PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851126

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851126

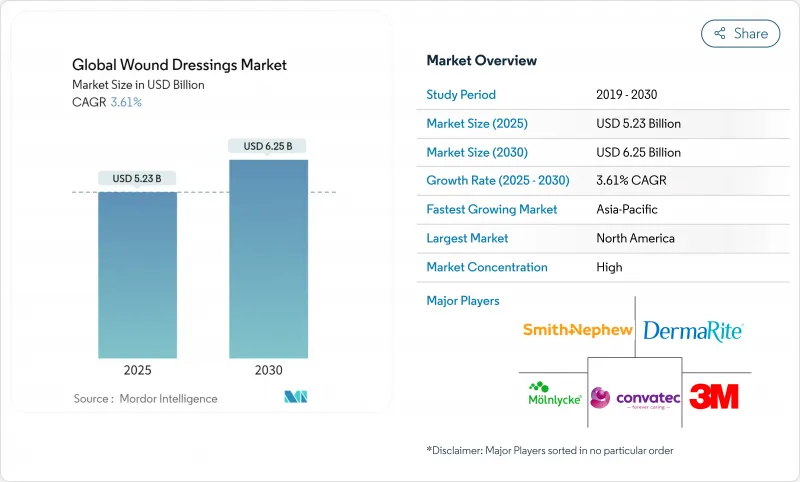

Global Wound Dressings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global wound dressings market is valued at USD 5.23 billion in 2025 and is projected to reach USD 6.25 billion by 2030, advancing at a 3.61% CAGR during the forecast period.

Growth reflects an industry that is transitioning from volume-driven commodity sales toward outcome-oriented solutions that integrate smart monitoring and bio-active technologies. Adoption is accelerating because hospital procurement teams increasingly evaluate total cost of care rather than purchase price, rewarding dressings that shorten healing time and reduce readmissions. Asia-Pacific's hospital build-out and chronic disease burden are adding incremental unit demand, while sustainability mandates in Europe nudge buyers toward bio-derived materials that lower lifecycle emissions. Competitive intensity is heightening as mid-sized biotechnology entrants apply novel polymers and digital sensors to capture premium niches within the wider wound dressings market.

Global Wound Dressings Market Trends and Insights

Rising incidence of chronic wounds & diabetic ulcers

Diabetic foot ulcers now affect between 19% and 34% of all people with diabetes, making them a leading cause of inpatient admissions and accounting for higher direct costs than several common cancers . More than half of these ulcers become infected and at least 20% progress to amputation, pushing providers to adopt dressings proven to hasten closure. American hospital data show healing times of 194 days in in-patients versus 136 days for out-patients when early advanced dressings are used, underscoring the economic benefit of outcome-based protocols. Health systems therefore finance multidisciplinary wound clinics that emphasize foam, hydrofiber and silver impregnated dressings, sustaining premium price segments within the wound dressings market.

Escalating volume of surgical procedures worldwide

Rapid growth in elective and outpatient surgery is enlarging the addressable base for post-operative dressings. Clinical protocols now target same-day discharge and reduced site infections, which positions advanced moist-active dressings as standard adjuncts. Medtronic's surgical technologies division recorded low-single-digit revenue growth in FY25, citing strength in wound management products tied to rising procedure counts. Tele-follow-up further lifts demand for dressings that minimise change frequency while enabling remote assessment, deepening penetration of interactive foams and negative pressure wound therapy (NPWT) systems within the wound dressings market.

High price-premium over traditional dressings

Advanced dressings command 2-5 times the unit price of conventional gauze, straining formularies that still favour upfront savings. Group purchasing organisations are demanding head-to-head cost-utility data before approving product switches, while manufacturers face supply-chain costs that consume up to 20% of revenue, limiting their room for discounting. Budget pressure is acute in public hospitals across Southeast Asia and Latin America, where lack of outcome-tracking infrastructure makes it hard to document long-term savings.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability mandates spurring adoption of bio-derived materials

- Technological shift toward moist-active & NPWT-integrated dressings

- Adoption of smart/connected dressings with real-time monitoring

- Expanding reimbursement for home-based wound care in OECD nations

- Limited clinician & patient awareness in emerging economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced dressings retained a commanding 63.15% wound dressings market share in 2024, underpinned by payer acceptance of evidence-based protocols that cut healing times. Emerging smart foams with integrated sensors, antimicrobial silver layers and adjustable exudate channels are bolstering hospital demand, while reimbursement pathways for NPWT-ready pads widen ambulatory usage. Foam and hydrofiber sub-categories grow fastest within advanced because they pair high absorbency with atraumatic removal, increasing patient satisfaction scores that influence procurement decisions.

Traditional formats are expanding at a 4.51% CAGR as product engineers embed antimicrobial coatings and better moisture vapor transmission rates into standard gauzes without inflating cost. Volume adoption in community clinics across India, Indonesia and Brazil shows that incremental innovation can protect share where purchasing budgets remain tight. This balanced dynamic ensures the wound dressings market size for basic products continues to climb even as premium categories set the technology agenda.

The Report Covers Global Advanced Wound Dressing Market Forecast and is Segmented by Type (Advanced Wound Dressing and Traditional Wound Dressing), Application (Surgical Wounds and Traumatic Wounds, Diabetic Foot Ulcers and More), End User (Hospitals and Surgical Centers, Specialty Wound Clinics, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.74% of global revenue in 2024 thanks to robust reimbursement pathways, early adoption of NPWT and widespread provider familiarity with evidence-based wound protocols. The United States dominates regional spending, yet Canada's integrated health system increasingly invests in smart dressings for chronic wound clinics, while Mexico's public insurers finance traditional formats alongside selective advanced SKUs.

Europe remains a core pillar of the wound dressings market. Implementation of Regulation (EU) 2024/1860 has standardised post-market surveillance, giving providers greater confidence in recently launched products . Sustainability clauses in public tenders accelerate the shift toward bio-derived alginate and collagen materials. Germany and the United Kingdom lead volume, but Southern Europe is closing the gap as pressure ulcer prevention funding rises.

Asia-Pacific is the fastest-growing region at a 4.78% CAGR. China's health outlay topped 8,532.749 billion yuan in 2022 and continues to climb, enabling county hospitals to upgrade from gauze to moist-active dressings. Japan's super-aged demographic sustains demand for chronic wound care, while India's swelling surgical pipeline underpins unit growth for both basic and advanced products. Australia and South Korea, with developed telehealth ecosystems, are early adopters of connected dressings that transmit wound data to clinicians.

- 3M

- Smiths Group

- Molnlycke Health Care

- Convatec

- Coloplast

- Johnson & Johnson (Ethicon, DePuy Synthes)

- Cardinal Health

- Medtronic

- B. Braun

- DermaRite Industries

- DeRoyal Industries

- Hollister

- Integra LifeSciences

- Organogenesis

- MiMedx Group

- KCI (Acelity - 3M)

- Lohmann & Rauscher

- Advancis Medical

- Urgo Medical

- Medline Industries

- Hartmann Group

- Baxter

- Argentum Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of chronic wounds & diabetic ulcers

- 4.2.2 Escalating volume of surgical procedures worldwide

- 4.2.3 Sustainability mandates are spurring adoption of bio-derived collagen, chitosan, and alginate dressings,

- 4.2.4 Technological shift toward moist-active & NPWT-integrated dressings

- 4.2.5 Adoption of smart/connected dressings with real-time monitoring

- 4.2.6 Expanding reimbursement for home-based wound care in OECD nations

- 4.3 Market Restraints

- 4.3.1 High price-premium over traditional dressings

- 4.3.2 Limited clinician & patient awareness in emerging economies

- 4.3.3 Growing regulatory scrutiny over cumulative silver ion exposure

- 4.3.4 Supply-chain volatility for bio-polymer feedstocks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Advanced Wound Dressings

- 5.1.1.1 Foams

- 5.1.1.2 Hydrocolloids

- 5.1.1.3 Films

- 5.1.1.4 Alginates

- 5.1.1.5 Hydrogels

- 5.1.1.6 Collagens & ECM

- 5.1.1.7 Antimicrobial / Silver

- 5.1.1.8 Super-absorbent Polymers

- 5.1.1.9 Interactive Smart Dressings

- 5.1.2 Traditional Wound Dressings

- 5.1.2.1 Bandages

- 5.1.2.2 Gauzes

- 5.1.2.3 Sponges & Pads

- 5.1.2.4 Cotton Rolls & Others

- 5.1.1 Advanced Wound Dressings

- 5.2 By Application

- 5.2.1 Surgical & Traumatic Wounds

- 5.2.2 Diabetic Foot Ulcers

- 5.2.3 Pressure Ulcers

- 5.2.4 Venous & Arterial Ulcers

- 5.2.5 Burns

- 5.2.6 Other Chronic / Acute Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Surgical Centers

- 5.3.2 Specialty Wound Clinics

- 5.3.3 Home-Healthcare Settings

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M

- 6.3.2 Smith & Nephew

- 6.3.3 Molnlycke Health Care

- 6.3.4 ConvaTec Group

- 6.3.5 Coloplast

- 6.3.6 Johnson & Johnson (Ethicon, DePuy Synthes)

- 6.3.7 Cardinal Health

- 6.3.8 Medtronic

- 6.3.9 B. Braun Melsungen

- 6.3.10 DermaRite Industries

- 6.3.11 DeRoyal Industries

- 6.3.12 Hollister Incorporated

- 6.3.13 Integra LifeSciences

- 6.3.14 Organogenesis

- 6.3.15 MiMedx Group

- 6.3.16 KCI (Acelity - 3M)

- 6.3.17 Lohmann & Rauscher

- 6.3.18 Advancis Medical

- 6.3.19 Urgo Medical

- 6.3.20 Medline Industries

- 6.3.21 Paul Hartmann AG

- 6.3.22 Baxter International

- 6.3.23 Argentum Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment