PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851453

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851453

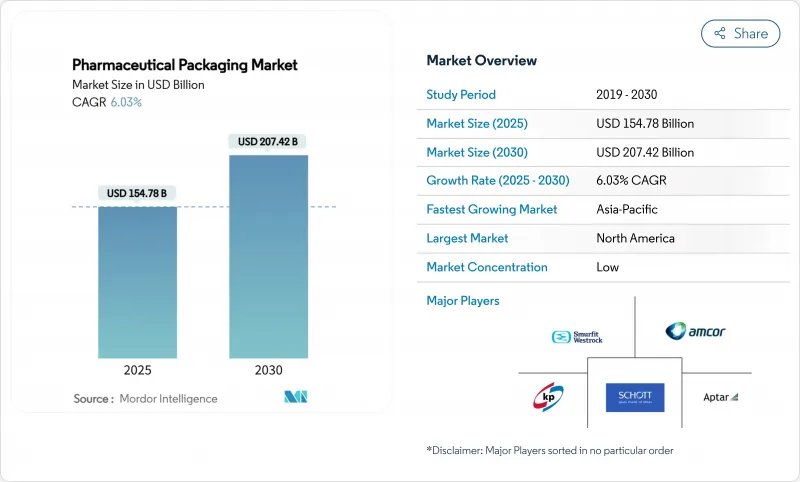

Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pharmaceutical packaging market size reached USD 154.78 billion in 2025 and is forecast to rise to USD 207.42 billion by 2030, advancing at a 6.03% CAGR.

Over the next five years, escalating biologics output, stricter global traceability rules, and widespread sustainability targets will keep capital flowing into new fill-finish lines, high-barrier materials, and circular-ready designs. Demand for flexible pack volumes that match smaller, personalized therapy batches will expand as gene and cell therapies reach commercial scale. North America remains the largest regional contributor, supported by DSCSA-driven serialisation, while Asia-Pacific's sizeable 8.96% CAGR reflects rising domestic drug production and broadening health coverage.Material strategies are in flux: plastics still dominate yet bio-based polymers, aluminium-free blisters, and post-consumer-recycled films move quickly from pilot to production as EU and US PFAS curbs near enforcement. Meanwhile, price swings in polyethylene, polypropylene, and PET keep margins tight, encouraging longer supplier contracts and vertical integration by larger converters.

Global Pharmaceutical Packaging Market Trends and Insights

Aging population and chronic disease prevalence

Rising median ages push long-term therapy volumes higher, underpinning consistent demand for calendar blisters, large-print labels, and one-hand-open vials that aid adherence among patients with reduced dexterity. Germany's 2024 vaccination shifts, with pneumococcal doses up 23% and meningococcal B up 52%, illustrate broader preventive-care uptake in seniors . Packaging suppliers respond with connected packs that log opening events and forward adherence data to care teams. Growth in smart closures and NFC-enabled cartons will intensify as payers link reimbursement to real-world outcomes.

Biologics and injectable pipeline expansion

Prefilled syringes sit at the core of new biologic launches because they simplify self-administration, minimise contamination risks, and reduce waste during fill-finish. BD's iDFill(TM) syringe embeds RFID for instant verification, while its Neopak(TM) XtraFlow(TM) design handles viscous formulations that were once vial-only. GMP Annex 1 revisions accelerate demand for ready-to-use glass tubing and polymer containers that bypass washing and depyrogenation steps, helping CDMOs scale capacity without constructing new cleanrooms.

Petro-derivative resin price volatility

Supply disruptions and force majeure events lifted PET prices by 1.1% in June 2024, shrinking already tight converter margins. Pharmaceutical contact material specs restrict rapid grade switches, forcing many converters to absorb cost spikes or renegotiate long contracts. Corrugated shippers also face higher fibre costs, with a USD 70 per-ton increase announced for January 2025.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-driven material substitution

- Digital traceability mandates (DSCSA, EU-FMD)

- Capital-intensive sterility and validation requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 45.64% of pharmaceutical packaging market share in 2024, anchored by HDPE bottles, PP closures, and PET blisters that balance cost and barrier needs. Yet the segment's growth moderates as brand owners court circularity objectives. Within plastics, the pharmaceutical packaging market size for PP-based syringes is rising steadily thanks to break-resistant cyclic olefin options. Glass remains indispensable for light- and moisture-sensitive biologics; Type I borosilicate vials dominate cytotoxic fills despite higher weight and shatter risk. Metals hold niche aerosol and implantable device roles.

Momentum gathers around bio-attributed resins, recycled PET mid-barrier webs, and paper-based pill bottles such as Allegheny Health Network's Tully Tube pilot. Developers weigh shelf-life assurance, extractables profiles, and line changeover costs before wide release, yet early adopters win procurement tenders from hospitals adding sustainability scoring to vendor audits.

The Pharmaceutical Plastic Packaging Market Report is Segmented by Raw Material (Polypropylene, and More), Product Type (Bottles and Solid Containers, Vials and Ampoules, and More), Packaging Format (Rigid, Flexible), Route of Drug Delivery (Oral, Parenteral/Injectable, and More), End-User (Pharma Manufacturers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 35.32% of pharmaceutical packaging market share in 2024 as investments worth USD 160 billion target biologics capacity and domestic supply resilience. DSCSA serialisation stipulations stimulate coding machinery upgrades, and early PFAS phase-outs drive polymer reformulation. Europe balances stringent green-deal rules with high-cost energy inputs; Germany saw 1.5% output decline in 2024 yet sustained R&D outlays in mRNA, gene, and radiopharma therapies demanding high-barrier packs. Region-wide packaging revenue is expected to rise from EUR 153 billion in 2024 to EUR 186 billion by 2029 as extended-producer-responsibility fees reward recyclable formats.

Asia-Pacific records the strongest 8.96% CAGR. China and India expand API output and attract CDMO investments that need local pack sourcing under tighter supply-security rules. Japan's stringent PMDA standards enforce early adoption of Annex 1 aligned isolators, mirroring EU sterility upgrades. Geopolitical shifts introduce risk: China's anti-espionage laws potentially complicate tech transfer and data sharing for pack serialisation partners. Across the region, national healthcare expansions and decentralised clinical models spur demand for mail-ready temperature-controlled shippers.

- Amcor plc

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc.

- AptarGroup Inc.

- Smurfit WestRock

- Becton, Dickinson & Company

- Catalent Inc.

- CCL Industries Inc.

- Klockner Pentaplast Group

- Nipro Corporation

- Vetter Pharma International GmbH

- McKesson Corporation

- FlexiTuff International Ltd.

- W. L. Gore & Associates Inc.

- Stevanato Group

- Corning Incorporated

- Owen-Illinois Inc.

- SGD Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population and chronic disease prevalence

- 4.2.2 Biologics and injectable pipeline expansion

- 4.2.3 Sustainability-driven material substitution

- 4.2.4 Digital traceability mandates (e.g., DSCSA, EU-FMD)

- 4.2.5 AI-enabled adaptive fill-finish lines (under-reported)

- 4.2.6 Rise of at-home/?decentralised trials needing mail-ready packs (under-reported)

- 4.3 Market Restraints

- 4.3.1 Petro-derivative resin price volatility

- 4.3.2 Capital-intensive sterility and validation requirements

- 4.3.3 Looming PFAS/fluoropolymer restrictions in EU and US (under-reported)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.1.1 HDPE

- 5.1.1.2 LDPE and LLDPE

- 5.1.1.3 PET

- 5.1.1.4 Other Plastics

- 5.1.2 Glass

- 5.1.2.1 Type I Borosilicate

- 5.1.2.2 Type II Treated Soda-lime

- 5.1.2.3 Type III Soda-lime

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.5 Biopolymers and Other Materials

- 5.1.1 Plastics

- 5.2 By Packaging Level

- 5.2.1 Primary Packaging

- 5.2.1.1 Bottles

- 5.2.1.2 Prefilled Syringes

- 5.2.1.3 Vials and Ampoules

- 5.2.1.4 Blister Packs

- 5.2.2 Secondary Packaging

- 5.2.2.1 Cartons and Sleeves

- 5.2.2.2 Labels and Inserts

- 5.2.3 Tertiary Packaging

- 5.2.3.1 Corrugated Shippers

- 5.2.3.2 Pallets and Protective Systems

- 5.2.1 Primary Packaging

- 5.3 By Product Type

- 5.3.1 Bottles

- 5.3.2 Prefilled Syringes

- 5.3.3 Vials and Ampoules

- 5.3.4 Blister Packs

- 5.3.5 Caps and Closures

- 5.3.6 Tubes and Pouches

- 5.3.7 Other Product Types

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Middle East

- 5.4.4.1.1 United Arab Emirates

- 5.4.4.1.2 Saudi Arabia

- 5.4.4.1.3 Turkey

- 5.4.4.1.4 Rest of Middle East

- 5.4.4.2 Africa

- 5.4.4.2.1 South Africa

- 5.4.4.2.2 Nigeria

- 5.4.4.2.3 Egypt

- 5.4.4.2.4 Rest of Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Gerresheimer AG

- 6.4.3 Schott AG

- 6.4.4 West Pharmaceutical Services Inc.

- 6.4.5 AptarGroup Inc.

- 6.4.6 Smurfit WestRock

- 6.4.7 Becton, Dickinson & Company

- 6.4.8 Catalent Inc.

- 6.4.9 CCL Industries Inc.

- 6.4.10 Klockner Pentaplast Group

- 6.4.11 Nipro Corporation

- 6.4.12 Vetter Pharma International GmbH

- 6.4.13 McKesson Corporation

- 6.4.14 FlexiTuff International Ltd.

- 6.4.15 W. L. Gore & Associates Inc.

- 6.4.16 Stevanato Group

- 6.4.17 Corning Incorporated

- 6.4.18 Owen-Illinois Inc.

- 6.4.19 SGD Pharma

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment