PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444386

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444386

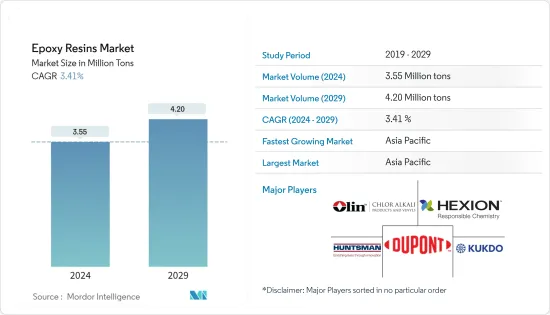

Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Epoxy Resins Market size is estimated at 3.55 Million tons in 2024, and is expected to reach 4.20 Million tons by 2029, growing at a CAGR of 3.41% during the forecast period (2024-2029).

The market was negatively impacted due to the COVID-19 pandemic in 2020, owing to the pandemic scenario and strict regulations in several countries. It affected various industries such as paints and coatings, adhesives and sealants, electrical and electronics, and others due to supply chain disruptions, work stoppages, and labor shortages. However, the condition normalized, and the market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the increasing demand for epoxy-based composites from the aerospace and automotive industries, strong growth in the construction industry, and rising demand for electrical and electronic devices are driving the market over the forecasted period.

- However, the hazardous impact of epoxy resins is expected to include major limitations on the growth rate of the epoxy resin market during the projected period.

- Nevertheless, the growing construction industry in the emerging countries of Asia-Pacific, the Middle East, and Africa are creating new opportunities for this market segment in the future.

- Asia-Pacific dominated the market across the world, with the majority of demand coming from China and India.

Epoxy Resin Market Trends

The Paints and Coatings Segment is Expected to Dominate the Market

- Epoxy resins are used as binders for coating applications to enhance the durability of coatings for floor and metal applications.

- Epoxy resins help to develop several properties in coatings, such as strength, durability, and chemical resistance. Their properties and abilities of quick drying, toughness, excellent adhesion, good curing, abrasion resistance, and outstanding water resistivity make them suitable for protecting metals and other surfaces.

- Globally, the production of paints and coatings experienced slow growth due to multiple factors like unfavorable macroeconomic factors, reduced consumer spending, high energy prices, and others.

- The production and consumption of paints and coatings in Europe and North American regions were more severely affected than others due to these factors.

- According to the data published by Coatings Europe, factors like the ongoing energy crisis, rising interest rates from the European Central Bank, and the slowing economic growth in key countries like Germany, the United Kingdom, France, and Italy has negatively affected the demand for paints and coatings from the region as over 50% of the regional demand is generated from these countries.

- Even though the region has not witnessed significant product cuts, the consumption volume of both decorative and nondecorative coatings in the region declined by nearly 6% in 2022 compared to 2021 volumes. This decline was most significant in the last quarter of 2022.

- Paints and coatings are extensively used for interior and exterior applications in various industries, including building and construction, automotive, industrial, and others.

- The growing construction industry is expected to augment the growth of the paints and coatings industry. The United States includes a major share of the construction industry in North America. The United States, Canada, and Mexico also contribute significantly to the construction sector investments.

- According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,792.85 billion in 2022, compared to USD 1,626.44 billion in the previous year. Moreover, the annual value of residential construction in the United States was valued at USD 908 billion in 2022, an increase of 13 % compared to USD 803 billion last year.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. These two countries are expected to represent over 43.3% of the global middle class by 2030.

- Additionally, the growth in the production of lightweight and commercial vehicles is expected to drive the overall market of epoxy resins used in the automotive coatings industry.

- According to Organisation Internationale des Constructeurs d'Automobiles(OICA), more than 85,016,728 motor vehicles were manufactured worldwide in 2022, an increase of 6% from a year earlier.

- The automotive, marine, and aerospace industries use epoxy coatings as primers for corrosion protection. The usage of epoxy coatings is expected to grow further due to the rising demand from the electric vehicle (EV), marine, and aerospace industries.

- Such factors are expected to significantly impact the demand for epoxy resins in paints and coatings, thereby affecting the growth of the epoxy resins market during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. Furthermore, China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- According to ZEVI, the Asian electrical & electronics market reached EUR 3,106 billion (USD 3,674 billion) in the previous year, a 10% rise. The market increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even larger than the combined markets of all industrialized countries. The Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023.

- Furthermore, as per the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025.

- For instance, Japan's construction sector is expected to expand moderately over the next five years, owing to increasing investments in public and private infrastructure, renewable energy, and commercial projects. It, in turn, is improving both consumer and investor confidence.

- Furthermore, in the Asia-Pacific region, China, Southeast Asia, and South Asia aerospace market are expected to rise significantly, further supporting the demand for the studied market. According to the Boeing Commercial Outlook 2022-2041 in China, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- Such factors are expected to increase the demand for epoxy resins in the Asia-Pacific region during the forecast period.

Epoxy Resin Industry Overview

The epoxy resins market is fragmented in nature. The major players (not in any particular order) include Hexion, Olin Corporation, Huntsman International LLC, DuPont, and KUKDO CHEMICAL CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Epoxy-based Composites from the Aerospace and Automotive Industries

- 4.1.2 Strong Growth in the Construction Industry

- 4.1.3 Rising Demand for Electrical and Electronic Devices

- 4.2 Restraints

- 4.2.1 Hazardous Impact of Epoxy Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Marine

- 5.2.6 Wind Turbines

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Atul Ltd

- 6.4.4 BASF SE

- 6.4.5 Chang Chun Group

- 6.4.6 Covestro AG

- 6.4.7 Daicel Corporation

- 6.4.8 DuPont

- 6.4.9 Hexion

- 6.4.10 Huntsman International LLC

- 6.4.11 Jiangsu Sanmu Group

- 6.4.12 Kemipex

- 6.4.13 KUKDO CHEMICAL CO., LTD.

- 6.4.14 NAMA Chemicals

- 6.4.15 NAN YA PLASTICS CORPORATION

- 6.4.16 Olin Corporation

- 6.4.17 Sika AG

- 6.4.18 SPOLCHEMIE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Construction Industry in the Emerging Countries of Asia-Pacific and Middle-East and Africa

- 7.2 Other Oppurtunities