PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402977

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402977

Asia-Pacific Charter Jet Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

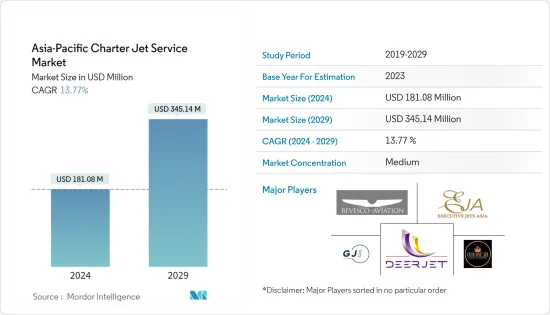

The Asia-Pacific Charter Jet Service Market size is estimated at USD 181.08 million in 2024, and is expected to reach USD 345.14 million by 2029, growing at a CAGR of 13.77% during the forecast period (2024-2029).

The increased demand for private jets from high-net-worth individuals, the growing popularity of air charter services among business travelers in the Asia-Pacific region, and the increasing demand for charter jets for emergency medical services and air ambulance transportation are expected to lead to market growth shortly. The development of on-demand travel in the region fosters the demand for chartered services. This has encouraged chartered service providers to enhance their services on new routes and launch attractive membership schemes, enhancing the economic prospects of active players and entrants in the Asia-Pacific charter jet services market. On the other hand, the limited aviation infrastructure and stringent regulations are expected to hinder the market's growth.

Asia-Pacific Charter Jet Service Market Trends

Light Aircraft is Anticipated to Grow with the Highest CAGR During the Forecast Period

The light aircraft segment is expected to grow significantly during the forecast period. Light private jets provide fast and comfortable transport for as many as seven passengers looking to travel to regional destinations. With the flexibility to land at nearly any airport, these aircraft are often the choice for family vacations, making ideal business jets.

According to the Air Charter Report of 2022, regarding the size category, the Asia-Pacific market shifted away from larger-sized charter jets. Although long-range charter aircraft have been witnessing significant growth in the past few years, light charter aircraft, which were primarily used for domestic flying, has been seen as being the most popular category since 2020. In addition, the previous COVID-19 outbreak and the subsequent travel restrictions followed changes in charter operators' fleets in many Asia Pacific countries, namely the shrinking of large jet charter fleets and the expansion of light jet charter fleets. Thus, the growth of light charter jets in various countries in the Asia-Pacific is expected to boost the market significantly during the forecast period.

India Will Showcase Remarkable Growth During the Forecast Period

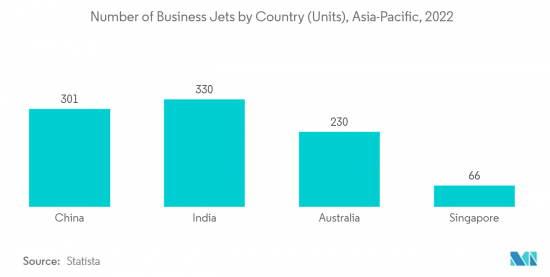

India is projected to show the highest growth during the forecast period. The increasing number of high-net-worth individuals, coupled with the growing number of business jet deliveries in India, is driving market growth across the country. However, infrastructure status, airspace limitations, and regulations throughout the country are often the paramount challenges that make it difficult to attain the aircraft utilization targets for the charter operators in the long run.

In India, the percentage of High-Net-Worth Individuals (HNI or HNWI) has gone up in recent times owing to a surge in business opportunities, foreign investments, and new-age digital entrepreneurs. This has led to a tectonic shift in the wealth management industry. The ranks of India's ultra-high-net-worth individuals are estimated to rise in the coming years. In addition, the billionaire population of India has witnessed growth from 161 people in 2022 to 145 people in 2021, and it is also expected this trend will change during the forecast period. Moreover, the Indian market for ultra-HNWI investments is still very nascent and yet to be explored to its full potential.

India is witnessing growth in terms of business jet deliveries. According to the aviation regulator Directorate General of Civil Aviation (DGCA), non-scheduled operator permit holders in India had a fleet of 330 charter aircraft as of April 2022. Moreover, for airlines in India, demand for different types of private charter flights witnessed a significant increase in December 2021 after India reopened following a strict, six-month-long Covid lockdown, and this will lead to a positive outlook and growth for charter jets market within India during the forecast period.

Asia-Pacific Charter Jet Service Industry Overview

The Asia-Pacific charter jet service market is fragmented, with various market players holding most of the market share. Some of the major players in the market are Deer Jet (Beijing) Co., Ltd., Club One Air, Revesco Aviation Pty Ltd., Global Jet International, and Executive Jets Asia Pte Ltd.

The key players in the market are focused on providing advanced air charter services to their customers. Moreover, charter service providers are now looking forward to increasing their fleet size to cater to the increasing demand for on-demand flights. In addition, membership schemes and new packages are being introduced by service providers to increase their market shares in the region. The high potential of the market has also attracted several charter service providers based in the United States and Europe to expand their services across Asia, and this will lead to the market witnessing growth during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Aircraft Size

- 5.1.1 Light Aircraft

- 5.1.2 Mid-size aircraft

- 5.1.3 Lage Aircraft

- 5.2 Asia-Pacific

- 5.2.1 China

- 5.2.2 Australia

- 5.2.3 India

- 5.2.4 Singapore

- 5.2.5 South Korea

- 5.2.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Deer Jet (Beijing) Co., Ltd.

- 6.2.2 AUSTRALIAN CORPORATE JET CENTRES

- 6.2.3 Club One Air

- 6.2.4 Revesco Aviation Pty Ltd.

- 6.2.5 Asian Aerospace Corporation

- 6.2.6 Pacific Flight Services

- 6.2.7 Phenix Jet International LLC.

- 6.2.8 Executive Jets Asia Pte Ltd.

- 6.2.9 Global Jet International

- 6.2.10 China Minsheng Investment Group.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS