PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408073

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408073

Australia Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

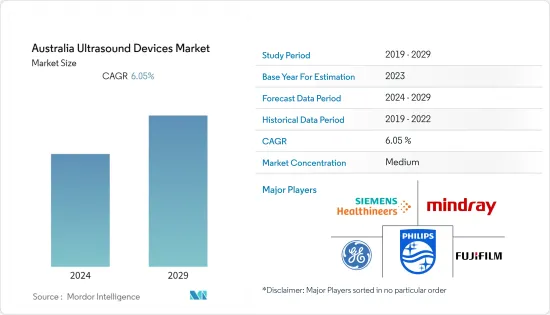

The Australian Ultrasound Devices Market size is expected to grow from USD 195.13 million in 2024 to USD 261.94 million by 2029, registering a CAGR of 6.05% during the forecast period (2024-2029).

The outbreak of COVID-19 impacted the ultrasound devices market in Australia. During the initial phase of the pandemic, the country witnessed a decline in diagnostic imaging services, adversely impacting the market. For instance, according to the NCBI study published in April 2022, during the first wave of COVID-19 in Australia, there was a significant reduction in overall diagnostic imaging services, with variable impacts across imaging modalities. The same source also reported that between January 2020 and June 2020, over 12.9 million diagnostic imaging services were performed. A statistically significant decrease in total imaging services in Australia was noticed in March 2020 (13.1%), April 2020 (32.4%), and May 2020 (21.4%). In addition, there were statistically significant decreases in ultrasound services performed in March 2020 (13.3%), April 2020 (30.5%), and May 2020 (22.3%) in Australia compared to previous years. Thus, the market witnessed slow growth during the pandemic's initial phase. However, with the resumption of radiology services in Australia due to the declining cases of COVID-19, the market started to gain traction and is expected to maintain an upward trend over the forecast period.

The increasing burden of chronic diseases such as cardiovascular diseases and cancer, coupled with the rising healthcare investment in the country and technological advancements, are the major drivers for the market. According to Cancer Australia 2021, around 3,830 new cases of thyroid cancer were diagnosed (1,070 males and 2,760 females) in Australia. The same source also stated that by age 85, a person's probability of being diagnosed with thyroid cancer is projected to be 1 in 83 (or 1.2 %) (1 in 145 or 0.69 % for males and 1 in 58 or 1.7 % for females). Ultrasound is the ideal imaging modality for detecting and evaluating a thyroid nodule. It is easy to perform, widely available and does not involve ionizing radiation. Thus, increasing cases of thyroid cancer in the country are expected to surge the demand for ultrasound devices, propelling the market growth.

Furthermore, the increasing funding by the Australian Government to strengthen imaging services in the country is expected to drive market growth. For instance, the Heart of Australia program, which includes providing mobile medical clinic services across northern Queensland, received backing and expansion funding from the Australian Government in April 2021, totaling about USD 12.0 million. Heart monitoring and other services are accessible through the mobile medical clinic. The Government's assistance in delivering cardiovascular care will increase demand for ultrasonic equipment, helping expand the market. Furthermore, technological advancement in Australia related to ultrasound is also expected to boost market growth. For instance, in February 2021, - See-Mode Technologies, a MedTech startup, received CE Mark and Therapeutic Goods Administration (TGA) approval for AI-powered Augmented Vascular Analysis (AVA) software. AVA can analyze a full vascular ultrasound scan, minimizing the need for manual drawings. This helps to augment the clinical workflow, resulting in greater overall productivity, accuracy, and improved patient outcomes. Therefore, considerable market growth is expected over the forecast period.

However, stringent regulations related to ultrasound devices in Australia may restrain the market growth over the forecast period.

Australia Ultrasound Devices Market Trends

High-intensity Focused Ultrasound Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Focused ultrasonic energy is a non-invasive method for tissue ablation, and it can be used to treat a variety of solid tumors. High-intensity focused ultrasound is utilized more frequently to treat primary and metastatic tumors because it can accurately identify tumors for ablation. High-intensity focused ultrasound is a potential therapy option for liver tumors in patients with significant medical co-morbidity who are at high risk for surgery or have a relatively low liver function that may limit hepatectomy.

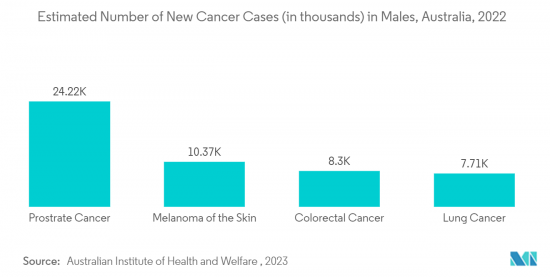

Factors such as the increasing cancer prevalence and research studies on high-intensity focused ultrasound devices are expected to increase segment growth. According to the report published by the Australian Institute of Health and Welfare in July 2022, around 162,000 new cancer cases were diagnosed in Australia, an average of over 440 every day in 2022. The same source also stated that more than half (55%) of these cases were diagnosed in males. With the rising prevalence of cancer in the nation, the demand for ultrasound devices is anticipated to rise as it is commonly used to detect and diagnose cancer/tumor.

Furthermore, the whole-gland high-intensity focused ultrasound (HIFU) presents a potential alternative minimally invasive and safe option for treating localized prostate cancer. For instance, according to the research journal published by the Mayo Foundation in August 2021, there was an increasing interest in limiting prostate cancer treatment-related side effects by restricting the amount of the treated prostate. In such a scenario, focal therapy has emerged as an effective treatment option as it limits such challenges. The focal therapy involves high-intensity focused ultrasound (HIFU). The HIFU treats only the area with the most aggressive tumor while leaving the rest of the prostate and its surrounding structures alone. This approach is widely accepted in other types of cancer as well. Kidney cancers are also treated by this approach, by removing or ablating only the tumor while leaving the rest of the kidney intact. Thus, this may lead to increased demand for HIFU systems for the minimally invasive treatment of prostate cancer in Australia, leading to higher adoption of HIFU systems in Australian healthcare. Hence, considerable segment growth is expected in Australia over the forecast period due to such instances.

Gynecology/Obstetrics Segment is Expected to Witness Considerable Growth Over the Forecast Period

In obstetrics, transvaginal ultrasound can assess fetal brain anatomy and development, especially during the first trimester, or diagnose problems such as placenta previa. Ultrasound is the safest option for the mother and baby to see structures in motion. In addition, it also helps to see the heart in motion, and these images help obstetricians more clearly assess the development during pregnancy. The gynecologic ultrasound is used to diagnose conditions in the cervix, fallopian tubes, ovaries, uterus, vagina, and bladder in women. In men, it is used to diagnose the bladder, prostate gland, and seminal vesicles.

The increasing number of cases of gynecological diseases in Australia is one of the major factors propelling the demand for ultrasound. For instance, according to the research article published by the Australian Cancer Research Foundation in July 2022, ovarian cancer is the eighth most commonly diagnosed cancer in Australian women. Compared to other gynecological cancers in Australia, ovarian cancer has the highest mortality rate at 4.8% of all cancers in women annually. The same source also stated that approximately 1,800 Australian women are diagnosed annually; internationally, the number of diagnoses reaches almost a quarter of a million. Similarly, according to the report published by Cancer Australia in July 2022, around 1,815 new cases of ovarian cancer were diagnosed in Australia in 2022. The same source also stated that it is estimated that a female has a 1 in 84 (or 1.2%) risk of being diagnosed with ovarian cancer (incl. serous carcinomas of the fallopian tube) by the age of 85. Thus, such an increasing burden of gynecological diseases in Australia is expected to increase the demand for ultrasound devices in Australia, thereby propelling segment growth over the forecast period.

Australia Ultrasound Devices Industry Overview

The Australian ultrasound devices market is moderately competitive and has several major players. Some companies currently dominating the market are Mindray Medical International Limited, Siemens Healthineers AG, GE Healthcare, Fujifilm Holdings Corporation, and Koninklijke Philips NV, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Chronic Diseases

- 4.2.2 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Stringent Regulations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Application

- 5.1.1 Anesthesiology

- 5.1.2 Cardiology

- 5.1.3 Gynecology/Obstetrics

- 5.1.4 Musculoskeletal

- 5.1.5 Radiology

- 5.1.6 Critical Care

- 5.1.7 Other Applications

- 5.2 By Technology

- 5.2.1 2D Ultrasound Imaging

- 5.2.2 3D and 4D Ultrasound Imaging

- 5.2.3 Doppler Imaging

- 5.2.4 High-intensity Focused Ultrasound

- 5.3 By Type

- 5.3.1 Stationary Ultrasound

- 5.3.2 Portable Ultrasound

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Canon Medical Systems Corporation

- 6.1.2 SonoScape Medical Corp

- 6.1.3 Fujifilm Holdings Corporation

- 6.1.4 GE Healthcare

- 6.1.5 Hologic Inc.

- 6.1.6 Koninklijke Philips NV

- 6.1.7 Mindray Medical International Limited

- 6.1.8 Samsung Electronics Co. Ltd.

- 6.1.9 Esaote SPA

- 6.1.10 Siemens Healthineers AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS