PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406129

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406129

Automotive Exhaust Heat Recovery System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

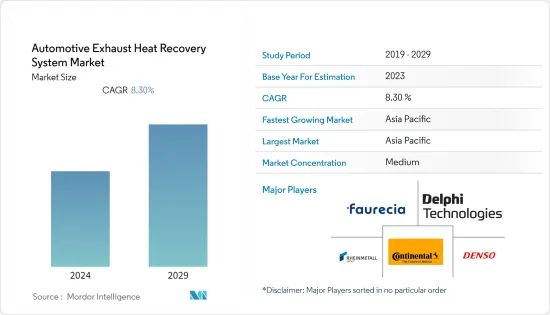

The Automotive Exhaust Heat Recovery market is estimated to be valued at USD 23.7 billion in the current year. It is expected to reach USD 35.4 billion by the end of the forecast period, registering a CAGR of 8.3% during the forecast period.

The Automotive exhaust heat recovery market is a rapidly evolving sector within the automotive industry. It focuses on harnessing and utilizing waste heat generated by a vehicle's exhaust system to enhance overall efficiency, reduce emissions, and improve fuel economy. This technology gained significant attention and importance due to environmental concerns, stricter emission regulations, and the continuous quest for improved fuel efficiency.

The adoption of exhaust heat recovery systems is on the rise globally as stricter emission standards push automakers to optimize combustion and reduce harmful emissions. Furthermore, the development of advanced materials, like heat-resistant alloys and ceramics, is enhancing the efficiency and durability of these components. Also, governments and regulatory bodies incentivize automakers through credits for adopting fuel-saving technologies, including exhaust heat recovery systems.

Another major driver for the Automotive Exhaust Heat recovery systems market is the sales of passenger cars and commercial vehicles. The increase in passenger car sales from USD 56.4 million in 2021 to USD 57.4 million in 2022 is contributing to the growth of the automotive exhaust heat recovery market.

Automotive Exhaust Heat Recovery System Market Trends

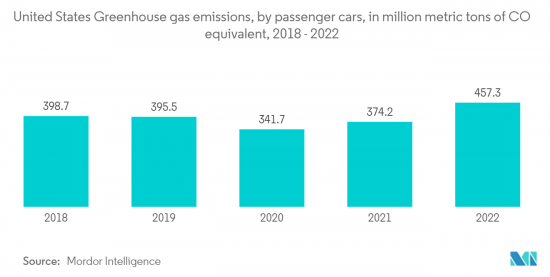

Strict Emission Regulations Driving the Market Growth

In April 2023, the Environmental Protection Agency (EPA) revealed updated standards aimed at further decreasing harmful air pollutant emissions from light-duty and medium-duty vehicles, with the initial implementation set for model year 2027. This proposal is built upon EPA's previous federal greenhouse gas emissions standards for passenger cars and light trucks covering model years 2023 through 2026. It harnesses the advancements in clean car technology to deliver a range of benefits to the American population. It includes reduced climate pollution, enhanced public health, and cost savings for drivers due to reduced fuel and maintenance expenses.

The proposed standards are expected to require automakers to further optimize combustion and reduce emissions significantly. To meet these stringent standards, automakers may increasingly turn to exhaust heat recovery systems (EHRS). It is an effective technology to recover waste heat and improve overall engine efficiency, ultimately leading to lower emissions.

As part of these standards, there is an emphasis on improving fuel economy. EHRS can play a crucial role in achieving better fuel efficiency by capturing and utilizing exhaust heat to perform useful work, thus reducing the fuel consumption of vehicles.

Asia-Pacific is Expected to be the fastest growing region

In 2022, Asia-Pacific accounted for the majority of global vehicle sales at 58%, reflecting a significant surge in demand owing to rapid technological innovations in the automotive industry.

Asia-Pacific accounts for almost 60 % of the world's population, and the demand for vehicles is expected to be the highest in the region for the forecasted period. Also, government regulations are becoming strict in the region. For example, BS-VI standards are enforced by Govt. of India to regulate the expelled pollutants from motor vehicles. With the addition of environmental norms, exhaust heat recovery systems will be more in demand as these systems not only reduce the percentage of pollutants coming out from the vehicles but also increase the fuel efficiency of the vehicle. With the growing pollution levels in the region, people are becoming more aware of the environment and more concerned about the emissions from the cars they purchase.

The rapidly progressing and tightening of exhaust emission standards in China is forcing manufacturers to achieve a further sustained reduction in particulate and nitrogen oxide emissions in order to comply with the current Chinese 6a emissions standard. Additional exhaust-gas recirculation measures are thus mandatory for commercial vehicles in the on and off-highway sector.

Automotive Exhaust Heat Recovery System Industry Overview

Key exhaust heat recovery system participants are Continental AG, Delphi Technologies, Denso, Faurecia, Rheinmetall Automotive, and others. The automotive exhaust heat recovery system is a fragmented and competitive market due to the presence of several manufacturers in the market, owing to various strategies such as focused research and development activities, new product developments, acquisitions, etc. For instance,

- In August 2022, Bosch acquired two SLM500s, a move that significantly boosted its expansion into the additive manufacturing sector. This strategic investment further propels the automotive industry by strengthening Bosch's capabilities in adopting 3D printing technologies.

- In January 2023, General Motors announced a substantial investment of USD 918 million across four US plants to bolster the production of V8 gasoline engines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Exhaust Gas Recirculation (EGR)

- 5.1.2 Turbocharger

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Technologies

- 6.2.2 Valeo Service

- 6.2.3 Denso

- 6.2.4 Faurecia

- 6.2.5 Mahle

- 6.2.6 Rheinmetall Automotive

- 6.2.7 Mitsubishi Electric

- 6.2.8 Calsonic Kansai

- 6.2.9 Continental AG

- 6.2.10 Borgwarner

7 MARKET OPPORTUNITIES AND FUTURE TRENDS