Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444381

Africa Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 105 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

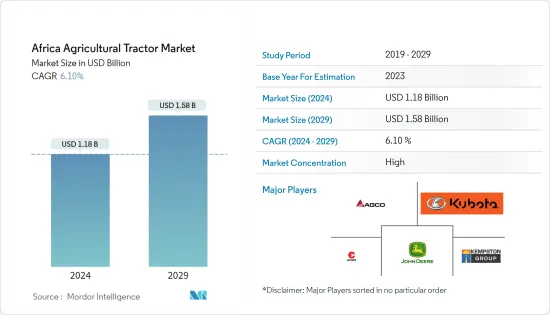

The Africa Agricultural Tractor Market size is estimated at USD 1.18 billion in 2024, and is expected to reach USD 1.58 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

Key Highlights

- Agriculture is critical to Africa's economic development, but it needs to function below its potential. Smallholder farmers make up more than 60% of the population in sub-Saharan Africa, and agriculture accounts for around 23% of the region's GDP. At the same time, the population is increasing on a large scale. As a result, there is an urgent need to raise crop yields in the coming decades to keep up with food demand in Africa. Therefore, mechanization in agriculture closes the yield gap by lowering harvest and post-harvest losses.

- As per the research survey conducted by the Agri Evolution Alliance, Africa holds great market potential for agricultural tractors. The increasing government support to develop the agricultural sector is expected to drive this sector.

- For instance, the Ghana government provides subsidized tractors to entrepreneurs who run 89 centers that rent out and service tractors. In major parts of Africa, tractor sales were affected due to uncertainty regarding crop yields and exchange rates. Additionally, issues with respect to land restitution and farmworkers' farm shares added to the farmers' uncertain conditions. Therefore, considering these factors, the market can witness growth in the coming years.

Africa Agricultural Tractor Market Trends

Increasing Focus on Sustainable Agricultural Mechanization

- Agriculture plays a crucial role in the economic development of Africa. Despite Africa having the highest area of uncultivated arable land in the world, its productivity needs to catch up to other developing regions. Moreover, crop yields are only reaching 56% of the international average. Thus, there is a dire need to increase crop yields in the coming decades to keep pace with the food demand driven by population growth and rapid urbanization in Africa. Therefore, mechanization through tractors can, directly and indirectly, bridge the yield gap.

- Additionally, this region's tractor sales have witnessed a growing trend in the past few years. For instance, according to the South African Agricultural Machinery Association (SAAMA), in 2022, 5,705 units of tractors were sold, while 4,862 units were sold in August 2021 in South Africa. This showed an increase of 17.3% more than the previous year. Therefore, the increase in sales of tractors shows the trend of an increase in mechanization in Africa.

- According to the Food and Agriculture Organization of the United Nations (FAO), agricultural mechanization in Africa is still in its initial stages. The studies undertaken by FAO also revealed that the level of mechanization in the country is slowly moving from hand-driven technology to power sources.

- However, as stated in the sustainable development goals indicated in agenda 2063, the African Union Commission (AUC) and the Food and Agriculture Organization of the United Nations (FAO) view agricultural mechanization as an immediate indispensable action for attaining the Zero Hunger vision by 2025. Such initiatives toward sustainable agricultural mechanization will likely boost the market for agricultural tractors in the near future.

South Africa Dominates the Market

- South Africa is the largest market among African countries. The South African agricultural economy has witnessed a paradigm shift from food aid to domestic production in the form of the green revolution, which was first started by the World Food Program of the United Nations. South Africa now has major potential for the growth of the agriculture and agriculture machinery market, including tractors.

- In South Africa, there is a need for more farm workers due to increasing urbanization. This developed into a significant issue, driving up labor costs. As a result, farm equipment sales increased, helping the market expand. Additionally, increasing government subsidies for farm mechanization, accommodative financing, growth in the agricultural industry, and increased awareness of farm machine mechanization are driving the tractor market in the coming years.

- The tractor market in South Africa has been reinvigorating from the standstill brought to the market due to extremely dry weather conditions. Major global tractor industry players like Deere & Company and Mahindra & Mahindra, are planning to make South Africa the hub for manufacturing and exports, given the high potential that the farm equipment market holds in South Africa.

- The South African Crop Estimate Committee (SACEC) reported that farmers intend to increase the area plantings for summer grains and oilseeds in the next cropping season, thereby boosting the tractor market during the forecast period.

Africa Agricultural Tractor Industry Overview

The market is consolidated, with international players accounting for a higher market share. Deere & Company, Kempston Agri, and Kubota SA are the few key players in the African agricultural tractor market. Companies compete not only on equipment quality and promotion but also on strategic moves to attain larger market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56750

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Engine Power

- 5.1.1 Less than 35 HP

- 5.1.2 35 to 50 HP

- 5.1.3 51 to 75 HP

- 5.1.4 76 to 100 HP

- 5.1.5 Above 100 HP

- 5.2 Geography

- 5.2.1 South Africa

- 5.2.2 Kenya

- 5.2.3 Egypt

- 5.2.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO Corporation

- 6.3.2 CNH Industrial America LLC

- 6.3.3 Deere & Company

- 6.3.4 Argo Tractors SpA

- 6.3.5 Kempston Agri

- 6.3.6 Kubota SA

- 6.3.7 Escorts Ltd

- 6.3.8 Mahindra & Mahindra Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.