PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405084

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405084

Commercial Aircraft Floor Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

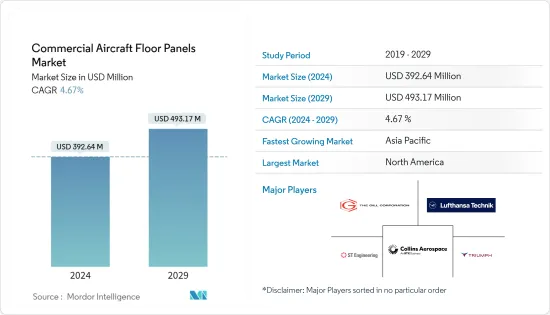

The Commercial Aircraft Floor Panels Market size is estimated at USD 392.64 million in 2024, and is expected to reach USD 493.17 million by 2029, growing at a CAGR of 4.67% during the forecast period (2024-2029).

Key Highlights

- One of the primary drivers in this market is the ever-increasing demand for air travel worldwide. As the global population continues to grow and economies expand, more people are opting for air travel, leading to a higher number of flights. With increasing production rates of the current aircraft programs, the pressure on the supply chain, especially on tier-1 providers, is anticipated to increase. These increased production rates are anticipated to drive the profits of the players during the forecast period.

- Airlines are also prioritizing fuel efficiency and operational cost savings, pushing for lightweight floor panels to reduce aircraft weight and improve overall efficiency. Furthermore, advancements in materials and manufacturing techniques are enabling the development of stronger, more durable, and lighter floor panels.

- To improve passenger comfort and safety in the aircraft, the demand for new types of floor panels that are fire retardant, lightweight, and thermally conductive (which can be controlled externally with a central aircraft unit) is increasing. On the other hand, several restraining factors exist. These include the high cost associated with advanced materials, which can limit the adoption of these panels. Additionally, the aviation industry operates under stringent regulatory standards, demanding rigorous testing and certification for any new components, which can lead to delays and increased costs.

Commercial Aircraft Floor Panels Market Trends

Narrow-body Aircraft Segment to Experience the Highest Growth during the Forecast Period

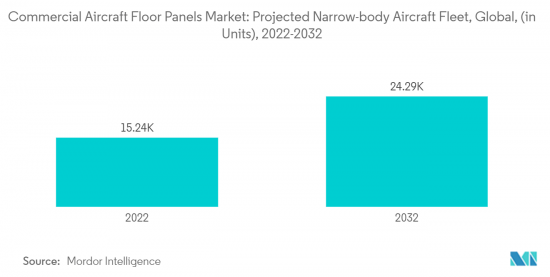

- The narrow-body aircraft segment of the market is anticipated to register the highest CAGR during the forecast period. This growth is mainly due to the increasing orders and deliveries of narrow-body aircraft, like A220, A320, B737, etc., from various LCCs across the world during the forecast period. The LCCs are currently expanding their fleet of narrow-body aircraft, as they can help to increase profits. With the increasing demand, aircraft manufacturers are increasing their production capacities which results in an increased demand for associated parts and components of aircraft.

- Additionally, new aircraft models like COMAC C919 and MC-21 are anticipated to further propel the growth of the market during the forecast period. For instance, in September 2023, China Eastern Airlines signed a USD 9.9 billion contract with the Commercial Aircraft Corporation of China (COMAC) to purchase 100 more units of passenger aircraft on top of the five aircraft already ordered in 2021.

- As of September 2023, COMAC had a backlog of 1,500 orders of C919 aircraft. Similarly, in September 2022, Aeroflot Group ordered 339 Russian-made aircraft from Rostec. The order comprises 210 Irkut MC-21-300 narrow-body aircraft, 40 Tupolev Tu-214 narrow-body aircraft, and 89 Irkut SSJ 100/95-NEW regional jets.

Asia-Pacific is Expected to Generate the Highest Demand during the Forecast Period

- Asia-Pacific region is expected to generate the highest demand for commercial aircraft floor panels market during the forecast period. The passenger traffic in the region has been rapidly growing over the past few years and has been the major driving factor for the aviation market. There is an increase in international and domestic passengers in developing economies like China and India. China is anticipated to overtake the United States in terms of air passenger traffic in the next few years.

- Likewise, India is also poised to replace the United Kingdom to become the third-largest aviation market in terms of domestic air passenger traffic over the next decade. Other countries, like Indonesia, Malaysia, Vietnam, Thailand, and Singapore, among others, are also attracting huge numbers of passengers from various regions around the world, making the airlines introduce new routes to offer better connectivity. Airlines in the Asia-Pacific region are increasingly investing in purchasing and modernizing their aircraft fleets to improve operational efficiency and passenger satisfaction.

- For instance, as of February 2023, Indian private airlines such as Air India, Indigo, and others had 1,100 pending aircraft orders from various aircraft manufacturers. With the increasing aircraft orders and deliveries, simultaneous demand is likely to be generated for floor panels from this region during the forecast period.

Commercial Aircraft Floor Panels Industry Overview

The commercial aircraft floor panels industry is semi-consolidated. The prominent players in the commercial aircraft floor panels market are The Gill Corporation, Triumph Group, Singapore Technologies Engineering Ltd., Collins Aerospace (RTX Corporation), and Lufthansa Technik AG. These players are the suppliers of floor panels on the majority of aircraft programs of Airbus and Boeing.

For instance, in the Boeing B787 Dreamliner, Collins Aerospace provides heated floor panels & integrated controllers; The Gill Corporation provides Gillfab 4809 floor panels with Kevlar honeycomb core & carbon fiber reinforced epoxy skins, and Triumph Group provides composite environmental control systems (ECS) ducting and floor panels. In a few aircraft programs, the passenger and cargo floor panels will be installed with panels from different companies. Innovation and expansion of product portfolio are anticipated to provide companies a competitive edge over others.

For instance, the new Airbus A321XLR aircraft's Doors-1 and Doors-4 entrance areas have new heated floor panels. Collins Aerospace has developed aeroBASE multi-use honeycomb floor panels for weight reduction and increased longevity, and the company offers 30 other standard configurations of floor and interior panels.

Additionally, long-term contracts with aircraft OEMs are anticipated to support the growth of companies. For instance, TRB Lightweight Structures offers customized solutions for floor panel replacement. TRB has been leading the way in the design and manufacture of lightweight floor panels since 1954. In June 2023, TRB Lightweight Structures successfully replaced balsa wood and aluminum floor panels in B-17 Flying Fortress aircraft.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Aircraft Type

- 5.1.1 Narrow-body Aircraft

- 5.1.2 Wide-body Aircraft

- 5.1.3 Regional Aircraft

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Italy

- 5.2.2.5 Russia

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Qatar

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.5.5 South Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 The Gill Corporation

- 6.2.2 Collins Aerospace (RTX Corporation)

- 6.2.3 Triumph Group, Inc.

- 6.2.4 Singapore Technologies Engineering Ltd

- 6.2.5 LATECOERE

- 6.2.6 Aeropair Ltd.

- 6.2.7 Elbe Flugzeugwerke GmbH

- 6.2.8 VINCORION Advanced Systems GmbH

- 6.2.9 Satair (Airbus SE)

- 6.2.10 Lufthansa Technik AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS