PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441451

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441451

Car Body Kit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

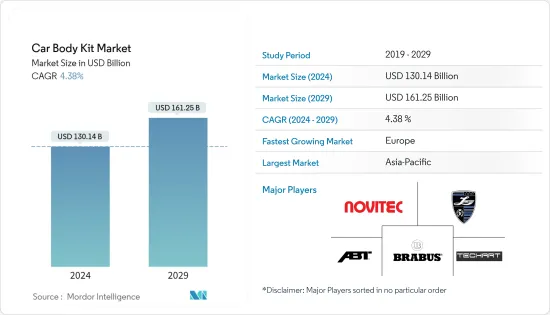

The Car Body Kit Market size is estimated at USD 130.14 billion in 2024, and is expected to reach USD 161.25 billion by 2029, growing at a CAGR of 4.38% during the forecast period (2024-2029).

The COVID-19 pandemic hurt the market during the forecast period, as the shutdown of car dealerships and service centers coupled with supply chain disruptions resulted in a decline in demand in the market. Further, the market is also affected by the halt in manufacturing activities of OEMs across major regions by OEMs during 2020. However, the market has been recovering since restrictions were lifted in 2021.

The increasing consumer inclination towards an entertaining driving experience, coupled with rising vehicle customization among the young population, are considered primary driving factors for the market growth during the forecast period, i.e., nowadays, most people try to make themselves different from others. Car owners express their individuality using their vehicles, making them unique, more comfortable, and noticeable among other cars.

In addition, the active participation of car enthusiasts and users of premium sports and racing cars in enhancing the overall performance of the market through aerodynamic kits, bumper tuning, etc., is expected to further augment the demand in the market in the coming years. Furthermore, normal accidents with spoilers and bumper damages contribute to the demand for body kits in the market.

However, the high cost of installation and the decrease in the resale value of these cars are expected to act as major restraints. The stringent regulations imposed by governments across some major countries hurt the growth of the market. For instance, According to the 2019 judgment, the Supreme Court of India ruled that any modification of the vehicle that varies with the manufacturer's original specification (as noted in the Registration Certificate) is illegal. It indicates that buyers cannot even install wider tires, bigger alloys, aftermarket exhausts, or horns in their cars.

The trend of electrification and the growing preference of consumers for using lightweight materials in the manufacturing process of body kits are expected to offer notable opportunities for the players operating in the market. Carbon fiber is one of the attractive options as it focuses on features like racetracks, such as extraordinary strength and durability against intense forces put upon it when traveling at speed for protracted periods.

Novitec Group, Maxton design, TECHART Automobildesign GmbH, and Others are some of the prominent players in the market.

Car Body Kit Market Trends

Increasing Launches of Car Body Kits Anticipated to Enhance Demand in the Market

Body kits can be used for a variety of purposes, but the most common use is to improve the appearance of the vehicle. Many people choose to add body kits because they make the car look more aggressive or sporty. Body kits can also be used to change the shape of the car, making it look wider or lower.

Over the recent years, Customer's inclination to reuse their old cars has been rising, and many car owners are focusing on changing their vehicle outlook to keep them appealing, which is expected to drive the demand for car body kits during the forecast period. For instance, As the trend of car modification is growing in popularity in order to give passenger cars a unique appearance, key OEMs offering new car model launches are anticipated to encourage body kit manufacturers during the forecast period. For instance, in January 2022, Skoda Auto revealed the official design sketches of the new Skoda Enyaq Coupe iV with a gently sloping roofline, the rear with a sharp tear-off edge, and side skirts in the body color. The new Enyaq Coupe iV is the first all-electric model series based on the Volkswagen Group's Modular Electrification Toolkit (MEB). The roof slopes gently from the B-pillar towards the rear and merges seamlessly with the tailgate. The rear styling is dominated by Skoda lettering in block capitals below a sharp tear-off edge and the brand's signature C-shaped rear lights. The front of the Enyaq Coupe iV is characterized by the large and striking Skoda grille and flat, sharply cut front headlights that accentuate the width of the vehicle.

Also, in February 2021, Toyota facelifted the Fortuner in India with a mid-life update, introducing a slew of exterior cosmetic updates, new features on the inside, and even some mechanical upgrades. Toyota also introduced a new Legender variant of the Fortuner in India. The Toyota-launched Legender body kit can be installed on both facelift and pre-facelift models. The headlights on the regular Fortuner will be replaced with Legender's unit, which comes with unique-looking integrated LED DRLs and all LED headlamps. The dynamic turn indicators are placed on the lower part of the bumper, and the fog lamps are placed on the bumper.

Such developments in the market, coupled with supportive government measures in the form of taxation policies, regulations, active sales of body kit components, etc., are encouraging several body kit manufacturers to focus on various growth strategies such as launching new products, expansion, mergers & acquisitions, etc. For instance, in July 2022, AvtoVAZ announced that it has expanded the range of LADA Granta trim levels for the 2022 model year and resumed production of Cross versions. The car is equipped with a reliable, economical, and high-torque engine (90 hp) and a manual transmission. Including 16 mm gave a modernized suspension, and another 7 mm added tires with an increased profile height. The body is protected by a functional body kit made of durable plastic, which protects the enamel from damage in light off-road conditions.

Automakers focus on basic architecture to complex components in the vehicle, especially the significant components, resulting in an average car quite sturdier than the cars consumers were offered before, indicating that rising older cars encourage consumers to replace the older, sturdier look with the latest body kit components. For example,

An average car is believed to last quite smoothly until it covers around 3,00,000 km - 3,50,000 km, even in major developing countries. For example, almost every car in India typically has a warranty of around 1,00,000 km. With extended maintenance and services, it would be safe to say that the car could probably double up its life. A car can pull off more than the mentioned limit if taken care of and kept in a spick and span state in at least 5-7 of its initial years.

Thus, considering the analysis of varied instances and positive developments, it is understood that the demand for the body kits market is anticipated to be supported by the contribution of body kit manufacturers and OEMs in the wake of growing global demand.

Asia-Pacific is Leading the Market

As the economy slowly recovers from the COVID-19 pandemic, consumer demand for premium cars has increased. Most major luxury brands see China as the fastest-growing market in terms of growth rate. China is the largest auto market globally but is disproportionately important to German premium car brands. The German luxury car manufacturers Mercedes-Benz, BMW, and Audi all posted record sales last year despite the industry facing a decline in the past years. Mercedes-Benz and Audi reported a year-on-year decrease of 6.6% and 1.8%, respectively, while other carmakers like BMW reported a year-on-year increase of 6.5%.

According to data from the China Automobile Dealers Association, China's luxury vehicle sales in the first 11 months of 2021 exceeded 2 million units, with a year-on-year increase of over 5%. This also marked the third consecutive year for luxury brands to register growth in the wake of downward pressure in China's overall automotive market. The Chinese auto market continues to have great potential due to the higher rise in demand for premium cars. Luxury carmakers have posted positive sales growth since 2020, with a significant increase in demand for luxury cars among young people. The carmakers target Gen Z consumers as they are more receptive to new body kits, aware of market trends, and focus on a stand-out personality. Owing to this, manufacturers are focusing more on providing different features in their vehicles. The trend can be seen in the mass market segment as well.

The country's luxury car market is led by European automakers, namely Mercedes-Benz, Audi, and BMW. In 2021, more than 4 million luxury vehicles were sold across the country, of which Mercedes-Benz sold a total of 758,863 vehicles, BMW sold 815,691 vehicles, and Audi sold 701,289 vehicles. BMW became the leading brand in the country, with an average monthly sales volume of more than 65,000 units (including the sales of Mini cars).

In recent years, these body kits have gained popularity, particularly among automakers and enthusiasts. The modifications allow users with enhanced performance and aesthetics resulting in increased power and torque. Performance kits in cars can provide a variety of additional characteristics without the need to modify or install any components or parts rather than just adding design elements.

Currently, only ultra-premium luxury auto brands are imported into the country, which may benefit from lower import tariffs, as these brands are fully imported from non-US factories. Several players are launching special editions of their best-selling cars in the market. For instance, in February 2022: DFSK launched the new Aeolus Yixuan MAX Dark Night Edge Edition with a body kit with a front spoiler and lip, winglets on the sides of the bumpers, winglets behind the front tires, side skirts, winglets at the front of the rear wheel, and expanded front and rear fenders that extend well beyond the back door are some examples of these features.

Car Body Kit Industry Overview

The car body kit market is fragmented, as major players such as NovitecGroup, Maxton design, TECHART Automobildesign GmbH, and Others. Product launches in key geographies and mergers and acquisitions are the key strategies adopted by the players to maintain and improve their competitive position in the market. For instance,

- April, 2022, Novitec launched a carbon fiber body kit set for Ferrari 458 Speciale. The body kits include an Air-intake louver side window, cover for taillights, front spoiler lip, flaps for front air-guide, trunk-lid side panels (set) with double-fins, and others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 Body Style

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.2 Body Kit Material

- 5.2.1 Fiberglass

- 5.2.2 ABS Plastic

- 5.2.3 Polyurethane

- 5.2.4 Carbon Fibre

- 5.2.5 Composites

- 5.3 Body Kit Component

- 5.3.1 Full-body Kits

- 5.3.2 Front and Rear Bumper Kits

- 5.3.3 Spoilers

- 5.3.4 Other Components (Lip Kit, Front Grille, Tuning Hoods, etc.)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Modsters Automotive

- 6.2.2 Auto Starke Private Limited

- 6.2.3 TECHART Automobildesign GmbH

- 6.2.4 Maxton Design

- 6.2.5 Novitec Group

- 6.2.6 LARTE Design

- 6.2.7 BRABUS GMBH

- 6.2.8 Mansory Design & Holding GmbH

- 6.2.9 ABT SportsLine GmBH

- 6.2.10 Motoren Mayer Technik GmbH

- 6.2.11 AC Schnitzer

7 MARKET OPPORTUNITIES AND FUTURE TRENDS