PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404564

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404564

Commercial Aircraft Evacuation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

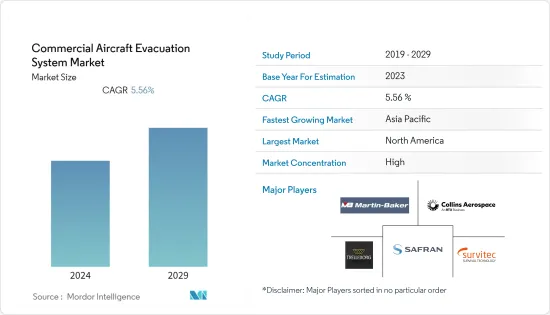

The Commercial Aircraft Evacuation System Market is valued at USD 1.84 billion in 2024 and is forecasted to reach USD 2.41 billion by 2029, registering a CAGR of 5.56% during the forecast period.

Growing demand for the newer generation aircraft coupled with the increasing regulations by organizations like the National Transportation Safety Board and Federal Aviation Administration on the safety of passengers is generating demand for new and advanced evacuation systems onboard aircraft. All aircraft manufacturers are required to demonstrate that they meet the evacuation requirements set by their respective aviation certification authority. In 2020, the FAA chartered the Emergency Evacuation Standards Aviation Rulemaking (ARC). The ARC included dozens of aviation stakeholders, including the National Transportation Safety Board (NTSB), the European Union Aviation Safety Agency, FlyersRights, the Allied Pilots Association, and the Association of Flight Attendants. The ARC made 27 recommendations to the FAA related to how the safety of such evacuations could be improved.

The development of new evacuation systems for increasing the average rate of evacuees per minute is anticipated to minimize the risk and make the evacuation process faster. Such innovations are anticipated to support the growth of the market during the forecast period. Recent emergency evacuations highlighted the potential risks associated with an ever-increasing amount of cabin baggage carried in passenger cabins, which can pose challenges to airplane crew and passengers in evacuations.

Commercial Aircraft Evacuation System Market Trends

Evacuation Slides Segment to Experience the Highest Growth During the Forecast Period

The Evacuation Slides segment of the market is anticipated to grow at the highest CAGR during the forecast period. This growth is due to the increase in the number of aircraft orders worldwide. It is also due to the development of new evacuation slides that feature reduced inflation time, high durability, and lightweight. Also, the average interval for an overhaul of the evacuation slides is about three years, with service life ranging from 12 to 18 years. It means the aged aircraft fleet operators should replace their slides with new slide systems, and the operators with a fleet of aircraft with ages ranging between 10-12 years should carry out regular maintenance and inspections. For instance, in July 2023, a United Airlines Boeing B767 lost an evacuation slide mid-air while it was on its final approach to Chicago's O'Hare International Airport. Currently, the life rafts are being replaced by evacuation slides that can be detached from the door and used as a raft. With this replacement picking up pace, the demand for such evacuation slides is anticipated to increase steadily in the years to come.

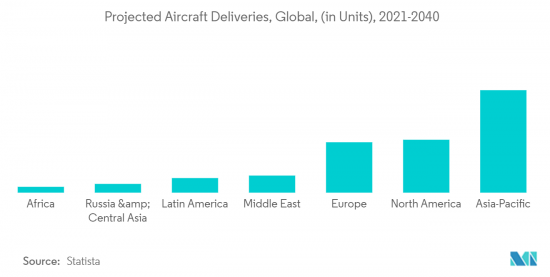

Asia-Pacific Region is Expected to Generate the Highest Demand During the Forecast Period

Asia-Pacific region is expected to generate the highest demand for commercial aircraft evacuation systems market during the forecast period. This increasing demand is mainly due to the increasing orders and deliveries of new aircraft, propelled by ever-growing passenger traffic in the region. For instance, as of February 2023, there are 1,100 planes on order by various domestic carriers in India. Air India placed orders for 470 planes with Airbus and Boeing. IndiGo Airlines includes approx. 500 planes on order, and Akasa Air contains 56 aircraft on order. In November 2022, China Aviation Supplies (CASC) signed a bulk purchasing agreement for 140 Airbus jets.

With the increase in the number of new aircraft inductions, the aircraft movement also greatly increased to serve the rapidly growing passenger traffic. Nevertheless, some incidents, such as the one in June 2023 wherein 11 passengers were injured while evacuating the Cathay Pacific jetliner aircraft when it aborted its take-off at Hong Kong International Airport, raised passenger safety concerns. It also raised the vigilance and focus of the regional aviation authorities towards integrating new aircraft evacuation technologies or improved variants of the existing ones.

Commercial Aircraft Evacuation System Industry Overview

The market for commercial aircraft evacuation systems is consolidated, with very few players in the market. The major players in the market are Collins Aerospace (RTX Corporation), Safran, Survitec Group Limited, Martin-Baker Aircraft Co. Ltd., and Trelleborg AB. Safran holds a major share in the market as it provides evacuation slides for commercial aircraft manufactured by The Boeing Company, Airbus SE, and Commercial Aircraft Corporation of China, Ltd. (COMAC), IRKUT CORPORATION, Bombardier, Inc., Sukhoi Civil Aircraft, Illyushin, Tupolev, etc. With very few players in the market, the existing players are broadening their existing product portfolio to capture a higher market share in the market. For instance, the ABC International company designed the life-vest boxes as transparent boxes in compliance with certification standards and in accordance with TSA safety and security regulations. As such, the box offers passengers easy access to take the life-vest in every seating position across the cabin, whenever needed, with a single quick action.

For instance, in December 2021, Mallaghan Engineering, Ltd., a UK-based company that produces airport ground support equipment, launched a new 6x6 fire rescue stair for airport ground support. A large platform for safe working conditions, high stability of driving, and several additional possibilities are provided by the new stairs. The Mallaghan Fire Rescue Stair was created for quick emergency aircraft passenger evacuation. Such developments are anticipated to help the manufacturers in the coming years. The aircraft manufacturers sign long-term contracts for procurement and maintenance of the evacuation systems. It acts as a major restraining factor for the new entrants into the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Evacuation Slides

- 5.1.2 Life Rafts

- 5.1.3 Personal Floatation Devices

- 5.2 Aircraft Type

- 5.2.1 Narrow-body

- 5.2.2 Wide-body

- 5.2.3 Regional

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Safran

- 6.2.2 Survitec Group Limited

- 6.2.3 Switlik Parachute Co., Inc.

- 6.2.4 EAM Worldwide

- 6.2.5 Martin-Baker Aircraft Co. Ltd.

- 6.2.6 Trelleborg AB

- 6.2.7 GKN plc

- 6.2.8 Survival Equipment Services Ltd

- 6.2.9 Mallaghan (G.A.) Inc

- 6.2.10 Collins Aerospace (RTX Corporation)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS