PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444069

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444069

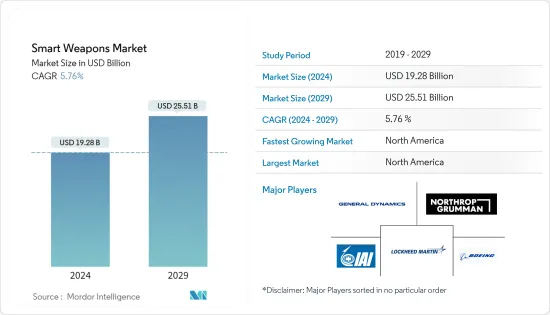

Smart Weapons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Smart Weapons Market size is estimated at USD 19.28 billion in 2024, and is expected to reach USD 25.51 billion by 2029, growing at a CAGR of 5.76% during the forecast period (2024-2029).

Key Highlights

- The smart weapons market witnessed unprecedented challenges due to the COVID-19 pandemic. The rapid spread of the pandemic had a significant impact on the market. Implementation of lockdowns by various countries worldwide led to affecting the supply chain and disruption in the movement of essential raw materials and logistics challenges. Moreover, the challenges related to the movement of essential raw materials, mass layoffs by various defense companies, as well as a reduction in terms of orders for smart weapons by various defense personnel worldwide led to a decline in the production of smart weapon systems.

- On the other hand, the defense systems manufacturers and service providers had to reduce expansion and R&D investments to withstand the decline in revenue and operating performance of the defense industry. The marker showcased a strong recovery post-covid due to an increase in demand by various defense personnel worldwide in terms of acquiring smart weapons. Moreover, the growing investments in research and development of smart weapons having advanced capabilities by various defense manufacturers are expected to propel the growth of the market during the forecast period.

- In addition, a change in warfare and demand for high-precision arms and ammunition are the two major factors that are driving the smart weapons market. Current conflicts which are taking place all over the world have spotlighted the critical need for precision attacks and operational strikes. A crucial need for avoiding collateral damage has also been stressed in the need for the procurement of advanced smart weapons for countries across the world.

- In addition, the increasing military spending of emerging countries is helping in terms of the development of new and advanced smart weapons and is expected to lead to the growth of the smart weapons market during the forecast period.

Smart Weapons Market Trends

Law Enforcement Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

- The law enforcement segment is anticipated to show significant growth during the forecast period. The increasing number of incidents related to mass shootings around the world and the growing need to cut down on the increasing number of deaths due to growing gun violence will be the major factors that will contribute to the growth of smart weapons for law enforcement in the near future.

- Currently, there has been an increasing rise in the number of incidents related to deaths due to growing gun violence. Firearm injuries and deaths around the world have increased in recent years and adversely affect many children and adolescents. According to data from a trusted business source, in 2020, firearms became the leading cause of death. In the US, in 2021, 48,830 people died from gun-related injuries.

- Moreover, according to data from the Centers for Disease Control and Prevention (CDC), in 2021, 54% of all gun-related deaths in the US were suicides (26,328), while 43% were murdered (20,958) while the remaining gun deaths were accidental (549), involved law enforcement (537) or had undetermined circumstances (458). Currently, there is a growing need for various law enforcement agencies across the globe to take the necessary steps in order to reduce the number of fatalities related to gun violence.

- There has been an increasing need to make guns safer and smarter. Although there have been various major developments with regard to smart weapons for law enforcement in recent times still, proper technology for a true smart gun, such as one that operates via radio or ultrasonic waves, is still in the fledgling stage and is many years in the future. On the other hand, advancements in technologies such as fingerprint scanning and facial recognition systems are propelling the growth of smart weapons for the law enforcement segment.

- In the present scenario, personalized smart guns are being made available to law enforcement agencies worldwide. In January 2022, LodeStar Works company announced the unveiling of their 9mm smart handgun for law enforcement agencies. Moreover, smart guns are now being developed with advanced technologies such as facial recognition in order to help prevent unwanted fatalities. In addition, smart guns are also helping to reduce suicides, render lost or stolen guns useless, and offer safety for police officers and jail guards who fear gun grabs.

- Thus, technological advancement for smart guns and the increasing growth of the usage of smart guns to prevent unwanted fatalities worldwide will lead to positive market growth for smart weapons in the law enforcement segment during the forecast period.

North America Will Showcase Remarkable Growth During the Forecast Period

- North America is projected to show the highest growth during the forecast period. The increasing defense budget, coupled with increasing technological advancements by various major players in the region, will foster market growth.

- In 2023, the defense budget for the US amounted to USD 773 million. This budget represents a USD 30.7 billion or 4.1 percent increase over the FY 2022 enacted base level of USD 742.3 billion and an 8.1 percent increase from the FY 2022 requested level. Compared to the FY 2021 level, the FY 2023 request has grown by nearly USD 70 billion (9.8 percent) over a 2-year period.

- There has been a growth with regard to the number of incidents regarding mass shootings in the North American region over the past few years. As of May 2023, according to data from Gun Violence Archives, at least 13,959 people have died from gun violence in the US. Moreover, of those who died, 491 were teens, and 85 were children. Deaths by suicide have made up the vast majority of gun violence deaths in 2023. There's been an average of about 66 deaths by suicide per day in 2023. This has led to an increase in the development of smart weapons by various defense manufacturers in the US in recent years. Making use of advanced technology such as fingerprint sensors has enabled the development of smart guns which do not fire other than when it is in the hands of the fingerprinted user. Smart guns have been a notoriously quixotic category for decades. The weapons carry the hope that an extra technological safeguard might prevent a wide range of gun-related accidents and death.

- On the other hand, there has been a growth with regard to smart weapons for the military, and the US is witnessing significant growth in this regard. In the present scenario, there have been technological advancements with regard to smart weapons for the United States defense forces. Modern battlefields are immersed in electronic devices and data, whether on the ground, at sea, or in the air. The amounts of data from well-established systems and technologies such as radar, sonar, and LiDAR are becoming too much for any warrior to process, encouraging the development of semi-autonomous or 'smart' weapons that can share in decision-making. Currently, weapons are now being equipped with artificial intelligence (AI) and machine learning (ML) technologies, and many of these weapons are being guided by light, sound, or electromagnetic (EM) waves to reach a selected target with high accuracy. In addition, smart weapons can be programmed to filter unwanted signals in multiple-signal environments and find a specific target on a battlefield with many potential targets. The US, in this regard, is now engaged in the development of new smart weapons which can pinpoint an enemy's location through a wall, and rounds can be fired, which explode upon reaching the place where the insurgent is believed to be hiding.

- Thus, developments in advanced smart weapons that make use of advanced technology both in the law enforcement and military sector will lead to the market of smart weapons witnessing significant growth in North America during the forecast period.

Smart Weapons Industry Overview

The smart weapons market is fragmented in nature, with various players holding significant shares in the market. Some prominent market players are General Dynamics Corporation, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, and The Boeing Company, amongst others.

The key players in the market are focusing on the development of advanced smart weapons systems, which will be used by various defense personnel around the world to carry out their military operations. Moreover, growing expenditure on research and development towards manufacturing advanced smart weapon systems will lead to creating better opportunities in the near future. Various manufacturers are now currently integrating technologies such as fingerprint recognition which will prevent accidental use and misuse of such weapons, and this is expected to support the growth of the smart weapons market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for advanced precision strike weapons

- 4.3 Market Restraints

- 4.3.1 Regulations on arm transport

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Missiles

- 5.1.2 Ammunition and Other Products

- 5.2 Technology

- 5.2.1 Satellite Guidance

- 5.2.2 Radar Guidance

- 5.2.3 Infrared Guidance

- 5.2.4 Laser Guidance

- 5.3 Platform

- 5.3.1 Land

- 5.3.2 Sea

- 5.3.3 Air

- 5.4 By End-User

- 5.4.1 Law Enforcement

- 5.4.2 Military

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 Israel Aerospace Industries Ltd.

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 Northrop Grumman Corporation

- 6.2.5 Rafael Advanced Defense Systems Ltd.

- 6.2.6 Rheinmetall AG

- 6.2.7 The Boeing Company

- 6.2.8 MBDA

- 6.2.9 BAE Systems plc

- 6.2.10 Raytheon Technologies Corporation

- 6.2.11 Safran

7 Market Opportunities and Future Trends

- 7.1 Advancement in terms of weapons technology