Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403919

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403919

Tumor Ablation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

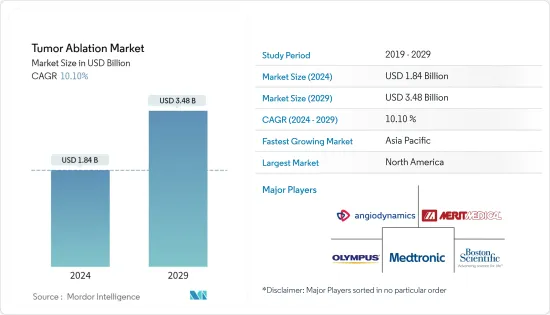

The Tumor Ablation Market size is estimated at USD 1.84 billion in 2024, and is expected to reach USD 3.48 billion by 2029, growing at a CAGR of 10.10% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic affected healthcare systems globally and resulted in the interruption of usual care in many healthcare facilities, exposing vulnerable patients with cancer to significant risks. For instance, according to the article published in November 2022 in PubMed, operative treatment during the pandemic was widely postponed since the immunosuppressive effects of surgical stress were likely to contribute to a higher risk of developing COVID-19 for patients with cancer.

- However, the growing number of cancer cases amid the outbreak had a positive impact on the market's growth, as hospitals and clinics continued to perform cancer surgeries and ablation procedures during the pandemic. For instance, the study published in April 2022 in the British Medical Journal (BMJ) journal stated that due to the increasing incidence of hepatocellular carcinoma (HCC) brought on by alcohol-related liver disease and non-alcoholic fatty liver disease in Northern England, there was less impact on resection and ablation, as elective cancer surgeries continued in various hospitals and clinics. Thus, the impact of COVID-19 on the market was adverse in its preliminary phase; however, owing to the resumption of surgical cancer procedures worldwide, the market is expected to gain traction over the coming years.

- Furthermore, factors that are propelling the growth of the market include the rising burden of cancer, technological advancements that are being made in ablation devices, and the growing demand for minimally invasive surgeries.

- Cancer is one of the most prevalent diseases globally, affecting the lives of several individuals. For instance, as per the Cancer Australia Statistics 2022, 162,163 new cases of cancer were diagnosed in Australia (88,982 males and 73,181 females) in 2022. Similarly, according to the October 2022 update by McMillan Cancer Support, 3 million people were living with cancer in the UK, rising to 3.5 million by 2025, 4 million by 2030, and 5.3 million by 2040. Thus, this increasing prevalence of cancer indicates a rising need for surgeries and effective ablation procedures for cancer, thereby driving market growth.

- Furthermore, key strategies adopted by major players, such as partnerships and collaborations, to strengthen the product portfolio in the market will also positively impact the market studied. For instance, in July 2021, Terumo Europe and University Medical Center Utrecht (UMC Utrecht) signed a Memorandum of Understanding (MoU) to strengthen their longstanding partnership in the field of oncology, including tumour ablation and chemoembolization through technological innovations.

- Similarly, in June 2022, IceCure Medical Ltd. submitted a regulatory filing to the Brazilian Health Regulatory Agency (ANVISA) for the approval of ProSense, an advanced liquid-nitrogen-based cryoablation therapy for the treatment of tumours (benign and cancerous) by freezing, with the primary focus areas being breast, kidney, bone, and lung cancer.

- Moreover, various research studies are demonstrating the technological advancements in ablation devices to treat tumours, which is expected to fuel market growth. For instance, as per the article published in March 2022 in the MDPI journal, the researchers obtained high standards of targeting accuracy, technical efficacy, procedural time, and radiation dose reduction using augmented reality (AR) as the sole guidance method for percutaneous thermal ablation, without encountering any complications.

- Therefore, due to the increase in cases of cancer and the rise in product launches coupled with technological advancements in tumour ablation devices, the studied market is expected to grow significantly during the study period. However, a strict regulatory process is expected to restrain the market's growth during the study period.

Tumor Ablation Market Trends

Lung Cancer Segment to is Expected to Witness Healthy Growth Over the Forecast Period

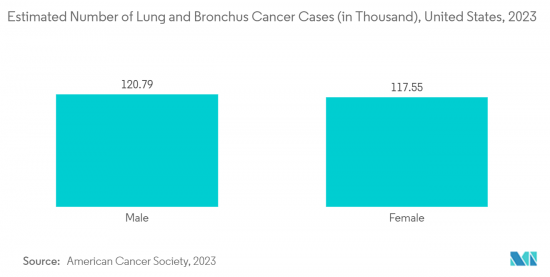

- The growing burden of lung cancer due to increased unhealthy habits and a surge in research and development activities, coupled with the launch of products, is driving the segment's growth. For instance, as per the American Cancer Society 2023 Statistics, 238,340 lung cancer cases are estimated to be diagnosed in 2023 in the United States. Thus, the high prevalence of lung cancer cases is likely to increase the demand for tumor ablation devices, which thereby augment the segment growth over the forecast period.

- Additionally, growing clinical research for lung cancer and ablation treatments is fuelling the segment's growth. For instance, a research study was initiated in December 2021 by Ethicon Inc. to evaluate the effectiveness and safety of the new wave-certus microwave ablation system in Chinese patients with primary or secondary tumors in the lung. The study is expected to be completed by December 2024.

- Moreover, in April 2022, the Food and Drug Administration (FDA) held a two-day online workshop on how transbronchoscopic thermal ablation devices may be developed to treat intermediate-stage lung tumors. Such programs are likely to increase the awareness of the ablation system for lung cancer among the patient population, thereby driving the segment's growth.

- Furthermore, in April 2021, Medtronic PLC received Breakthrough Device Designation status from the United States FDA for the Emprint ablation catheter kit, which can be used in conjunction with the Emprint microwave generator and Medtronic lung navigation platform to provide a minimally invasive, localized treatment of malignant lesions in the lung.

- Hence, due to the increase in the prevalence of lung cancer cases and the rise in research activities coupled with approvals and product launches, the studied segment is expected to grow over the forecast period.

North America is Anticipated to Hold a Significant Market Share Over the Forecast Period

- The North American region is expected to contribute significantly to the market growth during the study period owing to factors such as the growing cancer burden, increasing research and development procedures, and increasing product launches.

- For instance, according to the American Cancer Society 2023 Cancer Statistics, the new cancer cases are estimated to be 1.9 million in the United States in 2023. This estimation includes 1.01 million cases of males and 0.94 million cases of females. Similarly, as per the Statistics Canada 2022 update, 30,000 Canadians were diagnosed with lung and bronchus cancer in 2022. The high burden of cancer is expected to augment the demand for tumor ablation devices, thereby boosting the market growth over the forecast period.

- Furthermore, the launch and approval of new products in the market are expected to impact the country's market growth positively. For instance, in March 2022, Quantum Surgical, a developer of ablation devices and other medical devices, received FDA approval for Epione, a new category of interventional oncology robotics dedicated to minimally invasive liver cancer treatment. The company's Epione system helps plan and perform minimally invasive ablation surgery as an outpatient procedure by deploying computer-guided needles through the skin to single out and destroy tumors.

- Similarly, in September 2022, Stryker received 510(k) clearance from the Food Drug Administration (FDA) for its OptaBlate bone tumor ablation system (OptaBlate). Thus, such approvals increase the availability of products in the region, thereby driving market growth in North America.

- Thus, due to the increase in cancer cases and the rise in product launches and approvals, the studied region is expected to hold a significant market share over the forecast period.

Tumor Ablation Industry Overview

The tumor ablation market is consolidated and consists of a few major players. With technological advancements, it is believed that new companies will enter the market in the near future with their novel techniques. The major market players include Medtronic Plc, Boston Scientific Corporation, AngioDynamics Inc., Abbott, Merit Medical Systems, and Olympus Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52985

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Cancer

- 4.2.2 Technological Advancement in Ablation Devices

- 4.2.3 Growing Demand of Minimally Invasive Surgeries

- 4.3 Market Restraints

- 4.3.1 Strict Regulatory Process

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Technology

- 5.1.1 Radiofrequency (Rf) Ablation

- 5.1.2 Microwave Ablation

- 5.1.3 Cryoablation

- 5.1.4 Other Technologies

- 5.2 By Mode of Treatment

- 5.2.1 Surgical Ablation

- 5.2.2 Laparoscopic Ablation

- 5.2.3 Percutaneous Ablation

- 5.3 By Application

- 5.3.1 Liver Cancer

- 5.3.2 Lung Cancer

- 5.3.3 Kidney Cancer

- 5.3.4 Bone Metastasis

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AngioDynamics Inc.

- 6.1.2 Bioventus

- 6.1.3 Johnson and Johnson (NeuWave Medical, Inc.)

- 6.1.4 Medtronic PLC

- 6.1.5 B. Braun Melsungen AG

- 6.1.6 Merit Medical Systems

- 6.1.7 HealthTronics, Inc.

- 6.1.8 Boston Scientific Corporation

- 6.1.9 Olympus Corporation

- 6.1.10 IceCure Medical

- 6.1.11 Stryker Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.