Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273416

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273416

Nonmagnetic Wheelchair Market - Growth, Trends, and Forecasts (2023 - 2028)

PUBLISHED:

PAGES: 115 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The nonmagnetic wheelchair market studied was anticipated to grow with a CAGR of nearly 6.1% during the forecast period.

Key Highlights

- The COVID-19 pandemic had a significant impact on the nonmagnetic wheelchair market. For instance, as per the article published in December 2022 in MedRxiv, the pandemic disproportionately impacted physically disabled people because of the convoluted preexisting conditions. The interruption of vital services and support and preexisting health ailments, in some cases, have left the physically disabled in danger of acquiring several diseases. Hence, the patients were mostly left in households, which adversely impacted the sale of nonmagnetic wheelchairs during the pandemic. An article published in January 2021 in the journal of Spinal Cord Medicine stated that individuals with thoracic spinal cord injuries who used a manual wheelchair full-time during the pandemic had lower levels of physical activity than before the pandemic. Hence, COVID-19 had a significant impact on the nonmagnetic wheelchair market. However, with the resumption of hospitals and decreasing cases of COVID-19, the studied market is expected to recover from the impact of COVID-19 over the forecast period.

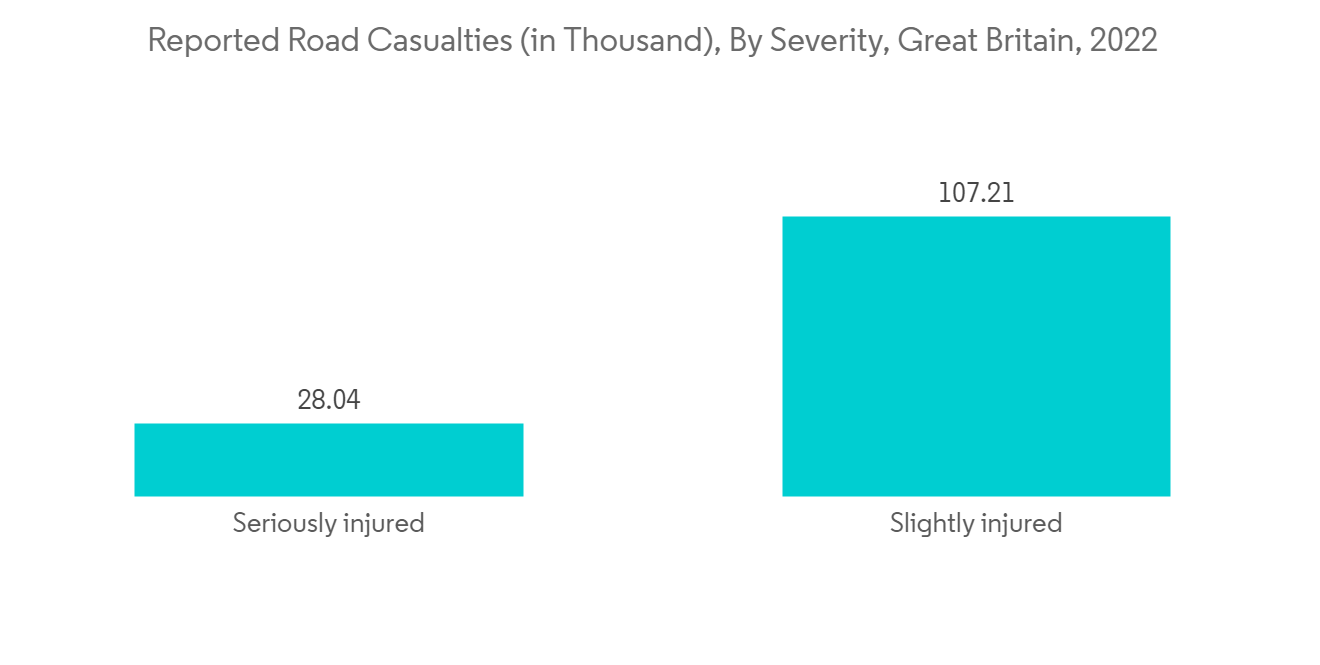

- Factors such as an increase in injuries, neuromuscular diseases, and a rise in the geriatric population are likely to drive the growth of the market. For instance, according to the WPP 2022 report published by the United Nations, the global geriatric population is increasing rapidly around the world. The older population is projected to grow at rates above 3% per year in Northern Africa and Western Asia, sub-Saharan Africa, Oceania (excluding Australia and New Zealand), and Central and Southern Asia. The share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. As the geriatric population rises, the disabilities associated with mobility increase, and the adoption of nonmagnetic wheelchairs rises.

- Moreover, the increasing prevalence of debilitating neurological diseases, rheumatoid arthritis, and osteoarthritis has been contributing to the increased percentage of the population with a disability to walk. For instance, as per the Arthritis WA November 2022 update, arthritis affects 3.6 million Australians (or 1 in 7) and costs USD 14 billion per year. As the arthritis complication increases, the likelihood of utilizing nonmagnetic wheelchairs rises, driving the growth of the nonmagnetic wheelchair market. Moreover, the increase in wheelchair donations worldwide also boosts the growth of the nonmagnetic wheelchair market. For instance, the Church of Jesus Christ donated or delivered 18,569 wheelchairs in support of 32 countries from May 2021 to April 2022.

- Due to the increase in the geriatric population, the rise in neurological diseases, and wheelchair donations, the studied market is expected to witness significant market growth over the forecast period. However, the lack of facilities in developing and under-developed regions are likely to restrain the growth of the market over the forecast period.

Nonmagnetic Wheelchair Market Trends

Hospital Segment is Likely to Witness a Significant Growth in the Nonmagnetic Wheelchair Market Over the Forecast Period

- The hospital segment is likely to witness significant growth in the market studied owing to the factors such as an increase in mobility issue cases, a rise in wheelchair donations, and a surge in sports injury cases that lead to disability. For instance, according to the National Safety Council (NSC), in 2021, exercise equipment accounted for about 409,000 injuries in the United States, the most in any category of sports and recreation. As per the same source, 222,086 cases of football injuries, 259,779 cases of basketball injuries, and 144,895 cases of soccer injuries were reported in 2021 in the United States. The high incidence of sports injuries is directly having an impact on the rise in hospital admissions, eventually boosting the growth in demand for non-magnetic wheelchairs worldwide.

- Furthermore, individual and group donations of wheelchairs to hospitals are likely to boost the growth of the segment over the forecast period. For instance, in May 2021, a teenager donated a wheelchair worth INR 6,500 (USD 78.61) to Vasai Covid hospital in India. Similarly, in October 2022, in collaboration with the Rwanda Biomedical Center and National Council of People with Disability (NCPD), the Church of Jesus Christ of Latter-day Saints closed a 4-day wheelchair delivery and training event in Kigali, Rwanda.

- Therefore, due to the increase in injury cases, the rise in neurological diseases, and wheelchair donations, the hospital segment is expected to witness significant growth over the forecast period.

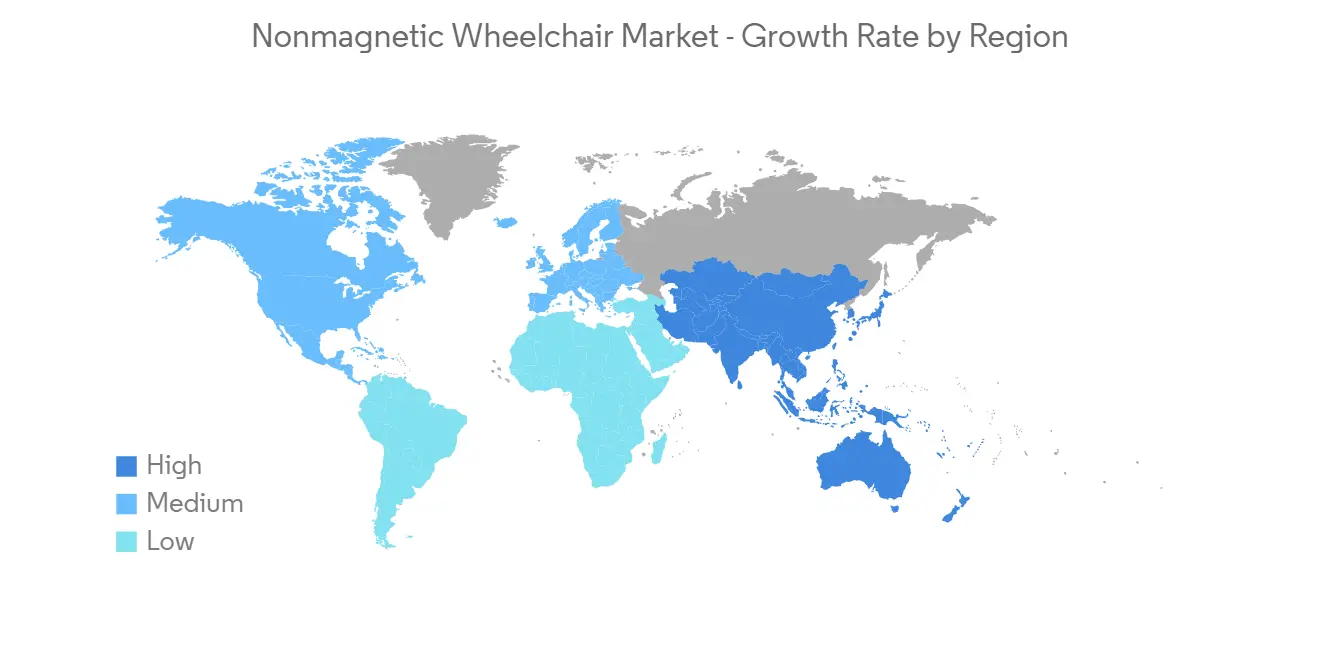

North America Anticipated to Hold a Significant Market Share Over the Forecast Period

- North America is expected to hold a significant market share in the overall market throughout the forecast period due to the increasing geriatric population who are more prone to mobility disorders (such as osteoporosis, rheumatoid arthritis, etc.), a rise in injury cases, and a surge in wheelchair donations and product launches. For instance, a study published in September 2022 in Springer demonstrated the high rates of all injuries and concussions in collision sports in Canadian high schools. This is particularly noteworthy when it is considered that four sports contribute 33% of all serious injuries to this population. Hence, sports injury cases raise the chance of utilization of wheelchairs, thereby driving the growth of the market.

- Furthermore, the supportive government initiatives that reduce the burden of the high cost of the devices, combined with growing reimbursement policies, have resulted in a high-volume usage of personal mobility devices. For instance, according to the report from the Whitehouse factsheet in 2021, the Global Cooperation for Assistive Technology, a partnership between United States Agency for International Development (USAID) and ATscale, planned to provide assistive products that can change their lives, such as wheelchairs, eyeglasses, prosthetic devices, or hearing aids to 500 million people by 2030. More than a billion people who use assistive technology or gadgets are expected to benefit from this partnership.

- Moreover, manufacturers in North America have access to novel technology, which enables the development of technologically advanced devices in a short span, which is a major factor in the growth of the market. For instance, in October 2021, Ki Mobility, a market player in sophisticated manual rehab wheelchairs and seating in the United States, was acquired by Etac AB, a creator and supplier of ergonomic assistive devices and patient handling equipment. With the acquisition, Etac AB offered a far wider range of products to people, families, and therapists that require specialized manual rehab wheelchairs, seating, and pediatric assistive devices.

- Thus, due to the increase in injury cases, the rise in product launches, and government initiatives, North America is expected to hold a significant market share in the market studied over the forecast period.

Nonmagnetic Wheelchair Industry Overview

The nonmagnetic wheelchair market is highly competitive and consists of a number of major players. Companies like Guangdong Shunde Jaeyong Hardware, Comfort Orthopedic, Axis Medical, PRO ACTIV Reha-Technik, Besco Medical, Melrose Wheelchair, Karma Medical, DeVilbiss Healthcare, Giraldin G&C, among others, hold substantial market share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 67798

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Injury and Neuromusculoskeletal Disorders

- 4.2.2 Increasing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Lack of Facilities in Developing and Under-Developed Regions

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Below 100 kg

- 5.1.2 100 kg to 150 kg

- 5.1.3 Above 150 kg

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Orthopedic Centers

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Guangdong Shunde JIEYANG HARDWARE Co. Ltd

- 6.1.2 Comfort Orthopedic Co. Ltd

- 6.1.3 Access Medical Wheelchairs

- 6.1.4 PRO ACTIV Reha-Technik

- 6.1.5 Besco Medical

- 6.1.6 Melrose Wheelchair

- 6.1.7 Karma Medical

- 6.1.8 DeVilbiss Healthcare

- 6.1.9 Giraldin G&C

- 6.1.10 MRIequip.com

- 6.1.11 Z&Z Medical Inc.

- 6.1.12 Varay Laborix

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.