PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441681

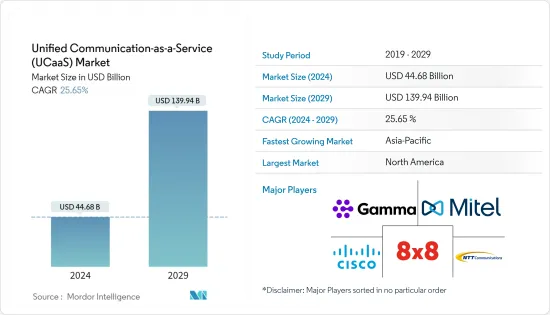

Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Unified Communication-as-a-Service Market size is estimated at USD 44.68 billion in 2024, and is expected to reach USD 139.94 billion by 2029, growing at a CAGR of 25.65% during the forecast period (2024-2029).

The increasing trend of work from home (WFH) model is compelling employers to use UCaaS solutions as it's beneficial for companies to reevaluate their operational costs and save their marginal revenue from declining. According to Eurostat, in 2022, the percentage of people who usually worked from home in the European Union accounted for 12.4%. Estonia recorded the highest rate of employed persons working from home in the CEE region, followed by Latvia. In Romania, only 1.4% of employees worked from home.

Key Highlights

- Unified Communications as a Service is a cloud-based service that integrates various communication and collaboration applications into a single platform. UCaaS enables businesses to streamline communication channels, reduce costs, and enhance productivity.

- UCaaS offers multiple communication tools, including voice and video conferencing, messaging, email, and collaboration software. The platform allows users to access these tools from anywhere, on any device, using an internet connection. It eliminates the need for expensive hardware, software, and maintenance costs, making it an attractive option for businesses of all sizes. For instance, in May 2023, the Indian government granted Zoom Video Communications, a web conferencing company, a Unified License with access covering all of India, National Long Distance (NLD), and International Long Distance (ILD). This will allow it to offer Zoom Phone, a cloud-based private branch exchange (PBX) service, to enterprises in the country.

- Furthermore, UCaaS enables enterprises to manage unified collaboration among employees anywhere, anytime, over the cloud. For instance, TTata Communications recently launched an end-to-end managed unified communications-as-a-service (UCaaS), Tata Communications GlobalRapide, for businesses to enable them to deliver digitally advanced and intelligent collaboration tools to their employees. With this unique service, Tata Communications becomes a one-stop-shop to address all international businesses' digital-first, cloud-first unified communications requirements. Similar solutions provider innovations and initiatives are expected to aid the market's growth during the pandemic.

- In addition, the introduction of 5G technology and high-speed internet is anticipated to boost the market in the forecasted period, as video and audio conferencing needs high-speed and low latency in the connection, which is easily provided by the 5G network. According to 5G Americas, as of 2023, there are an estimated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is forecast to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- Further, the rapidly increasing adoption of the BYOD trend and other mobility solutions is expected to drive the adoption of UCaaS solutions even further. Bring Your Own Device (BYOD) has emerged as a significant trend in this new era of flexibility and network accessibility for employees working around the globe for various organizations, making the workplace more productive. For instance, according to Cisco, enterprises with a BYOD policy save, on average, USD 350 per year per employee.

- The rising implementation of smart mobile gadgets and association tool improvements empower remote work and dispersed workforce tactics. Similarly, establishments employ a 'bring your device' (BYOD) rule across their business facilities. This approach will likely help organizations upsurge efficiency, refine internal interaction, and eradicate different prices. This is anticipated to eventually bolster the unified communication as a service market growth during the forecast period.

- Moreover, the demand for Unified Communications has grown over the last decade. It witnessed an exceptional rise after the pandemic outbreak. With the emergence of COVID-19, digital transformation became an urgent requirement for businesses to ensure their survival, growth, and market leadership. The need for unified, frictionless, and secure access to data and applications anytime, anywhere exponentially increased.

Unified Communication as a Service (UCaaS) Market Trends

Healthcare Segment Expected to Register High Market Growth

- UCaaS in healthcare has proven to be a delivery model wherein various communication and collaboration services and applications are outsourced to a third-party provider and provided over a network across the healthcare sector. UCaaS technologies include presence technology, video conferencing, enterprise messaging, and telephony.

- The advent of cost-effective cloud-based solutions has seen increased adoption from healthcare providers, which often have minimum IT budgets. With the subscription-based United Communication services in place, healthcare contact centers are establishing their PBX systems and seamlessly addressing multiple customer requests from various sites.

- Cloud-based Unified Communication as a Service (UCaaS) is a digital change for fortifying business assignments. UCaaS in healthcare is a conveyance model wherein a diversity of partnerships, communication applications, and administrations are moved to an outsider supplier and conveyed over a network across the healthcare sector.

- Increasing investment in the healthcare sector may further propel the demand in the studied market. For instance, According to StartUp Health, in 2022, eight of the largest ten digital health investment deals were done in the United States. This year, USD 600 million were invested into the U.S. company Ultima Genomics making it the most significant deal. The largest investment involving a company from outside the U.S. concerned Doctolib, which received a contract of USD 549 million.

- Cloud adoption in the sector, including moving EHR systems and other enterprise applications, which traditionally ran on client-server architectures, also provides scope for UC companies to offer their services over the cloud on a subscription basis. Most cloud communication providers across the region offer highend cloud-based security for each customer, eliminating the barriers and making the healthcare sector an addressable market for UCaaS. For instance, 8x8, a prominent UCaaS vendor, offers UC solutions that enable healthcare organizations to meet third-party-verified compliance with HIPAA, PCI-DSS 3.1, FISMA/FIPS 140-2, and Safe Harbor regulations.

- Health Insurance Portability and Accountability Act regulations complicate designing and securing a communications platform. Major cloud communication providers supply highend cloud-based security for each client to ensure patient information and help IT meet stringent compliance requirements. UCaaS is coupled with organizational mobility and provides several advantages, like real-time communications to instantly locate and connect caregivers, faster connections instantly, and compelling call routing, regardless of location, enabling healthcare organizations to establish rules and reduce distractions across ER rooms to surgeries.

- The increasing deployment of artificial intelligence has greatly aided organizations in catering to the digital transformation goal. AI-powered tools have allowed organizations to intuitively record calls, facilitate effortless transcriptions, and intelligently track speakers to understand users' needs and offer relevant services.

North America Expected to Hold a Significant Market Share

- The region is significantly contributing to the studied market growth, primarily due to the recent surge in mobility and the explosion of 5G connections due to the consumerization of I.T., which has aided enterprises in adopting I.P. telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the U.S., end-user verticals, such as retail, banking and finance, healthcare, information technology, and telecommunications, seek a more direct and seamless experience for all of their communications, audio, video, and chat, no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- The U.S. is among the foremost innovators and investors in the 5G market, with investments increasing for 5G deployment. The telecom sector in the country accounts for a significant portion of the global consumption of 5G technology. Telecom operators, such as Verizon, AT&T, and T-Mobile, have also signed billion-dollar deals with network equipment vendors, such as Huawei, Samsung, Ericsson, Nokia, and ZTE, to build their 5G network infrastructure in the country. For instance, According to Ericsson, in the U.S., it is expected that there will be more than 195 million 5G subscriptions by 2026, and by 2029, 5G will likely account for about 71.5% of the entire U.S. mobile market.

- This rapid growth will also create a platform for a 5G economy in the U.S., driving USD 275 billion in investment, creating 3 million jobs, and significant to USD 500 billion in economic growth, according to the CTIA.

- For new consumers in Las Vegas, Detroit, Atlanta, and San Francisco, Verizon provides a 10-year price lock, no data limitations, and rates ranging from 100 to 400 Mbps. The company's primary goal is to expand its 5G corporate internet presence nationwide, bringing its entire array of services, including video collaboration capabilities and edge computing, to the country.

- Further, in October 2022, RingLogix, a significant provider of UCaaS, secured a USD 3 million series of investments from M.K. Capital to improve its position as one of the swiftest-growing software firms allowing MSPs to brand and resell UCaaS. The proceeds were expected to speed up product innovation, deploy new integrations and solutions, expand partners' businesses, and increase their earnings.

- Moreover, with the growing demand for cloud-based communication services, various enterprises in the country are entering the market via partnerships and alliances. For example, NEC Corporation of America (NEC), a significant provider and integrator of communications and advanced I.T. Networking Solutions, recently announced the initial term of its exclusive international partnership with Intermedia Cloud Communications, a leading provider of Contact Center as a Service (CCaaS) and Unified Communications as a Service (UCaaS) applications to businesses and their partners, has been extended from five to ten years.

Unified Communication as a Service (UCaaS) Industry Overview

The competitive rivalry between market players is high owing to some major players like 8x8 Inc., Mitel Networks, Verizon, and many others, and the Unified Communication-as-a-Service (UCaaS) Market is moderately fragmented. These companies can gain a competitive advantage due to their ability to bring about innovations by investing heavily in research and development activities. Strategic partnerships, mergers, and acquisitions have allowed these companies to occupy a substantial market share.

In July 2022, Symbio and Cisco collaborated to provide a unified communications product for Cisco's Cloud Connect for Webex Calling. The product offered to Cisco distributors and their consumers in Singapore is in the country's telecoms sector. It delivered a simple, low-cost cloud communication option for Webex Calling.

In February 2022, Evolve IP, one of the leading international service providers of Work Anywhere solutions, announced a partnership with Webex, a prominent supplier of cloud-based collaboration solutions, to create Evolve Anywhere with Webex, Evolve IP's new unified communications solution. The Cisco-powered UCaaS solution combined enterprise-grade calling and cutting-edge features from Evolve IP Global Voice with Webex's powerful messaging and meetings capabilities, all within a single app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Emergence of Pay-as-you-go Model Driving Demand over Legacy UC Solutions

- 4.5.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 4.6 Market Challenges

- 4.6.1 Low Readiness to Move to Modern Unified Communications

- 4.7 Key Business Models in the UC Industry

5 TECHNOLOGY OVERVIEW

6 MARKET SEGMENTATION

- 6.1 By Size of Enterprise

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 Government and Public Sector

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 8X8 Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Mitel Networks Corporation

- 7.1.4 Gamma Communication PLC

- 7.1.5 NTT Communication Corporation

- 7.1.6 Vodafone Group PLC

- 7.1.7 Telia Company AB

- 7.1.8 KPN NV

- 7.1.9 BT Group PLC

- 7.1.10 Verizon Communications Inc.

- 7.1.11 Nextiva

- 7.1.12 Soluno (Destiny NV)

- 7.1.13 VADS Berhad

- 7.1.14 Singapore Telecommunications Limited

- 7.1.15 PLDT Enterprise

- 7.1.16 Telstra Corporation Limited

- 7.1.17 PCCW Global

- 7.1.18 Maxis Communications

8 KEY RECOMMENDATIONS

- 8.1 Key Strategic Recommendations

- 8.2 Analyst's View on Regional Demand and Positioning

- 8.3 Analysis of Most Adopted Strategies

9 FUTURE OF THE MARKET