PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331339

Thermoplastic Vulcanizate (TPV) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Thermoplastic Vulcanizate (TPV) Market size is expected to grow from 417.05 kilotons in 2023 to 558.11 kilotons by 2028, at a CAGR of 6% during the forecast period (2023-2028).

The COVID-19 pandemic disrupted the thermoplastic vulcanizate market, resulting in a reduction in supply due to transportation restrictions and a decline in demand from various sectors. Nonetheless, the market rebounded in 2022 due to increased demand from the automotive, building, and construction industries.

Key Highlights

- The major factors driving the market studied are the surge in demand from the automobile industry, the increase in utilization in the consumer goods industry, and favorable government policies related to using recyclable materials.

- However, poor resistance to chemicals and low wear resistance, and fluctuation in raw material prices could restrain the thermoplastic vulcanizate market.

- Growing use in the healthcare industry and surging demand for electrical appliances are expected to be major growth opportunities for the market.

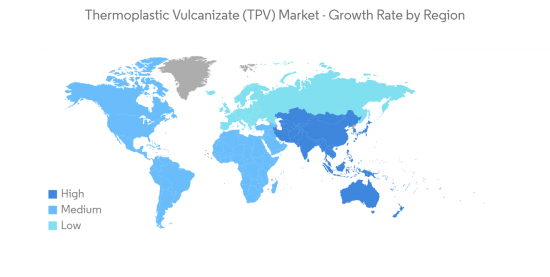

- The Asia-Pacific region is expected to be the largest and fastest-growing region in the forecast period.

Thermoplastic Vulcanizate (TPV) Market Trends

The Automotive Segment to Dominate the Market

- Automotive lightweight materials grew robustly over the past couple of years due to the increasing demand for luxurious, low-on-emission, safe, and high-performance vehicles.

- As a result, suppliers and manufacturers introduced various solutions that help OEMs meet continually tightening regulations and satisfy the widening range of consumers' tastes.

- The major applications of TVP in the automotive industry include hose coverings, air inlet duct covers, gaskets, seals, convoluted boots, vibration dampeners, strut covers, ignition components, bushings, and window seals.

- TPV flexible automotive under-the-hood components include air intake tubes and bellows, wheel well flares, steering system bellows, and sound abatement parts.

- Cost is the biggest advantage, with TPVs being 10-30% lower than EPDM, coupled with lower weight, improved design flexibility, and recyclability. Furthermore, the lightweight of TPV enables more fuel-efficient vehicles.

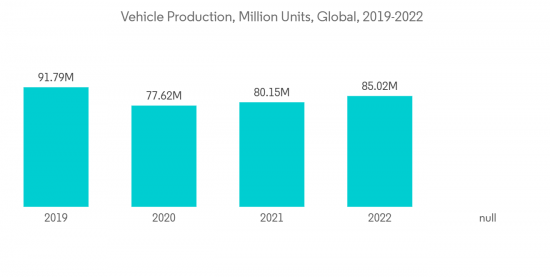

- In 2022, According to the International Organization of Motor Vehicle Manufacturers (OICA), global automobile production increased by 6% compared to the previous year due to increasing global demand for private mobility.

- In China, the total vehicle production was 270,20,615, with an increase of 3% in 2022 compared to the previous year. Also, in Canada, the total vehicle production was 12,28,735 in 2022, with an increase of 10% in the production of vehicles in the country compared to the previous year.

- Thus, based on the factors above, the automotive segment is expected to dominate the market.

Asia-Pacific to Witness the Fastest Growth

- Extensive demand from China, Japan, and India is one of the key reasons driving the demand in the market in Asia-Pacific.

- China is the world's largest automotive producer. However, the country witnessed a decline in the production of vehicles in the recent past. The economic shifts and China's trade war with the United States affected the automotive industry's performance.

- China is focusing on increasing the production and sales of electric vehicles. For this purpose, the country planned to increase the production of electric vehicles (EVs). It targeted to reach the share of electric vehicles to 20% of China's total new car production by 2025, stated the International Energy Agency (IEA).

- Moreover, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total vehicle production in China stood at 27,020,615 units, which increased by 3% compared to 2021.

- China's booming economy offered consumer product companies some of the world's greatest growth opportunities. Attracted by the huge potential of China's consumer goods market, many foreign companies entered China and set up production units. With the growth of consumer goods production, thermoplastic vulcanizate consumption may also see an increased demand.

- According to World Resources Institute (WRI), China is in the middle of a construction mega-boom. The country includes the largest building market in the world, making up 20% of all construction investment globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030.

- In Japan, Tokyo emerged as a top market among the rest of the major cities in the region for investments and development prospects, of which the residential sector accounted for the major share.

- Thus, the anticipated growth in the automotive, construction, and consumer goods industries will likely drive the domestic demand for thermoplastic vulcanizate during the forecast period in Asia-Pacific.

Thermoplastic Vulcanizate (TPV) Industry Overview

The thermoplastic vulcanizate (TPV) market is consolidated, with the top players accounting for around 70% of the market share. The major companies (in no particular order) include Exxon Mobil Corporation, Mitsui Chemicals Inc., Teknor Apex, Dawn Group, and KUMHO POLYCHEM.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Demand from the Automobile Industry

- 4.1.2 Increase in Use of Thermoplastic Vulcanizate in the Consumer Goods Industry

- 4.1.3 Favourable Government Policies Related to the Use of Recyclable Materials

- 4.2 Restraints

- 4.2.1 Poor Chemical and Wear Resistance

- 4.2.2 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Consumer Goods

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 Celanese Corporation

- 6.4.3 Elastron TPE

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FM Plastics

- 6.4.6 Kumho Polychem

- 6.4.7 LCY GROUP

- 6.4.8 LyondellBasell Industries holdings B.V.

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Mitsui Chemicals Inc.

- 6.4.11 Ravago

- 6.4.12 RTP Company

- 6.4.13 Teknor Apex

- 6.4.14 Trinseo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage in the Healthcare Industry

- 7.2 Growing Demand in Electrical Applicances