PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433916

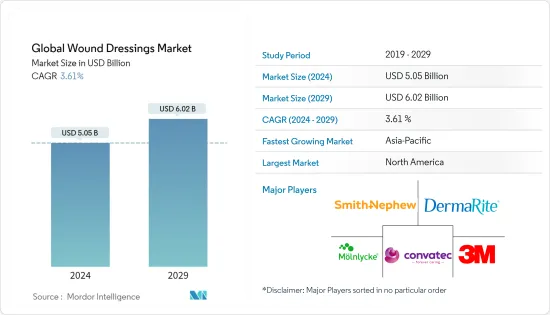

Global Wound Dressings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Wound Dressings Market size is estimated at USD 5.05 billion in 2024, and is expected to reach USD 6.02 billion by 2029, growing at a CAGR of 3.61% during the forecast period (2024-2029).

COVID-19 had a significant impact on the overall healthcare industry. Road accidents and transportation injuries are responsible for most of the wounds. This served as the market's primary growth factor. There were far fewer accidents and injuries because of the global lockdown imposed during the early stages of the epidemic and the cancellation of public transportation. As per the article published in 2021 under the title 'The impact of the SARS-CoV-2 pandemic on the management of chronic limb-threatening ischemia and wound care', except in critical cases like chronic limb-threatening ischemia, there has been a paradigm change in wound care toward hybrid telemedicine and home healthcare approach to keep patients at home and decrease the amount of in-person clinic visits and hospitalizations. Hence, the factors mentioned above showed that COVID-19 had a notable impact on the wound dressings market.

The major factors for the growth of the wound dressings market include the rising incidences of chronic wounds, diabetic ulcers, and an increase in the volume of surgical procedures worldwide. For instance, as per the 2022 update from the International Diabetic Federation (IDF), approximately 537 million adults (20-79 years) are living with diabetes. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Moreover, as per the IDF 2021 report, diabetic foot ulcers were affected by 40 to 60 million people globally. As a result, the market is likely to grow due to the increased prevalence of diabetic foot ulcers.

Chronic wounds lead to complications, such as infection, ulceration, and insufficient blood supply, thus, increasing the wound healing period. The most common chronic wounds include venous ulcers, diabetic foot ulcers, and pressure ulcers. Furthermore, government initiatives, awareness programs, and product launches boost market growth. For instance, Wounds Australia developed the Wound Awareness Week (WAW21) campaign in 2021 for the purpose of educating people regarding chronic wound complications and raising awareness of risks, warning signs, and treatments. In 2022 the campaign focused on the solutions needed to drive national change for those living with wounds.

As per the factors mentioned above, the wound dressings market is anticipated to witness growth over the forecast period. However high cost and lack of awareness about advanced wound dressing products restrain the market growth.

Wound Dressing Market Trends

Advanced Wound Dressing Segment is Expected to Hold Largest Market Share Over the Forecast Period

Advanced wound dressing focuses on keeping the wound hydrated to encourage healing and is generally prescribed by clinicians after a visit to the doctor or hospital. Advanced wound dressings include film, foam, hydrogel, hydrocolloid, collagen, and contact layers, among others. Factors such as the increased prevalence of diabetic foot ulcers are one of the major reasons behind the market growth. As per the 2020 update from IDF, diabetic foot ulcers affect 40 to 60 million people with diabetes globally.

Moreover, the availability of a wide range of products and the presence of key market players and R&D activities to advance the products in Advanced wound dressings. For instance, as per the article published in 2022, under the title 'L-Mesitran Foam: Evaluation of a New Wound Care Product', the study showed that the medical-grade honey of L-Mesitran has strong antimicrobial and wound healing activities. L-Mesitran Foam combines these properties of L-Mesitran Soft with the technology of foam dressings. Furthermore, the growing geriatric population, rising number of sports injuries, and associated risk of diabetes are projected to fuel the segment growth over the forecast period. For instance, as per the 2022 update from John Hopkins Sports Injury Statistics, in the United States, about 30 million children and teens participate in some form of organized sports, and more than 3.5 million injuries each year. Since increased injury cases lead to more adoption of wound dressing leading to market growth. Moreover, the presence of competitors, mergers, acquisitions, and product launches fuel the market growth. For instance, in April 2020, Convatec Group Plc, a global medical technology company, announced the launch of ConvaMax, a new superabsorber dressing distributed by Convatec.

Hence, as per the facts mentioned above, the advanced wound dressing segment is likely to boost market growth over the forecast period.

North America is Expected to Hold Largest Market Share over the Forecast Period

North America holds a major share in the wound dressings market, owing to the presence of better healthcare infrastructure and a rising number of surgical procedures in the region. The high number of diabetic populations in the country especially in the United States is indicating that there are chances of rising cases of diabetic ulcers. For instance, as per International Diabetes Federation, the United States of America is one of the 23 countries in the IDF NAC region. 537 million people have diabetes in the world and more than 51 million people in the NAC Region, this count is expected to rise to 63 million by 2045.

The presence of competitors, acquisitions, and mergers boost the market growth. For instance, in March 2022, Tennessee-based Triad Life Sciences Inc was acquired by Convatec Group. The Triad's current portfolio and product pipeline is transferred to Convatec's Advanced Wound Care (AWC) business and is likely to be known as Convatec Advanced Tissue Technologies.

As per the factors mentioned above, North America is expected to register a high growth rate for the studied market over the forecast period.

Wound Dressing Industry Overview

The Wound Dressings market studied is a moderately consolidated market owing to the presence of a few major market players. The market players are focusing on R&D to develop new and efficient products in the market. Some of the market players are 3M Company, ConvaTec Group PLC, DermaRite Industries LLC., DeRoyal Industries Inc., Hollister Incorporated, Integra LifeSciences Holdings Corporation, Coloplast A/S, Medtronic plc, Molnlycke Health Care AB, and Smith & Nephew plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidences of Chronic Wounds, Ulcers and Diabetic Ulcers

- 4.2.2 Increase in Volume of Surgical Procedures Worldwide

- 4.3 Market Restraints

- 4.3.1 High Cost and Lack of Awareness about Advanced Wound Dressing Products

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Advanced Wound Dressing

- 5.1.1.1 Foams

- 5.1.1.2 Hydrocolloids

- 5.1.1.3 Films

- 5.1.1.4 Alginates

- 5.1.1.5 Hydrogels

- 5.1.1.6 Other Advanced Wound Dressing

- 5.1.2 Traditional Wound Dressing

- 5.1.2.1 Bandages

- 5.1.2.2 Gauzes

- 5.1.2.3 Sponges

- 5.1.2.4 Abdominal pads

- 5.1.2.5 Other Traditional Wound Dressing

- 5.1.1 Advanced Wound Dressing

- 5.2 By Application

- 5.2.1 Surgical Wounds

- 5.2.2 Diabetic Foot Ulcers and Others

- 5.2.3 Burns

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M Company

- 6.1.2 ConvaTec Group PLC

- 6.1.3 DermaRite Industries LLC.

- 6.1.4 DeRoyal Industries Inc.

- 6.1.5 Hollister Incorporated

- 6.1.6 Integra LifeSciences Holdings Corporation

- 6.1.7 Coloplast A/S

- 6.1.8 Medtronic plc

- 6.1.9 Molnlycke Health Care AB

- 6.1.10 Smith & Nephew plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS