PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850009

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850009

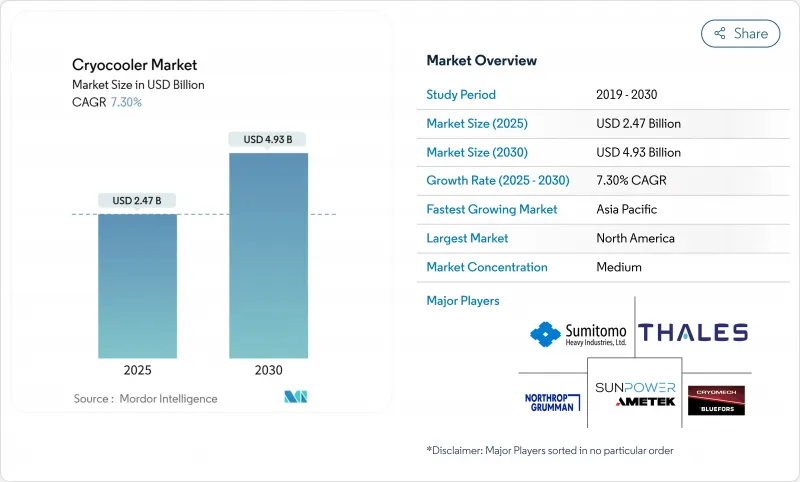

Cryocooler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cryocooler market stood at USD 3.47 billion in 2025 and is forecast to reach USD 4.93 billion by 2030, advancing at a 7.30% CAGR during 2025-2030.

Rising demand from space exploration, quantum computing and helium-free MRI installations anchors the underlying growth trajectory . Long-life space cryocoolers enable expanding small-satellite constellations, while sub-4 K dilution pre-coolers are becoming indispensable for quantum processors . In healthcare, hospitals in tier-2 cities across emerging economies deploy helium-light MRI systems that rely on sealed, closed-loop cooling to sidestep supply-chain exposure to liquid helium . At an application level, the proliferation of soldier-borne infrared (IR) sensors and next-generation optronic detectors is accelerating demand for compact Stirling coolers that balance size, weight and power (SWaP) constraints.

Global Cryocooler Market Trends and Insights

Surge in demand for compact cryogenic cooling for IR sensors in soldier-borne devices

Military modernization programs are intensifying the need for miniaturized cryocoolers that cool IR focal-plane arrays without burdening soldiers with excess weight. European Defence Fund calls for advanced optronic detectors, underscoring enduring investment in soldier systems. Suppliers such as SOFRADIR are improving High-Operating-Temperature detector architectures that tolerate >100 K, thereby shrinking cooler power budgets. Ongoing wear-resistance research into piston-seal coatings enables longer duty cycles for linear compressors SPIE. Finally, defense offset rules in India and UAE are building domestic production bases that could lower unit costs and reshape traditional export flows.

Rapid expansion of small-satellite constellations requiring long-life space cryocoolers

SmallSats increasingly integrate mechanical coolers to support hyperspectral imagers and science payloads that demand consistent sub-90 K focal-plane temperatures throughout multiyear missions . ESA's Joule-Thomson cooler advances offer vibration-free operation essential for optical stability . Northrop Grumman has already fielded 12 long-life pulse-tube and Stirling units on orbit, proving lifetime goals beyond 12 years . The Global Exploration Roadmap highlights the role of cryogenic systems in sustaining lunar habitats and Mars assets. NASA's FY 2026 budget earmarks USD 8.3 billion for exploration, part of which funds advanced cryogenic propellant management that depends on reliable low-temperature hardware .

Heat-lift limitations below 10 W in <5 kg platforms

Miniaturized coolers face physical limits where decreasing swept volumes constrain heat-lift, challenging designers of soldier-portable IR sights and CubeSat payloads . Even micron-scale seal wear can degrade Stirling efficiency within months of field deployment. Research into miniature free-piston Stirling devices shows gains but still trades off between vibration and cooling power . NASA's assessments echo the same dilemma for on-orbit CubeSats that must operate within tight mass-power envelopes .

Other drivers and restraints analyzed in the detailed report include:

- Growing MRI system installations in emerging economies' tier-2 cities

- Quantum-tech scale-up needs sub-4 K dilution pre-coolers

- Helium-3 supply bottleneck for sub-1 K applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Linear Stirling units accounted for 63% of cryocooler market share in 2024, reflecting legacy adoption across defense sensor suites. Pulse-tube coolers, although representing a smaller slice, are projected to grow at 9.4% CAGR to 2030 as vibration-free operation becomes critical for quantum hardware. The cryocooler industry is therefore tuning regenerator materials and inertance tube designs that boost pulse-tube efficiency while retaining reliability. Meanwhile, Gifford-McMahon and hybrid GM-JT devices like Sumitomo's RJT-100 serve large heat-lift duties in LNG and superconducting magnets . Overall, this rivalry signals a gradual rebalancing of the cryocooler market toward low-vibration technologies that accommodate emerging noise-sensitive payloads.

Second-generation Brayton cycle solutions continue to address aerospace subsystems with unique pressure-ratio demands; however, cost and complexity cap broader uptake. Modular design philosophies increasingly allow manufacturers to swap Stirling or pulse-tube cores into common compressor housings, shortening development times and fulfilling diversified program needs. The shift illustrates how OEMs pursue platform-agnostic strategies that protect margins as application mix evolves within the cryocooler market.

Applications operating between 50 K and 100 K held 42% revenue in 2024, underpinned by MRI, IR sensing and satellite instruments. Conversely, the 1-20 K niche is expanding at a 9.2% CAGR through 2030 as millikelvin regimes underpin superconducting qubit operation. This shift propels targeted R&D into high-conductivity lead-based regenerator matrices that maintain temperature gradients at millikelvin levels. Liquid-nitrogen class (77 K) cooling still dominates laboratory cryostats, yet its growth lags due to maturing demand. The cryocooler market size for 1-20 K applications is forecast to widen as quantum fabs scale pilot lines, reinforcing the strategic imperative for helium-economizing architectures.

Innovations such as the phase-separation refrigerator achieving 585 mK base with tiny helium-3 inventory highlight a path to unlock commercial throughput without crippling isotope demand. Simultaneously, space missions require long-term stability in the 20-40 K range to cool mid-infrared detectors; pulse-tube coolers integrated with Stirling precoolers remain preferred solutions in those regimes.

The Cryocooler Market is Segmented by Cryocooler Type (Stirling, Gifford-McMahon, Pulse-Tube, Joule-Thomson, Brayton) Temperature Range (1 K - 20 K and More), Operating Cycle (Closed-Loop, Open-Loo), Heat-Exchanger Type (Regenerative and More), End-User Vertical (Space, Healthcare, Military, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Segments.

Geography Analysis

North America retained 38% of 2024 revenue on the back of USD 4.4 billion in U.S. defense R&D that targets next-generation sensor payloads requiring embedded cryocoolers . NASA's USD 8.3 billion exploration systems budget also channels funds to long-life space coolers . Canada's aerospace cluster in Quebec supplies compressor sub-assemblies, while Mexico's maquiladora corridor supports precision machining for regenerator housings. The U.S. Treasury's 2024 rules barring outbound investment in Chinese quantum cooling triggered an uptick in domestic foundry commitments and joint ventures .

Asia-Pacific posts the fastest growth at 9.5% CAGR, led by China's LNG cold-energy initiatives and quantum drive under its 2024 industrial policy. Ningbo's cold-energy power plant demonstrates national capability to harvest cryogenic exergy from imported LNG. Japan pushes forward via AIST and Bluefors' dilution refrigerator partnership, bolstered by semiconductor revitalisation grants. India's defense-offset rules obligate foreign primes to source components locally, accelerating a nascent manufacturing ecosystem for miniature Stirlings targeting soldier optics.

Europe maintains robust share courtesy of ESA missions and the EuroQuIC consortium's public-funded quantum roadmap. Germany's precision engineering sector underwrites regenerator R&D, while France's Thales integrates pulse-tube coolers into space cameras. The European Defence Fund's 2025 call topics ensure recurring demand for soldier-borne thermal imagers that require efficient cooling. The UK's STFC campus leverages public-private partnerships to expand helium-recovery infrastructure, aligning with national net-zero targets. Sanctions on Russian aerospace imports reroute component sourcing towards intra-EU suppliers, subtly lifting average selling prices within the cryocooler market.

- Sumitomo Heavy Industries Ltd.

- Northrop Grumman Corporation

- Cryomech Inc. (Bluefors Oy)

- Thales Group

- Sunpower Inc. (AMETEK)

- Ricor Systems

- Stirling Cryogenics BV

- Chart Industries Inc.

- Creare LLC

- Air Liquide Advanced Technologies

- Janis ULT Cryogenics

- Advanced Research Systems Inc.

- Eaton Corp. PLC

- Cobham Ltd.

- Honeywell Aerospace

- Linde Cryogenics

- Lockheed Martin (SCD)

- Absolut System

- CryoSpectra GmbH

- DH Instruments (Addi-data)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for compact cryogenic cooling for IR sensors in soldier-borne devices

- 4.2.2 Rapid expansion of small-satellite constellations requiring long-life space cryocoolers

- 4.2.3 Growing MRI system installations in emerging economies tier-2 cities

- 4.2.4 LNG peak-shaving projects in North America & China driving large-capacity GM systems

- 4.2.5 Quantum-tech scale-up needs sub-4 K dilution-pre-coolers

- 4.2.6 Defense offset programs fostering domestic cryocooler production (India, UAE)

- 4.3 Market Restraints

- 4.3.1 Heat-lift limitations below 10 W in <5 kg platforms

- 4.3.2 Helium-3 supply bottleneck for sub-1 K applications

- 4.3.3 Vibro-acoustic noise non-compliance for airborne EO payloads

- 4.3.4 Capex premium of pulse-tube over GM for >100 W heat-lift

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Value Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cryocooler Type

- 5.1.1 Stirling

- 5.1.2 Gifford-McMahon

- 5.1.3 Pulse-Tube

- 5.1.4 Joule-Thomson

- 5.1.5 Brayton

- 5.2 By Temperature Range

- 5.2.1 1 K- 20 K

- 5.2.2 20 K - 77 K

- 5.2.3 77 K -200 K

- 5.2.4 > 200 K

- 5.3 By Operating Cycle

- 5.3.1 Closed-Loop

- 5.3.2 Open-Loop

- 5.4 By Heat-Exchanger Type

- 5.4.1 Regenerative

- 5.4.2 Recuperative

- 5.5 By End-user Vertical

- 5.5.1 Space

- 5.5.2 Healthcare

- 5.5.3 Military and Defense

- 5.5.4 Commercial and Industrial

- 5.5.5 Energy and Power

- 5.5.6 Transportation

- 5.5.7 Research and Academic

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Netherlands

- 5.6.3.7 Russia

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 ASEAN

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.2 Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Recent Developments)

- 6.4.1 Sumitomo Heavy Industries Ltd.

- 6.4.2 Northrop Grumman Corporation

- 6.4.3 Cryomech Inc. (Bluefors Oy)

- 6.4.4 Thales Group

- 6.4.5 Sunpower Inc. (AMETEK)

- 6.4.6 Ricor Systems

- 6.4.7 Stirling Cryogenics BV

- 6.4.8 Chart Industries Inc.

- 6.4.9 Creare LLC

- 6.4.10 Air Liquide Advanced Technologies

- 6.4.11 Janis ULT Cryogenics

- 6.4.12 Advanced Research Systems Inc.

- 6.4.13 Eaton Corp. PLC

- 6.4.14 Cobham Ltd.

- 6.4.15 Honeywell Aerospace

- 6.4.16 Linde Cryogenics

- 6.4.17 Lockheed Martin (SCD)

- 6.4.18 Absolut System

- 6.4.19 CryoSpectra GmbH

- 6.4.20 DH Instruments (Addi-data)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment