PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437972

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437972

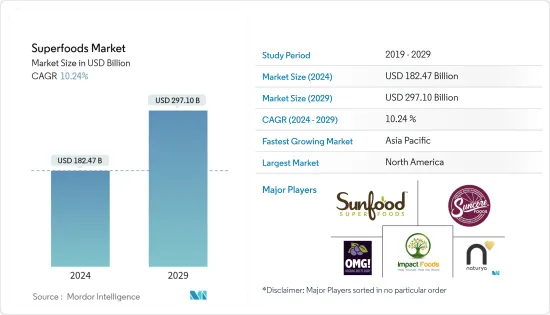

Superfoods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Superfoods Market size is estimated at USD 182.47 billion in 2024, and is expected to reach USD 297.10 billion by 2029, growing at a CAGR of 10.24% during the forecast period (2024-2029).

The popularity of 'Super' ingredients, often called 'superfoods', 'superfruits', or 'super grains has increased significantly over the recent past with product launches, as consumers are inclined more toward natural and wholesome ingredients. For instance, Quinoa exhibits high nutrient and antioxidant value that aids in reducing free radicals and preventing several diseases. These products have superior nutritional value, as they are rich sources of polyphenols, antioxidants, vitamins, and minerals. The market studied is driven by consumer preference toward functional and health-based naturally derived products. The popularity of 'super' products is used by food and drink manufacturers globally, triggering the demand for these nutritional products.

These days people have sedentary lifestyles. Therefore, diseases like obesity, diabetes, and heart-related conditions are very common because people prefer their food to be low-calorie and highly nutritious, which is why consumers prefer superfoods over regular food. Considering all these problems, market players provide products that benefit all consumers. For instance, in March 2021, Ocean Spray launched Fruit Medley, a dried fruit blend with many benefits like an immunity blend, fiber blend, and probiotic blend. Besides this, vigorous marketing strategies, promotions, and the influence of celebrities are also driving the market. But the high cost of raw materials is expected to restrain the market.

Superfood Market Trends

Increasing Health and Wellness Trend

Consumers have become more conscious of personal well-being and aim to improve it proactively through healthy living rather than conventional medicines. This increased health awareness associated with consumer willingness to experiment has led to the exposure of superfoods that allow manufacturers to produce various products, including superfood ingredients. For instance, in August 2021, Del Monte launched a fruit cup with added benefits like easy digestion, antioxidants, and hydration energy. The fruit cup is available in four new flavors. The fruit cup is made with real fruit juice with no added sugar or artificial sweeteners.

There is an increasing demand for plant botanicals or extracts, owing to their positive impact on the heath. Thus these product offers consumers a substantially high amount of nutrients with a minimum intake of calories. Different super grains like amaranth, quinoa, oats, and many more gives various health benefits. It plays an instrumental role in prolonging the lifespan and minimizing the risk of chronic diseases while contributing to a healthier diet. Superfoods increase the metabolic rate, prevent cardiovascular diseases and diabetes, and boost weight loss. They can be an alternative to gluten foods as well. Thus, the growing number of new product launches in different industries like food, beauty, personal care, health and hygiene, drink, and pet is one of the key trends that will gain traction in the superfood industry.

North America is Holding a Prominent Share in the Superfoods Market

Superfoods have emerged as an increasingly significant category of health food products and related popular discourse about food, health, and values. The United States Food and Drug Administration (USFDA) announced that food manufacturers could now carry a qualified health claim on foods that contained omega-3 EFAs that linked omega-3 consumption with reduced risk of coronary heart disease. The market players are constantly innovating new products with nutritional benefits and convenience, which is why the market is growing. Furthermore, extensive R&D activities and the advent of new monitoring technologies are expected to drive the market for superfoods in this developed region. For instance, in September 2021, Del Monte launched new Riced Veggies under its Veggieful brand. The Riced Veggies are ready-to-cook and are available in five different variations. Each bag of Veggieful Riced Veggies contains over three servings of vegetables per bag, 5 to 10 grams of carbs, and 50-80% fewer calories than prepared white rice.

Superfood Industry Overview

The superfoods market is highly competitive, with various regional and small players. These companies have collaboration and partnerships mostly in the form of co-operatives with farmers worldwide, which has made the process of sourcing and procuring ingredients easier, thus, boosting the growth of the superfoods market. There is a wide range of private-label brands, particularly the supermarket/hypermarkets chains in developed markets and traditional grocery stores/convenience stores/specialty retail stores/health stores in developing economies. Some of the prominent companies in the superfoods market include Sunfood, Supernutrients, Nestle, Nature's Superfoods LLP, OMG Superfoods, Aduna Ltd, and Navitas Natural.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fruits

- 5.1.2 Vegetables

- 5.1.3 Grains and Seeds

- 5.1.4 Herbs and Roots

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/ Hypermarkets

- 5.2.2 Online Channels

- 5.2.3 Traditional Grocery Stores

- 5.2.4 Convenience Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Sunfood

- 6.3.2 Nature's Superfoods LLP

- 6.3.3 OMG! Organic Meets Good

- 6.3.4 Suncore Foods Inc.

- 6.3.5 Superlife Co. Pte Ltd

- 6.3.6 Raw Nutrition

- 6.3.7 Barleans

- 6.3.8 Aduna Ltd

- 6.3.9 Del Monte

- 6.3.10 Impact Foods International Ltd

- 6.3.11 Naturya Bath

- 6.3.12 Anthony's Goods

- 6.3.13 Mannatech Incorporated

7 MARKET OPPORTUNITIES AND FUTURE TRENDS