PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444039

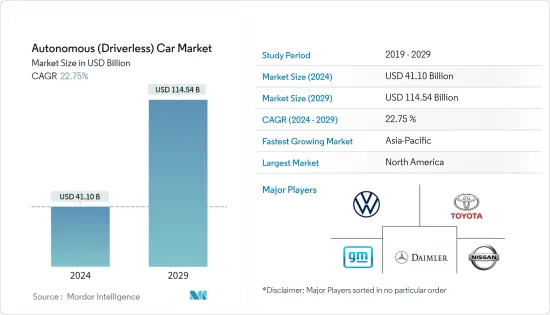

Autonomous (Driverless) Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Autonomous Car Market size is estimated at USD 41.10 billion in 2024, and is expected to reach USD 114.54 billion by 2029, growing at a CAGR of 22.75% during the forecast period (2024-2029).

The COVID-19 pandemic has impacted the overall automotive sector, compelling automakers to reduce the output at their production plants. The pandemic has also affected the operations of many OEMs, ranging from production to R&D, and created short-term disruptions that have delayed autonomous cars' deployment and rollouts.

Due to increasingly stringent government regulations focusing on increasing road safety, more autonomous cars are being developed with highly advanced technologies integrated with smartphones and creating opportunities for market players to attract customers. The recent technological advancements in the fields of artificial intelligence, machine learning, and other sensors like RADAR, LIDAR, GPS, and computer vision, have enabled manufacturers to increase self-driving capabilities in cars.

At present, Level 2 and Level 3 autonomous cars are most prominent in the market, while Level 4 and Level 5 (as scaled by SAE) are expected to reach wider acceptance by 2030. As a result, the growth of these Level 2 and Level 3 cars is expected to propel the market during the forecast period.

North America is expected to play a significant role in the market, followed by Asia-Pacific and Europe. Major automaker companies, technology giants, and specialist start-ups across North America have started investing in developing autonomous vehicle (AV) technology. As demand for self-driving cars is picking up across countries like China, Japan, India, and South Korea, the Asia-Pacific region is also expected to witness growth over the forecast period.

Autonomous Vehicle Market Trends

Semi-autonomous Cars Segment Anticipated to Gain Significance during the Forecast Period

Following the SAE (Society of Automotive Engineers) International Automated Driving Standards, cars with Level 1-3 automation features have been considered in the market segment for semi-autonomous vehicles. The growing need for safer and more efficient driving systems promotes the development and adoption of semi-autonomous vehicles. Moreover, several regional governments have placed stringent driving and safety laws, further encouraging companies to offer these technologies in their automobiles.

Several technological advancements have helped foster a conducive environment for the market's growth. Moreover, the presence of a high number of passenger cars has elevated the rising need to enhance the driving experience and is promoting the adoption of semi-automated vehicles. This has been evident in sales during the COVID-19 pandemic.

Even during the pandemic, autonomous cars witnessed a rise in sales, as in 2020, around 11.2 million cars were sold with Level 2 features, which was an increase of 78% over 2019. Owing to such a favorable environment in the market, automakers worldwide are introducing new semi-autonomous vehicle models to attract consumers. For instance,

In April 2021, Citroen unveiled its new model, C5 X SUV. This new model was offered in both gasoline and plug-in hybrid versions. C5 X offers semi-autonomous Level 2 driving in compliance with current legislation.

In April 2021, Beijing Hyundai Motor Co. Ltd launched the new Tucson L, a compact crossover SUV. The vehicle is built on the i-GMP platform, and it is equipped with a 1.5 liters turbocharged engine (maximum power output of 147 kW, peak torque of 253 Nm), mated to a 7-speed dual-clutch transmission. The vehicle features the Hyundai Smart Sense system, which includes 23 safety and assistance functions and supports Level 2 autonomous driving.

Based on the aforementioned factors, the semi-autonomous cars segment is likely to gain prominence over the forecast period.

North America Likely to Hold Dominant Share in the Market

North America is expected to dominate the autonomous (driverless) car market during the forecast period. The region has been a pioneer of autonomous vehicles due to factors like strong and established automotive company clusters and being home to the world's biggest technology companies like Google, Microsoft, Apple, etc. Particularly in the US, self-driving cars have already been tested and used in California, Texas, Arizona, Washington, Michigan, and other states of the US. However, their mobility is currently restricted to specific test areas and driving conditions.

Apart from various local companies, the country is witnessing the entry of companies from other countries. For instance,

In February 2021, Vietnam's domestic automaker Vin Fast announced that it had obtained a permit to test autonomous vehicles on California's public streets. The company sought this permit to commercialize its electric vehicles in the US market.

In April 2021, Honda and Verizon announced that they are working at MCity to explore Verizon 5G Ultra-Wideband and 5G Mobile Edge Compute (MEC). The companies are testing how using Verizon 5G Ultra-Wideband and MEC in the Honda SAFE SWARM can reduce the need for AI onboard each vehicle.

In March 2021, Motional announced that it would be using the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation robotaxi. Through its partnership, consumers in select markets will be able to book a Motional robotaxi through the Lyft app starting in 2023. Motional's IONIQ 5 will be equipped with Level 4 autonomous driving capabilities.

Thus, the North American region is likely to benefit from the aforementioned developments, and it is expected to witness stable demand for autonomous cars during the forecast period.

Autonomous Vehicle Industry Overview

The autonomous (driverless) car market is a moderately consolidated one. Apart from manufacturers, players, including hardware and software firms, have started focusing on catering to the growing demand for autonomous driving technology in the automotive sector. Thus, partnerships, collaborations, and investments toward developing autonomous vehicles have increased significantly in the automotive sector. These initiatives are likely to continue growing during the forecast period, primarily due to increasing support from governments and private sectors across several countries to promote autonomous driving vehicle technology.

In January 2021, Automotive Grade Linux announced that it had included Aicas, AVL, and Citos as new bronze members. AGL is an open-source project at the Linux Foundation that brings together automakers, suppliers, and technology companies to accelerate the development of all vehicle technologies, including autonomous driving.

In January 2021, automotive technology company Veoneer Inc. and Qualcomm Technologies Inc. signed an agreement under which the companies will collaborate on delivering scalable Advanced Driver Assistance Systems (ADAS) and Collaborative and Autonomous Driving (AD) solutions.

Some of the leading companies in the autonomous (driverless) car market include Volkswagen, Toyota Motor Corporation, General Motors Company, Ford Motor Company, Nissan Motor Company Ltd, Daimler AG (Mercedes-Benz), BMW, Volvo Cars, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Semi-autonomous Vehicles

- 5.1.2 Fully-autonomous Vehicles

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Uber Technologies Inc.

- 6.2.2 Daimler AG

- 6.2.3 Waymo LLC (Google Inc.)

- 6.2.4 Toyota Motor Corp.

- 6.2.5 Nissan Motor Co. Ltd

- 6.2.6 Volvo Car Group

- 6.2.7 General Motors Company

- 6.2.8 Volkswagen AG

- 6.2.9 Tesla Inc.

- 6.2.10 BMW AG

- 6.2.11 Aurora Innovation Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS