PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851168

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851168

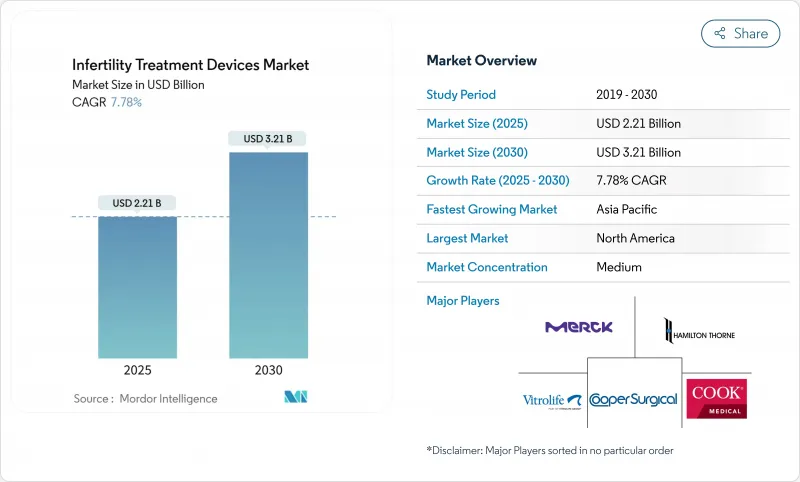

Infertility Treatment Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The infertility treatment devices market is valued at USD 2.21 billion in 2025 and is projected to reach USD 3.21 billion by 2030, reflecting a 7.78% CAGR.

Consistent global infertility prevalence, the rapid rollout of AI-enabled embryo-selection tools, and broader reimbursement in high-income nations underpin this expansion. Automation has become the core theme, with robotics streamlining in-vitro fertilization (IVF) workflows and driving down per-cycle labor costs while boosting laboratory throughput. Premium centers in North America and Western Europe prioritize fully integrated AI platforms, whereas clinics in Asia-Pacific focus on affordable modular upgrades that bridge manual and automated steps. Industry consolidation has accelerated because scale and software talent increasingly dictate product development velocity and regulatory readiness.

Global Infertility Treatment Devices Market Trends and Insights

Escalating Global Infertility Prevalence

Roughly 17.5% of adults now face fertility challenges, a figure that has elevated demand for assisted reproductive technologies in every region. Lifestyle stressors, environmental toxins, and occupational hazards have widened male-factor diagnoses, and protein-specific defects such as CFAP47 mutations are now directly linked to asthenozoospermia, spotlighting new diagnostic frontiers.As fertility status grows into a broader health marker, primary-care providers add baseline reproductive assessments, enlarging the infertility treatment devices market beyond traditional IVF clinics. This mainstreaming fuels procurement budgets for connected analyzers and automated lab modules even in hospital settings. Continuous monitoring technologies also support early intervention, fostering preventive care that ultimately enlarges the patient funnel.

Rising Maternal Age & Delayed Parenthood

Women aged 35 and older represent the fastest-growing treatment cohort, requiring sophisticated egg-quality metrics to offset chromosomal risks inherent to advanced maternal age. Non-invasive AI tools such as STORK-A now predict aneuploidy with 70% accuracy, shrinking reliance on invasive genetic tests.Handheld estradiol testers from the University of Chicago deliver lab-grade results in 10 minutes at USD 0.55 per test, supporting at-home cycle tracking. Emergency oocyte cryopreservation protocols have improved but still depend heavily on how long patients have attempted conception, magnifying the timing challenge tied to delayed childbearing. Together, these dynamics push clinics to invest in AI-assisted imaging systems and hormone analyzers that extend laboratory insight beyond brick-and-mortar walls.

High Procedure & Equipment Costs

An IVF cycle in developed markets often exceeds USD 20,000, pricing out households lacking robust insurance coverage. Setting up a modern IVF laboratory demands clean-room build-outs and capital-intensive robotics, investments smaller hospitals struggle to justify. Material shortages in 2024 raised PTFE catheter costs, forcing vendors to pass increases to end users and squeezing clinic margins. Automation promises lower per-cycle expenses long term, yet paradoxically requires the highest upfront capital outlay today. Consequently, adoption lags in cost-sensitive regions, reinforcing a two-tier global care model.

Other drivers and restraints analyzed in the detailed report include:

- Wider Reimbursement for ART

- AI-Enabled Embryo-Selection & Imaging Breakthroughs

- Stringent Ethical / Regulatory Hurdles in Many Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Incubators generated 23.45% of 2024 revenue and remain indispensable for optimal embryo culture. High-end models feature integrated cameras and AI scoring modules that synchronize developmental events with environmental logs, refining protocol adjustments in real time. Microfluidic sperm-sorting chips post a 12.14% CAGR because they isolate motile sperm with minimal shear stress, enhancing fertilization probabilities. Sperm analyzers exploit AI image recognition to classify morphology more consistently than manual microscopy, boosting diagnostic confidence. Ovum aspiration pumps now integrate pressure sensors that safeguard oocyte integrity during retrieval, an upgrade that reduces procedural complications. Cryosystems grow steadily, supported by rising oncofertility and elective egg freezing demand that rewards robust vitrification performance. Imaging systems evolve toward time-lapse modalities; Vitrolife's EmbryoScope+ embeds iDAScore algorithms for autonomous ranking, standardizing lab performance. Compact hybrid microscopes such as Opto's DualStation free bench space while enhancing ergonomics. Robotic micromanipulators facilitate fully automated intracytoplasmic sperm injection, minimizing operator fatigue and error. Adjacent innovations, including medical microrobots for gamete transport and RFID-tagged cryostorage racks, broaden the infertility treatment devices market by solving workflow bottlenecks.

The second-mechanism growth narrative hinges on precision and cost efficiency. Clinics that deploy microfluidic chips report shorter processing times and reduced reagent use, enabling higher cycle throughput without expanding lab footprints. Automated incubators equipped with predictive maintenance dashboards cut downtime and extend service intervals, a key benefit for high-volume urban centers. Imaging-rich incubators also supply datasets that retrain local AI models, helping centers tailor scoring criteria to demographic nuances. Together, these upgrades advance standardization, unlock economies of scale, and reinforce the competitive edge of early adopters.

In-vitro fertilization dominates with 71.21% revenue share, reflecting its versatility across male-factor, female-factor, and unexplained infertility cases. The infertility treatment devices market size for IVF-centric hardware is forecast to expand steadily as clinics integrate AI-assisted micromanipulation and embryo culture modules. Pre-implantation genetic testing support is the fastest-growing procedure group at 10.36% CAGR. Whole-genome approaches now screen over 3,200 genes, extending utility beyond aneuploidy to polygenic risk reduction. Intracytoplasmic sperm injection benefits from robotics that standardize needle penetration depth, elevating fertilization rates in severe oligozoospermia. Intrauterine insemination retains relevance as a low-cost entry, aided by automated sperm processors that recover 86% motile cells, well above manual methods. Cryopreservation and vitrification protocols grow alongside societal acceptance of elective fertility preservation, especially among cancer survivors and career-focused professionals.

Emergency oocyte cryopreservation shows 29.2% cumulative live-birth rates, with outcomes linked to male-factor severity and age, reinforcing the need for rapid decision support tools. AI-driven treatment planners integrate hormonal, morphological, and genetic inputs to propose individualized stimulation regimens, improving cumulative success without raising medication doses. These advancements broaden patient confidence and position genetic testing services as a standard adjunct, embedding additional device revenue in each cycle.

The Infertility Treatment Devices Market Report is Segmented by Type (Sperm Separation Devices, Ovum Aspiration Pumps and More), ART Procedure (IVF, Intracytoplasmic Sperm Injection and More), Tcehnology Platform (Manual / Conventional Devices, Semi-Automated Devices and More), End-User (Fertility Clinics, Hospitals & Other Healthcare Facilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 32.66% of 2024 revenue thanks to advanced insurance networks, consolidated clinic chains, and early uptake of premium AI modules. Market competition revolves around differentiating patient experience through zero-contact lab tours and transparent outcome dashboards. State mandates covering infertility procedures continue to spread, sustaining steady equipment upgrade cycles in private and academic centers. The infertility treatment devices market therefore remains firmly entrenched in North American strategic planning, even as regional growth moderates.

Asia-Pacific posts the fastest 9.56% CAGR, propelled by massive population bases, rising disposable income, and cultural emphasis on parenthood. China's removal of birth caps intersects with higher infertility rates, spurring a boom in clinics outfitting mid-range automation that balances throughput and cost. India positions itself as the fertility treatment capital, attracting medical tourists who benefit from price advantages while still accessing AI-enabled imaging systems.Southeast Asian operators, such as Thomson Medical, expand regionally to capture a share of outbound Chinese demand, further enlarging the infertility treatment devices market.

Europe displays steady adoption, aided by robust reimbursement and harmonized quality standards. Clinics allocate capital toward compliance with MDR 2017/745, favoring vendors capable of supplying complete technical documentation. Middle East and Africa witness greenfield projects in Gulf Cooperation Council states, where public-private partnerships finance world-class IVF centers. Qatar's Sidra Medicine installed advanced embryo imaging systems, signaling a shift from outbound to domestic care. South America benefits from Brazil's regulatory recognition of foreign approvals, trimming time-to-market for imported hardware and inviting multinationals to pilot lower-cost automation modules. Collectively, geographic dynamics ensure the infertility treatment devices market remains truly global in both demand and competitive rivalry.

- AB Scientific

- Cook Group

- The Cooper Companies

- DxNow (ZyMot Fertility)

- Eppendorf

- Esco Lifesciences

- Hamilton Thorne

- IVFtech ApS

- MedGyn Products

- Merck

- Rocket Medical

- Vitrolife

- Genea Biomedx

- Thermo Fisher Scientific

- Nidacon International

- FUJIFILM

- Gynemed GmbH

- Kitazato

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Infertility Prevalence

- 4.2.2 Rising Maternal Age & Delayed Parenthood

- 4.2.3 Wider Reimbursement For ART

- 4.2.4 AI-Enabled Embryo-Selection & Imaging Breakthroughs

- 4.2.5 Launch of Technologically Advanced Products and Their Adoption

- 4.2.6 Surge For Home-Based Fertility Hardware

- 4.3 Market Restraints

- 4.3.1 High Procedure & Equipment Costs

- 4.3.2 Stringent Ethical / Regulatory Hurdles In Many Countries

- 4.3.3 Shortage Of Skilled Embryologists & Lab Technicians

- 4.3.4 Supply-Chain Fragility For Critical IVF Consumables

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Sperm Separation Devices

- 5.1.2 Ovum Aspiration Pumps

- 5.1.3 Sperm Analyzer Systems

- 5.1.4 Micromanipulator Systems

- 5.1.5 Incubators

- 5.1.6 Cryosystems

- 5.1.7 Imaging Systems

- 5.1.8 Microscopes

- 5.1.9 Others

- 5.2 By Assisted Reproductive Technology (ART) Procedure

- 5.2.1 In-Vitro Fertilization (IVF)

- 5.2.2 Intracytoplasmic Sperm Injection (ICSI)

- 5.2.3 Intrauterine Insemination (IUI)

- 5.2.4 Cryopreservation / Vitrification Support

- 5.2.5 Pre-implantation Genetic Testing (PGT) Support

- 5.3 By Technology Platform

- 5.3.1 Manual / Conventional Devices

- 5.3.2 Semi-Automated Devices

- 5.3.3 Fully Automated / Robotic Systems

- 5.3.4 AI-Enabled Imaging & Analytics Platforms

- 5.3.5 Micro-fluidic Lab-on-Chip Devices

- 5.4 By End-user

- 5.4.1 Fertility Clinics

- 5.4.2 Hospitals & Other Healthcare Facilities

- 5.4.3 Clinical Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 AB Scientific Ltd

- 6.3.2 Cook Medical Inc

- 6.3.3 CooperSurgical Inc

- 6.3.4 DxNow (ZyMot Fertility)

- 6.3.5 Eppendorf AG

- 6.3.6 Esco Micro Pte Ltd

- 6.3.7 Hamilton Thorne Inc

- 6.3.8 IVFtech ApS

- 6.3.9 MedGyn Products

- 6.3.10 Merck KGaA

- 6.3.11 Rocket Medical PLC

- 6.3.12 Vitrolife AB

- 6.3.13 Genea Biomedx

- 6.3.14 Thermo Fisher Scientific

- 6.3.15 Nidacon International

- 6.3.16 FUJIFILM Irvine Scientific

- 6.3.17 Gynemed GmbH

- 6.3.18 Kitazato Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment