PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404339

Baked Food And Cereals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

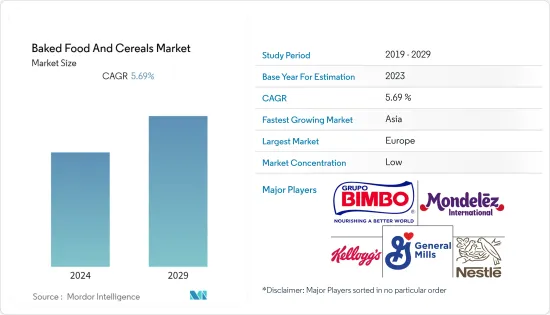

The baked food and cereals market is valued at USD 552.4 billion for the current year and is projected to register a CAGR of 5.69% over the next five years.

Key Highlights

- The bakery food and cereal market is mainly driven by convenience. The necessity to embrace practical solutions in every area of life grows due to the fast-paced way of living. It's challenging for customers to spend more time cooking due to long working days. So, a busy lifestyle increases the consumption of foods like bread, cookies, cakes, and breakfast cereals that are ready to consume.

- Additionally, a fast-paced lifestyle brought on by expanding urbanization and high purchasing capacity also significantly contribute to the rise in demand for convenient, healthy foods. According to the state of a snacking report published by Mondelez International in 2022, 64% of consumers prefer snacking as regular eating behavior over traditional mealtime.

- Additionally, the cost of cakes and pastries is typically more than regular bread manufactured in in-store bakeries. Still, the wide accessibility of options, customization, and expanded options attract consumers to buy, thereby driving the segment's and industry's revenue. Also, there are continuous innovations as the bakery and cereal industry invests a lot in developing beneficial and nutritional products.

- Low-carb, high-fiber, multigrain, and fortified baked food & cereals that appeal to health-conscious consumers have triggered the market growth. The bakery and cereal industry has satisfied the consumers' health concerns and their indulgence in consuming baked and packaged foods as they are produced with high-quality ingredients.

- However, the bakery products contain a significant number of calories. Owing to this factor, health-conscious consumers try to consume low-calorie bakery products. Meanwhile, the increasing prevalence of obesity worldwide is anticipated to drive the sales of low-calorie bakery products over the forecast period.

Baked Food And Cereals Market Trends

Rising Demand for Artisan Bakery Goods

- Artisan bakeries often use whole grains, natural sweeteners, and other wholegrain ingredients to prepare bakery goods that appeal to health-conscious consumers. Millennials tend to gravitate towards whole grains, natural ingredients, and fresh food products, thus prefer artisan bakery products, including bread, biscuits, morning goods, and others.

- Artisan bakeries offer unique, distinct flavors and creative products that are not readily available in mass-market bakeries and are made using traditional methods. For instance, La Farm Bakery, located in North Carolina, United States, offers 15 different styles of bread and 20 seasonal breads.

- The bakery claims to offer hand-crafted bread and uses unbleached and unbromated flour. In addition, consumers' increased preference for high-quality bakery goods and the rising consumers' willingness to pay a premium price for healthy and high-quality baked goods, along with the rising disposable income, is supporting the growth of artisan baked goods in the market studied.

- Furthermore, artisan bakery goods are perceived to be healthier as they generally contain seeds, nuts, and value-added nutrient-rich grains such as quinoa, amaranth, spelled, and others to boost their nutritional value. The rise in conscious baking and inclination towards artisan-style bakery products, along with the change in consumption patterns and adoption of healthier food products, is driving the sales of the market.

- For instance, in 2022, according to the International Food Information Council, 54% of Americans tried to eat healthier, 38% focused on healthy behaviors instead of weight loss, and 37% of consumers followed a specific diet or eating pattern.

- Thus, the high potential growth in artisan bakeries is attracting bakers to offer unique, nutritious, and healthy bakery goods to fulfill consumers' demand, which in turn fuels the growth of the market.

Asia-Pacific Currently Registers the Fastest Growth Rate

- Convenience coupled with the fast-paced style of life has increased the need for effective solutions in every aspect of existence, leading to a rise in the consumption of foods like ready-to-eat bread, cookies, cakes, breakfast cereals, and biscuits across the region. For instance, in July 2021, Kellogg's Australia unveiled the launch of a new gluten-free breakfast cereal such as Coco Pops Gluten Free and Sultana Bran Gluten Free. Per the company's claim, these products are developed to satisfy the breakfast cereal needs of consumers with gluten intolerances or allergies.

- Additionally, the Asian bakery and cereal products market is driven mainly by value addition in bakery products and cereal products. Consumers look for products based on nutritional value or certifications like halal and kosher, organic, and innovative flavors. The bakery industry in the region has increased the availability and variety of healthy baked and cereal goods, such as high-fiber bread, gluten-free product ranges, and low-fat flatbread, due to the prevalence of obesity and to cater to consumers' demand for healthy products. For instance, in January 2023, Nestle India launched Koko Krunch Millet-Jowar and Munch Breakfast Cereals, providing more diverse and innovative options to Indian consumers. The company's products include whole grain wheat flour, rice, and corn in Munch breakfast cereals.

- Furthermore, artisanal bakeries and cafes are gaining prominence among upper- and middle-class consumers. In recent years, artisanal bread, pastries, and cakes have significantly benefited from their expansion into in-store bakeries in supermarkets. In-store bakeries play a pivotal role in driving the sector. These bakeries position artisanal products in prominent displays in attractive multi-portion packaging to generate impulsive purchases. For instance, in July 2021, Massimo launched the limited edition of an artisanal multigrain bread loaf in the Malaysian market.

Baked Food And Cereals Industry Overview

The global baked food and cereal market is highly fragmented due to the presence of several local, domestic, and global players in this segment. Due to the existence of several players and the dominance of local players in the market, the rivalry among the competitors is also high. Several prominent players in this industry include Groupo Bimbo, The Kellogg's Company, General Mills, Mondelez International Inc., and Nestle S.A.. The key players use growth strategies, including mergers and acquisitions, expansion, new product development, and partnerships, to fuel market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Demand for Convenient and Healthy On-The-Go Snacking

- 4.1.2 Consumers Proclivity Towards Artisan Bakery Goods

- 4.2 Market Restraints

- 4.2.1 Consumers Shift Towards Healthy Substitutes of Bakery Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Bread

- 5.1.2 Breakfast Cereals

- 5.1.3 Biscuits and Cookies

- 5.1.4 Morning Goods

- 5.1.5 Cakes and Pastries

- 5.1.6 Other Product Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialist Stores

- 5.2.3 Convenience Stores/Grocery Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Grupo Bimbo SAB de CV

- 6.3.2 Mondelez International Inc.

- 6.3.3 Nestle S.A.

- 6.3.4 General Mills Inc.

- 6.3.5 Barilla Group

- 6.3.6 The Kellogg's Company

- 6.3.7 Flowers Foods, Inc.

- 6.3.8 Campbell Soup Company (Freedom Foods)

- 6.3.9 The Oetker Group

- 6.3.10 Dawn Food Products, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS