PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438272

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438272

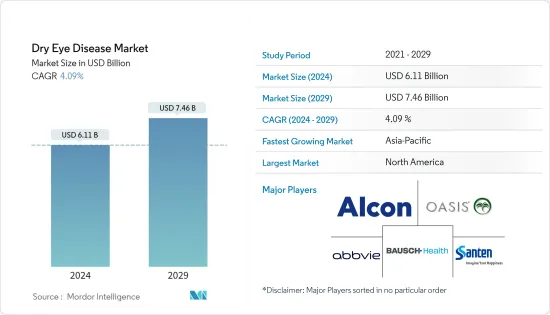

Dry Eye Disease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Dry Eye Disease Market size is estimated at USD 6.11 billion in 2024, and is expected to reach USD 7.46 billion by 2029, growing at a CAGR of 4.09% during the forecast period (2024-2029).

The impact of COVID-19 on the dry eye market was adverse in the initial phases owing to the cancellations in elective procedures including diagnosis and eye treatments along with supply chain disruptions of medications worldwide. During the lockdown, people's screen time (irrespective of their age) increased significantly, which had a severe impact, and an increase in ophthalmic disorders was observed. For instance, a research study published in December 2021 stated that both dry eye disease (DED) patients and healthy participants up to the age of 60 experienced worsening dry-eye symptoms during the COVID-19 lockout due to increased visual display terminal (VDT) period. The study also reported that younger persons had more severe dry-eye problems than older respondents, particularly during the lockdown. Therefore, the market gained traction as the restrictions were lifted. Since the pandemic led to an increase in dry eye disease cases globally. Hence, it is expected to propel the market growth during the forecast period.

Several factors, such as aging, decreasing supportive hormones, systemic inflammatory diseases, ocular surface diseases, or surgeries that affect the cholinergic nerves, which stimulate tear secretion, may be associated with the rising prevalence of dry eye-related diseases. For instance, an article published in Frontiers in Medicine Journal stated that among people who require eye care, DED has become the fifth most prevalent ocular condition in women and ninth most prevalent in men in the United States in 2021. Additionally, an article published in the Journal of the British College of Ophthalmic Opticians stated that the global prevalence of dry eye disease was estimated at 11.59% in 2021. Thus, the burden of DED is anticipated to drive the studied market growth in the country.

Furthermore, a research study published in BMC in Opthalmology Journal in May 2021, conducted a survey by 452 participants in Dubai, out of which 63.7% were females. The prevalence of dry eyes in Dubai was estimated to be 62.6% in the surveyed population, with 42% having severely dry eyes. A significant percentage of the global population suffers from dry eye disease. The disease is particularly more common among women than in men. This factor is responsible for propelling the market growth in the analysis period.

The strategic initiatives adopted by the key market players such as product launches, approvals, partnerships is also driving growth. For instance, in November 2021, I-MED Pharma USA launched I-DROP MGD, preservative-free, viscoadaptive eye drop containing a lipid designed to enhance and stabilize all three layers of the tear film to treat dry eye. Such developments are estimated to augment the market growth during the forecast period.

However, the high cost of specialty dry eye products with complex reimbursement scenarios and the availability of alternative therapies are likely to impede the market's growth over the forecast period.

Dry Eye Disease Market Trends

The Corticosteroid Drugs Segment is Expected to Hold a Major Market Share Over the Forecast Period

The Corticosteroids drug segment is expected to hold a significant market share owing to its huge demand for treating dry eye diseases, advantages, and rising product launches and approvals.

According to a research study published in Clinical Opthalmology Journal in February 2021, the mean age of the patients surveyed was 57.8 years, and the tear MMP-9 positivity was 73.0%. The patients were kept on topical corticosteroids treatment for one month which showed significant improvement of symptoms and signs in the patients, an improvement of up to 90.6%. This indicates the high prevalence of dry eye disease in the elderly population. Given the advantages of corticosteroids like anti-inflammatory benefits and providing symptom relief with short-term use, the segment is estimated to propel during the forecast period.

It has also been found that the elderly population is expected to grow in the coming years. This population group is more prone to eye-related disorders, which will ultimately drive the market in the future. Rising product approvals and new product launches are other factors anticipated to propel the demand for corticosteroids. For instance, in February 2021, the US FDA approved an abbreviated new drug application (ANDA) submitted by Akorn Operating Company LLC for loteprednol etabonate ophthalmic gel 0.5%, which is indicated for the treatment of post-operative inflammation and pain following ocular surgery.

Overall, this segment has the greatest share of anti-inflammatory medications in the market studied, and it is predicted to exhibit stable growth during the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a major share of the dry eye disease market owing to the high prevalence of dry eye diseases and the easy availability of solutions in the region.

There are people of various ages found living in this multi-screen world. Computer or digital screen use may cause less blinking, which may contribute to symptoms of dry eye disease (DED), thereby, increasing the demand for better and more effective therapeutics against DED which is expected to fuel growth in the studied market in the North American region. For instance, an article published in Cureus Journal in July 2022 stated that the prevalence of DED has been estimated at 21% in Canada. Women who used eye cosmetics were substantially more likely to have DED than the general population, which suggests that using eye cosmetics is one of the risk factors for developing DED. The high prevalence of the disease is estimated to boost market growth in the region during the forecast period.

Additionally, drug launches are one of the key factors boosting the market's growth in the region. For instance, in January 2021, Kala Pharmaceuticals Inc. launched EYSUVIS (loteprednol etabonate ophthalmic suspension) 0.25% for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease. EYSUVIS is now available in national and regional United States pharmaceutical distribution centers. Patients with a prescription can access EYSUVIS through their local retail pharmacies or home delivery.

Furthermore, in January 2022, Sun Pharma Canada Inc, a subsidiary of the Mumbai-based company Sun Pharmaceutical Industries Limited launched Cequa (cyclosporine ophthalmic solution 0.09 percent w/v), a calcineurin inhibitor immunomodulator. All these novel product launches may give the country a cutting edge in the market. Thus, due to the above-mentioned factors, the North American market for dye eye disease is expected to occupy a major share in the studied market and grow over the forecast period.

Dry Eye Disease Industry Overview

The dry eye disease market is fragmented in nature due to the presence of many companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known. Some major players are AbbVie Inc. (Allergan PLC), AFT Pharmaceuticals, Akorn, Alcon Inc., Bausch Health Companies Inc., Horus Pharma, Johnson & Johnson, Mitotech, Novaliq GmbH, OASIS Medical, Otsuka Pharmaceutical Co. Ltd, Prestige Consumer Healthcare, Santen Pharmaceutical Co. Ltd, Sentiss Pharma Pvt. Ltd, Sun Pharmaceutical Industries Ltd, and VISUfarma.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Dry Eye Disease

- 4.2.2 Technological Advancements and Emergence of Novel Diagnostic Tools

- 4.3 Market Restraints

- 4.3.1 High Cost of Specialty Dry Eye Products with Complex Reimbursement Scenario

- 4.3.2 Availability of Alternative Therapies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Artificial Tears

- 5.1.2 Anti-inflammatory Drugs

- 5.1.2.1 Cyclosporine

- 5.1.2.2 Corticosteroid

- 5.1.2.3 Other Anti-inflammatory Drugs

- 5.1.3 Punctal Plugs

- 5.1.4 Secretagogues

- 5.1.5 Other Products

- 5.2 By Distribution Channel

- 5.2.1 Hospital Pharmacies

- 5.2.2 Independent Pharmacies and Drug Stores

- 5.2.3 Online Pharmacies

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AbbVie Inc. (Allergan PLC)

- 6.1.2 AFT Pharmaceuticals

- 6.1.3 Akorn

- 6.1.4 Alcon Inc.

- 6.1.5 Bausch Health Companies Inc.

- 6.1.6 Horus Pharma

- 6.1.7 Johnson & Johnson

- 6.1.8 Mitotech

- 6.1.9 Novaliq GmbH

- 6.1.10 OASIS Medical

- 6.1.11 Otsuka Pharmaceutical Co. Ltd

- 6.1.12 Prestige Consumer Healthcare

- 6.1.13 Santen Pharmaceutical Co. Ltd

- 6.1.14 Sentiss Pharma Pvt. Ltd

- 6.1.15 Sun Pharmaceutical Industries Ltd

- 6.1.16 VISUfarma

7 MARKET OPPORTUNITIES AND FUTURE TRENDS