Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440202

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440202

Gas Insulated Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 133 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

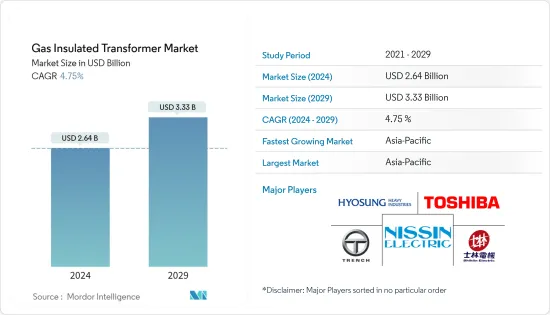

The Gas Insulated Transformer Market size is estimated at USD 2.64 billion in 2024, and is expected to reach USD 3.33 billion by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing investments in transmission and distribution infrastructure, increase in power consumption, the rise of an influx of renewable sources in the energy mix, along with upgradation and modernization of aging infrastructure, are expected to drive the market in the forecast period over the medium term.

- On the other hand, strict environmental regulations, concerns regarding the use of SF6 gas, and the high cost of gas-insulated transformers are likely to restrain the growth of the gas-insulated transformer market in the coming years.

- Nevertheless, the focus has increased on investments in clean energy projects and the development of renewable energy globally. As a result, the extensive development of new renewable projects and rising electricity usage are likely to create an excellent opportunity for the gas insulated transformer market in the future.

- Asia-Pacific is dominating the gas insulated transformer market and is expected to witness significant market growth during the forecast period, with the majority of the demand coming from China and India.

Gas Insulated Transformer Market Trends

Utility Sector to Dominate the Market

- The rising demand for electricity in cities globally, the lack of space to construct new substations or upgrade the existing ones located near the load centers, and adverse environmental conditions have encouraged a trend in overpopulated urban areas to move large-scale substations underground. This has led to a growing demand for incombustible and nonexplosive, large-capacity gas insulated transformers (GIT) to prevent accidents and ensure the compactness of equipment.

- With increasing demand and a lack of environmentally acceptable sites for additional extra-high-voltage/high-voltage outdoor substations in city centers, utilities consider indoor substations an alternative solution.

- For instance, the Villaverde substation is part of the Madrid plan project developed by Spanish utility Iberdrola in agreement with the regional government and the city of Madrid. The plan replaces extra-high-voltage and high-voltage transmission lines crossing Madrid with an underground cable network. There may be 16 air-insulated substations dismantled and 18 new indoor substations built.

- The market growth for the utility segment during the forecast period is expected to be attributed to the growing demand for reliable power supply and increasing investments in the power infrastructure.

- Investments in smart grids and the up-gradation of older grids are also expected to significantly drive the power utility segment of the global gas-insulated transformer market. With many large Asia-Pacific countries, such as India, trying to modernize their grid systems, large investments are being made.

- In November 2021, the Power minister of Goa (India) announced plans to build to state's first gas insulated substation. They costed around USD 4.3 million. The substation is expected to serve consumers residing in Davorilm, Navelim, and some parts of Margao and Curtorim. Plans have also been laid out to extend gas insulated substation (GIS) technology throughout the state.

- Therefore, owing to the above points, the utility segment is expected to witness significant growth during the forecast period.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is one of the most densely populated regions globally. Due to the rapid growth in industrialization and urbanization across the region, electricity demand has increased substantially over the past few years. Due to this, transmission and distribution (T&D) infrastructure investments have also grown significantly over the same period. Additionally, as long-distance T&D projects are becoming more eco-friendly by reducing environmental impact and improving safety by creating underground networks and smaller substations, gas insulated transformers are becoming increasingly attractive.

- In China, in August 2022, the State Grid Corporation of China announced that the company would invest over USD 22 billion in the second half of 2022 to execute a new batch of ultra-high voltage (UHV) power transmission projects across China.

- In India, significant investments are also being made in T&D infrastructure. In December 2021, the Indian Government approved 23 interstate transmission system (ISTS) projects to be built across India with an estimated USD 2.1 billion investment. Of the projects to be developed, 13 will be established under a tariff-based competitive bidding (TBCB) scheme, with an estimated cost of USD 1.78 billion. The remaining ten will be developed under a regulated tariff and require an USD 0.14 billion investment.

- The Asia-Pacific region is also the fastest-growing region in renewable energy deployment. The growth is led by renewable energy giants such as China and India. Due to the rapid rise in renewable power generation, grid stability has become a significant issue in countries with a high level of renewable integration in their grids, which also requires the modernization of older T&D infrastructure. As renewable energy generated from sources such as solar and wind provides variable power output, traditional T&D systems are unsuitable for renewable energy transmission and distribution and require up-gradation or retrofitting with smart grid technologies.

- Moreover, many large-scale electrical and T&D equipment manufacturing companies such as Hyosung, Meidensha, Mitsubishi, Toshiba, and Zheijhang have originated from the eastern Asia-Pacific region, and most of their manufacturing facilities are concentrated in the region. According to the Powergrid Corporation of India, equipment such as gas insulated substations for the Thrissur-Pugalur HVDC line was supplied by factories in India as a part of the Make In India Program. As the region has a robust electrical equipment manufacturing industry, proximity to demand centers is expected to boost the Asia-Pacific segment of the Global gas insulated transformer market during the forecast period.

- Therefore, owing to the above points, the Asia-Pacific is expected to dominate the gas-insulated transformer market during the forecast period.

Gas Insulated Transformer Industry Overview

The gas insulated transformer market is partially fragmented. Some of the major players in the market (in no particular order) include Hyosung Heavy Industries Corp, Toshiba Corp, Shihlin Electric & Engineering Corp., Nissin Electric Co. Ltd, and Trench Group., among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71079

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Voltage

- 5.1.1 Low Voltage (Up to 72.5 KV)

- 5.1.2 Medium Voltage (72.5 KV - 220 KV)

- 5.1.3 High Voltage (Above 220 KV)

- 5.2 By Installation

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By End-User

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Utility

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nissin Electric Co., Ltd

- 6.3.2 Arteche Group

- 6.3.3 Hyosung Heavy Industries Corp.

- 6.3.4 Meidensha Corp.

- 6.3.5 Mitsubishi Electric Corporation

- 6.3.6 Trench Group

- 6.3.7 Chint Group

- 6.3.8 Toshiba Corp

- 6.3.9 Takaoka Toko Co., Ltd

- 6.3.10 Shihlin Electric & Engineering Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.