PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406095

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406095

Asia-Pacific Airport Baggage Handling Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

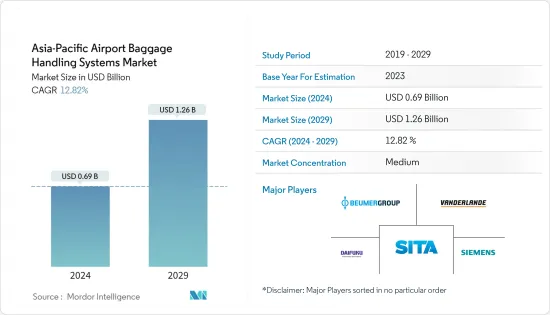

The Asia-Pacific Airport Baggage Handling Systems Market size is estimated at USD 0.69 billion in 2024, and is expected to reach USD 1.26 billion by 2029, growing at a CAGR of 12.82% during the forecast period (2024-2029).

Increasing air traffic, growing expenditure on the construction of new airports, and the need to ensure maximum security at the airports drive the growth of the market. Low airfares, increasing business and leisure travel, improvement in living standards, and growth of the middle-class population and their income are some of the major contributors to the increased air travel in Asia-Pacific. The increased traffic growth in Asia-Pacific is leading to an increased demand for more efficient airport baggage-handling systems, which is expected to propel the growth of the market during the forecast period. According to the IATA, China surpassed the US and became the largest aviation market in terms of seating capacity in 2020.

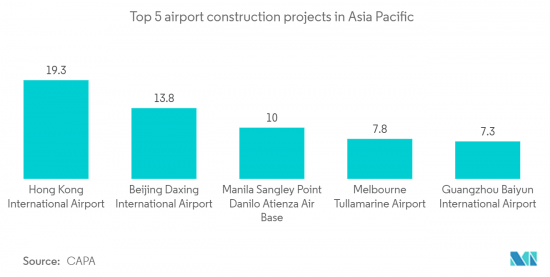

The increasing emphasis on airport security, as well as advanced technologies in terms of passenger baggage screening, is expected to support the growth of the market in the years to come. Construction of new airports, as well as terminal expansion, is expected to provide further growth opportunities for the manufacturers of airport baggage handling systems during the forecast period.

Asia-Pacific Airport Baggage Handling System Market Trends

Above 40 Million Segment is Projected to Lead the Market During the Forecast Period

The above 40 million segment is anticipated to lead the market during the forecast period. The growth is attributed to the increasing expenditure on the construction of airports and rising airport security concerns. The number of airports entering the above 40 million segment has increased over the years due to the steep growth of air passengers globally. The number of airports in the above 40 million segment is increasing. These numbers are expected to increase further by 2023 as several airports are enlarging their passenger handling capacity through infrastructure expansion. In India, As the disposable income of the individual has increased, most people consider air travel in most cases, so some of the engaged airports are planning to expand the customer handling capacity. For instance, In June 2022, Chennai airport could be expanded across the Adyar River to handle 50 to 60 million passengers per annum (MPPA). A masterplan will likely be prepared for this within six months, reported airport director Dr. Sharad Kumar. Thus, increasing air traffic leads to the growing development of larger airports, driving the growth of the segment during the forecast period.

China Held Highest Market Share During the Forecast Period

China is estimated to hold the highest shares in the market during the forecast period. The growth is due to the increasing number of air passengers and rising spending on the aviation sector. The Civil Aviation Administration of China (CAAC) is planning to construct 216 new airports by 2035 to meet the growing demands for air travel. With such a huge demand for the construction of new airports, there may be a significant demand for baggage handling systems from these airports during the forecast period.

China is planning to build airports in the Beijing-Tianjin-Hebei region, the Yangtze River Delta region, the Guangdong-Hong Kong-Macau Greater Bay Area, as well as in the cities of Chongqing and Chengdu. The Chinese airports have boosted their IT spending with a focus on equipping new airports and terminals with the latest technologies and managing growing passenger numbers by increasing both passenger and baggage handling capacities, thereby reducing waiting times. With the increasing passenger inflow into the airports, there is an increasing focus on accurate, fast, and efficient baggage handling systems. In this regard, new and technologically advanced baggage handling systems are being installed in several airports in China. In January 2022, China experienced a new round of airport construction and expansion projects. The fourth phase of Shanghai Pudong International Airport's expansion is projected to facilitate 130 million annual passengers by 2030. Hence, rising investment in enhancing airport infrastructure and growing security concerns propels market growth across the country.

Asia-Pacific Airport Baggage Handling System Industry Overview

The Asia-Pacific airport baggage handling systems market is semi-consolidated, with a handful of players accounting for the majority of the market share. Some of the prominent players in the market are Daifuku Co., Ltd., SITA, Vanderlande Industries B.V., Siemens Logistics GmbH, and BEUMER GROUP. Various contracts received by the players in the recent past helped the companies strengthen their market presence.

In November 2022, Noida International Airport (NIA) signed an agreement with Siemens Logistics India Private Limited for handling baggage at the upcoming airport. Under the agreement, the company will design, supply, install, commission, operate, and maintain the departure and arrival baggage handling system for NIA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Airport Capacity

- 5.1.1 Up to 15 million

- 5.1.2 15-25 million

- 5.1.3 25-40 million

- 5.1.4 More than 40 million

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 CIMC TianDa Holdings Co. Ltd.

- 6.1.2 BEUMER GROUP

- 6.1.3 Leonardo S.p.A.

- 6.1.4 Vanderlande Industries B.V.

- 6.1.5 SITA

- 6.1.6 Siemens Logistics GmbH

- 6.1.7 Daifuku Co., Ltd.

- 6.1.8 Ansir Systems

- 6.1.9 Unisys Corporation

- 6.1.10 G&S Airport Conveyor

7 MARKET OPPORTUNITIES AND FUTURE TRENDS