PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445863

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445863

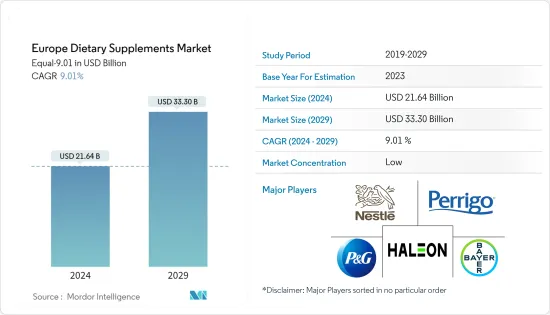

Europe Dietary Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Dietary Supplements Market size is estimated at USD 21.64 billion in 2024, and is expected to reach USD 33.30 billion by 2029, growing at a CAGR of 9.01% during the forecast period (2024-2029).

Key Highlights

- Europe has experienced an increase in the consumption of dietary supplements due to their perceived benefits in promoting a healthier lifestyle through the inclusion of macro and micro-nutrients. Many consumers view dietary supplements as self-care tools and immunity boosters that can aid in maintaining overall health, heart and digestive health, immune system, energy, and skin health. The growing awareness among consumers regarding preventive healthcare measures and practices has further driven the demand for these products.

- To cater to the evolving needs and preferences of consumers, manufacturers in the market are experimenting with different dietary supplement delivery formats. Direct-dose powders, chews, gummies, and other interesting formats have become increasingly popular among European consumers due to their convenience and easy availability.

- In November 2021, Procter and Gamble entered the market of vitamin C formulations containing zinc and other mineral or herbal ingredients by launching its products co-packaged with two of its best-known OTC drug brands, Vick's DayQuil and NyQuil cold remedies. This move highlights the increasing trend of combining dietary supplements with conventional drugs to create new product offerings and cater to the growing demand for preventive healthcare measures.

Europe Dietary Supplements Market Trends

Escalating Consumer Investment in Preventive Healthcare Products

- The aging population in Europe is driving the demand for various dietary supplements that can help maintain and enhance overall health and well-being. This trend is further fueled by the high healthcare costs in the region, as Europeans spend a considerable amount out-of-pocket on healthcare expenses for both communicable and non-communicable diseases.

- For instance, according to the Organisation for Economic Co-operation and Development (OECD), in 2021, in Germany, the average per capita out-of-pocket spending on healthcare was USD 858.4. Vegan and all-natural supplements are some of the fastest-growing categories, as they are gaining popularity due to their perceived health benefits. Probiotics, in particular, have experienced significant growth in recent years as they aid in gut health.

- Market companies have responded quickly to this trend, expanding their product portfolios to include such supplements. For instance, in June 2022, Procter & Gamble launched a new line of dietary supplements, including in Europe.

Italy Holds the Largest Market Share

- Italian consumers place great value on functional foods and believe that they offer significant health benefits. As a result, they are increasingly demanding affordable products with functional properties. This has led to substantial growth in the market, driven by growing awareness of the link between diet and health and a desire for dietary supplements that can improve health while providing essential nutrition.

- Consumers in the region are mainly focused on preventive healthcare and are spending more on healthcare as a result. There is also an increasing prevalence of obesity in the country, which is driving demand for fitness supplements and other dietary supplements. According to World Population Review data from 2023, 19.9% of adults in Italy are obese.

- Market players in the region are launching new dietary supplements to meet consumer needs. For example, in February 2021, Garden of Life launched new baby vitamins designed to provide optimal wellness for babies. These liquid supplements are certified United States Department of Agriculture (USDA) organic, non-genetically modified organism (GMO) project verified, and are vegan and gluten-free.

Europe Dietary Supplements Industry Overview

The Europe dietary supplements market is highly fragmented, with global and regional players competing for market share. Among the prominent players in the market are Nestle SA, Bayer AG, Haleon PLC, Procter & Gamble Co, and Perrigo Co Plc. These companies continually seek to expand their product portfolios and market reach through mergers and acquisitions. For example, in February 2022, Nestle Health Science completed its acquisition of Vital Proteins, a leading lifestyle and wellness platform offering a range of supplements, beverages, and food products. This move aimed to strengthen Nestle Health Science's position in the health and wellness market, especially in the fast-growing collagen supplement segment. The acquisition also allowed Vital Proteins to leverage Nestle Health Science's global distribution network and resources to expand its product offerings and customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Consumer Spending on Preventive Healthcare Products

- 4.1.2 Weight-loss Dietary Supplements Capturing the Market

- 4.2 Market Restraints

- 4.2.1 Escalating Functional Food Consumption

- 4.2.2 An Environment of Austere Regulations

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Vitamins and Minerals

- 5.1.2 Enzymes

- 5.1.3 Herbal Supplements

- 5.1.4 Proteins and Amino Acids

- 5.1.5 Fatty Acids

- 5.1.6 Probiotics

- 5.1.7 Other Types

- 5.2 Distribution Channel

- 5.2.1 Pharmacies and Drug Stores

- 5.2.2 Supermarkets and Hypermarkets

- 5.2.3 Online Channels

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 Spain

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 France

- 5.3.5 Italy

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Amway Corporation

- 6.3.2 Glaxosmithkline PLC

- 6.3.3 Bayer AG

- 6.3.4 Procter & Gamble Company

- 6.3.5 Perrigo Plc

- 6.3.6 Nestle SA

- 6.3.7 Herbalife Nutrition Ltd.

- 6.3.8 Sanofi

- 6.3.9 Pileje SAS

- 6.3.10 Biogaia AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS