PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852130

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852130

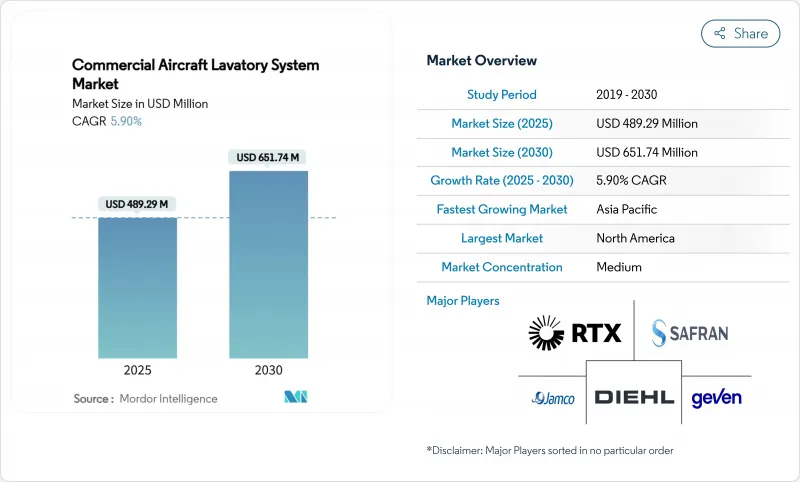

Commercial Aircraft Lavatory System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial aircraft lavatory system market size stands at USD 489.29 million in 2025 and is forecasted to reach USD 651.74 million by 2030, advancing at a 5.90% CAGR.

Steady backlogs for single-aisle programs, airline demand for hygiene upgrades, and new mandates for accessibility propel near-term growth. Touchless fixtures move from niche to mainstream as fleet operators target reduced maintenance and faster turnarounds. Cabin densification pressures designers to deliver lighter, slimmer modules without compromising functionality. Retrofit opportunities expand because airlines favor extending asset life while meeting rules for passengers with reduced mobility. Supply-chain bottlenecks and certification timelines are the primary headwinds, yet tier-one suppliers continue to secure long-term contracts that lock in pricing and technology roadmaps.

Global Commercial Aircraft Lavatory System Market Trends and Insights

Increased Airline Adoption of Touchless Lavatory Technologies

Airlines accelerated trials of sensor-based faucets, flush actuators, and waste lids after 2020, and most tier-one carriers now require touch-free options on all new deliveries. Collins Aerospace will begin shipping fully modular touchless units for the B737 program in early 2025, giving operators a catalog solution that reduces retrofit downtime. JAMCO Corporation holds the majority of wide-body lavatories and embeds contactless fixtures across B777 and B787 lines. Airlines perceive added value in lower cleaning cycles and fewer unserviceable events, which feed directly into on-time performance metrics. OEMs report that kits integrating micro-LED mood lighting and antimicrobial finishes command price premiums yet face minimal resistance from buyers. Certification pathways for sensor assemblies are established, so near-term barriers are primarily supply logistics rather than regulatory.

Sustained Growth in Single-Aisle Aircraft Deliveries Over the Long Term

Boeing delivered 348 airplanes in 2024 and Airbus shipped 766 units, filling order books that now stretch a decade in some variants. Lavatory system vendors, therefore, enjoy multi-year production visibility that supports tooling investment. Single-aisle jets increasingly cover 1,500-3,000-mile sectors, and higher time-in-seat drives passenger demand for larger facilities. Embraer's 20-year outlook predicts 10,500 sub-150-seat deliveries, which broadens the addressable fleet for compact lavatory modules. Sustained throughput appears resilient to temporary supply chain friction as airlines pay escalated prices to secure slots.

Weight Constraints Limiting the Integration of Advanced Lavatory Features

Fuel burn rises about 0.3% for every 100 lbs carried on short-haul sectors, so weight penalties can offset the economic gains of upgraded interiors. Airlines frequently adopt water load planning to cut 440 lbs tied to overfilling tanks, but this strategy sets a hard ceiling on new feature mass. Collins Aerospace's Agile vacuum unit trims structural weight by 50% without sacrificing reliability across 30 million flight hours. Boeing's recycled carbon panels shave 25 lbs per 737 shipset yet involve complex lay-up processes that constrain output.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Lavatory Retrofits to Support PRM Accessibility Standards

- Cabin Densification Trends Driving Demand for Space-Efficient Lavatory Designs

- Certification Delays for Next-Generation Antimicrobial and Hygiene Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Narrowbody aircraft controlled 46.28% of the commercial aircraft lavatory system market share in 2024, a lead from record A320 and 737 output and rising use on routes exceeding 3,000 miles. Regional jets provide the highest 7.12% CAGR because carriers deploy sub-150-seat equipment to match fluctuating demand while preserving schedule frequency. The commercial aircraft lavatory system market size for narrowbody platforms is projected to grow consistently through 2030 as backlog conversion accelerates.

Growth factors differ across segments. Single-aisle types integrate slimmer wall structures, demanding lavatory modules that fit inside tighter fuselage contours. Collins Aerospace's line-fit agreement for the B737 family secures forward commitment through 2034. Widebody fleets concentrate on retrofit because cabin refresh cycles align with heavy checks around year 8. JAMCO leverages its exclusive B787 and B777 positions to test new bidet functions that could migrate into single-aisle models later in the decade. Regional OEMs increasingly adopt standard part numbers that allow cross-family stocking, lowering operator inventory.

Vacuum solutions contributed 82.76% revenue in 2024, confirming their status as the default selection for most new builds. Airlines favor these systems because they use 80% less water, cutting block-fuel burn and maintenance. Hybrid architectures will expand at 7.72% CAGR as airlines trial Diehl's greywater reuse module that redirects hand-wash drainage for flushing, saving 210 kg on long-haul rotations. Prototype data indicate payback within 18 months for twin-aisle fleets.

The commercial aircraft lavatory system market continues to see R&D in pump efficiency and odor control. Collins Aerospace's Agile platform records a 50% weight reduction compared with legacy bowls while maintaining 30 million flight hours of reliability. Competitive responses include modular ejector pumps that share parts across biz-jet and commercial lines, lowering cost. Recirculating technology holds a small share for niche operators needing increased flush counts on very short segments where water uplift is less critical.

The Commercial Aircraft Lavatory System Market Report is Segmented by Aircraft Type (Narrowbody, Widebody, and Regional Jets), Lavatory Technology (Vacuum, Recirculating, and Hybrid/Others), Component (Lavatory Module, Vacuum Toilet, Water and Waste Management System, and More), Fit Type (Line Fit and Retrofit), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 33.84% revenue in 2024 after carriers accelerated fleet standardization programs that integrate touchless fixtures and meet future accessibility deadlines. The commercial aircraft lavatory system market benefits from Boeing's domestic manufacturing base and a dense MRO network that supports rapid retrofit execution. New US regulations foster technology adoption, ensuring replacement cycles remain brisk even during macro volatility.

Asia-Pacific exhibits the highest 6.98% CAGR outlook as regional traffic rebounds to pre-2020 levels and carriers like IndiGo, AirAsia, and China Eastern firm orders for hundreds of single-aisle units. Mixed-fleet strategies couple narrowbodies with regional jets, expanding the installed base for compact lavatory solutions. Domestic suppliers emerge in China, yet quality benchmarks keep Western vendors active through joint ventures. Nations like India set soft rules encouraging accessible cabin designs, reinforcing retrofit potential across older fleets.

Europe's share remains sizable, underpinned by robust environmental regulation and circular-economy incentives. EU operators lead trials of recyclable flax composites, which align with upcoming disclosure norms under the Corporate Sustainability Reporting Directive. The Middle East registers double-digit twin-aisle orders that favor premium lavatory monuments with custom finishes. Africa sees sporadic growth tied to fleet renewals by Ethiopian Airlines and others, yet limited MRO capacity moderates retrofit velocity.

- Collins Aerospace (RTX Corporation)

- Safran

- JAMCO Corporation

- Diehl Stiftung & Co. KG

- Hong Kong Aircraft Engineering Company Limited (HAECO)

- Yokohama Rubber Co., Ltd.

- Geven SpA

- Satys SA

- CIRCOR International, Inc.

- FACC AG

- EnCore Corporate, Inc. (The Boeing Company)

- MAC Aero Interiors ( Magnetic Group)

- Lufthansa Technik AG

- Aviation Technical Services (ATS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased airline adoption of touchless lavatory technologies

- 4.2.2 Sustained growth in single-aisle aircraft deliveries over the long term

- 4.2.3 Rising demand for lavatory retrofits to support Person-with-Reduced-Mobility (PRM) accessibility standards

- 4.2.4 Cabin densification trends driving demand for space-efficient lavatory designs

- 4.2.5 Mandates promoting water-efficient vacuum toilet technologies

- 4.2.6 Industry shift toward circular economy with recyclable lavatory module designs

- 4.3 Market Restraints

- 4.3.1 Weight constraints limiting the integration of advanced lavatory features

- 4.3.2 Certification delays for next-generation antimicrobial and hygiene materials

- 4.3.3 Capital expenditure delays by airlines due to macroeconomic uncertainty

- 4.3.4 Onboard potable water limitations affecting ultra-long-haul lavatory operations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.1.3 Regional Jets

- 5.2 By Lavatory Technology

- 5.2.1 Vacuum

- 5.2.2 Recirculating

- 5.2.3 Hybrid/Others

- 5.3 By Component

- 5.3.1 Lavatory Module

- 5.3.2 Vacuum Toilet

- 5.3.3 Water and Waste Management System

- 5.3.4 Sinks, Faucets, and Accessories

- 5.4 By Fit Type

- 5.4.1 Line-fit

- 5.4.2 Retrofit

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Collins Aerospace (RTX Corporation)

- 6.4.2 Safran

- 6.4.3 JAMCO Corporation

- 6.4.4 Diehl Stiftung & Co. KG

- 6.4.5 Hong Kong Aircraft Engineering Company Limited (HAECO)

- 6.4.6 Yokohama Rubber Co., Ltd.

- 6.4.7 Geven SpA

- 6.4.8 Satys SA

- 6.4.9 CIRCOR International, Inc.

- 6.4.10 FACC AG

- 6.4.11 EnCore Corporate, Inc. (The Boeing Company)

- 6.4.12 MAC Aero Interiors ( Magnetic Group)

- 6.4.13 Lufthansa Technik AG

- 6.4.14 Aviation Technical Services (ATS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment