PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444461

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444461

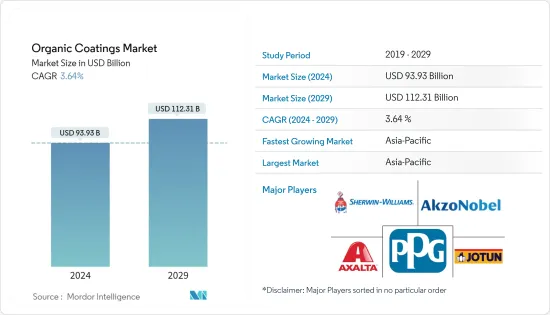

Organic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Organic Coatings Market size is estimated at USD 93.93 billion in 2024, and is expected to reach USD 112.31 billion by 2029, growing at a CAGR of 3.64% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020 due to restrictions on all industrial activities and disruptions in the supply chain. However, the sector has been recovering well since restrictions were lifted. The rise in the level of architectural activities is likely to positively impact the studied market.

Key Highlights

- Over the short term, increasing usage of organic coatings in protective applications and the rising demand from the building and construction sector are some of the factors driving the market demand.

- The environmental concerns related to organic coatings and the availability of substitutes are the factors hindering the market's growth.

- The rising potential demand for eco-friendly organic coatings is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Organic Coatings Market Trends

Increasing Demand from Architectural Applications

- Architectural coatings are finishes used for the interiors and exteriors of buildings. The main purpose of an architectural coating is decorative. However, the coating also provides some protection to the underlying building materials.

- Alkyd paints are among the most versatile and useful materials in organic coatings. Long-oil alkyds of the air-drying type are widely used in high-quality interior architectural paints and enamels due to their good elasticity and exterior durability.

- According to China's Five Year Plan (January 2022), the construction industry in the country is estimated to register a growth rate of 6% in 2022. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years.

- Europe also witnessed an expansion in retail, with the new construction of malls across the continent. The Metropol Mall in Turkey, the Mall of Scandinavia in Sweden, Westfield Bradford in the United Kingdom, Weberzeile Ried in Austria, the Mall of Europe in Belgium, and Lublin Mall in Poland are some of the recent constructions in Europe.

- According to the US Census Bureau, in December 2021, the construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,639.9 billion, 0.2% more than the revised November estimate of USD 1,636.5 billion. Moreover, in 2021, construction spending amounted to USD 1,589.0 billion, 8.2% above USD 1,469.2 billion in 2020, thereby indicating an increase in the demand for coatings from architectural applications.

- Such factors are likely to increase the demand for organic coatings during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China and India are among the fastest-growing economies in the world.

- Organic coatings are increasingly used in China's building and construction industry. China is home to the world's largest construction industry. With several major construction projects in progress, China will likely maintain this position for the foreseeable future.

- Organic coatings are also widely used in vehicle manufacturing. In India, the contribution of the automobile sector to the overall GDP stands at 7.1%. It also contributes 49% of the manufacturing GDP. The Indian automotive industry is expected to be the world's third-largest automotive market in terms of volume in a few years.

- In addition, 43,99,112 vehicles were produced in India in 2021, which increased by 30% compared to 33,94,446 units manufactured in 2020. The Indian automotive sector is optimistic about reaching pre-pandemic levels of production volume this year, despite manufacturing being hampered by a semiconductor shortage.

- Japan is expected to have 100% of its car sales be EVs by 2035, and the Japanese electric vehicle market is growing. US companies may also find business opportunities in various areas related to electric vehicles. The expansion of the electric vehicle market in the country is therefore projected to aid the growth of organic coatings.

- All the aforementioned factors are likely to augment the studied market over the forecast period.

Organic Coatings Industry Overview

The organic coatings market is partially consolidated in nature. Some of the major players in the market include Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel, Jotun, and Axalta Coating Systems (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in Protective Applications

- 4.1.2 Rising Demand From the Building and Construction Sector

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to Organic Coatings

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Primers

- 5.1.2 Topcoats

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Protective

- 5.2.2 Marine

- 5.2.3 Architectural

- 5.2.4 Automotive

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AKZO Nobel NV

- 6.4.2 Anochrome Group

- 6.4.3 Axalta Coating Systems Ltd

- 6.4.4 Dupont

- 6.4.5 Dymax

- 6.4.6 Jotun

- 6.4.7 Nippon Paint Holdings Co. Ltd

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Potential Demand for Eco-friendly Organic Coatings