PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444345

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444345

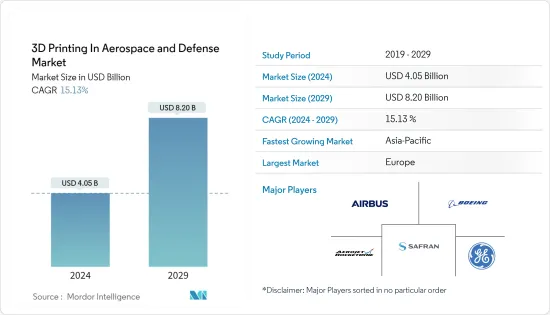

3D Printing In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The 3D Printing In Aerospace And Defense Market size is estimated at USD 4.05 billion in 2024, and is expected to reach USD 8.20 billion by 2029, growing at a CAGR of 15.13% during the forecast period (2024-2029).

The COVID-19 pandemic affected the aviation industry in 2020. Thus, airlines have opted to accelerate the retirement of older aircraft as a cost-cutting measure and are now planning to replace them with newer generation aircraft that are comparatively lightweight and more fuel-efficient. Several aerospace OEMs are investing in large-scale research projects to enhance the use of 3D-printed parts and components in newer-generation aircraft. Furthermore, the use of 3D-printed parts is increasing in the aftermarket space, as such parts may reduce the pressure on traditional supply chains.

The benefits offered by 3D printing have popularized its adoption in the aerospace sector. 3D printing produces parts at lower costs with faster lead times and more digitally flexible design and development methods. 3D printing also results in significant cost savings for users and manufacturers.

Although the adoption of 3D printing is increasing in the A&D sector, there are significant challenges that are currently delaying its progress toward mass adoption. Nevertheless, the advancements, including 3D printing technology and material sciences, are likely to address most of these limitations, thereby driving the adoption of 3D printing in the aviation industry in the coming years.

3D Printing in Aerospace and Defense Market Trends

Aircraft Segment is Expected to Show Highest Growth During the Forecast Period

The aircraft segment will showcase remarkable growth during the forecast period. The growth would be due to the increasing number of commercial aircraft orders and deliveries, as well as the rising adoption of advanced technologies in aircraft manufacturing. 3D printing has revolutionized the aircraft manufacturing industry, and there is a massive expansion in the number of use cases where additive manufacturing can replace conventional methods of manufacturing commercial and military aircraft parts at lower costs, faster lead times, and more digitally flexible design and development methods. The B777X aircraft is a prominent example of the application of additive manufacturing as its GE9X engines are made of 300 3D printed parts, including fuel nozzles, temperature sensors, heat exchanges, and low-pressure turbine blades.

Aircraft OEMs and 3D printing firms are collaborating to significantly reduce inventory costs and storage requirements instead of maintaining large stocks of spare parts. Manufacturers can produce them as needed, reducing lead times and supply chain complexities. For instance, in January 2023, Leonardo signed a five-year deal with BEAMIT Group, an Italian premier service bureau for high-end 3D printing applications, to develop and qualify parts for installation onboard Leonardo aircraft models. Since 2017, the two firms have collaborated to qualify and install over 100 parts onboard the M345, M346, and C27J aircraft models. Such developments are expected to drive the market growth in coming years.

Asia-Pacific is Expected to Project Significant Growth in the Market During the Forecast Period

Asia-Pacific is anticipated to show remarkable growth in 3D printing in the aerospace and defense market during the forecast period. The growth is expected to be due to the rapid expansion of the aviation sector and increasing defense expenditure from countries such as China, India, and South Korea. According to the International Air Transport Association (IATA), China became the largest aviation market in terms of seating capacity in mid-2020. According to plans released in February 2021, China is planning to have 400 civilian transport airports by the end of 2035.

Under the country's Made in China 2025 master plan, the Chinese government has earmarked the development of aerospace equipment and 3D printing as key growth drivers of Chinese manufacturing industries. A Chinese manufacturer developed the C919 narrow-body aircraft using 3D printed titanium parts, 28 cabin door parts, and two fan inlet structural parts to reduce the airliner's weight and increase its safety. Also, China's aviation industry has started using 3D printing technologies on new-generation warplanes, with 3D printed parts widely used on newly developed aircraft. 3D printing technologies have been implemented in the major aircraft manufacturing factories of the Chinese aviation industry. 3D printed parts provide numerous advantages such as high structural strength and long service life, as well as being lightweight, low cost, and quicker to manufacture.

Furthermore, India is gradually growing concerning its utilization of 3D printing technology, with startups springing up in cities like Bangalore, Chennai, Mumbai, Visakhapatnam, etc., to produce essential parts for the aerospace and defense sector. The clientele includes the Indian Navy, Air Force, Indian Space Research Organization (ISRO), and Hindustan Aeronautics Limited (HAL). For instance, in November 2022, the Indian Army constructed 3D printed bunkers or permanent defenses along the Line of Actual Control in eastern Ladakh. Military Engineering Services (MES) and start-ups have developed 3D printed structures of varying sizes and capabilities. The MES is planning to deploy permanent 3D printed shelters, such as bunkers and houses, from the beginning of 2023 along the Line of Actual Control and International Border, from Sikkim, Ladakh, and Arunachal Pradesh to desert regions. Thus, growing adoption of 3D printing in aerospace and defense boosts the market growth across the region.

3D Printing in Aerospace and Defense Industry Overview

The market for 3D printing in aerospace and defense is fragmented with the presence of aircraft OEMs and spacecraft manufacturers, along with Tier-1 and Tier-2 manufacturers that support the aerospace and defense industry. Some of the prominent players in the market are General Electric Company, Airbus SE, Safran SA, Aerojet Rocketdyne Holdings Inc., and The Boeing Company. With the increasing demand for lightweight components and more fuel-efficient airborne platforms, the companies are robustly investing in expanding their existing additive manufacturing capabilities to seize the growing opportunities.

On this note, in July 2021, Burloak Technologies announced the opening of its second additive manufacturing center in Camarillo, California. The new facility is expected to reinforce its Additive Manufacturing Center of Excellence in Ontario. Aircraft OEMs are also increasing their footprint in the additive manufacturing market with the increasing requirement for 3D printed components. Also, due to the economic advantage of 3D printing components in the space sector compared to the traditional subtractive manufacturing methods, space agencies like NASA and ESA are currently looking to manufacture spacecraft parts using 3D printed components. This factor is expected to allow new companies to venture into the market in the coming years, increasing competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Aircraft

- 5.1.2 Unmanned Aerial Vehicles

- 5.1.3 Spacecraft

- 5.2 Material

- 5.2.1 Alloys

- 5.2.2 Special Metals

- 5.2.3 Other Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aerojet Rocketdyne Holdings Inc.

- 6.2.2 MTU Aero Engines AG

- 6.2.3 Moog Inc.

- 6.2.4 Safran SA

- 6.2.5 General Electric Company

- 6.2.6 The Boeing Company

- 6.2.7 Airbus SE

- 6.2.8 Samuel, Son & Co.

- 6.2.9 Raytheon Technologies Corporation

- 6.2.10 Honeywell International Inc.

- 6.2.11 American Additive Manufacturing LLC

- 6.2.12 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS