PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849846

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849846

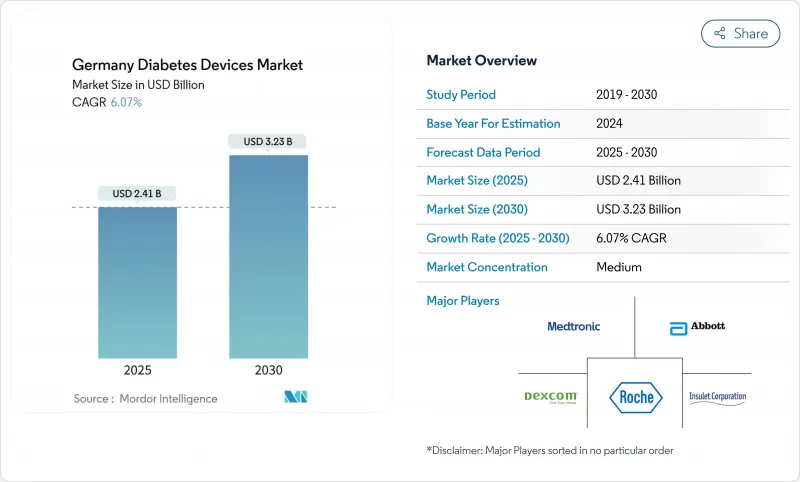

Germany Diabetes Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany diabetes devices market stands at USD 2.41 billion in 2025 and is forecast to reach USD 3.23 billion by 2030, reflecting a 6.07% CAGR.

Growth is underpinned by statutory health insurance reimbursement for flash and real-time continuous glucose monitoring, wider coverage for hybrid closed-loop pumps, and sustained public funding for AI-enabled insulin titration. A rapidly ageing, insulin-intensive population, coupled with the Digital Healthcare Act's fast-track pathway for reimbursable health apps, is steering demand toward connected, home-based solutions. Manufacturers are concentrating on integrated ecosystems that pair sensors, pumps and cloud software, a strategy that helps defend margins while test-strip prices fall under tendering pressure. The Baden-Wurttemberg med-tech cluster adds resilience by localising R&D and production, reducing exposure to global supply-chain shocks.

Germany Diabetes Devices Market Trends and Insights

National Diabetes Strategy-driven SHI Reimbursement for Flash-CGM

Expanded reimbursement now covers type 2 patients needing >= 3 insulin injections daily, insulin-treated gestational diabetes, and all minors under 18. Usage among adults with type 1 diabetes jumped from 31.1% in 2017 to 75.4% in 2021/2022 . The policy emphasises access rather than price reduction, enabling firms to sustain R&D while broadening reach. Higher penetration lifts demand for sensors, transmitters and data platforms, reinforcing the Germany diabetes devices market's technology-led expansion.

Hybrid Closed-Loop Pump Reimbursement Accelerating Adoption

Statutory coverage for automated insulin delivery creates a clear upgrade path from multiple daily injections. Ypsomed's mylife Loop drove 80.8% sales growth in 2024/25 in Germany . Clinical studies record a 76% drop in severe hypoglycaemia for users with impaired awareness . Competition is intensifying as incumbents and newcomers race to refine algorithms, extend sensor wear time and simplify onboarding, adding depth to the Germany diabetes devices market.

MDR Recertification Backlog Slowing New Device Launches

Fewer than 10% of legacy devices have transitioned to the new EU regulation, and 83% of companies have postponed certification for new products. Lengthy audits restrict pipeline flow, dulling innovation momentum in the Germany diabetes devices market until notified-body capacity expands.

Other drivers and restraints analyzed in the detailed report include:

- Ageing, High-Insulin-Utilisation Population Base

- Digital-Health-App (DiGA) Law Boosting Connected Home Monitoring

- SHI Tendering Driving Test-Strip Price Compression

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring Devices captured 56.12% of device revenues in 2024 and is rising at a 7.52% CAGR, faster than the Germany diabetes devices market size overall. Expanded reimbursement for flash systems and paediatric coverage sustains volume gains, while platforms such as Abbott's forthcoming continuous ketone sensor hint at adjacent profit pools (lovemylibre.com). Self-monitoring blood glucose remains an entry point for newly diagnosed patients but endures compressing prices under SHI tenders. The Germany diabetes devices market share for management devices sits at 44%; hybrid closed-loop pumps are lifting this portion through double-digit unit growth.

Predictive insights increasingly inform therapy: time-in-range metrics correlate with lower retinopathy and cardiovascular risks. Sales of the mylife YpsoPump exemplify convergence of monitors and pumps into near-autonomous loops. As sensor accuracy, algorithm sophistication and smartphone integration improve, the Germany diabetes devices market is migrating from episodic testing toward continuous, closed-loop control.

The Report Covers Germany Diabetes Management Companies and the Market is Segmented Into Monitoring Devices (Self-Monitoring Blood Glucose and Continuous Glucose Monitoring) and Management Devices (Insulin Pumps, Insulin Disposable Pens, Insulin Syringes, Cartridges in Reusable Pens, and Jet Injectors), End User (Homecare and Hospital and Clinics). The Market Provides the Value (in USD) for the Above Segments.

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Medtronic

- Dexcom

- Ascensia

- Lifescan

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Insulet

- Tandem Diabetes Care

- Ypsomed

- AgaMatrix

- B. Braun

- Terumo

- Senseonics Holdings

- Owen Mumford

- DarioHealth Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 National Diabetes Strategy-driven SHI Reimbursement for Flash-CGM

- 4.2.2 Hybrid Closed-Loop Pump Reimbursement Accelerating Adoption

- 4.2.3 Ageing, High-Insulin-Utilisation Population Base in Germany

- 4.2.4 Digital-Health-App (DiGA) Law Boosting Connected Home Monitoring

- 4.2.5 Baden-Wurttemberg Med-Tech Cluster Securing Local Supply

- 4.2.6 Bund-funded AI Projects for Automated Insulin Titration

- 4.3 Market Restraints

- 4.3.1 MDR Recertification Backlog Slowing New Device Launches

- 4.3.2 SHI Tendering Driving Test-Strip Price Compression

- 4.3.3 GDPR-linked Cloud-Data Privacy Concerns

- 4.3.4 Shortage of Diabetes Educators for Advanced Pump Training

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (BfArM, G-BA, MDR)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device

- 5.1.1 Monitoring Devices

- 5.1.1.1 Self-Monitoring Blood Glucose

- 5.1.1.1.1 Glucometers

- 5.1.1.1.2 Blood-Glucose Test Strips

- 5.1.1.1.3 Lancets

- 5.1.1.2 Continuous Glucose Monitoring

- 5.1.1.2.1 Sensors

- 5.1.1.2.2 Durables/Transmitters

- 5.1.1.2.3 By CGM Type

- 5.1.2 Management Devices

- 5.1.2.1 Insulin Pumps

- 5.1.2.1.1 Tethered Pumps

- 5.1.2.1.2 Patch Pumps

- 5.1.2.2 Insulin Pens

- 5.1.2.2.1 Disposable Pens

- 5.1.2.2.2 Re-usable Pens & Cartridges

- 5.1.2.3 Insulin Syringes

- 5.1.2.4 Jet Injectors

- 5.1.1 Monitoring Devices

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Personal / Homecare

6 Market Indicators

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Market Share Analysis

- 7.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.3.1 Abbott Diabetes Care

- 7.3.2 Roche Diagnostics

- 7.3.3 Medtronic PLC

- 7.3.4 Dexcom Inc.

- 7.3.5 Ascensia Diabetes Care

- 7.3.6 LifeScan

- 7.3.7 Novo Nordisk A/S

- 7.3.8 Eli Lilly and Company

- 7.3.9 Sanofi

- 7.3.10 Insulet Corporation

- 7.3.11 Tandem Diabetes Care

- 7.3.12 Ypsomed AG

- 7.3.13 AgaMatrix Inc.

- 7.3.14 B. Braun Melsungen AG

- 7.3.15 Terumo Corporation

- 7.3.16 Senseonics Holdings

- 7.3.17 Owen Mumford Ltd.

- 7.3.18 DarioHealth Corp.

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment