PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851598

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851598

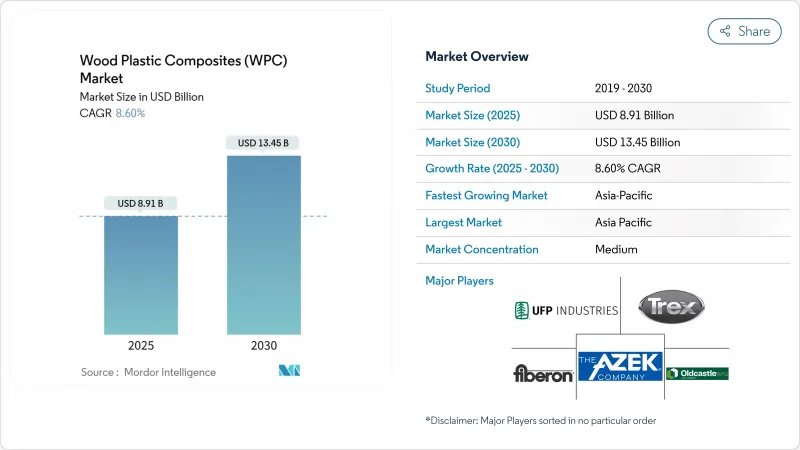

Wood Plastic Composites (WPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wood Plastic Composites Market size is estimated at USD 8.91 billion in 2025, and is expected to reach USD 13.45 billion by 2030, at a CAGR of 8.60% during the forecast period (2025-2030).

Demand accelerators include growing construction activity in Asia, DIY renovation in North America, and regulatory pushes for recycled content in Europe. Product developers are blending higher wood-fiber loads with compatibilizers that improve strength, while automakers in Europe specify lighter non-structural parts to extend electric-vehicle range. Suppliers are also scaling capped profiles that protect colour and curb moisture uptake, which widens retail appeal. Asia-Pacific commands 55% of 2024 revenue and will remain the fastest-expanding geography at a 9.50% CAGR through 2030 as local manufacturers upgrade capacity and pursue lead-free PVC indoor panels that meet tightening regional health rules.

Global Wood Plastic Composites (WPC) Market Trends and Insights

Rise in DIY Home Improvement Trends

Home-owners are spending more on decks that install quickly, resist staining, and avoid yearly re-sealing. Retailers respond by stocking click-fit boards that save labor and tap into the wider sustainability preference of consumers. Carbon-negative WPC decking prototypes now store more CO2 than production emits, potentially locking away 250,000 tons annually if adopted at scale. Big-box chains in the United States dedicate additional aisle space to capped profiles, reinforcing steady cash sales that cushion producers from construction cyclicality. Digital tutorials and influencer content widen do-it-yourself reach, pushing the wood plastic composite market into suburban remodel budgets. The trend also lifts aftermarket railing and lighting kits that match board colours, creating incremental revenue streams.

Mandatory Wood-Fiber Reuse Targets in EU Circular Economy Action Plan

The EU seeks to double its circular material-use rate to 23.2% by 2030, which obliges panel and decking factories to integrate more post-consumer wood flour. Companies deploy optical sorters and chemical cleaning lines that raise recycled-content ratios without hurting mechanical properties. Simultaneously, the Packaging and Packaging Waste Regulation compels every packaging format to be recyclable, reinforcing demand for biocomposite alternatives. German and French builders, backed by green-building labels, specify higher recycled fractions that shorten payback for advanced sorting plants. Consequently, recyclate supply contracts are now negotiated over multi-year tenors, reducing feedstock-price uncertainty. These policy levers collectively expand the wood plastic composite market as compliance shifts become structural demand drivers.

Technical Issues Like Temperature Sensitivity and Wearability

Some formulations creep under sustained heat, limiting under-hood use where temperatures breach 120 °C. High-traffic flooring reveals surface gloss loss after millions of footfalls, which deters facility managers. Nanoparticle fortification studies show promise for tougher surfaces yet add cost overheads that mid-tier builders resist. Dimensional drift at temperature peaks also raises installation tolerances, lengthening job times for contractors. These concerns lower substitution rates in applications where metal or engineered wood remain proven.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Shift Toward Lead-Free PVC-Based WPC for Indoor Applications in Asia

- Light-weighting Push by European OEMs for Non-Structural Automotive Parts

- Fire-Resistance Certification Hurdles in High-Rise Construction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene WPC held 55% of the wood plastic composite market share in 2024, establishing its dominant position in the market. Its dominance stems from easy extrusion, broad filler tolerance, and attractive raw-material pricing. Manufacturers mix up to 60% wood flour without severe viscosity spikes, which keeps board costs competitive. Polypropylene grades expand fastest at a 9.20% CAGR, lifted by higher heat-deflection and stiffness that suit automotive interior panels where 30% weight savings are proven. Lead-free PVC boards, especially in Asian indoor flooring, fill a growing health-conscious niche. Biopolymers such as PLA appear in pilot deck tiles, signalling future openings once cost gaps narrow. Compatibilizer innovation, notably maleic-anhydride grafts, lifts interfacial bonding so producers can raise wood loadings and shrink resin usage. That step enhances sustainability scores and margins simultaneously.

Market participants broaden their resin slate to hedge against polymer price swings that reached double-digit volatility in 2024. The strategy also secures feedstock continuity when planned cracker shutdowns tighten PE supply. Consequently, portfolio breadth becomes a competitive credential in winning long-term distributor contracts. These shifts reinforce the wood plastic composite market trajectory by aligning material science with application-specific needs.

Extrusion lines produced 70% of 2024 global volume, making the method the backbone of deck and fence output. Twin-screw extruders with gravimetric feeders can now run 800 kg/hr while keeping moisture below 0.5%, which minimises void formation. Line automation tracks profile temperature in real time, trimming scrap rates below 2%. Injection molding, though smaller, climbs at 9.10% CAGR because automakers require three-dimensional geometries and tight tolerances. Multi-material over-molding joins WPC cores with soft-touch TPE skins, enhancing vehicle interior feel while cutting assembly steps. Pultrusion holds niche appeal for high-modulus beams in bridge walkways, leveraging continuous glass rovings for strong bending stiffness.

Process innovation spreads through licencing deals between machinery OEMs and regional processors, flattening the learning curve. Inline monitoring with near-infrared spectroscopy provides rapid moisture feedback that once required laboratory drying tests. These upgrades raise throughput and shrink energy per kilogram, boosting the wood plastic composite market size and trimming carbon footprints. WPC-ready 3D-printing filaments emerge in design studios, giving architects freedom to test customised lattice decks without full industrial runs, foreshadowing another adoption wave.

The Wood Plastic Composite Market Report is Segmented by Plastic Material (Polyethylene, Polypropylene, and More), Processing Technology (Extrusion, Injection Molding, and More), Product Form (Capped (Co-Extruded) WPC and Un-Capped (Conventional) WPC), Application (Building and Construction Products, Automotive Parts, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

In 2024, the Asia-Pacific region accounted for 55% of the global wood plastic composite market, demonstrating its significant contribution to the industry. Strong urbanisation, supportive green-building norms, and abundant biomass supply anchor the region's leadership. Chinese decking exports to North America climb as factories optimise capstock lines and secure FHA acceptance. Japan pioneers low-VOC indoor boards, aided by government subsidies for healthier housing. India's infrastructure push sees WPC pedestrian bridges that avoid termite issues common in tropical settings.

North America benefits from a strong DIY culture and premium brand strategies, driving its market growth. Trex and AZEK supply more than 6,700 retail outlets, extending reach into secondary cities. Capped boards priced at USD 4.00 per linear foot outsell traditional pressure-treated lumber at home-centre chains, reinforcing market expansion. Canada benefits from domestic wood-fiber availability that shortens supply chains and boosts decentralised board production to serve remote communities.

Europe's policy framework reshapes sourcing and recycling routes as mandatory reuse targets near. German processors trial up to 80% recycled wood content to gain environment labels that sway large developers. Automotive OEM demand positions Central Europe as a hub for injection-molded WPC parts, integrating supply with nearby assembly plants. Nordic markets, despite cold climates, adopt capped decking for holiday cottages where low maintenance outweighs initial spend.

The Middle East, specifically GCC nations, records brisk uptake of desert-resistant composite pergolas. Formulations embed UV blockers and heat-stable pigments that preserve colour at 45 °C ambient conditions. Municipal beautification in Dubai triggers boardwalk orders that underscore WPC lifecycle cost benefits compared with tropical hardwood. Africa remains early stage but South African retailers report double-digit growth in premium outdoor furniture made from composite slats that weather salt air without cracking.

- Anhui Sentai WPC Group Share Co., Ltd.

- Axion Structural Innovations LLC

- Beologic

- Fiberon (Fortune Brands Innovations)

- FKuR

- Geolam AG

- Green Bay Decking LLC

- Guangzhou Kindwood Co., Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- Oldcastle APG (CRH)

- PolyPlank Solutions AB

- Resysta International

- Saint-Gobain

- TAMKO Building Products LLC

- The AZEK Company Inc.

- Trex Company Inc.

- UFP Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in DIY Home Improvement Trends

- 4.2.2 Mandatory Wood-Fiber Reuse Targets in EU Circular Economy Action Plan

- 4.2.3 Accelerated Shift Toward Lead-Free PVC-Based WPC for Indoor Applications in Asia

- 4.2.4 Light-weighting Push by European OEMs for Non-Structural Automotive Parts

- 4.2.5 Surge in Demand for Low-Maintenance Urban Outdoor Landscaping Products in GCC

- 4.3 Market Restraints

- 4.3.1 Technical Issues Like Temperature Sensitivity, Wearability, etc

- 4.3.2 Volatility in Prices

- 4.3.3 Fire-Resistance Certification Hurdles in High-Rise Construction

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Plastic Material

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Polystyrene (PS)

- 5.1.5 Others (ABS, PLA, etc.)

- 5.2 By Processing Technology

- 5.2.1 Extrusion

- 5.2.2 Injection Molding

- 5.2.3 Compression and Pultrusion

- 5.3 By Product Form

- 5.3.1 Capped (Co-extruded) WPC

- 5.3.2 Un-capped (Conventional) WPC

- 5.4 By Application

- 5.4.1 Building and Construction Products

- 5.4.1.1 Decking

- 5.4.1.2 Fencing

- 5.4.1.3 Molding and Trimming

- 5.4.1.4 Landscaping and Outdoor

- 5.4.2 Automotive Parts

- 5.4.3 Industrial

- 5.4.4 Consumer Goods

- 5.4.5 Furniture

- 5.4.6 Others

- 5.4.1 Building and Construction Products

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 Turkey

- 5.5.4.3 South Africa

- 5.5.4.4 Nigeria

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anhui Sentai WPC Group Share Co., Ltd.

- 6.4.2 Axion Structural Innovations LLC

- 6.4.3 Beologic

- 6.4.4 Fiberon (Fortune Brands Innovations)

- 6.4.5 FKuR

- 6.4.6 Geolam AG

- 6.4.7 Green Bay Decking LLC

- 6.4.8 Guangzhou Kindwood Co., Ltd.

- 6.4.9 JELU-WERK J. Ehrler GmbH & Co. KG

- 6.4.10 Oldcastle APG (CRH)

- 6.4.11 PolyPlank Solutions AB

- 6.4.12 Resysta International

- 6.4.13 Saint-Gobain

- 6.4.14 TAMKO Building Products LLC

- 6.4.15 The AZEK Company Inc.

- 6.4.16 Trex Company Inc.

- 6.4.17 UFP Industries, Inc.

7 Market Opportunities and Future Outlook

- 7.1 Emerging Bio-based WPCs

- 7.2 White-space and Unmet-need Assessment