Ongoing research and development projects for the advancement of anode materials

- 5.1.3.2. Expanding preference for sustainable battery anode materials and innovations in recycling technologies

- 5.1.4. Challenges

- 5.1.4.1. Technical limitations of using battery anode materials

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Material: R&D initiatives to propel the use of active anode materials by optimizing their performance characteristics

- 5.2.2. Battery Product: Surging adoption of battery pack due to its ability to provide reduced charging times

- 5.2.3. End-Use: Awareness about the need to reduce vehicular emissions leading to demand for electric vehicles in the automotive sector

- 5.3. Market Trend Analysis

- 5.3.1. Large-scale production of battery storage systems and electric vehicles elevating battery manufacturing backed by high-quality anode materials in the Americas

- 5.3.2. Ready supply of raw materials coupled with an emphasis on electric vehicles in the APAC region

- 5.3.3. Significant investments in battery anode material production to meet the government's sustainable energy objectives across the EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Battery Anode Materials Market, by Material

- 6.1. Introduction

- 6.2. Active Anode Materials

- 6.3.1. Li-Compounds & Metal

- 6.3.2. Natural Graphite

- 6.3.3. Silicon

- 6.3.4. Synthetic Graphite

- 6.3. Anode Binders

- 6.4.1. Polyvinylidene Fluoride

- 6.4.2. Styrene Butadiene Copolymer

- 6.4. Anode Foils

- 6.5.1. Aluminium Foils

- 6.5.2. Copper Foil

7. Battery Anode Materials Market, by Battery Product

- 7.1. Introduction

- 7.2. Battery Pack

- 7.3. Cell

8. Battery Anode Materials Market, by End-Use

- 8.1. Introduction

- 8.2. Automotive

- 8.3. Non-Automotive

- 8.4.1. Aerospace

- 8.4.2. Energy Storage

- 8.4.3. Marine

9. Americas Battery Anode Materials Market

- 9.1. Introduction

- 9.2. Argentina

- 9.3. Brazil

- 9.4. Canada

- 9.5. Mexico

- 9.6. United States

10. Asia-Pacific Battery Anode Materials Market

- 10.1. Introduction

- 10.2. Australia

- 10.3. China

- 10.4. India

- 10.5. Indonesia

- 10.6. Japan

- 10.7. Malaysia

- 10.8. Philippines

- 10.9. Singapore

- 10.10. South Korea

- 10.11. Taiwan

- 10.12. Thailand

- 10.13. Vietnam

11. Europe, Middle East & Africa Battery Anode Materials Market

- 11.1. Introduction

- 11.2. Denmark

- 11.3. Egypt

- 11.4. Finland

- 11.5. France

- 11.6. Germany

- 11.7. Israel

- 11.8. Italy

- 11.9. Netherlands

- 11.10. Nigeria

- 11.11. Norway

- 11.12. Poland

- 11.13. Qatar

- 11.14. Russia

- 11.15. Saudi Arabia

- 11.16. South Africa

- 11.17. Spain

- 11.18. Sweden

- 11.19. Switzerland

- 11.20. Turkey

- 11.21. United Arab Emirates

- 11.22. United Kingdom

12. Competitive Landscape

- 12.1. FPNV Positioning Matrix

- 12.2. Market Share Analysis, By Key Player

- 12.3. Competitive Scenario Analysis, By Key Player

- 12.3.1. Merger & Acquisition

- 12.3.1.1. Birla Carbon Acquires Nanocyl to Drive Growth In Battery Materials for Lithium Ion Batteries

- 12.3.1.2. Enovix to Acquire Battery Manufacturer Routejade

- 12.3.1.3. Battery Materials Company Group14 Gets A European Foothold Via Acquisition In Germany

- 12.3.1.4. Sicona Acquires Major International Patent Portfolio

- 12.3.2. Agreement, Collaboration, & Partnership

- 12.3.2.1. Panasonic Energy and Sila Sign Purchase Agreement For Silicon Anode Material

- 12.3.2.2. Tms International Partnering With Nippon Carbon As North American Distributor Of Graphite Electrodes

- 12.3.2.3. NEO Battery Materials Receives First Purchase Order for Silicon Anode Materials

- 12.3.2.4. SK On signs deal with Westwater Resources to Develop Anode Materials

- 12.3.2.5. Anovion and Forge Nano Sign Offtake Agreement for the Supply of Synthetic Graphite Anode Powders Optimized With Atomic Armor for Next-Generation Lithium-Ion Batteries

- 12.3.3. New Product Launch & Enhancement

- 12.3.3.1. GDI tests World's First Fully Silicon Battery Anode

- 12.3.3.2. L&F Teams up With Mitsubishi Chemical to Make Advanced Anode Materials

- 12.3.3.3. Alkegen Launches Commercial Production for Groundbreaking Silicon Battery Anode Material

- 12.3.4. Investment & Funding

- 12.3.4.1. Shanshan Considers EUR 1.3 Billion Battery Materials Factory in Finland

- 12.3.4.2. NOVONIX Finalizes USD 100 Million Grant Award from U.S. Department of Energy

- 12.3.4.3. Epsilon Advanced Materials to Invest USD 650M into Graphite Anode Facility in North Carolina

- 12.3.5. Award, Recognition, & Expansion

- 12.3.5.1. NEO Battery Materials Ltd. Completes Relocation of R&D Scale-Up Centre to Gyeonggi Technopark

- 12.3.5.2. Sunrise New Energy Secures Highly Regarded Japanese Patent for Invention of Lithium-Ion Battery Anode Material Preparation Method

- 12.3.5.3. NanoGraf Completes UL1642 and IEC62133 Global Safety Certifications for Energy-Dense 18650 Lithium-ion Cell

- 12.3.5.4. Echion Technologies Achieved ISO 9001:2015 Certification for Quality Management of its Fast-charging XNO Battery Anode Materials and Associated Processes and Procedures

- 12.3.5.5. BASF India to Invest in Anode Binder Production Assets for the Lithium-Ion Battery Industry

- 12.3.1. Merger & Acquisition

13. Competitive Portfolio

- 13.1. Key Company Profiles

- 13.1.1. Amprius Technologies, Inc.

- 13.1.2. Anovion Technologies

- 13.1.3. BASF SE

- 13.1.4. BTR New Material Group Co., Ltd.

- 13.1.5. Daejoo Electronic Materials Co., Ltd.

- 13.1.6. E-magy

- 13.1.7. Enevate Corporation

- 13.1.8. Epsilon Advanced Materials Pvt. Ltd.

- 13.1.9. Gotion High-tech Co., Ltd.

- 13.1.10. Himadri Speciality Chemicals Ltd.

- 13.1.11. Hunan Kingi Technology Co., Ltd.

- 13.1.12. JFE Chemical Corporation

- 13.1.13. Kanthal AB

- 13.1.14. Kuraray Co., Ltd.

- 13.1.15. Kureha Corporation

- 13.1.16. Mitsubishi Chemical Corporation

- 13.1.17. NEI Corporation

- 13.1.18. NEO Battery Materials Ltd.

- 13.1.19. Nexeon Ltd.

- 13.1.20. Ningbo Shanshan Co., Ltd.

- 13.1.21. Nippon Carbon Co., Ltd.

- 13.1.22. POSCO Chemical Co., Ltd.

- 13.1.23. Resonac Holdings Corporation

- 13.1.24. SGL Carbon SE

- 13.1.25. Shin-Etsu Chemical Co., Ltd.

- 13.1.26. Sila Nanotechnologies Inc.

- 13.1.27. Sumitomo Chemical Co., Ltd.

- 13.1.28. Talga Group

- 13.1.29. Targray Technology International Inc.

- 13.1.30. Tokai Carbon Co., Ltd. by Cabot Corporation

- 13.1.31. Vianode

- 13.2. Key Product Portfolio

14. Appendix

- 14.1. Discussion Guide

- 14.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. BATTERY ANODE MATERIALS MARKET RESEARCH PROCESS

- FIGURE 2. BATTERY ANODE MATERIALS MARKET SIZE, 2023 VS 2030

- FIGURE 3. BATTERY ANODE MATERIALS MARKET SIZE, 2019-2030 (USD MILLION)

- FIGURE 4. BATTERY ANODE MATERIALS MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. BATTERY ANODE MATERIALS MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. BATTERY ANODE MATERIALS MARKET DYNAMICS

- FIGURE 7. BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2023 VS 2030 (%)

- FIGURE 8. BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2023 VS 2030 (%)

- FIGURE 10. BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2023 VS 2030 (%)

- FIGURE 12. BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 14. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 16. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 18. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. BATTERY ANODE MATERIALS MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 22. BATTERY ANODE MATERIALS MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. BATTERY ANODE MATERIALS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2019-2023

- TABLE 3. BATTERY ANODE MATERIALS MARKET SIZE, 2019-2030 (USD MILLION)

- TABLE 4. GLOBAL BATTERY ANODE MATERIALS MARKET SIZE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 5. BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 6. BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, BY REGION, 2019-2030 (USD MILLION)

- TABLE 7. BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 8. BATTERY ANODE MATERIALS MARKET SIZE, BY LI-COMPOUNDS & METAL, BY REGION, 2019-2030 (USD MILLION)

- TABLE 9. BATTERY ANODE MATERIALS MARKET SIZE, BY NATURAL GRAPHITE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 10. BATTERY ANODE MATERIALS MARKET SIZE, BY SILICON, BY REGION, 2019-2030 (USD MILLION)

- TABLE 11. BATTERY ANODE MATERIALS MARKET SIZE, BY SYNTHETIC GRAPHITE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 12. BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, BY REGION, 2019-2030 (USD MILLION)

- TABLE 13. BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 14. BATTERY ANODE MATERIALS MARKET SIZE, BY POLYVINYLIDENE FLUORIDE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 15. BATTERY ANODE MATERIALS MARKET SIZE, BY STYRENE BUTADIENE COPOLYMER, BY REGION, 2019-2030 (USD MILLION)

- TABLE 16. BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, BY REGION, 2019-2030 (USD MILLION)

- TABLE 17. BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 18. BATTERY ANODE MATERIALS MARKET SIZE, BY ALUMINIUM FOILS, BY REGION, 2019-2030 (USD MILLION)

- TABLE 19. BATTERY ANODE MATERIALS MARKET SIZE, BY COPPER FOIL, BY REGION, 2019-2030 (USD MILLION)

- TABLE 20. BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 21. BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PACK, BY REGION, 2019-2030 (USD MILLION)

- TABLE 22. BATTERY ANODE MATERIALS MARKET SIZE, BY CELL, BY REGION, 2019-2030 (USD MILLION)

- TABLE 23. BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 24. BATTERY ANODE MATERIALS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 25. BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 26. BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 27. BATTERY ANODE MATERIALS MARKET SIZE, BY AEROSPACE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 28. BATTERY ANODE MATERIALS MARKET SIZE, BY ENERGY STORAGE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 29. BATTERY ANODE MATERIALS MARKET SIZE, BY MARINE, BY REGION, 2019-2030 (USD MILLION)

- TABLE 30. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 31. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 32. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 33. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 34. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 35. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 36. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 37. AMERICAS BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2019-2030 (USD MILLION)

- TABLE 38. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 39. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 40. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 41. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 42. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 43. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 44. ARGENTINA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 45. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 46. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 47. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 48. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 49. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 50. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 51. BRAZIL BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 52. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 53. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 54. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 55. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 56. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 57. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 58. CANADA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 59. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 60. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 61. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 62. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 63. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 64. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 65. MEXICO BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 66. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 67. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 68. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 69. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 70. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 71. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 72. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 73. UNITED STATES BATTERY ANODE MATERIALS MARKET SIZE, BY STATE, 2019-2030 (USD MILLION)

- TABLE 74. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 75. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 76. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 77. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 78. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 79. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 80. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 81. ASIA-PACIFIC BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2019-2030 (USD MILLION)

- TABLE 82. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 83. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 84. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 85. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 86. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 87. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 88. AUSTRALIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 89. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 90. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 91. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 92. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 93. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 94. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 95. CHINA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 96. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 97. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 98. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 99. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 100. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 101. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 102. INDIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 103. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 104. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 105. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 106. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 107. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 108. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 109. INDONESIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 110. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 111. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 112. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 113. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 114. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 115. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 116. JAPAN BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 117. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 118. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 119. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 120. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 121. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 122. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 123. MALAYSIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 124. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 125. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 126. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 127. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 128. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 129. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 130. PHILIPPINES BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 131. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 132. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 133. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 134. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 135. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 136. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 137. SINGAPORE BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 138. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 139. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 140. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 141. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 142. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 143. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 144. SOUTH KOREA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 145. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 146. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 147. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 148. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 149. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 150. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 151. TAIWAN BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 152. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 153. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 154. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 155. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 156. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 157. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 158. THAILAND BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 159. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 160. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 161. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 162. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 163. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 164. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 165. VIETNAM BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 166. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 167. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 168. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 169. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 170. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 171. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 172. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 173. EUROPE, MIDDLE EAST & AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY COUNTRY, 2019-2030 (USD MILLION)

- TABLE 174. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 175. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 176. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 177. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 178. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 179. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 180. DENMARK BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 181. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 182. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 183. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 184. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 185. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 186. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 187. EGYPT BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 188. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 189. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 190. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 191. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 192. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 193. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 194. FINLAND BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 195. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 196. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 197. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 198. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 199. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 200. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 201. FRANCE BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 202. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 203. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 204. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 205. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 206. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 207. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 208. GERMANY BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 209. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 210. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 211. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 212. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 213. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 214. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 215. ISRAEL BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 216. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 217. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 218. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 219. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 220. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 221. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 222. ITALY BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 223. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 224. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 225. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 226. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 227. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 228. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 229. NETHERLANDS BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 230. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 231. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 232. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 233. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 234. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 235. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 236. NIGERIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 237. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 238. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 239. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 240. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 241. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 242. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 243. NORWAY BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 244. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 245. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 246. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 247. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 248. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 249. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 250. POLAND BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 251. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 252. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 253. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 254. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 255. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 256. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 257. QATAR BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 258. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 259. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 260. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 261. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 262. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 263. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 264. RUSSIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 265. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 266. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 267. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 268. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 269. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 270. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 271. SAUDI ARABIA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 272. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 273. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 274. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 275. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 276. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 277. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 278. SOUTH AFRICA BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 279. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 280. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 281. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 282. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 283. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 284. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 285. SPAIN BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 286. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 287. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 288. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 289. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 290. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 291. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 292. SWEDEN BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 293. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 294. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 295. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 296. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 297. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 298. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 299. SWITZERLAND BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 300. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 301. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 302. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 303. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 304. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 305. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 306. TURKEY BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 307. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 308. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 309. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 310. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 311. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 312. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 313. UNITED ARAB EMIRATES BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 314. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY MATERIAL, 2019-2030 (USD MILLION)

- TABLE 315. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY ACTIVE ANODE MATERIALS, 2019-2030 (USD MILLION)

- TABLE 316. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE BINDERS, 2019-2030 (USD MILLION)

- TABLE 317. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY ANODE FOILS, 2019-2030 (USD MILLION)

- TABLE 318. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY BATTERY PRODUCT, 2019-2030 (USD MILLION)

- TABLE 319. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY END-USE, 2019-2030 (USD MILLION)

- TABLE 320. UNITED KINGDOM BATTERY ANODE MATERIALS MARKET SIZE, BY NON-AUTOMOTIVE, 2019-2030 (USD MILLION)

- TABLE 321. BATTERY ANODE MATERIALS MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 322. BATTERY ANODE MATERIALS MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 323. BATTERY ANODE MATERIALS MARKET LICENSE & PRICING