PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444339

Germany Beauty and Personal Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

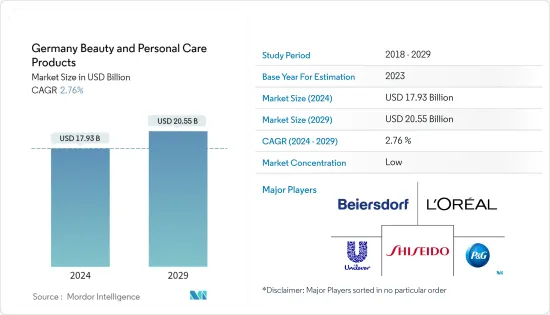

The Germany Beauty and Personal Care Products Market size is estimated at USD 17.93 billion in 2024, and is expected to reach USD 20.55 billion by 2029, growing at a CAGR of 2.76% during the forecast period (2024-2029).

The high relative costs of hair treatments and a shortage of time stifle German people. They are more interested in products that style hair quickly and efficiently, saving time and money on salon visits, making Germany Europe's largest market for hair care products. In addition, a growing number of people have gained awareness about the benefits of natural and organic products, the effects of harmful chemicals in the existent ones, and the ability to take care of hair in the house itself, resulting in a decline in salon visits. Demand for child sun care products is expected to increase in Germany as consumers are taking extra care to protect the delicate skin of babies and kids against extended exposure to sun rays. Among adults, sun care products' demand depends heavily on weather conditions. However, many consumers took a more holistic approach to sun care, paying more attention to UV levels and their possible impact on skin health and aging. The German cosmetics and toiletries market is mainly driven by women and younger consumers willing to spend more money on such offerings. Hair, skin, and face care products are the two categories with the highest turnover.

Germany is the largest cosmetic market in Europe, followed by France and the United Kingdom. Drug stores are observed to be the largest distribution channel in the beauty and personal care industry in Germany, owing to their convenient location and wide selection of mass-market beauty brands.

Germany Beauty & Personal Care Products Market Trends

Growing Influence of Social Media on the Market

The emergence of evolving technologies, such as smartphones, personal computers, the internet, e-commerce, social media, communication strategies, and marketing campaigns have changed the landscape of the German beauty and personal care products market. Additionally, the internet penetration in Germany in 2022 was 94%. Hence, with the increased internet penetration, social media usage has grown proportionally; the players are operating in the market have been using influencer marketing to influence customers and encourage advertisers and practitioners to shift their brand conversations in the digital space. Social media posts can reach many potential customers across the country and generate buzz, particularly in the beauty and personal care industry.

Leading brands such as L'Oreal, Unilever, and Estee Lauder, among others, have been turning to Facebook, Instagram, and YouTube to promote product launches and engage their consumers with tutorials and promotional campaigns. Consumers are more likely to discover new brands or products via advertisements and updates on brands' social media pages on platforms including Facebook and Twitter. Furthermore, beauty and personal care product consumers tend to consider product reviews and other consumers' opinions in the form of recommendations, comments on social media, posts from expert bloggers, or celebrity endorsements before making their purchase decision. Thus, the growing influence of social media coupled with digital technological advancements has further augmented the market's growth over the review period.

Rising Demand of Oral Care Products

Key players in the Germany oral care market are highly indulged in partnerships with several dental associations, by launching oral care centers and campaigns to create awareness and promote their oral care products. Moreover, these dental associations approve various oral care brands as safe and effective to use. This has also encouraged the customers to invest in mouthwashes and other oral care products, supported by rise in per capita spending for oral hygiene products. GlaxoSmithKline and Procter & Gamble continued to lead the German toothpaste market, as they contain a portfolio of well-known and trusted brands. These companies have gained share, partly with the introduction of a new Sensodyne whitening toothpaste, which is also suitable for those with sensitive teeth. Key players are leveraging online platforms optimally, by selling their products through their own websites, as well as by listing the products in the popular e-retailing websites, in order to improve their brand visibility and reachability of products.

Germany Beauty & Personal Care Products Industry Overview

Leading players in the market enjoy a dominant presence worldwide. Brand loyalty among consumers gives these companies an upper edge. The leading players, including L'Oreal Group, Unilever, Procter & Gamble, Beiersdorf AG, Shiseido Company, Revlon, The Estee Lauder Companies Inc., Riverderm AG, Skinceuticals Inc., Natura & Co.among others, hold the majority of the share. The major companies in the market follow the expansion and new launches as the primary strategy for improving their regional footprints. The companies aim to increase production capacities to cater to the ever-increasing demand for cosmetics and personal care products. Key players have intensely embarked on industry consolidation by leveraging their distribution network, and entering into partnerships with local distributors, especially in emerging economies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Personal Care Products

- 5.1.1.1 Hair Care Products

- 5.1.1.1.1 Shampoo

- 5.1.1.1.2 Conditioners

- 5.1.1.1.3 Other Hair Care Products

- 5.1.1.2 Skin Care Products

- 5.1.1.2.1 Facial Care Products

- 5.1.1.2.2 Body Care Products

- 5.1.1.2.3 Lip Care Products

- 5.1.1.2.4 Bath and Shower Productrs

- 5.1.1.3 Oral Care

- 5.1.1.3.1 Toothbrushes

- 5.1.1.3.2 Toothpaste

- 5.1.1.3.3 Mouthwashes and Rinses

- 5.1.1.3.4 Other Oral Care Products

- 5.1.1.4 Deodrants and Antiperspirants

- 5.1.2 Cosmetics/Make-up Products

- 5.1.2.1 Facial Cosmetics

- 5.1.2.2 Eye Cosmetic Products

- 5.1.2.3 Lip and Nail Make-up Products

- 5.1.2.4 Hair styling and colouring products

- 5.1.1 Personal Care Products

- 5.2 Category

- 5.2.1 Mass Products

- 5.2.2 Premium Products

- 5.3 Distribution Channel

- 5.3.1 Specialist Retail Stores

- 5.3.2 Supermarkets/Hypermarkets

- 5.3.3 Convenience Stores

- 5.3.4 Pharmacies/Drug Stores

- 5.3.5 Online Retail Channels

- 5.3.6 Other Distribution Channel

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 L'Oreal S.A.

- 6.3.2 The Procter & Gamble Company

- 6.3.3 Beiersdorf AG

- 6.3.4 Unilever PLC

- 6.3.5 The Estee Lauder Companies Inc.

- 6.3.6 Shiseido Company,Ltd.

- 6.3.7 Skinceuticals Inc

- 6.3.8 Natura & Co.

- 6.3.9 Merck & Co., Inc.

- 6.3.10 Riverderm AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS