PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406152

Locomotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

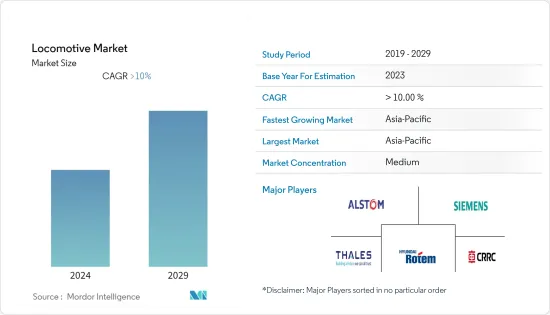

The Locomotive Market was valued at USD 24.2 billion in the current year and is projected to grow to USD 43.58 billion by the next five years, registering a CAGR of 10% in terms of revenue during the forecast period.

Over the long term, an increase in urbanization, environmental sustainability, a broad spectrum of impending rail projects, growth in demand for energy-efficient rolling stock, and an expanding infrastructure of rail networks are expected to act as major factors driving the locomotives market. The extensive rail networks globally further support the growth of electric locomotives to meet the demand as a means of public transport.

In addition, technological progress, such as the launch of the Sic module, IGBT module, and auxiliary power units, has resulted in a surging demand for locomotive engines. This progress has reduced emissions, escalated fuel efficiency, and lowered overall weight. It has also reduced power loss when switching to the current state.

However, certain restraining factors are impeding the growth of the locomotives market, which include the capital intensiveness of rolling stock, high maintenance costs, and overhaul costs. Despite these market challenges, the global market is expected to grow significantly in the coming years.

With the developing transportation industry, the volume of cargo to be moved is expanding globally, while Asia-Pacific and North America may witness significant growth during the forecast period.

Locomotive Market Trends

Increasing Number of Electric Locomotive Projects to Fuel Growth of the Market

Locomotives are powered engines that are used to pull trains. The ability of a locomotive to carry a payload separates it from low-power engines. The force required to pull trains is much higher than normal vehicles; thus, large-scale investments are a necessity and not a benefit.

The recent technological advances in design, as well as structures of locomotives, have allowed applications with higher pulling capacities and lower fuel consumption. The massive investment in the railway sector is consequential to the many passengers it can carry. The extensive railways in densely populated countries such as India will create several growth opportunities for the companies operating in the market. The presence of several large-scale companies will emerge in favor of market growth.

The Inspiron walkthrough-style trains are planned for introduction in 2023, and they are likely to replace the old trains, which have already surpassed the 40-year design life. These are some of the factors that will soon boost the railway industry and the locomotive market in Europe.

With the increase in traffic congestion across urban centers around the globe, there is a strong need to develop faster, more efficient, and more reliable transportation systems coupled with the advancement in technology and its integration with transportation systems like artificial intelligence and machine learning.

At the same time, the railway industry is in the transformation stage, led by emerging digital technologies like 5G, big data, the Internet of Things, automation, artificial intelligence, and blockchain. Driverless trains can enhance capacity, improve safety, and offer cost savings through reduced labor and maintenance requirements, making them an attractive solution for transportation authorities and rail operators. Many regional governments are deploying autonomous trains across the region to increase efficiency and reduce costs. For instance,

- In February 2023, Delhi Metro launched its first-ever indigenously developed Train Control and Supervision System (TCSS). The system, developed in collaboration with Bharat Electronics Limited (BEL), replaces the existing technology used for train control and signaling. The indigenously developed TCSS incorporates advanced features like automatic train operation, automatic train protection, and remote diagnostics. This technological milestone showcases India's capability to develop state-of-the-art metro rail systems and contributes to the country's efforts in self-reliance in the field of urban transportation infrastructure.

- In November 2022, The first driverless trains were introduced on the Sydney City and Southwest Line in Australia. The trains, manufactured by Alstom, will operate autonomously, enhancing passenger safety and improving travel efficiency. The driverless trains feature advanced technologies and spacious interiors for a comfortable commuting experience. This milestone marks a significant step towards modernizing Sydney's rail network and adopting automated train operations for increased reliability and capacity.

The above-mentioned development across the globe is likely to witness major growth for the market during the forecast period.

Asia-Pacific Region is Expected to Lead the Locomotive Market

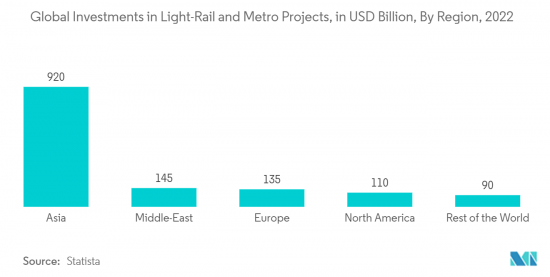

The Asia-Pacific region is anticipated to hold the largest market share during the forecast period. The massive transport industry and the constantly rising railway passengers and train travel are likely to create several opportunities for companies operating in the regional market.

In addition, the railway is the most preferred means of transport among the passengers of the major Asian economies such as China, India, and Japan. These three countries are also topping the list of passenger kilometers per year, as major manufacturers of the locomotive market are headquartered in this region.

The growing popularity of metro travel as public transportation in India is also witnessing major growth in the market. Due to this, the railway network plays a very significant role in the economic development of countries in Asia-Pacific. For instance,

- In February 2022, the Hangzhou metro opened two new lines and an extension, adding more than 59 route km to the network. The installed base of metro-rail rolling stock in India is expected to increase to 5,458 railcars by 2023, owing to the huge demand for commuter transportation in metropolitan cities. A total of 3,343 railcars are planned to be added to the metro-rail network over five years, from 2018 to 2023.

Japan is one of the prominent countries using autonomous trains. Japan started testing its E7 series Shinkansen bullet trains in 2022 with a focus on operating such driverless trains soon. The East Japan Railway Co. expects that such trains will reduce human efforts, offer time and cost savings, and improve safety. These are some of the factors that are going to boost the demand for autonomous trains in the Asia-Pacific autonomous train market.

Asia-Pacific is also characterized by developed and developing economies, such as Singapore, Malaysia, Indonesia, and Bangladesh. New rail projects for urban passenger transportation and the replacement and maintenance of the existing fleet are expected to drive the market in these countries.

The Malaysian Industry-Government Group for High Technology (MIGHT) signed a memorandum of understanding with Bombardier Transportation, outlining their collaboration on developing home-grown rail industry expertise over the coming years.

The Malaysian government ordered 252 driverless vehicles for the Kuala Lumpur metro Line LRT3 from a consortium of Siemens China, CRRC Zhuzhou, and a Malaysian partner, Tegap Dinamik. The government also ordered 108 Innovia Metro 300 vehicles from a consortium of Hartasuma and Bombardier that are likely to be used for Kuala Lumpur's Kelana Jaya Line.

Owing to the above factors, the deployment of locomotives in the region is expected to observe significant growth during the forecast period.

Locomotive Industry Overview

The locomotive market is dominated by several key players such as CRRC, Alstom SA, Siemens AG, Hyundai Rotem, and others. The companies are expanding their presence by acquiring other market participants, forming strategic alliances with other players in the market, and launching new and advanced locomotives. For instance,

In December 2022, the Ministry of Railway, India, published a National Rail Plan and announced to increase the share of rail freight traffic by 27% to 45% by the end of 2030. Further, the development of Dedicated Freight Corridors (DFCs) on key high-density routes is a crucial policy move by Indian Railways to halt the downward trend in the market share of the country's railways and would also tip the balance in favor of rail transportation. Additionally, to encourage private investment in general-purpose wagons, special-purpose/high-capacity wagons, automobile carrier wagons, etc., numerous programs have also been developed.

In November 2022, Alstom, in collaboration with Dutch infrastructure management ProRailand Belgian rail freight operator Lineas, exhibited the maximum level of automation on a shunting locomotive in Breda, the Netherlands. This level of automation, known as GoA4, entails completely automated starting, driving, halting, and dealing with unexpected obstructions or incidents without the direct involvement of any on-train personnel during shunting tasks.

In October 2022, Siemens Mobility, in collaboration with consortium partners ST Engineering and Stadler, was granted a turnkey contract to deliver the Yellow Line for the Kaohsiung Metro. Siemens Mobility will integrate GoA4 capabilities into its cutting-edge CBTC signaling system, enabling fully automated train operations (ATO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Rail Transporation Across the Globe

- 4.2 Market Restraints

- 4.2.1 High Capital and Service Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Propulsion Type

- 5.1.1 Diesel

- 5.1.2 Electric

- 5.2 By Technology

- 5.2.1 IGBT Module

- 5.2.2 GTO Thyristor

- 5.2.3 SiC Module

- 5.3 By Component Type

- 5.3.1 Rectifier

- 5.3.2 Inverter

- 5.3.3 Traction Motor

- 5.3.4 Alternator

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 CRRC Corporation Limited

- 6.2.2 Alstom SA

- 6.2.3 Turbo Power Systems

- 6.2.4 Siemens AG

- 6.2.5 Kawasaki Heavy Industries Ltd.

- 6.2.6 CJSC Transmashholding

- 6.2.7 Stadler Rail

- 6.2.8 Toshiba Corporation

- 6.2.9 Hyundai Rotem

- 6.2.10 Mitsubishi Heavy Industries, Ltd.

- 6.2.11 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS