PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852086

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852086

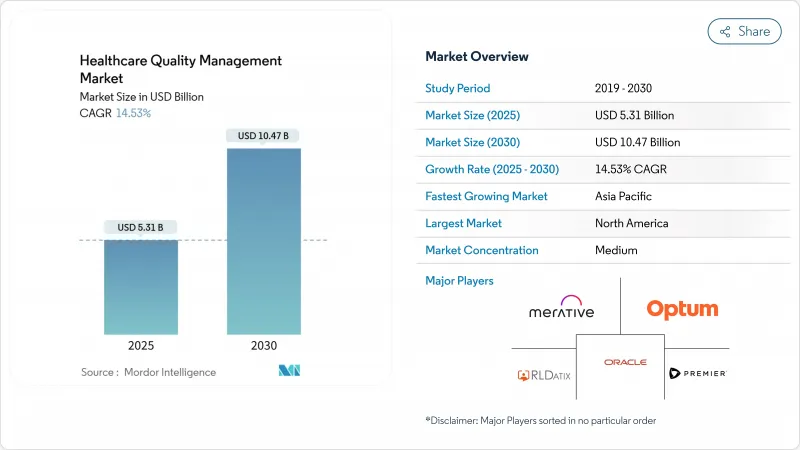

Healthcare Quality Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The healthcare quality management market size stands at USD 5.31 billion in 2025 and is forecast to reach USD 10.47 billion by 2030 at a 14.53% CAGR.

This rapid expansion reflects a shift from retrospective compliance reporting toward predictive intelligence platforms that improve clinical outcomes and margins. Escalating electronic clinical quality-measure mandates, expanding value-based payment models, and rising volumes of structured and unstructured health data are pushing providers and payers to adopt integrated analytics suites. Cloud deployment now dominates as organizations trade capital outlays for subscription models that offer swift scalability and tighter cyber-resilience. AI-enabled population-health modules are gaining traction because they help identify high-risk cohorts, automate care-gap closure, and lower readmissions. Competitive intensity is increasing as electronic-health-record incumbents acquire or partner with AI-native firms to defend installed bases and meet growing interoperability requirements.

Global Healthcare Quality Management Market Trends and Insights

Government Mandates and Incentives for Quality Reporting

Regulators now embed financial carrots and sticks in reimbursement, compelling hospitals and accountable-care organizations to elevate reporting sophistication. The Centers for Medicare & Medicaid Services will expand accountable-care quality measures from 4 in 2025 to 11 in 2028, turning manual spreadsheets into high-risk liabilities. Annual submission of six electronic clinical quality measures determines payment adjustments, pushing laggards toward modern platforms. Hospitals that ignore these rules risk both revenue loss and exclusion from value-based programs. The 21st Century Cures Act adds penalties for information blocking, making interoperable data flows a non-negotiable requirement. As a result, investment in end-to-end quality suites has shifted from discretionary to mission-critical budgeting.

Aging Population and Chronic Disease Burden

Noncommunicable diseases account for 74% of global deaths, creating multicomorbidity challenges that strain fee-for-service economics. Asia-Pacific bears the heaviest demographic load, spurring investments in population-health quality platforms that orchestrate longitudinal care plans across providers. Value-based contracts place downside financial risk on outcomes, making proactive disease-management dashboards indispensable. Organizations deploying such systems see hospital-readmission reductions and per-patient cost savings, demonstrating that demographic pressure is fuelling sustained platform demand well into the next decade.

High Implementation and Integration Costs

Smaller providers struggle to fund platform rollouts when HIPAA security amendments alone require USD 9.3 billion nationwide in first-year compliance costs. Linking new quality modules with legacy EHRs often extends timelines by up to two years and multiplies consulting fees. Total cost of ownership includes ongoing upgrades and user training that frequently double or triple initial license expenditure. As a result, some mid-tier systems revert to manual workarounds that eventually prove unsustainable, slowing market penetration in cost-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Advancement of Artificial-Intelligence Analytics

- Rise of Consumer Transparency and ESG Accountability

- Data Security and Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Business Intelligence & Advanced Analytics retained the largest footprint, reflecting fundamental demand for dashboards that fulfill reporting obligations. Population-Health Quality Management however is accelerating at 16.54% CAGR because payers and integrated networks need proactive risk-stratification tools. Vendors embed AI prediction into these modules, shifting the Healthcare quality management market from retrospective charts toward real-time intervention engines. Quality Reporting & Benchmarking suites remain vital for CMS compliance, while Clinical Risk & Patient-Safety platforms gain attention amid stricter accreditation rules.

The convergence trend favours unified stacks that merge visualization, predictive analytics, and safety surveillance. Wolters Kluwer's UpToDate-powered AI Labs illustrates how decision support and quality analytics now coexist in one workflow. Hospitals adopting full-spectrum platforms report USD 13.3 million annual savings and rapid ROI, propelling further uptake. As AI transparency rules tighten, vendors with explainable models enjoy a competitive edge in the Healthcare quality management market.

Cloud-based deployment captured 58.43% of 2024 revenue, underscoring provider appetite for elastic infrastructure. Web-Hosted SaaS leads growth at 15.79% CAGR, highlighting movement toward subscription economics that sidestep capital budgets. Average annual health-system cloud spend has surpassed USD 38 million, signalling confidence in vendor-managed security and redundancy. On-premise implementations persist mainly where data-sovereignty law or legacy interfaces dictate local hosting.

Oracle Health's pursuit of Qualified HIN status within TEFCA underscores the priority on secure information exchange across cloud backbones oracle.com. SaaS delivery also democratizes advanced analytics for rural and community hospitals that lack extensive IT staff. Consequently, cloud-native suppliers are poised to outpace legacy competitors in the Healthcare quality management market.

The Healthcare Quality Management Market Report is Segmented by Software Type (Business Intelligence & Advanced Analytics, and More), Mode of Delivery (Cloud-Based, and More), Application (Data Management & Quality Reporting, and More), End User (Ambulatory Care & Specialty Clinics, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership at 40.45% revenue share in 2024, supported by rigorous CMS programs and large-scale IT budgets. Proposed HIPAA security amendments alone will drive billions in compliance spend, pressing even mid-size hospitals to modernize infrastructures. Canada and Mexico add momentum through federal digitization strategies, but the United States remains the anchor of regional demand.

Asia-Pacific is the fastest-growing territory at 15.67% CAGR to 2030, catalyzed by national digital-health blueprints across Australia, India, and Malaysia. Integrated primary-care technology investments combat high noncommunicable-disease prevalence, creating fertile territory for population-health modules. Cloud uptake lets emerging markets leapfrog on-premise constraints, further stimulating the Healthcare quality management market.

Europe shows steady expansion as interoperability and health-technology-assessment frameworks spread across the bloc. Germany's Hospital Future Act, France's MaSante2022 plan, and the United Kingdom's NHS digitization agenda all demand transparent outcome metrics. GDPR compliance shapes vendor roadmaps, favouring platforms with advanced consent and pseudonymization controls. Collectively, these dynamics sustain regional growth while raising the regulatory bar for global entrants.

- Oracle

- Optum

- Merative

- Premier

- Mckesson

- RLDatix

- Health Catalyst

- CitiusTech

- Nuance (Microsoft)

- Dolbey Systems

- Medisolv

- Clarity Group

- Riskonnect Inc.

- Press Ganey

- Quantros Inc.

- Wolters Kluwer Health

- Flatiron Health

- MedeAnalytics

- Koninklijke Philips

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Mandates and Incentives for Quality Reporting

- 4.2.2 Surge In Healthcare Data Volume and Complexity

- 4.2.3 Aging Population and Chronic Disease Burden

- 4.2.4 Digital Transformation of Provider Workflows

- 4.2.5 Advancement of Artificial Intelligence Analytics

- 4.2.6 Rise of Consumer Transparency and ESG Accountability

- 4.3 Market Restraints

- 4.3.1 High Implementation and Integration Costs

- 4.3.2 Data Security and Privacy Concerns

- 4.3.3 Lack of Interoperability Standards

- 4.3.4 Algorithmic Bias and Regulatory Liability

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power Of Suppliers

- 4.5.2 Bargaining Power Of Buyers/Consumers

- 4.5.3 Threat Of New Entrants

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Software Type

- 5.1.1 Business Intelligence & Advanced Analytics

- 5.1.2 Quality Reporting & Benchmarking Suites

- 5.1.3 Clinical Risk & Patient-Safety Management

- 5.1.4 Provider Performance & Productivity Improvement

- 5.1.5 Population-Health Quality Management

- 5.2 By Mode Of Delivery

- 5.2.1 Cloud-Based

- 5.2.2 Web-Hosted (SaaS)

- 5.2.3 On-Premise

- 5.3 By Application

- 5.3.1 Data Management & Quality Reporting

- 5.3.2 Risk & Compliance Management

- 5.3.3 Outcome & Cost Analytics

- 5.3.4 Patient-Safety & Adverse-Event Surveillance

- 5.4 By End User

- 5.4.1 Hospitals & Integrated Delivery Networks

- 5.4.2 Ambulatory Care & Specialty Clinics

- 5.4.3 Payers & Accountable-Care Organizations

- 5.4.4 Other Providers (Rehab, Long-Term Care)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Oracle

- 6.3.2 Optum, Inc.

- 6.3.3 Merative

- 6.3.4 Premier Inc.

- 6.3.5 McKesson Corporation

- 6.3.6 RLDatix

- 6.3.7 Health Catalyst

- 6.3.8 CitiusTech Inc.

- 6.3.9 Nuance (Microsoft)

- 6.3.10 Dolbey Systems Inc.

- 6.3.11 Medisolv Inc.

- 6.3.12 Clarity Group

- 6.3.13 Riskonnect Inc.

- 6.3.14 Press Ganey

- 6.3.15 Quantros Inc.

- 6.3.16 Wolters Kluwer Health

- 6.3.17 Flatiron Health

- 6.3.18 MedeAnalytics

- 6.3.19 Philips Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment