PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443973

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443973

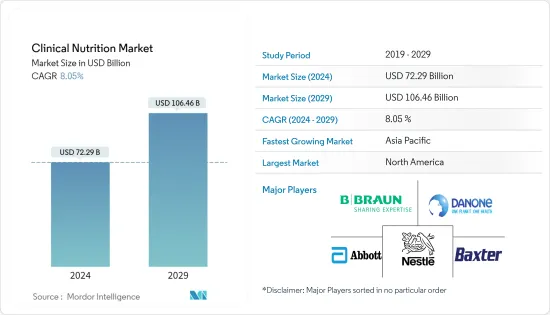

Clinical Nutrition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Clinical Nutrition Market size is estimated at USD 72.29 billion in 2024, and is expected to reach USD 106.46 billion by 2029, growing at a CAGR of 8.05% during the forecast period (2024-2029).

The COVID-19 pandemic had an effect on the clinical nutrition market. Various studies provide insight into the effects of the pandemic. For instance, in May 2021 a research study published in the National Library of Medicine stated that the prevalence of malnutrition was 42% in patients hospitalized with COVID-19. Thus, such high prevalence provides insight into the lack of nutritional support during the pandemic. Moreover, initiatives such as issuing new guidelines are expected to provide growth to the market over the forecast period. For instance, the European Society for Clinical Nutrition and Metabolism issued guidelines in January 2021, related to nutritional management in ICU patients infected with COVID-19, as clinical nutrition played a crucial role in preventing infection and treating infection-associated malnutrition. Similarly, in February 2021, Tata and Lyle launched Tata & Lyle Nutrition Centre, a new digital hub providing easy access to authoritative science on ingredients that would help food manufacturers address public health challenges. Thus, the market is expected to have a favorable impact during the forecast period of the study.

Certain factors are propelling the clinical nutrition growth of the market, including the increasing prevalence of metabolic disorders, high spending on healthcare, and the rise of the middle class in emerging economies. Over the past decade, the prevalence of metabolic disorders has increased. For instance, the Gaucher's Institute article updated in November 2021 reported that Gaucher disease is equally prevalent in males and females and has a worldwide prevalence of 0.70 to 1.75 per 100,000 individuals. The same source also reported that the standardized birth incidence of Gaucher disease within the general population varies from 0.39 to 5.80 per 100,000 individuals. Such a burden of diseases creates the need for clinical nutrition products and thus drives the growth of the market. During surgeries, clinical nutrition plays a major part in minimizing patient adverse consequences and enabling surgeons to work in a controlled environment. According to the Organization for Economic Co-operation and Development updated in August 2022, the number of surgeries (in thousand) performed in some European countries such as Portugal, Denmark, Ireland, and Norway in 2021 include 94.87, 49.33, 32.84, 21.5. Thus, with the rising burden of diseases and the volume of surgeries, the clinical nutrition market is expected to boost during the forecast period.

Similarly, product launches are another factor in market growth. For instance, in August 2021, Esperer Nutrition launched a range of consumer nutraceuticals for bone and joint health, immunity, urinary tract health, sleep apnea, and pre-diabetic care. Such product launches are expected to increase the adoption of clinical nutrition which is expected to increase market growth over the forecast period. Hence, the growing number of the elderly population and the development of clinical nutrition products specific to the aging population are expected to boost market growth.

However, imprecise perceptions about clinical nutrition and reduction in birth rates are expected to hinder the market growth.

Clinical Nutrition Market Trends

Oral and Enteral Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Of the all routes of administration available for clinical nutrition, oral and enteral routes are used the most, followed by the parenteral route. This is mainly because of the additional cost of processing the product/nutrient involved in parenteral routes. Until other routes of administration are deemed necessary, physicians mostly prefer the oral route, as it involves fewer complexities and costs, when compared to the other two routes of administration. Enteral therapy includes specialized liquid feedings containing protein, carbohydrates, fats, vitamins, minerals, and other nutrients needed to live. These nutrition support products are formulated to meet individual needs for a variety of disease states and conditions. In addition to this, most of the disease conditions, for which the oral route is used for the administration of clinical nutrition, are chronic conditions and non-acute conditions. According to the paper published in the Journal of Nephrology in 2021, in the case of end-stage renal disease (ESRD), the patients only have two options: opting for a transplant (which may not always be possible, due to the unavailability of donors; even in cases where a donor is found, it could take anywhere between a few months to several years) or undergoing regular hemodialysis. Specialized clinical nutrition through oral and enteral feeding is prescribed for these patients to reduce the burden on their kidneys, so that the production of excretory products, such as creatinine, uric acid, and bilirubin, is in control. Initiatives by key market players are another factor in market growth. For instance, in April 2021, NutiFood partnered with BASF to produce Human Milk Oligosaccharides (HMO) products. NutiFood is the first Vietnamese dairy company to cooperate with a European corporation to bring HMO into its line of nutrition products. These products can be consumed through oral feeding.

Thus, the above-mentioned factors are expected to contribute to the growth of the segment over the forecast period.

North America Hold Significant Share in the Clinical Nutrition Market and is Expected to Follow the Same Trend over the Forecast Period

North America contributes heavily to the market growth compared to the other regions. The emergence of COVID-19 has led to shortages of clinical nutritional products in this region. As per the data provided by the American Society for Parenteral and Enteral Nutrition (ASPEN), as of January 2021, certain parenteral products, including multi-vitamin infusion (adult and pediatric), amino acids, potassium acetate injection, USP, sodium acetate injection, USP, and sodium chloride, 23.4% of injections are currently at a shortage.

To meet the evolving demands driven by new consumer buying behavior amid the COVID-19 pandemic, manufacturers have increased production and are working with retailers and government agencies to help ensure adequate availability of and continued access to oral clinical nutrition products. Some of the primary factors attributing to the growth of the clinical nutrition market include an increase in the prevalence of metabolic disorders. For instance, as per a press release by the government of Canada published in August 2021, diabetes is one of the major chronic diseases affecting Canadians where over 3 million Canadians, or 8.8% of the population were diagnosed with diabetes and 6.1% of Canadian adults were at high risk of developing diabetes as of August 2021. Such diseases require long-term clinical nutritional support thus, diseases such as diabetes are expected to increase market growth over the forecast period.

Hence, such instances indicate a rising demand for clinical nutrition products, thereby driving market growth.

Clinical Nutrition Industry Overview

The market players are continuously engaged in expanding their presence through various inorganic growth strategies, such as acquisition, merger, and strategic collaboration, to gain significant market share and strengthen their product portfolios. Some of the key players in the market include Abbott Nutrition, Nestle Health Science, Baxter Healthcare, B. Braun SE, and Nutricia among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Metabolic Disorders

- 4.2.2 High Spending on Healthcare

- 4.2.3 Growing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Imprecise Perception About Clinical Nutrition

- 4.3.2 Reduction in Birth Rates

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Route of Administration

- 5.1.1 Oral and Enteral

- 5.1.2 Parenteral

- 5.2 By Application

- 5.2.1 Nutritional Support for Malnutrition

- 5.2.2 Nutritional Support for Metabolic Disorders

- 5.2.3 Nutritional Support for Gastrointestinal Diseases

- 5.2.4 Nutritional Support for Cancer

- 5.2.5 Nutritional Support in Neurological Diseases

- 5.2.6 Nutritional Support in Other Diseases

- 5.3 By End User

- 5.3.1 Pediatric

- 5.3.2 Adult

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories (Abbott Nutrition)

- 6.1.2 Nestle Health Science

- 6.1.3 Baxter Healthcare

- 6.1.4 B. Braun SE

- 6.1.5 Danone (Nutricia)

- 6.1.6 Perrigo Company PLC

- 6.1.7 Fresenius Kabi

- 6.1.8 AYMES International Ltd

- 6.1.9 Reckitt Benckiser

- 6.1.10 Medifood International Ltd

- 6.1.11 Ajinomoto Cambrooke Inc. (Nualtra Ltd)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS