PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836555

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836555

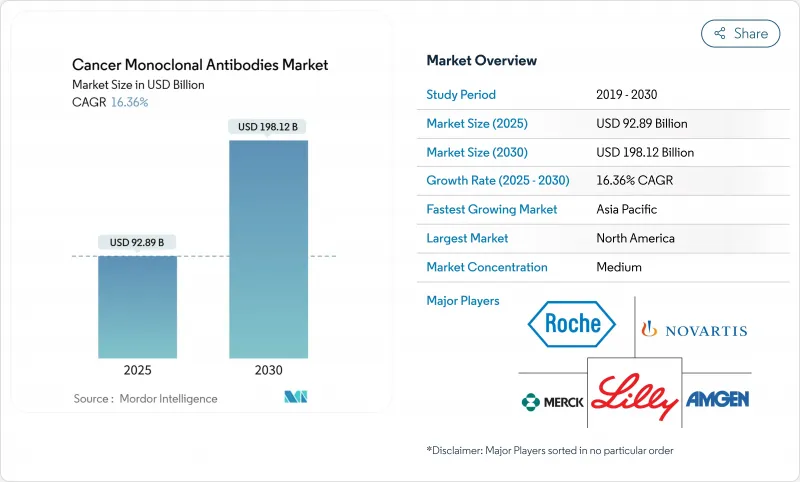

Cancer Monoclonal Antibodies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cancer Monoclonal Antibodies Market size is estimated at USD 92.89 billion in 2025, and is expected to reach USD 198.12 billion by 2030, at a CAGR of 16.36% during the forecast period (2025-2030).

Rapid gains stem from artificial-intelligence-enabled antibody design, a faster regulatory path for bispecific antibodies, and wider adoption of antibody-drug conjugates that together expand therapeutic breadth and boost revenue visibility. Capacity expansions by contract manufacturers, the shift toward value-based oncology care, and breakthrough clinical data from Chinese biotechnology firms further reshape competitive dynamics while keeping pipeline productivity high. Headline risks include bioreactor bottlenecks, stringent safety monitoring, and competition from CAR-T and gene-editing modalities, yet companies that integrate AI-driven engineering and flexible manufacturing retain strategic advantage.

Global Cancer Monoclonal Antibodies Market Trends and Insights

Rising Global Cancer Incidence

Cancer incidence climbs from 20 million cases in 2022 to a projected 35 million in 2050, a 77% jump that expands patient pools across lung, breast, and colorectal cancers. Aging populations in developed regions and lifestyle changes in emerging economies intensify demand for targeted biologics. The cancer monoclonal antibodies market benefits as monoclonal antibodies deliver tumor-specific action that aligns with precision oncology protocols. Low- and middle-income countries witness the fastest case growth, creating access challenges yet opening underserved markets for cost-optimized biosimilars. This demographic surge sustains top-line growth well beyond current forecast windows.

Increasing Allocation to Oncology R&D

Oncology commands the highest share of biopharmaceutical R&D budgets, and 35% of oncology trials now involve antibody-drug conjugates or multispecific constructs. Improved development productivity and blockbuster acquisitions, Bristol Myers Squibb's USD 5.8 billion Mirati buyout, Eli Lilly's USD 1.4 billion Point Biopharma deal strengthen late-stage pipelines. Capital flows foster robust partnership activity that injects technical know-how and de-risks innovation, allowing the cancer monoclonal antibodies market to secure continual first-in-class launches.

Stringent Regulatory and Safety Monitoring

Agencies demand integrated safety data for bispecifics and ADCs, adding pediatric study rules and comparative-effectiveness reviews that stretch timelines and cost outlays. European joint clinical assessments further raise evidence thresholds. Small companies face resource gaps, nudging them into licensing deals or M&A with larger players that possess the regulatory infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Proven Clinical Success of Humanized and Fully-Human mAbs

- Emergence of Bispecific Antibodies and Antibody-Drug Conjugates

- Manufacturing Bottlenecks in Bioreactor and Raw Material Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Humanized antibodies delivered 51.16% of 2024 revenue, underscoring their heritage in blockbuster oncology regimens. The cancer monoclonal antibodies market now witnesses accelerated uptake of fully-human antibodies, which post a 19.17% CAGR through 2030 on the back of superior safety and rising use in combination protocols. Manufacturing process simplicity and favorable regulatory profiles position fully-human constructs to migrate from niche to mainstream over the forecast period.

Pipeline platforms leverage transgenic mice and phage display to generate diversified fully-human candidates that tackle traditionally hard targets. Lower immunogenicity cuts retreatment risk and improves quality-of-life scores. As costs fall, payers gain comfort funding earlier-line use, reinforcing trajectory. Murine and chimeric formats lose ground except in specialized settings where rapid clearance confers benefit. Firms pivoting rapidly to fully-human candidates are likely to outpace rivals in the cancer monoclonal antibodies market.

Trastuzumab held 17.23% of cancer monoclonal antibodies market share in 2024 owing to deep physician familiarity and robust evidence in HER2-positive breast cancer. However, an innovation wave centered on ADCs and bispecifics fuels the "Others" bucket, which grows 21.34% annually. New approvals, such as trastuzumab deruxtecan for HER2-low disease, extend benefit to broader patient subsets. Epcoritamab-bysp posted an 82% response rate in follicular lymphoma, proving bispecific potency and drawing attention away from older single-target constructs.

Strategic layering of antibodies with checkpoint inhibitors or small molecules enhances depth of response, widening the revenue base for next-generation agents. Biosimilar erosion trims trastuzumab value but drives volume, cushioning segment revenue. The end result is a diversified therapy mix in which novel mechanisms progressively tilt market share yet established brands conserve relevance through life-cycle management.

The Cancer Monoclonal Antibodies Market Report Segments the Industry Into by Source of Antibody (Murine, Chimeric, and More), Monoclonal Antibody Therapy (Bevacizumab, Trastuzumab, and More), Cancer Application (Breast Cancer, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains first place with 42.14% of global revenue in 2024, helped by robust clinical-trial ecosystems and favorable payer policies. Real-world evidence requirements gain traction, prompting life-science firms to set up longitudinal patient registries that support value-based contracts. Subcutaneous pembrolizumab approval exemplifies the region's push for patient-centric dosing that trims facility burden and supports tele-oncology rollouts.

Asia-Pacific records the fastest growth at 19.43% CAGR to 2030, reflecting bigger oncology budgets, demographic aging, and regulator-backed accelerated pathways. China's Akeso produced ivonescimab, which outperformed Keytruda in time-to-progression, strengthening domestic confidence and luring capital into local antibody platforms cnn.com. Commercial health insurance penetration widens affordability, while public-private partnerships finance biomanufacturing parks near major urban centers.

Europe pursues balanced access through joint clinical assessments that streamline approvals yet guard budgets. Conditional marketing authorizations for breakthrough antibodies, including linvoseltamab, showcase agility in addressing high unmet need. High biosimilar uptake pressures prices, but volume increases maintain therapy availability and free funds for next-generation constructs.

Middle East & Africa and South America add incremental upside as governments prioritize oncology in universal-health-coverage blueprints. Foreign direct investment flows into fill-and-finish plants that shorten import cycles. Flexible pricing and patient-assistance programs mitigate affordability barriers, expanding therapy reach without compromising fiscal prudence. Collectively, these moves broaden the geographic footprint of the cancer monoclonal antibodies market.

- Roche

- Merck

- Bristol-Myers Squibb

- Amgen

- Novartis

- Johnson & Johnson

- AstraZeneca

- Eli Lilly and Company

- Pfizer

- GlaxoSmithKline

- Regeneron Pharmaceuticals

- Abbvie

- Seagen

- Daiichi Sankyo Co. Ltd

- Sanofi

- Genmab

- BeiGene

- Spectrum Pharmaceuticals

- Mitsubishi Tanabe Pharma

- Wuxi Biologics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Cancer Incidence

- 4.2.2 Increasing Allocation to Oncology R&D

- 4.2.3 Proven Clinical Success of Humanized and Fully Human mAbs

- 4.2.4 Emergence of Bispecific Antibodies and Antibody-Drug Conjugates (ADCs)

- 4.2.5 Adoption of AI-Driven Antibody Engineering

- 4.2.6 Shift Toward Value-Based Oncology Care Models

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory and Safety Monitoring

- 4.3.2 High Clinical Attrition Rates and Lengthy Development Cycles

- 4.3.3 Manufacturing Bottlenecks in Bioreactor and Raw Material Supply

- 4.3.4 Growing Competition from Advanced Modalities

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Source of Antibody

- 5.1.1 Murine

- 5.1.2 Chimeric

- 5.1.3 Humanized

- 5.1.4 Fully-Human

- 5.2 By Monoclonal Antibody Therapy

- 5.2.1 Bevacizumab

- 5.2.2 Trastuzumab

- 5.2.3 Rituximab

- 5.2.4 Cetuximab

- 5.2.5 Daratumumab

- 5.2.6 Others

- 5.3 By Cancer Application

- 5.3.1 Breast Cancer

- 5.3.2 Blood Cancer

- 5.3.3 Colorectal Cancer

- 5.3.4 Lung Cancer

- 5.3.5 Liver & GI Cancer

- 5.3.6 Other Solid Tumour

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche Ltd

- 6.3.2 Merck & Co., Inc.

- 6.3.3 Bristol Myers Squibb Co.

- 6.3.4 Amgen Inc.

- 6.3.5 Novartis AG

- 6.3.6 Johnson & Johnson

- 6.3.7 AstraZeneca

- 6.3.8 Eli Lilly and Company

- 6.3.9 Pfizer Inc.

- 6.3.10 GlaxoSmithKline PLC

- 6.3.11 Regeneron Pharmaceuticals

- 6.3.12 AbbVie Inc.

- 6.3.13 Seagen Inc.

- 6.3.14 Daiichi Sankyo Co. Ltd

- 6.3.15 Sanofi SA

- 6.3.16 Genmab A/S

- 6.3.17 BeiGene Ltd

- 6.3.18 Spectrum Pharmaceuticals Inc.

- 6.3.19 Mitsubishi Tanabe Pharma

- 6.3.20 WuXi Biologics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment