PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433936

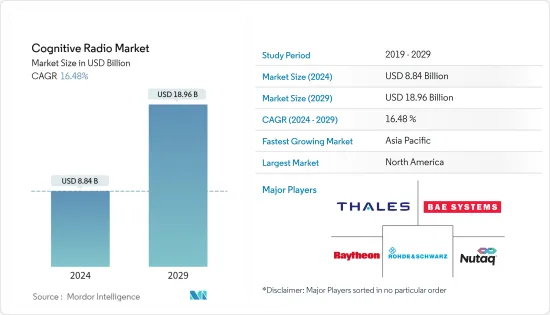

Cognitive Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Cognitive Radio Market size is estimated at USD 8.84 billion in 2024, and is expected to reach USD 18.96 billion by 2029, growing at a CAGR of 16.48% during the forecast period (2024-2029).

The emerging 5G technologies are used to meet future wireless technologies' heavy mobile data traffic. More capacity will demand more spectrum, resulting in the integration of CR in 5G networks. The focus of CR is to enable much more efficient use of the spectrum, though it adapts itself to provide the optimum communications channel.

Key Highlights

- In today's world, the economy and communication infrastructure closely depend on each other. With improved spectrum utilization efficiency in numerous dimensions, cognitive radio will make the mobile communication paradigm more personal. CR identifies the free channels in the spectrum and uses them for communication by dynamically changing the transmission parameters, leading to better utilization of channel resources.

- Some technical hurdles must be overcome before the technology can be implemented in a real-world scenario. To differentiate between a primary signal that is fading and white space, cognitive radios must be more sensitive. A single cognitive radio using local sensing may not be able to achieve this improved sensitivity in cases of severe fading since the necessary sensing time may be longer than the sensing period.

- There was an increased reliance on the internet for numerous daily tasks during and after the COVID-19 pandemic. The heavy shift towards network traffic urged the need for more spectrums with multiple frequencies, which created a demand for the cognitive radio market.

- The extensive usage of cognitive radio by rural broadband telcos helps independent local carriers get around the issue of high costs and limited spectrum to deploy wireless in underdeveloped rural markets, thereby increasing its use for public safety.

Cognitive Radio Market Trends

Telecommunication Sector is Gaining Traction Due to Emergence of 5G Applications

- As most wireless communication systems are based on fixed frequency allocation, this results in low spectrum utilization. The growing demand for IoT for industrial use, connected vehicles, and other IT-enabled applications is accelerating the need for more spectrums. Cognitive radio hence plays an important role here as it automatically detects available channels in a wireless spectrum, enabling more communication to run concurrently without obstructing the licensed users.

- According to the GSMA, at the end of November 2022, more than 225 operators from 87 countries launched 5G services. By the end of 2023, the number of 5G mobile connections is expected to reach 1.5 billion. This growth will require additional spectrum resources in different frequency bands.

- To enhance dynamic user experiences in high-capacity scenarios, ZTE Corporation and China Telecom jointly developed a self-adaptive spatiotemporal cognitive network based on ZTE's Radio Composer. The network solution analyzes the traffic space distribution trend in different periods.

Ericsson and AXIAN Telecom announced a partnership to provide faster and more reliable mobile services throughout Madagascar while reducing network energy consumption and enhancing the 5G ecosystem. Through this partnership, AXIAN aims to boost digitalization across Madagascar and Tanzania, increasing network capacities and providing enhanced speeds to its customers.

Asia-Pacific to Register the Fastest Growth During the Forecast Period

- Countries in the Asia-Pacific region have been at the forefront of 5G mobile technologies. The first commercial 5G network was launched in South Korea. Though establishing 5G technology will take time, it is expected that it will reach 1.8 billion connections by 2025.

- The 700 MHz bands, particularly the 3500 MHz range, are the currently preferred frequencies for 5G and should be the primary focus for awards wherever feasible. The precise range of spectrum within 3500 MHz varies by country. There may be a need for extensive refarming work to ensure that mobile operators have access to a spectrum that does not suffer from interference while maximizing the bandwidth available.

- Nokia, Docomo, and NTT have partnered on emerging 6G technologies. The trio is projected to work to develop new spectrum technologies, a network as a sensor, and cognitive, automated, and specialized architectures.

- Japan's Ministry of Internal Affairs and Communications (MIC) will introduce a spectrum auction, including a millimeter-wave (mmWave) spectrum. The spectrum is expected to be used for fixed wireless access to increase coverage in stadiums and other extensive facilities and deliver broadband in residential areas.

Cognitive Radio Industry Overview

A few players meet the demand, this market has moderate competition. These cognitive radio providers sign contracts and invest with various companies to help expand their services. As the demand for fast and stable network connections increases, they have a broader scope of expansion with the development of enhanced cognitive radio solutions. Some significant companies offering services in this sector include BAE Systems PLC, Thales Group, Raytheon Company, and Rohde & Schwarz GmbH & Co. KG.

In October 2022, STC adopted Ericsson's technologies to ensure proactive support and elevate customer experiences during surges in high traffic on the network. The AI-based Cognitive Software solution leverages automation, big data scalability, speed, accuracy, and consistency for improved network optimization. The solution was expected to contribute to reducing carbon dioxide emissions from operational activities like the use of virtual drive testing and remote automatic spectrum analysis.

In June 2022, the Indian Institute of Technology, Mandi, developed cooperative spectrum sensors to offer cutting-edge telecom solutions and improve the radio-frequency spectrum's reusability. The idea of this solution was that a wireless device, such as a cell phone, used by the secondary user could be fitted with a unique sensor that could detect spectrum holes that the primary user does not use and use them when the main channel is unavailable or crowded.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Need to Optimise the Spectrum Utilisation

- 4.2.2 Rising Development of 5G Service Applications Among End-user Industries

- 4.3 Market Restraints

- 4.3.1 Lack of Proper Computational Security Infrastructure

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of COVID-19 impact on the industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Spectrum Sensing & Allocation

- 5.1.2 Location Detection

- 5.1.3 Cognitive Routing

- 5.1.4 QoS (Quality of Service) Optimisation

- 5.1.5 Other Applications

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By End-user Industry

- 5.3.1 Telecommunication

- 5.3.2 IT & ITes

- 5.3.3 Government & Defense

- 5.3.4 Transportation

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BAE Systems PLC

- 6.1.2 Thales Group

- 6.1.3 Raytheon Company

- 6.1.4 Innovation Nutaq Inc. (NuRAN Wireless Inc.)

- 6.1.5 Shared Spectrum Company

- 6.1.6 Rohde & Schwarz GmbH & Co KG

- 6.1.7 Spectrum Signal Processing (Vecima)

- 6.1.8 Rockwell Collins Inc. (United Technologies Company)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS