Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273424

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273424

Paraffin Market - Growth, Trends, and Forecasts (2023 - 2028)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The paraffin market is projected to register a CAGR of over 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. According to Organisation Internationale des Constructeurs d'Automobiles (OICA), about 90.42 million vehicles were sold globally in 2019 and reached about 77.97 million in 2020, with a decline rate of 13.8%. However, the use of paper packaging based on paraffin has increased for food and e-commerce uses, which has increased the demand for paraffin post-pandemic.

- Over the short term, increasing demand for candles and packaging and the growing personal care industry in Asia-Pacific is driving the market growth. Continuous growth in online beauty spending, expanding use of social networks, increasing consumer interest in new and premium products, accelerating urbanization, and the growth of the upper-middle-class population are the major factors driving the paraffin market in the personal care industry in the Asia-Pacific region.

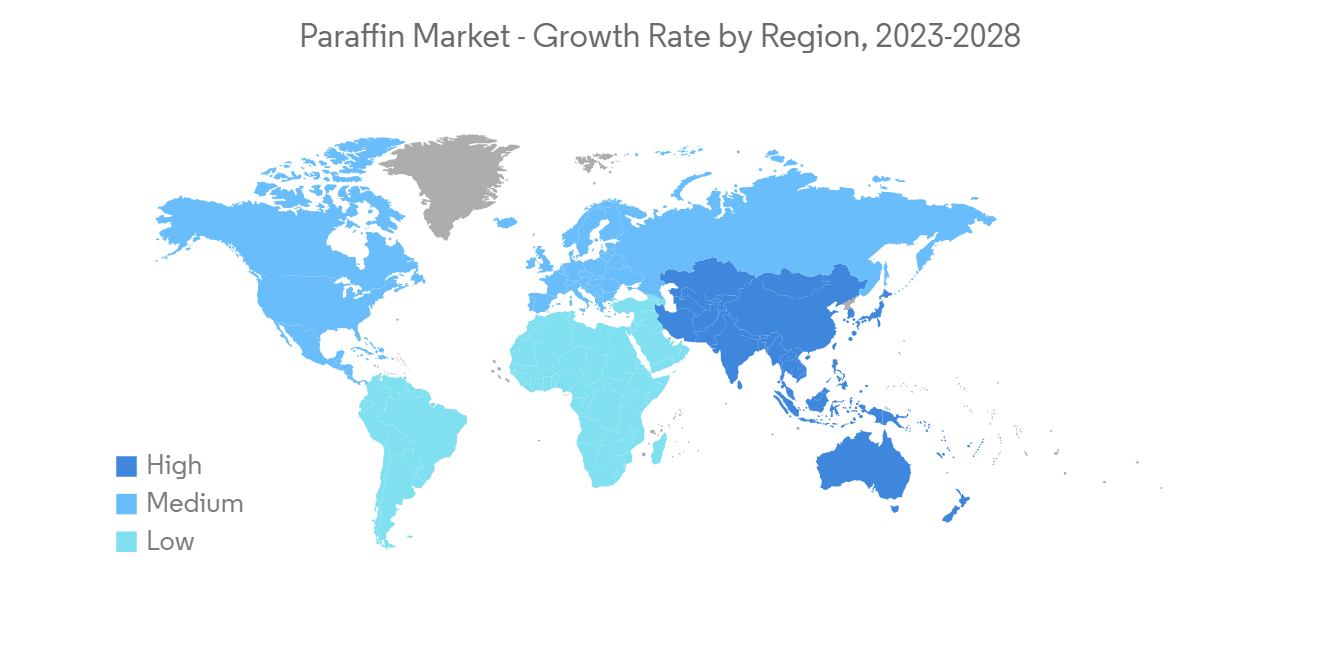

- The development of bio-based products is hindering the market's growth. Increasing investment casting will likely create market opportunities in the coming years. Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Paraffin Market Trends

Increasing Demand for the Paperboard and Packaging Application

- Paraffin wax finds applications in flexible packaging as paraffin and paraffin blends provide moisture and grease barriers along with gloss and freshness seals. The key benefits of using the product include its ability to provide a gas and odor barrier (preventing loss of flavor or contamination), improved process efficiency, and water and water vapor resistance. Besides, a product derived from petroleum is highly cost-effective and possesses low viscosity. It also needs relatively low-cost machinery for the application at high speeds.

- Due to the need for stability during storage and transportation and aesthetic considerations, a significant share of industrial products is offered in packaging. Crown corks, lug caps, plastic film laminates, craft paper, paper board, and packaging machinery are among India's top exports, along with flattened cans, printed sheets, and components. The fastest-growing packaging categories in India include laminates and flexible packaging, particularly PET and woven sacks.

- India's paper and paperboard packaging market was valued at USD 10.77 billion in 2021 and is expected to reach around USD 15.69 billion by 2027. The export of packaging materials from India grew at a compound annual growth rate (CAGR) of 9.9% to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. The United States remains the major export destination for the packaging industry, followed by the United Kingdom, the UAE, the Netherlands, and Germany.

- The improvement in living standards and higher purchasing incomes, especially in eastern European and North American countries, has increased the demand for a broad range of products, all of which require packaging. Therefore, the demand for packaging is increasing, resulting in the increased consumption of paraffin.

- Most of the demand from the packaging segment is from the food and beverage industry. On the other hand, healthcare products are the largest users of folding cartons. The aforementioned end-user segments will likely boost the demand for paraffin during the forecast period.

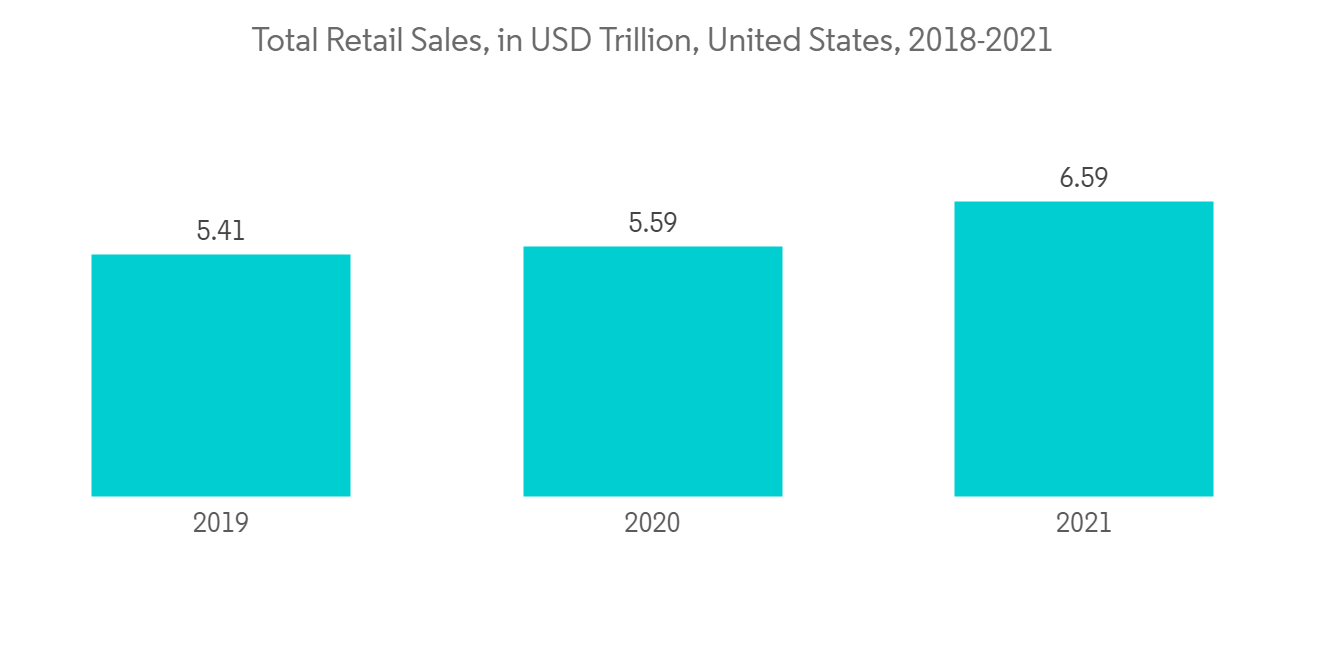

- Furthermore, North America is one of the largest consumers of paperboard and packaging. According to Packaging Machinery Manufacturers Institute's (PMMI) Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Additionally, according to the National Retail Federation (NRF), retail sales grew by 7% in 2020 and over 14% in 2021. By the end of 2021, total retail sales reached approximately USD 6.6 trillion in the United States.

- Due to all these factors, the paraffin market will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global paraffin market as the demand for paraffin-based products, like candles, paperboard, packaging, and cosmetics, is increasing with an increasing focus on personal care and quality of life.

- In 2021, the Asia-Pacific region accounted for the largest demand for lubricants. In 2021, around 26.08 million vehicles were sold in China compared to 25.22 million in 2020, witnessing an increasing growth rate of about 3%. This led to increased demand for fuel and lubricants, positively affecting the market demand for paraffin.

- The Chinese beauty and personal care industry was valued at USD 51 billion in 2021 and is estimated to reach USD 72.9 billion by 2027. Personal care products held the largest portion of this revenue (over USD 24 billion), followed by skin care products (USD 14 billion).

- According to the Packaging Industry Association of India (PIAI), the sector is growing rapidly at about 22-25% per annum. The Indian packaging industry has made a mark with its exports and imports, thus, driving technology and innovation growth and adding value to various manufacturing sectors. During the forecast period, growth in the packaging industry is expected to drive the paraffin market in India.

- South Korea has one of the world's most exceptional beauty markets. New beauty trends and innovations featuring sophisticated ingredients and aesthetically appealing packaging are constantly displayed. The South Korean beauty and personal care products market was valued at USD 11.9 billion in 2021, and it is expected to reach USD 13.9 million by 2027, which is likely to enhance the market demand.

- Therefore, all the above factors are expected to boost the paraffin market during the forecast period.

Paraffin Industry Overview

The global paraffin market is fragmented in nature. The major companies include Sasol, Exxon Mobil Corporation, Lanxess, Eneos Corporation, and China Petroleum & Chemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 64764

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Candles and Packaging

- 4.1.2 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Development of Bio-based Products

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Paraffin Wax

- 5.1.2 Liquid Paraffin

- 5.1.3 Kerosene

- 5.1.4 Petroleum Jelly

- 5.2 By Application

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Paperboard and Packaging

- 5.2.3 Fuel

- 5.2.4 Rubber

- 5.2.5 Lubricants

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aromachimie Ltd

- 6.4.2 Calumet Specialty Products Partners LP

- 6.4.3 Cepsa

- 6.4.4 China National Petroleum Corporation

- 6.4.5 China Petroleum & Chemical Corporation

- 6.4.6 ENEOS Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 H&R GROUP

- 6.4.9 HollyFrontier Refining & Marketing LLC

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 Kemipex

- 6.4.12 LANXESS

- 6.4.13 NIPPON SEIRO CO. LTD

- 6.4.14 PersiaParaffin

- 6.4.15 Petrobras

- 6.4.16 Repsol

- 6.4.17 Sasol

- 6.4.18 The International Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Investment Casting

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.