PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237830

Artificial Intelligence And Analytics In Defense Market - Growth, Trends, And Forecasts (2023 - 2028)

Artificial Intelligence (AI) and Analytics in the Defense market is expected to grow with a CAGR of over 13% during the forecast period.

Key Highlights

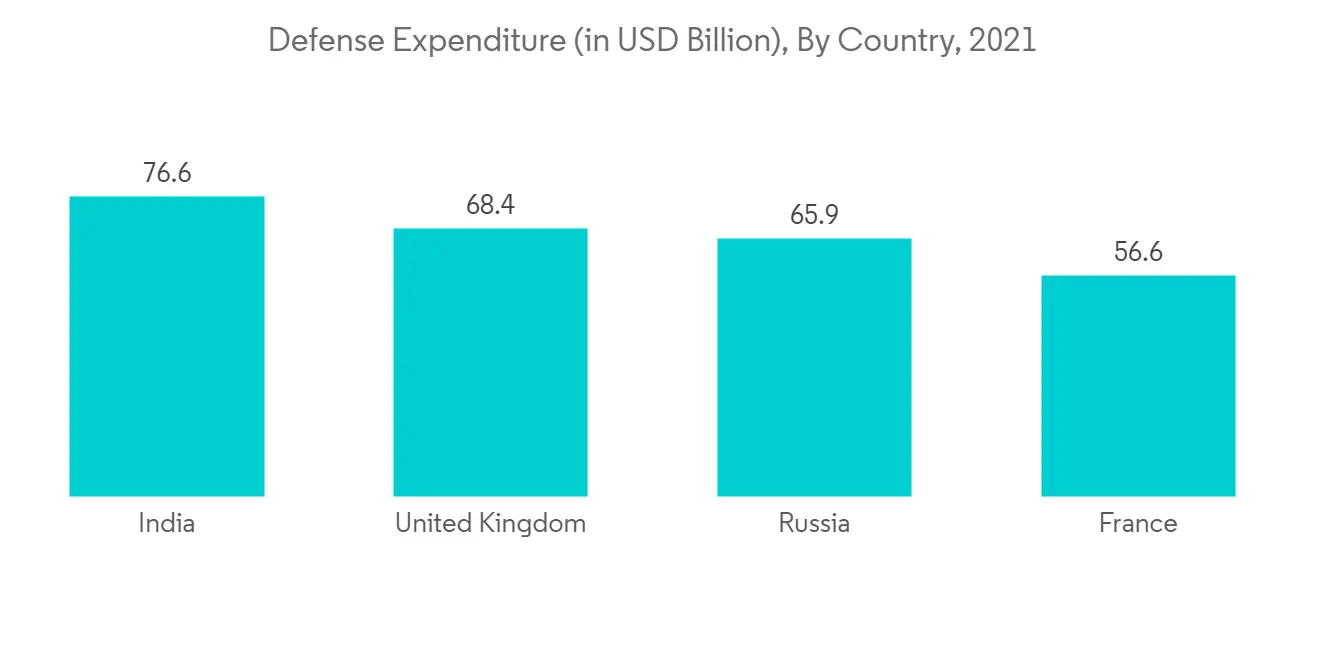

- The global defense sector witnessed a mild impact of the COVID-19 pandemic. The global military expenditure reached approximately USD 2 trillion in 2020. With exponentially increasing military intelligence capabilities, it became imperative to use AI and Analytics in the global defense sector to monitor various parameters of a vehicle or personnel. At the same time, the high defense spending by various military powerhouses of the world had led to significant investment into this sector of the global defense agencies, leading to a relatively low impact on the market during the pandemic.

- Artificial intelligence and analytics in the defense sector is the major aspect of strengthening military forces. Major countries are highly investing in next-generation technologies to transform their defense capabilities. AI-enabled military devices efficiently handle large amounts of data. Also, AI technology has improved self-control, self-regulation, and self-actuation due to its enhanced computation and decision-making skills. AI in defense provides numerous advantages, such as strategic decision-making, target recognition, combat simulation, threat monitoring, and cybersecurity.

- The latest trend in the defense sector is replacing conventional defense equipment with smart robots and intelligent machines. The future war systems will be dominated by unmanned systems and automatic weapons that provide enhanced operational efficiency and accuracy during warfare situations. Thus, growing investment in research and development and rising adoption of next-generation technologies in defense will drive market growth during the forecast period.

Artificial Intelligence & Analytics in Defense Market Trends

Software Segment Will Showcase Remarkable Growth During the Forecast Period

The software segment in the AI and analytics market is anticipated to show significant growth during the forecast period. The growth is attributed to the increasing defense spending and the development of advanced AI software and related software development kits. AI software installed in computer systems performs various complex operations. It collects data from hardware systems and processes in AI systems to generate an intelligent response. The AI software includes machine learning, virtual assistant, and speech and voice recognition.

For instance, in July 2022, Palantir Technologies Inc. announced that the company would work with the United States Army Research Laboratory to implement data and artificial intelligence (AI)/machine learning (ML) capabilities for end users across combatant commands (COCOMs). The contract was valued at USD 99.9 million for two years. Thus, rising investment from the global defense forces for developing advanced AI software drives the market's growth.

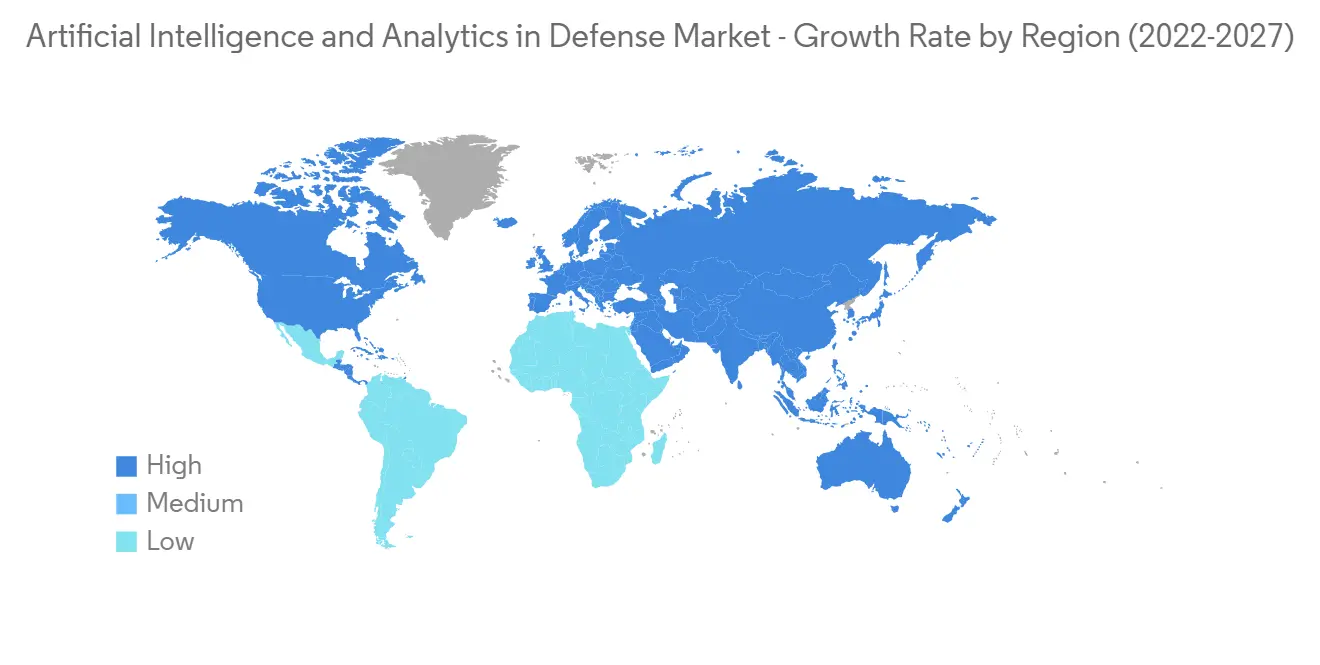

North America Is Projected to Dominate the Market During the Forecast Period

North America held the largest market share in 2022 and continued its domination during the forecast period. The growth is due to the highest defense expenditure from the United States. Increasing spending on research and development of advanced defense equipment and growing procurement of AI-enabled devices for defense operations from the United States Department of Defense drive the market's growth across the region.

In the fiscal year 2022, the United States Department of Defense (DoD) plans to invest USD 874 million in artificial intelligence (AI) related technologies to boost deterrence against potential adversaries like China. DoD also focuses on enhancing efficiencies in command and control, computing, and logistics. In the United States 2022 research and development budget, the Army requested USD 15 million for AI, and machine learning applied research, USD 10.2 million for AI and machine learning basic research, and USD 909,000 for AI and machine learning advanced technologies.

For instance, in April 2022, the United States Army signed a contract worth USD 19 million with 23 small businesses to develop machine learning and artificial intelligence solutions that will lead to more informed decision-making in the army, support autonomous operations, and increase the speed and scale of military action. Thus, growing spending from the United States government for enhancing AI capabilities in defense drives the market's growth.

Artificial Intelligence & Analytics in Defense Market Competitor Analysis

The AI and analytics market is moderately consolidated in nature, with few players holding significant shares in the market. Some prominent market players are Northrop Grumman, Thales Group, BAE Systems, Raytheon Technologies Corporation, Lockheed Martin Corporation, and IBM. The introduction of advanced technologies and the development of AI-enabled defense equipment drive market growth.

- October 2022: The Lockheed Martin Corporation entered a partnership with Red Hat, an American technology firm, to enable small military platforms to handle increased artificial intelligence (AI) workloads. Through this partnership, Lockheed Martin Corporation will utilize the Red Hat Device Edge in integrating advanced software on small platforms such as the Stalker unmanned aerial system. Furthermore, in October 2021, IBM signed a contract with Raytheon Technologies to jointly develop advanced artificial intelligence, quantum, and cryptographic solutions for the defense, aerospace, and intelligence industries. Thus, introducing advanced technologies and growing OEM partnerships to develop next-generation AI-enabled solutions for defense forces will boost market growth during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porters 5 Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Technology

- 5.2.1 Artificial Intelligence

- 5.2.2 Big Data Analytics

- 5.2.3 Others

- 5.3 By Platform

- 5.3.1 Army

- 5.3.2 Navy

- 5.3.3 Airforce

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Israel

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 BAE Systems

- 6.2.2 Raytheon Technologies Inc.

- 6.2.3 Thales Group

- 6.2.4 Lockheed Martin Corportaion

- 6.2.5 Northrop Grumman

- 6.2.6 IBM Corporation

- 6.2.7 Shield AI

- 6.2.8 Leidos

- 6.2.9 SparkCognition Inc.

- 6.2.10 General Dynamics Corporation

- 6.2.11 Charles River Analytics Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS