PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1272688

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1272688

Artemisinin Combination Therapy Market - Growth, Trends, and Forecasts (2023 - 2028)

Over the next few years, the market for artemisinin combination therapy is expected to grow at a CAGR of 8.31%.

The COVID-19 pandemic had a significant impact on the artemisinin combination therapy market. For instance, an article published by the National Center for Biotechnology Information (NCBI) in October 2021 reported that children and pregnant women were bearing a disproportionate burden of excess malaria mortality arising from COVID-19-related disruption of health systems and malaria control programs, particularly in sub-Saharan Africa. This was primarily because the COVID-19 pandemic was disrupting malaria diagnosis, as both diseases share some symptoms. It is because of these factors that the artemisinin combination therapy market was expected to be affected during the COVID-19 pandemic. In the current scenario, due to the availability of better diagnoses and vaccines for COVID-19 treatment, the artemisinin combination therapy may be used for malaria treatment, and the market is expected to witness significant growth over the forecast period.

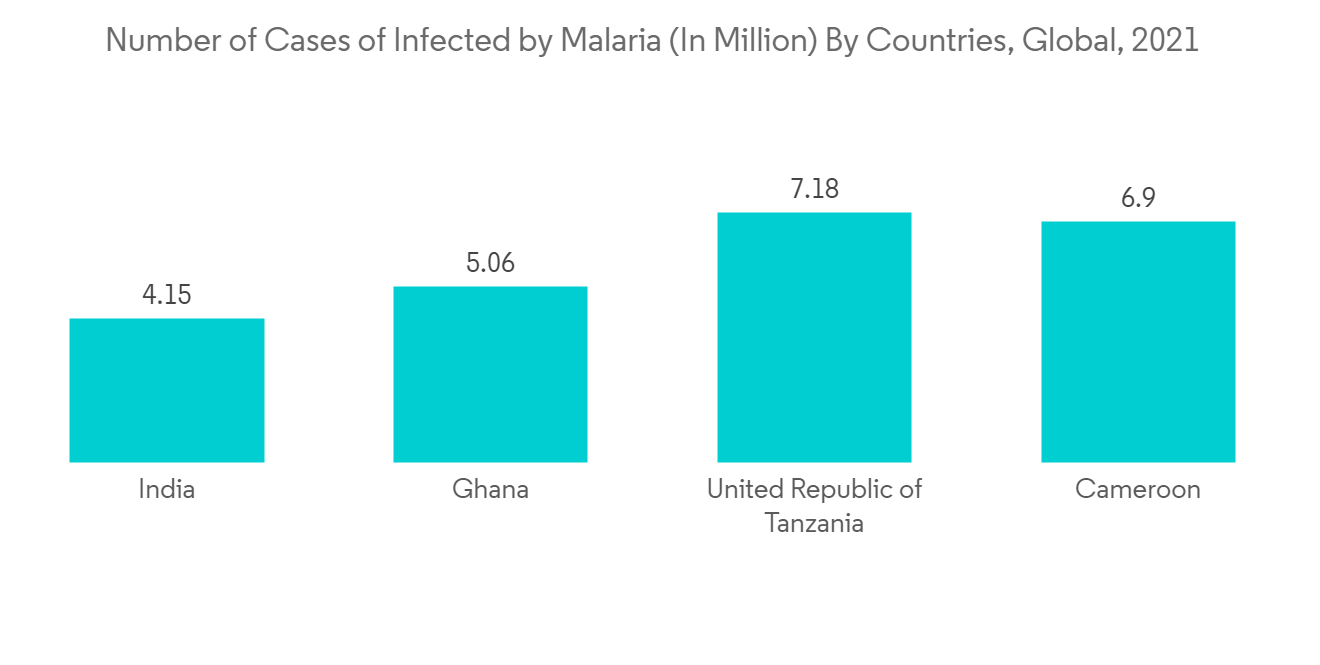

The studied market is growing because there is a lot of malaria in developing and underdeveloped countries, governments are trying to raise awareness, and more research is being done to find new drugs and new ways to use old ones.For instance, the data published by the World Malaria Report in 2022 reported that the following regions showed an increase in malaria cases in 2021: Comoros (56.9%), Costa Rica (52.4%), the Democratic People's Republic of Korea (22.8%), Ecuador (11.1%), Eswatini (53.9%), French Guyana (2.1%), Guatemala (16.9%), Honduras (47.4%), Panama (55.3%), and Sao Tome and Principe (28.9%). According to the source, the number of malaria-endemic countries with fewer than 1000 indigenous malaria cases increased from 33 in 2020 to 35 in 2021.Thus, a high number of malaria cases is driving the growth of the studied market.

Additionally, awareness programs and other government initiatives are other factors that propel market growth. For instance, in July 2022, the Ministry of Health and Family Welfare of India launched Jan Abhiyaans with log bhagidari (people's participation) to enthuse and engage citizens and communities to ensure that their homes, premises, and neighborhoods are free of mosquitoes. Similarly, in July 2021, WHO launched the E-2025 initiative to support 25 countries and one territory identified as having the capacity to eliminate malaria by 2025. Thus, such initiatives are likely to increase market growth.

Furthermore, clinical trials for the introduction of new drugs are propelling the growth of the studied market.For instance, in November 2022, Novartis and Medicines for Malaria Venture (MMV) reported plans to advance a ganaplacide/lumefantrine solid dispersion formulation (SDF) into a Phase III clinical trial to treat individuals with acute, uncomplicated malaria caused by Plasmodium falciparum. Thus, such studies are contributing to the studied market's growth.

Thus, due to the high prevalence of malaria in developing and underdeveloped countries, awareness initiatives undertaken by the governments, and increasing research for new drugs and new combination therapies, the market is expected to witness significant growth over the forecast period. However, the side effects of antimalarial drugs and the presence of counterfeit and substandard drugs are restraining the growth of this market.

Artemisinin Combination Therapy Market Trends

Artemether-Lumefantrine Segment is Expected to Witness Significant Growth Over the Forecast Period.

Artemether-Lumefantrine is a medication that combines the drugs artemether and lumefantrine.It is used to treat malaria caused by Plasmodium falciparum, which is not treatable with chloroquine. They were both developed in China. It is one of the drugs on the World Health Organization's List of Essential Medicines, the most effective and safe medicines needed in a health system.

The World Health Organization says that Plasmodium falciparum malaria that is not complicated should be treated with a combination of artemisinin and lumefantrine.According to the study titled "Efficacy and safety of artemether-lumefantrine for the treatment of uncomplicated Plasmodium falciparum malaria in Ethiopia: a systematic review and meta-analysis" published in May 2021, artemether-lumefantrine therapy is efficacious and safe in treating uncomplicated falciparum malaria in Ethiopia.

Also, the studied market is being driven by the growing number of malaria cases around the world.For instance, in 2022, the World Malaria Report stated that total funding for malaria research in 2021 was estimated at USD 3.5 billion, an increase from USD 3.3 billion in 2020 and USD 3.0 billion in 2019. The increase in funding for malaria research is expected to increase demand for artemether-lumefantrine research for malaria treatment, thereby driving the growth of the segment.

As this combination is used as the first-line drug for malaria in most countries, it is expected to cover a large share of the global artemisinin combination therapy market.

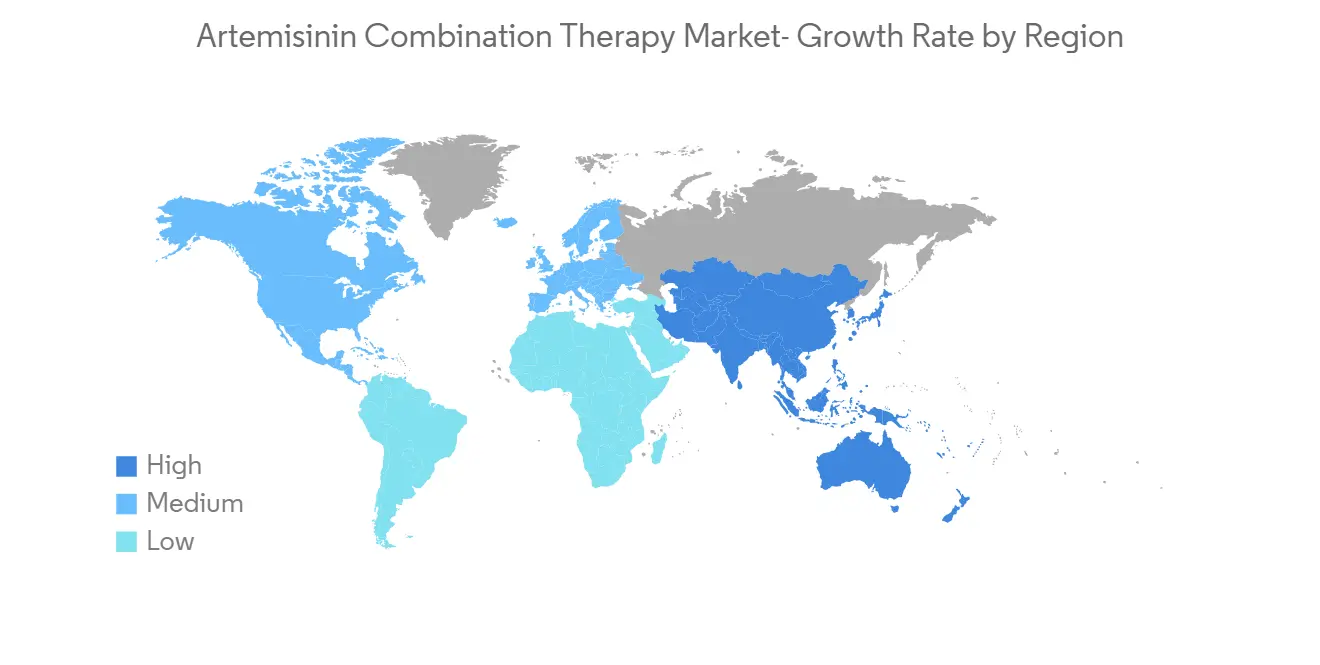

The Middle East and Africa Region is Expected to Witness a Significant Growth Over the Forecast Period.

The Middle East and Africa region are expected to witness growth over the forecast period, due to the rising investments by the developed countries and larger patient populations, coupled with the rising focus of the World Health Organization (WHO) to reduce the mortality rate of malaria in the African countries.

According to World Health Organization data, Sub-Saharan Africa will most likely continue to bear the burden of malaria in 2021, accounting for approximately 95% of all cases and 96% of all deaths.According to information released by the World Health Organization, mutations linked to partial artemisinin resistance, which is the first-line treatment for P. falciparum malaria with no complications, will be found in Rwanda in Africa in 2021.P. falciparum is the most prevalent malarial parasite in the region, accounting for an estimated 99% of all cases in Africa, according to the WHO. Also, as per the same source, children under the age of 5 are the most vulnerable group affected by malaria since they account for 67% (274 000) of all malaria deaths worldwide. These facts are indicative of the rising prevalence of malaria diagnoses in the Middle East and Africa. Thus, the increasing cases of malaria in the region require effective treatment, which is further expected to boost the growth of the market in the region over the forecast period.

Moreover, in August 2022, President Muhammadu Buhari inaugurated the Nigeria End Malaria Council (NEMC) in Abuja, projecting that the successful implementation of the council's agenda and savings from the estimated economic burden of the disease would save Nigeria about N687 billion in 2022 and N2 trillion by 2030. Such initiatives taken by the government in the region are expected to boost the growth of the market over the forecast period.

Thus, due to a high number of malaria cases and research, the region is expected to witness growth over the forecast period.

Artemisinin Combination Therapy Industry Overview

The artemisinin combination therapy market is highly fragmented and consists of several major players. The major players on the international stage manufacture the majority of artemisinin combination therapy drugs. Market leaders with more funds for research and a better distribution system have established their positions in the market. Some of the global players are based in developed countries like the United States, the United Kingdom, France, Germany, and Japan. Some of the companies currently dominating the market are Cipla Inc., PLC, Novartis AG, Sanofi S.A., KPC Pharmaceuticals, and Shanghai Fosun Pharmaceutical Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Malaria in Developing and Under Developed Countries

- 4.2.2 Awareness Initiatives Undertaken by the Governments

- 4.2.3 Increasing Research for New Drugs and New Combinations Therapies

- 4.3 Market Restraints

- 4.3.1 Side Effects Associated with Artemisinin Combination Therapy (ACT) Coupled with Less Availability of Raw Material for Production of ACTs

- 4.3.2 Presence of Counterfeit Drugs and Substitutes for ACT

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Combination Therapy Type

- 5.1.1 Artemether-Lumefantrine

- 5.1.2 Artesunate-Amodiaquine

- 5.1.3 Artesunate-Pyronaridine

- 5.1.4 Artesunate-Sulfadoxine-Pyrimethamine

- 5.1.5 Other Combination Therapy Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cipla Ltd.

- 6.1.2 Desano Inc.

- 6.1.3 Hovid Berhad

- 6.1.4 KPC Pharmaceuticals

- 6.1.5 Guilin Pharmaceutical (Fosun Pharmaceutical )

- 6.1.6 Novartis AG

- 6.1.7 Sanofi S.A.

- 6.1.8 Ipca Laboratories Ltd.

- 6.1.9 Ajanta Pharma

- 6.1.10 Shelys Africa Pharmaceuticals Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS