PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403914

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403914

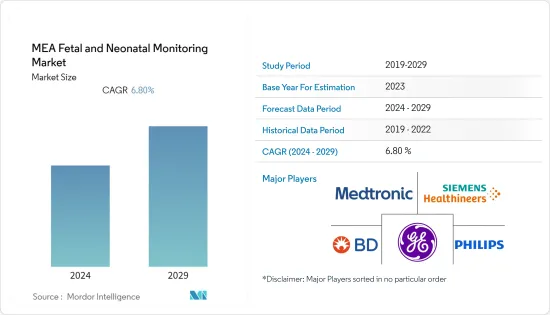

MEA Fetal & Neonatal Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The MEA Fetal & Neonatal Monitoring Market is expected to register a CAGR of 6.80% during the forecast period(2024-2029).

Key Highlights

- The outbreak of COVID-19 in the region adversely affected the market owing to limited neonatal intensive care unit (ICU) beds, delayed elective and/or complicated surgical procedures, inevitable staffing shortfall in the medical field due to illness, and scarcity of personnel in the newborn wards for monitoring. However, the strategies made by the hospitals for fetal and neonatal monitoring during the COVID-19 pandemic created a significant impact on the market.

- For instance, in July 2022, Sheba Medical Center started to provide its pregnant virus-positive patients with a new Israeli-developed handheld system they use to monitor the fetal heart rate. This helps to avoid unnecessary contact, which reduces the spread of COVID-19 infection and is expected to have a significant impact on the market in the pandemic and post-pandemic period.

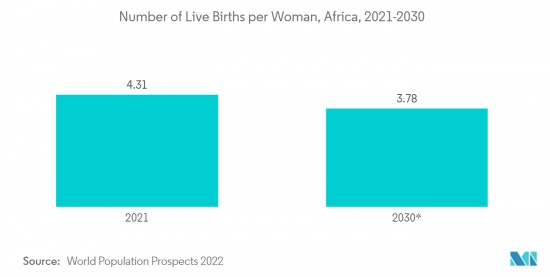

- Fetal monitoring devices are vital tools that are routinely used in gynecology and obstetrics interventions to examine fetal health during labor and delivery. Neonatal devices are thus extensively used in neonatal intensive care units (NICUs), where complex machines and monitoring devices are designed for the unique needs of newborn babies. The prevalence of preterm births has increased in recent decades in these Middle Eastern countries. These preterm newborns are found prone to diseases and infections, which lead to death.

- For instance, in November 2022, UNICEF stated that in Lebanon, a country in the Middle East, 639 newborns passed away before becoming 28 days old in 2021. This high preterm death can be reduced using neonatal monitoring devices, which are expected to drive the market. Furthermore, government initiatives can help to manage these deaths with various campaigns.

- As per the same source, the Ministry of Public Health, Lebanon, in partnership with UNICEF, launched the National Newborn and Prematurity Campaign to raise awareness of the importance of proper health care for newborns and premature babies and highlight the essential role of family and health care providers. Hence, these campaigns on newborns who should be kept under surveillance using monitoring equipment increase the demand for monitoring devices and equipment in the region and are expected to boost the growth of the market over the forecast period.

- However, the stringent regulatory procedures in the region are expected to hinder the growth of the market over the forecast period.

MEA Fetal & Neonatal Monitoring Market Trends

Cardiac Monitors Under Neonatal Monitoring Segment is Expected to Have Highest CAGR in the Market Over the Forecast Period

- Cardiac monitoring is a useful, noninvasive diagnostic tool to monitor the wide array of neonatal patient conditions in emergency departments. These cardiac monitors are used to measure the heart rate in neonates. The major factors that drive the growth of the segment are increasing preterm or low birth weight, which leads to alterations in heart rate. In addition, the new government initiatives in the region are expected to boost the market over the study period.

- According to the study report published by Frontiers in Global Women's Health in June 2022, over 9 times more African babies than European babies are in danger of dying as a result of premature delivery complications. These complications include abnormal heart rate, which should be monitored using cardiac monitoring devices to avoid the premature death of neonates. In addition, as per the same above source, preterm birth was prevalent among women admitted for labor at the Komfo Anokye Teaching Hospital, Ghana. Hence, to avoid deaths and monitor heart complications in highly prevalent premature neonates, there is an increased demand for cardiac monitors, which is expected to boost the market growth over the study period.

- Furthermore, the new partnerships among the market players are expected to drive the market due to the widespread applications in the region. For instance, in December 2021, med-tech startup Datos Health entered a partnership with the Heart Institute at Sheba Medical Center's Safra Children's Hospital, Israel, to offer remote home monitoring of pediatric cardiac patients in medically underserved communities. Thus, the new partnerships help to increase the cardiac monitoring applications to various healthcare facilities, which are expected to propel the growth of the market over the forecast period.

South Africa is Expected to Have Highest CAGR in the Market Over the Forecast Period

- South Africa has made significant strides toward lowering maternal and infant fatalities using various healthcare developments that involve monitoring devices. The increasing adoption of various fetal and neonatal monitoring devices, along with increasing preterm or low birth weight babies in the country, likely increases the demand for monitoring devices and is expected to drive the growth of the market over the study period.

- Furthermore, the high risk of birth defects in the country is expected to increase the demand for monitoring devices. For instance, the meta-analysis report published by SAGE Open Medicine in September 2022 reported that the pooled prevalence of omphalocele and gastroschisis in sub-Saharan Africa is high. Therefore, perinatal screening programs for congenital malformations ought to be put in place that likely raise the demand for fetal and neonatal monitoring devices and boost the market over the forecast period.

- Moreover, premature and newborn deaths are high in the country, which can be managed using monitoring of devices in healthcare facilities. For instance, as per the report published by the World Health Organization (WHO) in January 2022, Sub-Saharan Africa has the highest neonatal mortality rate in the world. Compared to children born in high-income nations, children born in sub-Saharan Africa have a 10-fold higher risk of dying within the first month of life. Hence, the efficient usage of monitoring devices decreases neonatal deaths, which is expected to boost the market over the forecast period.

MEA Fetal & Neonatal Monitoring Industry Overview

The Middle East and Africa fetal and neonatal monitoring market is moderately competitive with several market players. The majority of fetal and neonatal monitoring equipment and devices are being manufactured by the key players. Key players are developing and launching novel products and technologies to compete with existing products, while others are acquiring and partnering with other companies trending in the market. Some of the major market players include Becton, Dickinson and Company (BD), GE Healthcare, Koninklijke Philips NV, Medtronic, Siemens Healthcare GmbH, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Preterm and Low-weight Births

- 4.2.2 Advanced Technology in Fetal and Prenatal Monitoring

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Procedures

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 Fetal Monitoring Devices

- 5.1.1.1 Heart Rate Monitors

- 5.1.1.2 Uterine Contraction Monitor

- 5.1.1.3 Pulse Oximeters

- 5.1.1.4 Other Fetal Monitoring Devices

- 5.1.2 Neonatal Monitoring Devices

- 5.1.2.1 Cardiac Monitors

- 5.1.2.2 Capnographs

- 5.1.2.3 Blood Pressure Monitors

- 5.1.2.4 Pulse Oximeters

- 5.1.2.5 Other Neonatal Monitoring Devices

- 5.1.1 Fetal Monitoring Devices

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Neonatal Care Centers

- 5.2.3 Other End-users

- 5.3 Geography

- 5.3.1 GCC

- 5.3.2 South Africa

- 5.3.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Becton, Dickinson and Company (BD)

- 6.1.2 CooperSurgical Inc.

- 6.1.3 Draegerwerk AG & Co. KGaA

- 6.1.4 FUJIFILM SonoSite Inc.

- 6.1.5 GE Healthcare

- 6.1.6 Huntleigh Healthcare Limited

- 6.1.7 Koninklijke Philips N.V

- 6.1.8 Medtronic Plc

- 6.1.9 Natus Medical Incorporated

- 6.1.10 Siemens Healthcare GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS