Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406107

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406107

Intragastric Balloon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 119 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The intragastric balloon market is expected to register a CAGR of 9.1% over the forecast period.

Key Highlights

- The outbreak of the COVID-19 pandemic impacted the intragastric balloon market. People with an underlying condition such as obesity were at greater risk during the COVID-19 pandemic. For instance, as per the data published by the World Health Organization (WHO), in 2020, more than 1.9 billion adults, 18 years and older, were overweight. Among them, over 650.0 million were obese. Similarly, as per the data published by the CDC in March 2021, around 30.2% of the total COVID-19 hospitalizations were attributed to obesity. In addition, during COVID-19, the obesity rate increased exponentially.

- For instance, according to the research article published by the European Journal of Nutrition in December 2021, the rate of obesity increased during the pandemic due to a change in lifestyle and a decrease in exercise practice among people, as they avoided gym and yoga classes due to the social distancing protocols. Thus, such an increased rate of obesity surged the demand for intragastric balloons during the pandemic, and thus, the market witnessed positive growth during COVID-19 and is expected to continue the upward trend over the forecast period.

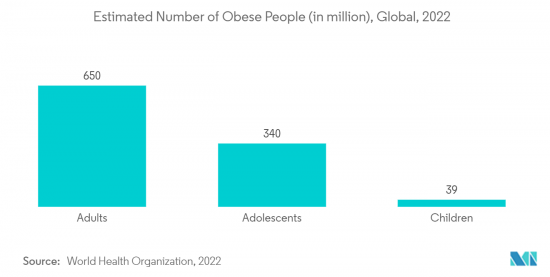

- The rising adoption of minimally invasive treatment and the increasing prevalence of obesity are the major factors propelling market growth. For instance, according to the report published by the World Health Organization (WHO) in March 2022, more than 1.0 billion people worldwide are obese, of which 650 million adults, 340 million adolescents, and 39 million children. The same source also stated that by 2025, approximately 167 million people will be obese, including adults and children. Intragastric balloons are widely used for the treatment of obesity and offer effective results.

- For instance, according to the National Center for Biotechnology Information (NCBI) study published in January 2023, intragastric balloons serve as a minimally invasive tool to combat the obesity pandemic. There are multiple intragastric balloons approved for the United States and European markets. Indications in the United States include a BMI of 30 to 35 kg/m^2 but a BMI of 27 to 35 kg/m^2 in Europe. Thus, increasing cases of obesity across the globe are expected to positively impact market growth.

- The increasing preference towards minimally invasive treatment and product launches by the key players are also driving market growth. For instance, according to the NCBI research article published in February 2022, in the studied population, about 57.0% of the patients who preferred minimally invasive treatment made their decision under the influence of the healthcare professionals as they recommended minimally invasive treatment and reported less perceived disadvantages following their treatment. Such studies depict the higher acceptance of healthcare professionals and patients of minimally invasive procedures over traditional procedures. Furthermore, in September 2022, Allurion Technologies, the United States-based medical device manufacturer, launched its weight loss solution, a swallowable gastric balloon, in India. The product claims to reduce weight by 10-15% on average within 16 weeks. Therefore, increasing adoption of minimally invasive treatments and product launches are anticipated to propel the market growth over the forecast period.

- However, the side effects or complications associated with intragastric balloons may hamper the market growth over the forecast period.

Intragastric Balloon Market Trends

Single Intragastric Balloon Segment is Expected to Witness Significant Growth Over the Forecast Period

- Single intragastric balloons are estimated to witness healthy growth in the future, which is attributed to increasing awareness, rising demand for minimally invasive procedures, availability of many products in the market, and scientific proof for their safety and efficacy. For instance, as per the National Institute of Health (NIH) report published in 2021, the Orbera intragastric balloon, a type of single fluid-filled intragastric balloon, is safe and effective for reducing obesity-related comorbidities in a real-world population and weight loss population. Thus, such advantages are anticipated to propel the segment growth over the forecast period.

- The increasing number of obese patients with several technological advancements for better outcomes and developments in the intragastric balloon will promote segment growth in the future. Factors, such as the rising intake of junk foods/fast foods, are resulting in a declining healthy population worldwide, leading to an increase in the prevalence of obesity, especially in some developed parts of the world.

- For instance, as per the report published by the Trust for America's Health Organization in 2021, the United States adult obesity rate represents more than 42.4%, and it is the first time the national rate has passed the 40.0% mark. The national adult obesity rate has increased by 26.0% since previous years.

- Similarly, according to the report published by the State Obesity in 2022, black adults have the highest rate of obesity in the United States, which is 49.9% compared to 45.6% of Hispanic adults, 41.4% of white adults, and 16.1% of Asian adults. Thus, increasing cases of obesity across the globe are anticipated to propel the demand for single intragastric balloons, thereby surging the segment growth over the forecast period.

North America is Expected to Witness Considerable Growth Over the Forecast Period

- North America is expected to hold a significant market share in the global intragastric balloon market due to the increasing obese population and high adoption of weight loss treatments. For instance, as per the data provided by the Organization for Economic Co-operation and Development (OECD), in 2021, more than 38.2% of the United States population was obese, which is the highest in the world.

- Similarly, according to the data published by the OECD, in Canada, more than 59.1% of the population aged 15 years or more were obese, whereas, in Mexico, more than 75.2% of the population aged 15 years or more was obese in 2021. Therefore, such a high number of obese population in the region is anticipated to propel the demand for the intragastric balloon, thereby surging the market growth in the region.

- Key product launches, high concentration of market players or manufacturer's presence, and acquisition & partnerships among major players, favorable initiatives, and rising adoption of minimally invasive treatments in the United States are some of the factors driving the growth of the intragastric balloon market in the country.

- For instance, according to the National Center for Biotechnology Information (NCBI) research article published in April 2022, the United States healthcare system is moving toward value-based care, and hospitals are shifting toward minimally invasive treatment. The article also stated that minimally invasive treatments offer shorter lengths of stay compared to the open approach, owing to the high demand for minimally invasive procedures in the country.

- Furthermore, in March 2023, the healthcare provider, Pristyn Care, partnered with Allurion Technologies to offer a comprehensive platform for weight loss and obesity care. The program represents the world's first swallowable gastric balloon that does not require surgery, endoscopy, or anesthesia. The program aims to help patients lose an average of 10 to 15% of their body weight during 16 weeks of treatment. Thus, owing to the increasing adoption of minimally invasive treatments and favorable initiatives, considerable market growth is expected in the country.

Intragastric Balloon Industry Overview

The intragastric balloon market is moderately competitive with several major players. Some companies currently dominating the market are Obalon Therapeutics, Apollo Endosurgery Inc., Allurion Technologies Inc., Spatz3, ReShape Lifesciences, MEDSIL, Helioscopie, and Silimed. Mergers and acquisitions, divestments, and new product developments and launches are the key strategies adopted by established market players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69555

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Minimally Invasive Treatment

- 4.2.2 Increasing Prevalence of Obesity

- 4.3 Market Restraints

- 4.3.1 Side Effects or Complications Associated with Intragastric Balloons

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Single

- 5.1.2 Dual

- 5.1.3 Triple

- 5.2 By Filling Material

- 5.2.1 Gas Filled

- 5.2.2 Saline Filled

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Obalon Therapeutics

- 6.1.2 Apollo Endosurgery Inc.

- 6.1.3 Allurion Technologies Inc.

- 6.1.4 Spatz3

- 6.1.5 ReShape Lifesciences

- 6.1.6 Lexel Medical

- 6.1.7 Endalis

- 6.1.8 MEDSIL

- 6.1.9 Helioscopie

- 6.1.10 Silimed

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.