PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1329328

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1329328

North America Diabetes Drugs Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The North America Diabetes Drugs Market size is estimated at USD 34.93 billion in 2023, and is expected to reach USD 41.65 billion by 2028, growing at a CAGR of 3.58% during the forecast period (2023-2028).

The market is estimated to reach a value of more than USD 39 billion by 2027.

The COVID-19 pandemic positively impacted the North America Diabetes Drugs Market. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people.

Diabetic drugs are medicines developed to stabilize and control blood glucose levels amongst people with diabetes. Diabetic drugs are commonly used to manage diabetes. Diabetic drugs have been potential candidates for treating diabetic patients affected by SARS-CoV-2 infection during the COVID-19 pandemic. In North America, till April 2022, the United States was having the highest COVID cases around 82 million, the country also registered the highest death rate. Pandemic emergency has created a rise in remote care from both patients and providers and removed many long-standing regulatory barriers.

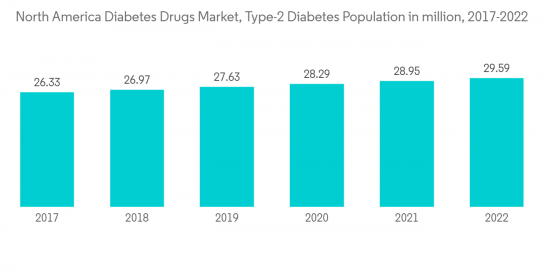

The North American region had witnessed an alarming increase in the prevalence of diabetes, in recent years. In developed countries, such as the United States and Canada, the rate of diabetes is at an all-time high, mainly due to lifestyle changes. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day for maintaining nominal blood glucose levels, such as the administration of additional insulin or ingestion of additional carbohydrates by monitoring their blood glucose levels.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

North America Diabetes Drugs Market Trends

The Oral anti-diabetic drugs segment is expected to register the highest CAGR in the North America Diabetes Drugs Market

The Oral anti-diabetic drugs segment is expected to register the highest CAGR of 4.7% in the North America Diabetes Drugs Market.

Oral Anti-Diabetic Drugs are available internationally. These are recommended for use when treatment escalation for type 2 diabetes is required, along with lifestyle management. According to the Division of Metabolism and Endocrinology Products in the FDA, "Patients want effective treatment options for diabetes that are as minimally intrusive on their lives as possible, and the FDA welcomes the advancement of new therapeutic options that can make it easier for patients to control their condition." Oral agents are typically the first medications used in treating type 2 diabetes due to their wide range of efficacy, safety, and mechanisms of action. Anti-diabetic drugs help diabetes patients control their condition and lower the risk of diabetes complications. People with diabetes may need to take anti-diabetic drugs for their whole lives to control their blood glucose levels and avoid hypoglycemia and hyperglycemia. Oral anti-diabetic agents present the advantages of easier management and lower cost and become an attractive alternative with better acceptance, which enhances adherence to the treatment.

In July 2022, Zydus Lifesciences announced that it had received final approval from the USFDA to market Empagliflozin and Metformin Hydrochloride tablets in multiple strengths. Empagliflozin and Metformin Hydrochloride tablets are used with proper diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus. They are also used to lower the risk of cardiovascular death in patients with type 2 diabetes mellitus and established cardiovascular disease.

Most health insurance plans cover diabetes medications because they are considered medically necessary. Medicare generally covers diabetes medications. The American Diabetes Association includes a guide to Medicare and diabetes prescription drug benefits. For patients covered by insurance, typical out-of-pocket costs consist of a prescription drug copay ranging from USD 10 to USD 50, depending on the drug. If the patient takes multiple drugs, copays can total USD 200 monthly or more.

The market will likely continue to grow due to the rising rate of obesity, the increasing prevalence, and the factors above.

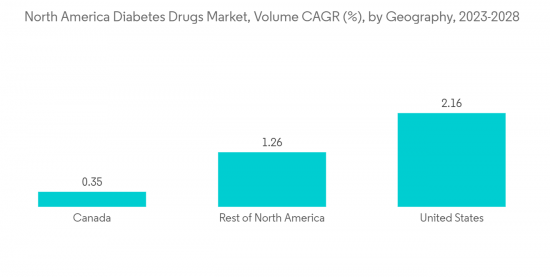

The United States held the highest market share in the North America Diabetes Drugs Market

The United States held the highest market share of around 86% in the North America Diabetes Drugs Market.

The Centers for Disease Control and Prevention National Diabetes Statistics Report 2022 estimated that more than 130 million adults are living with diabetes or prediabetes in the United States. Type 2 diabetes is more common, and diabetes is more consequential among communities of color, those who live in rural areas, and those with less education, lower incomes, and lower health literacy.

The disease's growing incidence, prevalence, and progressive nature encouraged the development of new drugs to provide additional treatment options for diabetic patients. Non-insulin treatments, used as first-line therapies for patients with type 2 diabetes, currently capture more than half the sales in the anti-diabetic market. Over the past decade, two important classes entered this market: dipeptidyl peptidase-4 inhibitors and sodium-glucose cotransporter-2 inhibitors.

In August 2022, Novo Nordisk announced headline results from a phase 2 clinical trial with CagriSema, a once-weekly subcutaneous combination of semaglutide and a novel amylin analogue, cagrilintide. The trial investigated the efficacy and safety of a fixed dose combination of CagriSema (2.4 mg semaglutide and 2.4 mg cagrilintide) compared to the individual components semaglutide 2.4 mg and cagrilintide 2.4 mg. These are all administered once weekly in 92 people with type 2 diabetes and who are overweight.

Owing to the factors above, the market is expected to grow during the forecast period.

North America Diabetes Drugs Industry Overview

The North America Diabetes Drugs Market is moderately fragmented with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, etc., and other generic players. A major share of the market is held by manufacturers concomitant with strategy-based M&A operations and constantly entering the market to generate new revenue streams and boost the existing ones. These measures taken by the market players will ensure a competitive marketplace, forcing companies to experiment with new technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insulins

- 5.1.1 Basal or Long Acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Basaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast Acting Insulins

- 5.1.2.1 NovoRapid/Novolog (Insulin Aspart)

- 5.1.2.2 Humalog (Insulin Lispro)

- 5.1.2.3 Apidra (Insulin Glulisine)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin/Actrapid/Insulatard

- 5.1.3.2 Humulin

- 5.1.3.3 Insuman

- 5.1.4 Biosimilar Insulins

- 5.1.4.1 Insulin Glargine Biosimilars

- 5.1.4.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long Acting Insulins

- 5.2 Oral Anti-diabetic drugs

- 5.2.1 Biguanides

- 5.2.1.1 Metformin

- 5.2.2 Alpha-Glucosidase Inhibitors

- 5.2.2.1 Alpha-Glucosidase Inhibitors

- 5.2.3 Dopamine D2 receptor agonist

- 5.2.3.1 Bromocriptin

- 5.2.4 SGLT-2 inhibitors

- 5.2.4.1 Invokana (Canagliflozin)

- 5.2.4.2 Jardiance (Empagliflozin)

- 5.2.4.3 Farxiga/Forxiga (Dapagliflozin)

- 5.2.4.4 Suglat (Ipragliflozin)

- 5.2.5 DPP-4 inhibitors

- 5.2.5.1 Onglyza (Saxagliptin)

- 5.2.5.2 Tradjenta (Linagliptin)

- 5.2.5.3 Vipidia/Nesina(Alogliptin)

- 5.2.5.4 Galvus (Vildagliptin)

- 5.2.6 Sulfonylureas

- 5.2.6.1 Sulfonylureas

- 5.2.7 Meglitinides

- 5.2.7.1 Meglitinides

- 5.2.1 Biguanides

- 5.3 Non-Insulin Injectable drugs

- 5.3.1 GLP-1 receptor agonists

- 5.3.1.1 Victoza (Liraglutide)

- 5.3.1.2 Byetta (Exenatide)

- 5.3.1.3 Bydureon (Exenatide)

- 5.3.1.4 Trulicity (Dulaglutide)

- 5.3.1.5 Lyxumia (Lixisenatide)

- 5.3.1.6 Ozempic (Semaglutide)

- 5.3.2 Amylin Analogue

- 5.3.2.1 Symlin (Pramlintide)

- 5.3.1 GLP-1 receptor agonists

- 5.4 Combination drugs

- 5.4.1 Insulin combinations

- 5.4.1.1 NovoMix (Biphasic Insulin Aspart)

- 5.4.1.2 Ryzodeg (Insulin Degludec and Insulin Aspart)

- 5.4.1.3 Xultophy (Insulin Degludec and Liraglutide)

- 5.4.2 Oral Combinations

- 5.4.2.1 Janumet (Sitagliptin and Metformin)

- 5.4.1 Insulin combinations

- 5.5 Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes population

- 6.2 Type-2 Diabetes population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Novo Nordisk A/S

- 7.1.2 Sanofi Aventis

- 7.1.3 Eli Lilly

- 7.1.4 Astra Zeneca

- 7.1.5 Bristol Myers Squibb

- 7.1.6 Boehringer Ingelheim

- 7.1.7 Pfizer

- 7.1.8 Janssen Pharmaceuticals

- 7.1.9 Merck

- 7.1.10 Astellas

- 7.1.11 Teva

- 7.1.12 Takeda

- 7.2 COMPANY SHARE ANALYSIS

- 7.2.1 Novo Nordisk A/S

- 7.2.2 Sanofi Aventis

- 7.2.3 Eli Lilly

- 7.2.4 Astra Zeneca

- 7.2.5 Janssen Pharmaceuticals

- 7.2.6 Merck

- 7.2.7 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS