PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331293

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331293

Italy Beauty And Personal Care Products Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Italy Beauty and Personal Care Products Market size is expected to grow from USD 10.42 billion in 2023 to USD 12.10 billion by 2028, at a CAGR of 3.04% during the forecast period (2023-2028).

The increasing number of dental problems among children and adults due to poor eating habits and the rise in popularity of herbal oral care products drive the oral care products market in Italy. Moreover, the rising premiumization and consumers' need for more targeted solutions are accelerating the market's growth. For instance, in April 2022, Crest Pro-Health launched a new toothpaste called "Crest Densify." The product claims to rebuild tooth density and remineralize enamel for stronger teeth. The rise in oral health consciousness helped vendors introduce oral hygiene product categories, such as teeth-whitening products. The improving quality of life, the positive effects of beauty and personal care on self-esteem and social interaction, and the gradual consumer shift toward premium and luxury cosmetic brands are a few factors that are likely to propel the market over the longer term.

Furthermore, the consumers in the region are very attracted to cosmetics and beauty products. The demand for organic face creams and cosmetics has increased in the past few years owing to skin sensitivity issues and environmental changes in the region. The number of young people in the region drives the cosmetics market. Market players are establishing innovative technologies for finding customized beauty products for consumers. For instance, in September 2022, Marionnaud Italy and Revive, a beauty-technology company, launched an AI-powered skincare advisor. It is a digital tool that aims to facilitate the choice of more suitable products for consumers and also educate them about sun protection.

Italy Beauty & Personal Care Products Market Trends

Rising Demand for Natural/Organic Personal Care Products

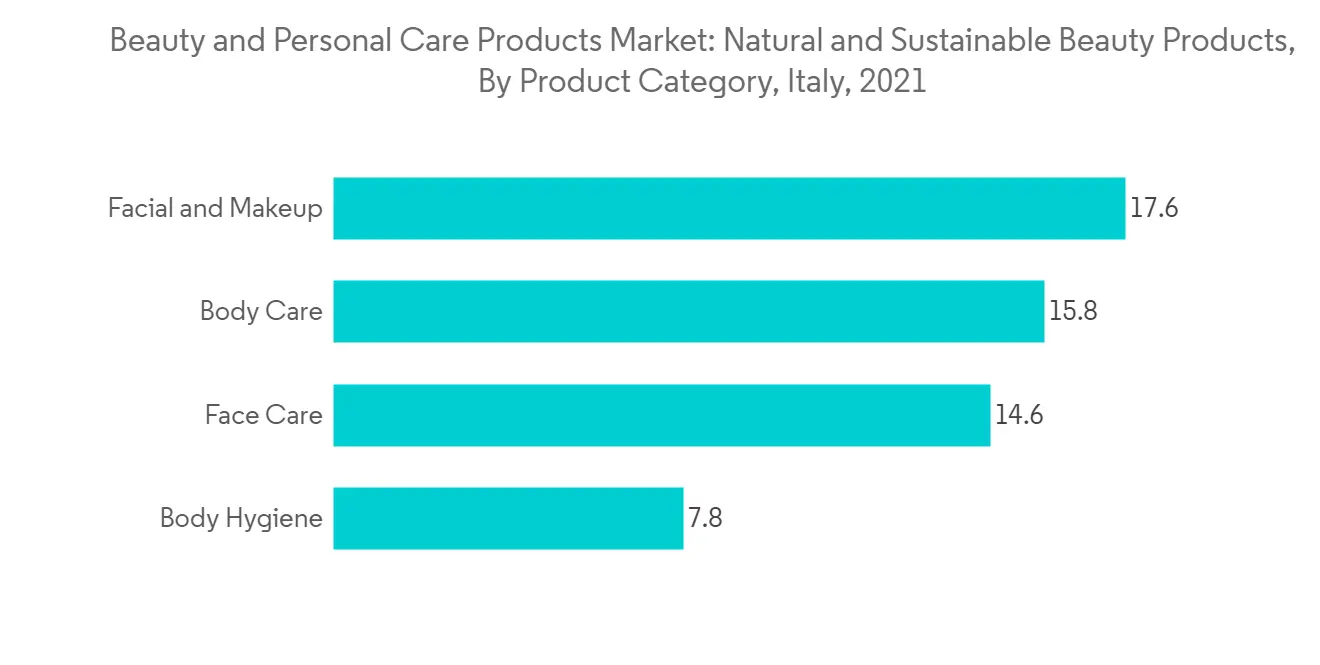

Owing to increased public concern regarding the adverse effects of synthetic chemicals, such as paraben and aluminum compounds used in skincare, haircare, and deodorants, the country has seen an increase in the demand for natural and organic products. Because of its natural formulation, a high number of consumers choose one brand over another. In recent years, there has been a rise in the market for clean, natural, and organic deodorant products. Purchases made are dependent on performance, which provides long-lasting protection as well as clinical properties. The market's appetite for natural ingredients has been very clear, and as a result, several businesses have launched products containing nature-inspired ingredients, such as plant-inspired and luxury botanical ingredients combined with multi-functional properties. For instance, in June 2022, a new beauty brand called TiL and renowned perfumer Francis Kurkdjian will launch a perfume inspired by the Linden tree. The name of the perfume is "Eau-De-Toilette L'Eau-Qui-Enlace."

Pharmacy/Health Stores Hold a Prominent Share of the Market

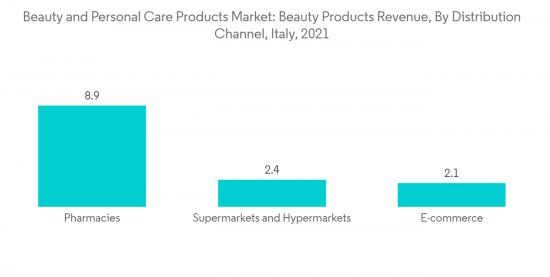

In many countries, cosmetics and personal care products are sold primarily through a pharmacy. For instance, in Italy, the majority of personal care and cosmetic products, including hair care goods, are sold through pharmacies and specialty stores. An increased presence of natural and organic products in pharmacies and drug stores was observed, resulting in buyers becoming more curious about such labels as they discovered their benefits and therefore more open to trying these products out. There are varieties of options available with more key features for beauty and personal care products in pharmacies, which has made them a more prominent channel for sales of these products in Italy. Some anti-aging creams, soaps, talcum powders, and other hygiene products are only available in pharmacies and specialty stores, which is why they are sold only in those distribution channels. For instance, Tosla Nutricosmetics, an Italy-based nutricosmetic company, provides collagen-based cosmetics in Italy.

Italy Beauty & Personal Care Products Industry Overview

The beauty and personal care market in Italy is a highly competitive market owing to the presence of numerous regional and private label players as well as global giants. Key players in the country are Unilever PLC, Amway Corp., and Johnson & Johnson Inc., among others. The consumers in the country are inclined towards organic products for their everyday purposes; thus, following the consumer demand, the players are actively participating in the launch of purely organic products as well as acquiring small players so as to consolidate their position in the market. Furthermore, the country's Omni-channel distribution channels benefit manufacturers by expanding their consumer base to the greatest extent possible.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Category

- 5.1.1 Premium Products

- 5.1.2 Mass Products

- 5.2 Type

- 5.2.1 Personal Care

- 5.2.1.1 Hair Care

- 5.2.1.1.1 Shampoo

- 5.2.1.1.2 Conditioners

- 5.2.1.1.3 Hair styling and colouring products

- 5.2.1.1.4 Other Hair Care Products

- 5.2.1.2 Skin Care

- 5.2.1.2.1 Facial Care Products

- 5.2.1.2.2 Body Care Products

- 5.2.1.2.3 Lip Care Products

- 5.2.1.3 Bath and Shower

- 5.2.1.3.1 Shower Gel

- 5.2.1.3.2 Soaps

- 5.2.1.3.3 Other Bath and Shower Products

- 5.2.1.4 Oral Care

- 5.2.1.4.1 Toothbrushes

- 5.2.1.4.2 Toothpaste

- 5.2.1.4.3 Mouthwashes and Rinses

- 5.2.1.4.4 Other Oral Care Products

- 5.2.1.5 Men's Grooming Products

- 5.2.1.6 Deodrants and Antiperspirants

- 5.2.2 Beauty & Make-up / Cosmetics

- 5.2.2.1 Facial Cosmetics

- 5.2.2.2 Eye Cosmetics

- 5.2.2.3 Lip and Nail Make-up Products

- 5.2.1 Personal Care

- 5.3 Distribution Channel

- 5.3.1 Hypermarkets/Supermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Specialist Retail Stores

- 5.3.4 Online Retail Stores

- 5.3.5 Pharmacies/Drug Stores

- 5.3.6 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Amway Corp.

- 6.3.2 Unilever PLC

- 6.3.3 Procter & Gamble Co

- 6.3.4 Estee Lauder Companies

- 6.3.5 Beiersdorf AG

- 6.3.6 The Avon Company

- 6.3.7 Johnson & Johnson Inc.

- 6.3.8 L'Oreal S.A.

- 6.3.9 Colgate-Palmolive Company Limited

- 6.3.10 Cosmesi Italia S.N.C

7 MARKET OPPORTUNITIES AND FUTURE TRENDS