PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404388

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404388

Medical Marijuana - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

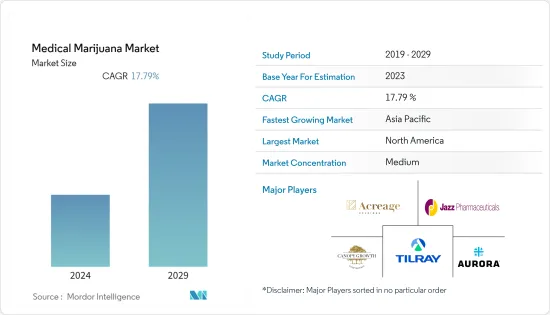

The medical marijuana market is expected to register a CAGR of 17.79% during the forecast period.

The COVID-19 pandemic has had an immense impact on the market as there is a dilemma regarding the effect of Cannabis on patients with coronavirus. Researchers are claiming that Cannabis has an impact on COVID-19 patients. For instance, according to a press release in January 2022, studies conducted in the United States claim that Cannabis is the key to Covid prevention, as the plant contains compounds that can stop the virus from entering human cells. Additionally, according to an article published by Fortune Journal in February 2022, medical marijuana, a mixture of THC 20% and CBD 4%, administered at a daily dose of 15 mg/kg, proved an optimal protocol for attenuating post-COVID-19 physical and mental sequelae without evoking adverse effects. Such studies depict the increased therapeutic application of medical marijuana in therapies and treatments later post-pandemic. For instance, according to an article published by the government of Canada in March 2023, there were slight shifts towards a higher frequency of medical cannabis use after the onset of the COVID-19 pandemic. Daily medical cannabis use increased by 7% points, from 83.2% pre-pandemic to 90.3% after Wave 2. Thus, due to the surge in medical cannabis use, the demand is also expected to increase in the post pandemic phase, ultimately leading to market growth over the forecast period.

The major factors driving the medical marijuana market include the increasing number of countries legalizing the use of medical marijuana, the trend of producing edible products with Cannabis, and favorable reimbursement environment and government support in selected countries. For instance, according to a United Nations press release in June 2022, Cannabis legalization has accelerated daily use and related health impacts. It also stated that there is a rise in the manufacturing of cocaine and the expansion of synthetic drugs to new markets.

Furthermore, government initiatives are boosting the growth of Cannabis for medical use. For instance, in January 2022, the Delhi High Court stated that the use of Cannabis is not completely banned in India, and its medical and scientific use is allowed under the law.

Moreover, the adoption of key strategies such as partnerships and acquisitions has been improving the potential of marijuana in medical applications, which is expected to augment the market growth during the study period. For instance, in February 2022, the Agro-based enterprise Bombay Hemp Company partnered with Poonthottam Ayurvedasram to meet the ancient ayurvedic potential of Cannabis with human reason. The collaborative venture is called 'AyurCann: Ayurvedic Cannabis Therapies' and is Asia's first Ayurvedic Cannabis Wellness Retreat.

Thus, owing to the factors above, the market studied is anticipated to grow over the analysis period. However, a lack of awareness about the dosage and medicinal properties of marijuana and social stigma related to cannabis use are expected to restrain the market's growth.

Medical Marijuana Market Trends

The Chronic Pain Segment is Expected to Experience the Fast Growth Over the Forecast Period

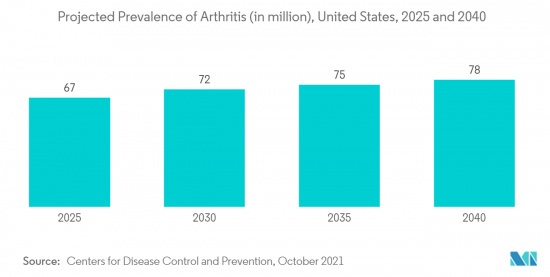

Chronic pain is long-standing pain that persists beyond the usual recovery period or occurs with a chronic health condition, such as arthritis. Many studies have shown that medical cannabis is found to be an effective method for the treatment of chronic pain and that it is far safer than many other options. It is an affordable, natural alternative that lacks side effects and is traditionally used to treat chronic pain. There are also several ongoing kinds of research on medical marijuana for the treatment of chronic pain, which is expected to impact the market's growth directly. For instance, according to an article published by the CDC in April 2023, an estimated 20.9% of U.S. adults (51.6 million persons) experienced chronic pain, and 6.9% (17.1 million persons) experienced high-impact chronic pain (i.e., chronic pain that results in a substantial restriction to daily activities) with a higher prevalence among non-Hispanic American Indian or Alaska Native adults. Thus, with an increase in chronic pain, the demand for medical marijuana increases, leading to market growth.

Furthermore, according to a study published by the Journal of the American Medical Association in January 2023, about a third of Americans have used medical marijuana to deal with chronic pain. The study stated that 31% of respondents reported using medical marijuana to relieve chronic pain at some point. Hence, such a rise in the use of medical marijuana for chronic pain is expected to drive market growth.

Additionally, the rise in research and development studies is a key factor promoting the growth of the studied market. For instance, in April 2022, a minimal medical cannabis trial dubbed Canpain, focusing on chronic pain, was launched to understand the medical efficacy of cannabinoids better. Campaign is one of the first government-backed trials which could also lead to patients finally being prescribed medical cannabis via the National Health Service (or NHS).

Thus, due to the above-mentioned factors, the studied segment is expected to contribute to the significant growth of the market.

North America Accounted for the Significant Share in the Global Market Over the Forecast Period

North America holds a significant share of the medical marijuana market and is expected to show a similar trend over the forecast period without significant fluctuations. The surging pace of cannabis legalization in North America is one of the key factors contributing to its increased demand. For instance, in April 2022, the United States House of Representatives passed legislation that would legalize marijuana nationwide, eliminating criminal penalties for anyone who manufactures, distributes, or possesses the substance.

Moreover, in April 2022, Metrc, the provider of cannabis regulatory systems in the United States, signed a new contract with Mississippi to support regulating its medical cannabis market. Metrc will help facilitate Mississippi's medical cannabis program's data collection and regulatory oversight through its robust track-and-trace platform, which is essential in creating a safe and secure marketplace for patients and providers.

Furthermore, according to an article published by WUFT, in December 2022, cannabis sales increased to USD 30 billion in 2021, 40% higher than the previous year. The United States will make up 75% of global cannabis sales in 2026. Hence, with the increased demand for medical marijuana, the region's market is expected to grow.

Thus, due to the abovementioned factors, the studied market will augment in the North American region during the study period.

Medical Marijuana Industry Overview

The medical marijuana market is moderately concentrated in nature due to the presence of companies operating globally as well as regionally. The competitive landscape includes an analysis of companies, including Canopy Growth Formation, Acreage Holdings, Aurora Cannabis, Tilray Brands, Inc., and Jazz Pharmaceuticals Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Countries Legalizing the Use of Medical Marijuana

- 4.2.2 Trend of Producing Edible Products with Cannabis

- 4.2.3 Favorable Reimbursement Environment and Government Support in Certain Countries

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness about the Dosage and Medicinal Properties of Marijuana

- 4.3.2 Social Stigma Related to Cannabis Use

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD)

- 5.1 By Formulation Type

- 5.1.1 Capsules

- 5.1.2 Oils

- 5.1.3 Other Formulation Types (Drops, Gel)

- 5.2 By Application

- 5.2.1 Chronic Pain

- 5.2.2 Arthritis

- 5.2.3 Migraine

- 5.2.4 Cancer

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 MiddlecEast and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lexaria Bioscience Corp.

- 6.1.2 Canopy Growth Corporation

- 6.1.3 Aurora Cannabis

- 6.1.4 Acreage Holdings

- 6.1.5 Cara Therapeutics Inc.

- 6.1.6 Jazz Pharmaceuticals Inc.

- 6.1.7 LivWell Enlightened Health LLC (PharmaCann Inc.)

- 6.1.8 Tilray Brands, Inc.

- 6.1.9 Medical Marijuana Inc.

- 6.1.10 Arcadia Biosciences

- 6.1.11 Tikun Olam

- 6.1.12 Babylon Sciences SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS