PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432453

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432453

Parachute - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

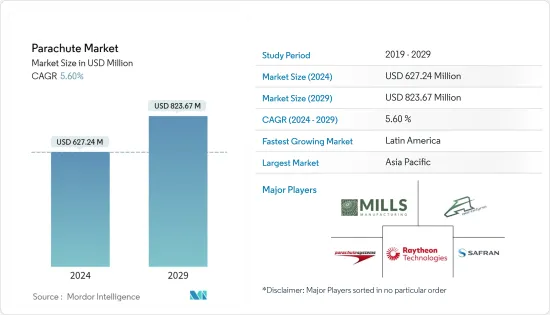

The Parachute Market size is estimated at USD 627.24 million in 2024, and is expected to reach USD 823.67 million by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

The COVID-19 pandemic has resulted in governments resorting to lockdowns and shuttered production units. Although no manufacturing company remains unscathed, the effect of the pandemic has not been uniform. While some suppliers and product manufacturers have experienced harrowing drops in business and profits, others have managed to sustain themselves, although their fortunes have depended on the markets they serve and their ability to turn to products suddenly in demand.

The demand for parachutes has remained steady from the defense sector; however, there has been a dramatic fall in demand from the recreational sector as many end users are still reeling from the effects of the pandemic. This disruption is also expected to continue in 2021, while the demand for civilian-use parachutes is expected to increase in the latter half of the forecast period. Nevertheless, new and advanced lightweight parachutes are gaining popularity, and the growth of smart textiles is subsequently envisioned to drive the adoption of such technologies for parachutes.

Parachute Market Trends

The Military Application Segment is Expected to Dominate the Market

Parachutes have been widely used by military forces across the world. They were first used on a large scale during World War II for troop distribution and transportation. Paratroopers are often used in surprise attacks. Many countries have one or several paratrooper units, usually associated with the national Army or Air Force, and in some cases, to the Navy. Australia, the United States, the United Kingdom, France, India, Germany, Israel, Italy, Japan, and Poland are among the few countries with parachute brigades that often take part in military parachuting drills organized in various countries. For instance, recently, about 100 Polish soldiers of the 6th Airborne Brigade and around 200 American paratroopers from the 319th Artillery Regiment of the 173rd Airborne Brigade participated in the 'Marauder-21' exercises in north-west Poland. The Russian military recently deployed paratroopers from an altitude higher than Mount Everest. The troops used a novel parachute system in combination with oxygen equipment and navigation devices when jumping from the Ilyushin Il-76 military transport aircraft. In mid-2020, with the increasing tension between India and China, the Chinese People's Liberation Army (PLA) paratroopers held intensive tactical drills in Northwest China. A PLA Air Force airborne brigade of thousands of paratroopers maneuvered from Central China's Hubei Province to an undisclosed location in the plateaus of northwestern China in just a few hours. Such deployments are expected to generate demand for the induction of new parachutes as replacement sales for inventory.

Latin America is Expected to Witness the Highest Growth During the Forecast Period

In the last decade, Latin America has been witnessing persistent political unrest and frequent terrorist activities, and the defense forces in the region need to be appropriately prepared for rapid deployments to neutralize any terror activity in a geographically diverse environment. Aerial dispersal strategies are used to mark superiority during such conflicts, with minimal collateral damage.

Furthermore, climate change has exposed Latin America to a wide range of weather-related disasters. Floods and droughts are the most devastating natural disasters in the region. Natural phenomena, such as El Nino (unusually warm temperatures in the equatorial Pacific) and La Nina (unusually cool temperatures), result in extreme weather disruptions across the Amazon basin, severely affecting crops and livestock. The shifting weather patterns have necessitated humanitarian support in the form of supplying food and potable water to the affected regions. Between 2016-2018, the European Union (EU) allocated around EUR 14.92 million toward risk mitigation projects in Bolivia, Colombia, Ecuador, Paraguay, Peru, and Venezuela. Since food and water are delivered to the affected regions through airdrops during an emergency, the deployment of cargo parachutes is needed to ensure the safe landing of resources in such situations. Disaster relief funds cover the necessary equipment required for facilitating emergency services. Hence, a part of such funds is directed toward the procurement of parachutes for the delivery of emergency supplies for an extended period.

Countries in the region are strengthening the capabilities of their airborne platoons. For instance, the Brazilian Army maintains its parachute brigade consisting of 5,500 personnel, which conducts a comprehensive array of autonomous operations. Owing to the short shelf-life of unused parachute systems, periodical operations or exercises will also necessitate the procurement of new parachute systems. Therefore, regional manufacturers may be able to secure business opportunities from Latin American countries during the forecast period. Furthermore, the commercial use of parachutes is also growing in the region. The region has a total of 122 licensed drop zones designated for civilian use. The rising demand for recreational adventure activities, such as parasailing, tandem parachuting, and skydiving, may also propel the adoption of parachutes in the region during the forecast period.

Parachute Industry Overview

The major players in the parachute market are Safran SA, Raytheon Technologies Corporation, Aerodyne Research LLC, Mills Manufacturing Corporation, and Parachute Systems, which accounted for nearly half of the market share. The parachute market is highly competitive and marked by the presence of many prominent vendors that are competing for market share. The presence of stringent safety and regulatory policies in the defense sector is expected to restrict the entry of new vendors. The sales of technology-based platforms such as parachutes are primarily influenced by the economic conditions in dominant markets such as Asia-Pacific and Europe. Hence, during an economic downturn, purchases may be subject to deferrals or cancelation, which could lead to relatively slow adoption and adversely affect the market dynamics. Business uncertainty can also be caused due to failures or delays in obtaining licenses and certifications for export, which can hurt the businesses and operating results of vendors. The vendors intend to devote significant resources and effort to capitalize on the proficiency of parachutes and enhance their penetration in the rapidly evolving market segments of the global commercial and military parachute market. The diversification of geographical markets, in tandem with the product offerings, will be a key criterion to ensure profitability and survival in the long run.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD billion)

- 5.1 Type

- 5.1.1 Round Parachute

- 5.1.2 Cruciform Parachute

- 5.1.3 Ram-air Parachute

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Military

- 5.2.2 Cargo

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Transdigm Group Inc.

- 6.2.2 Mills Manufacturing Corporation

- 6.2.3 Precision Aerodynamics

- 6.2.4 Aerodyne Research LLC

- 6.2.5 Safran SA

- 6.2.6 FXC Corporation

- 6.2.7 Parachute Systems

- 6.2.8 BAE Systems PLC

- 6.2.9 NZ Aerosports Ltd

- 6.2.10 Bourdon Forge Company Inc.

- 6.2.11 Raytheon Technologies Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS