PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444016

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444016

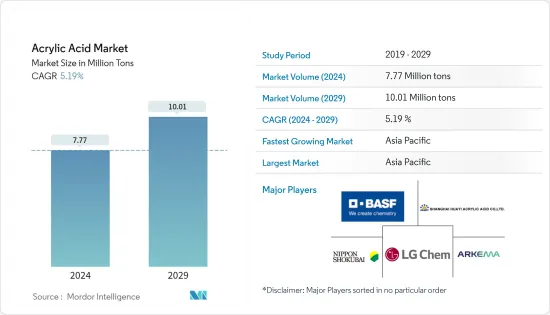

Acrylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Acrylic Acid Market size is estimated at 7.77 Million tons in 2024, and is expected to reach 10.01 Million tons by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic. However, in 2021, the demand for laundry care products increased due to the increased awareness and consciousness regarding personal hygiene and clean surroundings. Acrylic acid is used to produce liquid laundry detergent, stimulating the demand for the acrylic acid market.

Key Highlights

- Over the short term, the rising applications of acrylic acid-based super absorbent polymers and the increasing use of chemical synthesis are expected to drive the growth of the market.

- Health hazards associated with acrylic acid may hinder the growth of the market.

- The rising demand for bio-based polymers is likely to act as an opportunity for the growth of the market during the forecast period.

- The Asia-Pacific accounted for the largest market share, and it is likely to dominate the market during the forecast period.

Acrylic Acid Market Trends

Increasing Usage in Paints and Coatings Application

- Acrylic acid is increasingly used to make acrylate esters, which are used in various applications, including paints and coatings.

- Acrylics are used in architectural coatings, finishes for products for original equipment manufacturers, including automotive (OEM) and refinishes, and special-purpose coatings.

- Acrylic powder coatings have been introduced as clear coats on car bodies. Although it is an ideal solution for many applications, curing is achieved at a high temperature in an oven. It is, therefore, not universally applicable (e.g., painting of wood and plastics).

- Architectural coatings are meant to protect and decorate surface features and are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. Each architectural coating must provide certain decorative, durable, and protective functions despite their use.

- Most homeowners prefer to use the color of their choice for the living room and bedroom walls. Acrylic paints are the preferred choice as they offer a wide variety of choices in terms of color and shade. A vast majority of ceilings are painted flat white so that they may reflect the majority of the ambient light in the room, to make the resident feel that the room is spacious and relaxed. Basement masonry walls can often weep water.

- In May 2022, Grasim Industries (Aditya Birla Group) planned to invest INR 10,000 crore (~USD 1209.47 million) for its paint business by FY2025. In January 2021, the company announced plans to enter the paints business with INR 5,000 crore (~USD 604.73 million) in the next three years. The company will likely commission a paint plant with a production capacity of 1,332 million liters per annum (MLPA) by Q4 FY2024.

- According to the Ministry of Economy, Trade, and Industry (Japan), the production volume of synthetic resin paints in Japan amounted to approximately 1.01 million metric tons in 2021, making up an enormous production volume of paints. Overall, paints' production volume increased to nearly 1.53 million metric tons in 2021, compared to 1.50 million metric tons in 2020.

- According to the American Coatings Association (Coatings Tech), the paints and coatings industry in the US accounted for USD 25.21 billion in 2020, and it was expected to reach USD 28.06 billion by 2022. Similarly, in terms of volume, the paints and coatings industry stood at 1,337 million gallons in 2020, and was expected to reach 1,416 million gallons by 2022. This is likely to enhance the demand for acrylic acid from the paints and coatings sector in the country.

- Overall, the demand for acrylic acid is expected to witness moderate to high growth in the region after the initial recovery period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific dominated the market due to the high demand from countries like China, India, and Japan.

- China is the largest consumer of acrylic acid in the Asia-Pacific region, and its demand is expected to grow during the forecast period. The demand for adhesives, paints, and coatings in China is also increasing significantly due to the growing investments in the construction and infrastructure sectors.

- Additionally, China is one of the major consumers of personal hygiene products globally. The country's demand for personal hygiene products is attributed to a large infant population and increasing disposable income, leading to increased spending on personal and hygiene care. Thus, it is anticipated to boost the market for acrylic acid during the forecast period.

- China is known for its industrialization and manufacturing sector, where paints and coatings are widely required. Some of the major sectors where paints and coatings are used in the country are the automotive, industrial, and construction sectors, among others. China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years, driving the acrylic acid market in coatings application.

- Nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BAF SE, and Axalta Coatings, have manufacturing bases in China. Paints and coatings companies have been increasingly growing investments in the country. This is likely to fuel the market for acrylic acid used to manufacture automotive paints and coatings.

- Companies like DuPont invested approximately USD 30 million in the adhesive sector to build a new manufacturing facility in East China in Zhangjiagang, Jiangsu Province. The company's new facility produces adhesives to serve customers in the transportation industry, primarily supporting two mega-industry trends: vehicle electrification applications and lightweight. Construction began in Q3 2021, and the facility is expected to be operational by early 2023.

- Some key players operating in the paints and coatings business in India are Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel India. Recently, various companies have announced their capacity expansions, which are likely to boost the demand for acrylic acid from paints and coatings formulations in the country.

- Acrylic acid is used in adult and female hygiene products. In India, the lack of menstrual hygiene has always been a challenge. As of April 2021, according to UNESCO and Whisper, 23 million girls have dropped out of school due to a lack of menstrual hygiene and awareness in India. Out of a total of ~40 crore menstruating women in India, less than 20% use sanitary pads. In urban areas, this number only goes up to 52%.

- Hence, dueto these factors, the Asia-Pacific region is likely to dominate the acrylic acid market during the forecast period.

Acrylic Acid Industry Overview

The acrylic acid market is consolidated in nature. Some major players in the market include BASF SE, Arkema, NIPPON SHOKUBAI CO. LTD, LG Chem, and Shanghai Huayi Acrylic Acid Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications of Super Absorbent Polymers

- 4.1.2 Increasing Usage in Chemical Synthesis

- 4.2 Restraints

- 4.2.1 Health Hazards of Acrylic Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Derivative

- 5.1.1 Methyl Acrylate

- 5.1.2 Butyl Acrylate

- 5.1.3 Ethyl Acrylate

- 5.1.4 2-Ethylhexyl Acrylate

- 5.1.5 Glacial Acrylic Acid

- 5.1.6 Superabsorbent Polymer

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Surfactants

- 5.2.4 Sanitary Products

- 5.2.5 Textiles

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.4 Dow

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 LG Chem

- 6.4.7 Merck KGaA

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NIPPON SHOKUBAI CO. LTD

- 6.4.10 Sasol

- 6.4.11 Shanghai Huayi Acrylic Acid Co. Ltd

- 6.4.12 Satellite Chemical Co. Ltd

- 6.4.13 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polymers