PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444658

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444658

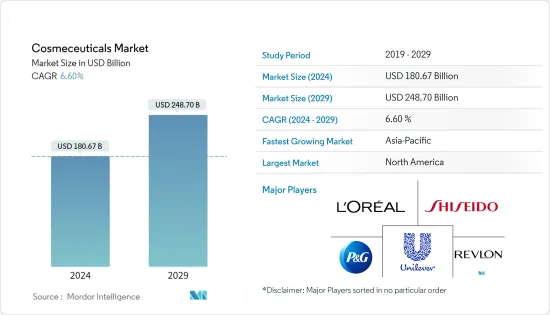

Cosmeceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Cosmeceuticals Market size is estimated at USD 180.67 billion in 2024, and is expected to reach USD 248.70 billion by 2029, growing at a CAGR of 6.60% during the forecast period (2024-2029).

The market is expected to grow as consumers become more conscious of their physical appearance. The introduction of cosmeceuticals transformed the cosmetic and personal care industries. Unlike makeup products, these products can resolve the imperfections' origin rather than just covering them. This quality significantly increased product demand and market share in the cosmetic and personal care industries.

Due to the increasing prevalence of skin and hair disorders, the aging population, and the increased awareness of dermatological treatment, the demand for cosmeceutical products is rising globally. Furthermore, Cosmeceuticals are expected to continue to benefit from the increased preference for natural products among the general population worldwide. Natural ingredients are becoming more popular than traditional ingredients, including those with lesser side effects like skin cracking and hair thinning. Introducing new products with bio-active ingredients is crucial in driving the demand for cosmeceutical products worldwide.

Countries such as the United States, Canada, United Kingdom, Germany, and other European countries held a prominent share in the global cosmeceuticals market. China, India, and Vietnam present considerable growth opportunities for the market players, primarily due to the growing millennial population. Moreover, the leading companies are eyeing e-commerce as an opportunistic market segment as consumers are preferring online channels to purchase these products due to convenience and ease of purchase.

Cosmeceuticals Market Trends

Growing Ageing Population

Consumers, especially the aging population, are increasingly looking for methods and products to maintain and improve their appearance to look youthful and beautiful, especially with the rising awareness about anti-aging products. According to World Bank data, in Japan, the population of 65 years old accounted for 26.59% in 2016, which increased to 28.7% in 2021. Additionally, middle-aged people are increasingly witnessing aging anxiety due to the high prevalence of aging signs. Anti-aging skin products are cosmeceuticals, as they overlap the distinction between cosmetics and pharmaceuticals. Over the past two decades, the declining fertility and mortality rates resulted in a sustained rise in the aging population across the region, especially in China and Japan. The strong desire among men and women to retain youthful appearances groomed and nurtured the cosmetic industry across the region.

Asia-Pacific Fastest Growing Region in the Market

The region's increasing demand for cosmetic skin care, oral care, and hair care products is attributed to accelerated urbanization, an increase in urban populations, and changing lifestyle demands. Additionally, the growing disposable income in emerging economies such as China, India, Vietnam, etc., is fueling the demand for cosmeceuticals. Recently, the term 'cosmeceuticals' started gaining momentum in China, becoming one of the country's most preferred product categories. The busier and more stressful lifestyles of consumers in the region and worsening environmental conditions created more concern around skin conditions among consumers seeking products for skin rejuvenation. It led to an increase in sales of cosmeceuticals.

Moreover, the population of Japan is among the most prolific consumers of cosmetics, placing it among the top five national markets for personal care products. From both size, trends, and market demand, Japan can be regarded as a gateway to other Asian markets. Success in the Japanese market can raise product/brand profile and visibility, particularly in other Asian markets. Additionally, the rising number of millennials in the region is spending more on cosmetic products to maintain their appearance. They are leading the trend of beauty athleisure. Additionally, social media trends are expected to increase in the upcoming years, as well as the growing need for people to look good, boosting the demand for cosmeceuticals in the region.

Cosmeceuticals Industry Overview

The most active companies in the market include key players, such as Procter & Gamble, Unilever, L'Oreal SA, Shiseido Co. Ltd, and The Estee Lauder Companies Inc. L'Oreal SA is one of the most active companies, with numerous brands offering a broad cosmeceuticals range worldwide. The company improved its quality and product innovation regarding ingredients, functionality, and packaging. These companies have been taking significant measures to increase their market penetration worldwide by establishing regional hubs and innovation centers. Moreover, these players are increasing their investments in R&D and marketing. They are expanding their distribution channels to maintain their market positions and offer innovative and multi-functional cosmeceuticals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Skin Care

- 5.1.1.1 Anti-ageing

- 5.1.1.2 Anti-acne

- 5.1.1.3 Sun Protection

- 5.1.1.4 Moisturizers

- 5.1.1.5 Other Skin Care Product Types

- 5.1.2 Hair Care

- 5.1.2.1 Shampoos and Conditioners

- 5.1.2.2 Hair Colorants and Dyes

- 5.1.2.3 Other Hair Care Product Types

- 5.1.3 Lip Care

- 5.1.4 Oral Care

- 5.1.1 Skin Care

- 5.2 By Distribution Channel

- 5.2.1 Supermarket/Hypermarkets

- 5.2.2 Online Retail Stores

- 5.2.3 Convenience Stores

- 5.2.4 Specialist Stores

- 5.2.5 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 L'Oreal SA

- 6.3.2 Procter & Gamble

- 6.3.3 Unilever PLC

- 6.3.4 Shiseido Co. Ltd

- 6.3.5 Revlon Inc.

- 6.3.6 Groupe Clarins SA

- 6.3.7 Beiersdorf AG

- 6.3.8 Johnson & Johnson Inc.

- 6.3.9 Kao Corporation

- 6.3.10 Avon Products Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS